Good morning, it's Paul here.

See Friday's report for a couple of updated sections that I wrote up on Saturday morning, including a review of the Sports Direct (LON:SPD) debacle - in particular a potentially huge tax liability that has cropped up in Belgium. I'm expecting a big drop in share price there today.

The catalogue of things that have gone disastrously wrong is quite astonishing. There is the huge, total loss on DEB shares - which Ashley tries to blame on anyone but himself. He now admits that buying House of Fraser was a mistake. Some see him as a brilliant entrepreneur, but I feel he's far too arrogant & erratic, to be able to sleep at night as a shareholder. Hence why I'm steering well clear.

Takeover bids

Continuing a theme from last week, I note that there seem to be a surge in takeover bids for UK listed companies. Tech companies in particular. This could be an area for rich pickings, if we can identify any patterns in takeover bids, and then buy shares in similar companies which might become bid targets. Tech companies which dominate a particular niche seem to be popular targets at the moment.

Last week, bruised shareholders in accesso Technology (LON:ACSO) got a nice surprise, when it announced it had received potential bid interest. This morning we have a similar announcement from Proactis Holdings (LON:PHD) . A takeover deal would be a good move for PHD, as management have over-geared their balance sheet, and not performed well (profit warning in Feb 2019), so getting bought out would possibly be the best option for shareholders.

There is also news that a Dutch company called Takeaway.com NV is bidding for Just Eat (LON:JE.) at a modest 15% premium, in an all share deal. The two companies are a similar valuation - JustEat shareholders would own 52%, and Takeaway.com shareholders 48% - those percentages strike me as rather appropriate, given that the bid is from Europe! I can't see why JustEat shareholders would want to own Dutch shares though. Selling this deal to JE shareholders might be a struggle. Takeaway.com looks to be well behind JustEat, with smaller revenues, and is still loss-making. Therefore I would reject the deal, if I held JustEat shares. The inferior company seems to be over-valuing itself in this deal, judging from the StockReport on Takeaway.com

Therefore this looks a bum deal for JE. shareholders, in my view. The problem with all share deals, is that the subsequent share price can be weak, as sellers rush to get rid of new shares that they don't really want.

EDIT @ 08:28 - the JustEat share price has risen 24% to 790p - a long way above the 731p implied price of the all-share deal. It looks as if the market now considers JustEat to be in play, and is pricing in a higher, competing offer. Exciting times for JE shareholders! It just shows that conventional valuation metrics such as PER simply don't apply to growth/tech shares right now. How long that state of play continues, is anybody's guess.

Reach (LON:RCH)

Share price: 85.6p (pre market open)

No. shares: 299.3m

Market cap: £256.2m

This newspaper group (formerly called Trinity Mirror) reports interim results, for the 26 weeks to 30 June 2019.

In a separate RNS, it says that CEO Simon Fox will be stepping down on 16 Aug 2019. No explanation is given as to why he's leaving, which might concern some investors. A new CEO is lined up, Jim Mullen, formerly CEO of Ladbroke Coral. It's usually not a cause for concern if a new CEO has been lined up, as opposed to more worrying situations where a CEO is suddenly sacked out of the blue - which usually means something has gone wrong.

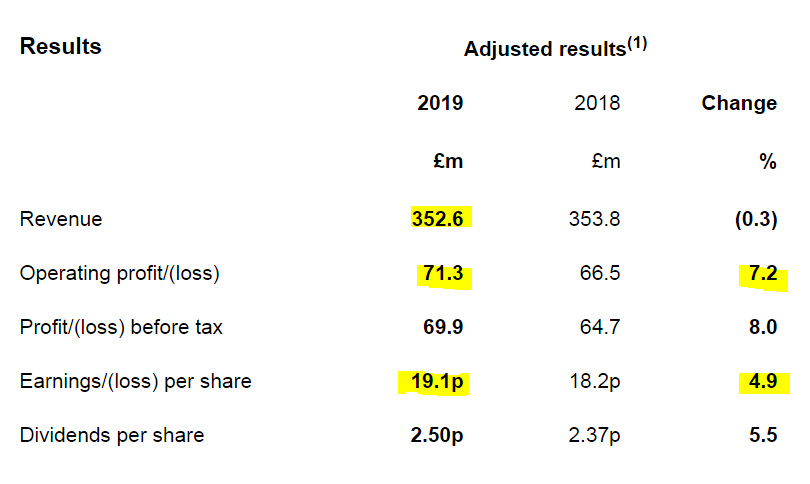

For a share that is priced for failure (fwd PER is only about 2.5!) these seem remarkably resilient figures;

Of course, we already know why the share is priced on such a lowly valuation, it's because;

- Newspapers are seen as a structurally dying sector

- Massive pension fund/deficit

Reach seems to have done a remarkable job in maintaining its profitability. This has been done by;

- Continued, multi-year cost cutting - which is only finite, there would come a point where no more costs could be cut. There's also a risk that with lower editorial budgets, that content quality could suffer, leading to a downward spiral in circulation, and then hence advertising spending by customers.

- Bargain acquisitions - often with cost synergies.

Note the outstandingly high operating margin of 20%. It's difficult to think of other structurally declining sectors which have remained as astonishingly profitable. That matters, as it gives Reach options. Being this profitable, it could be that the business could actually survive long-term, in some form, perhaps?

Revenue - on a like-for-like basis, this fell 6.3% - a slight improvement from -7.2% in H1 2018. The acquisition of Express & Star boosted total revenue to -0.3%

Digital revenues are significant now, at £48.7m for H1, up 17% on prior year H1. This is potentially interesting. If growth can be accelerated, then there's the possibility that this share could re-rate, into being seen as a growing digital business, with a newspaper business attached? Maybe that's far-fetched, but you never know.

Let's look at the big issues;

Pension scheme - note that payments of £24.5m were made into the pension funds - that's just in a half year, so we're looking at almost £50m p.a. - a huge cash drain, and more than double the dividends paid to shareholders.

Contributions have been agreed at £48.9 million per annum for 2019 and 2020, £56.1 million per annum for 2021 to 2023, £55.3 million per annum for 2024 to 2026 and £53.3 million for 2027.

The challenge for Reach, is whether it can continue generating prodigious cashflows enough to fund the pension deficits, and leave enough left over for generous dividends. Since the pension schemes rank ahead of dividends, it would be dividends that are cut, in the event of profit falling. Hence the big divis should be seen as risky, and cannot be guaranteed.

The word pension is mentioned 85 times in today's RNS.

The accounting pension deficit barely changed, at £348.2m (£284.8m net of deferred tax). Note that both these figures are greater than the £256m market cap, so this is a huge issue, very material to valuation of the shares.

The scale of the problem is fairly mind-blowing: the total scheme liabilities are now £2.66bn, with partially offsetting assets of £2.34bn. The deficit is therefore the difference between two very large numbers, hence it's difficult to know what's likely to happen.

Actuarial deficits are usually worse than accounting deficits.

The problem is that rising interest rates now seem to be on hold. Asset prices are clearly now addicted to ultra-low interest rates, and whenever the USA tries to raise interest rates, it causes a stock market plunge, and they reverse track. That's happened several times in recent years. Interest rates elsewhere are strongly influenced by USA interest rates. And the EU of course too.

That environment leaves little prospect of Reach's pension deficit being reduced by higher interest rates (which have the effect of reducing the calculation of future liabilities).

Dividends - the company says it plans to increase dividends by 5% p.a. - although as mentioned above, the pension scheme comes first.

Net debt - excluding the pension deficit, this is now low, at £12.9m [corrected, many thanks to davidjhill for pointing out that I'd picked up the prior year figure by mistake], hence is not a problem.

Balance sheet - this is a bit complicated.

NAV: £578.2m

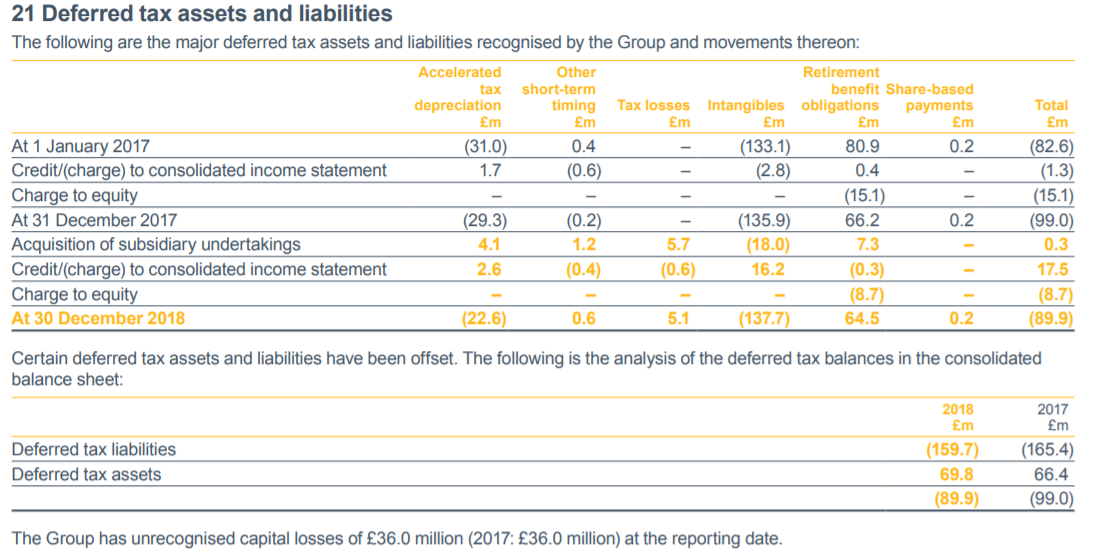

NTAV: I'm inclined to write off £42m goodwill, £810m other intangible assets, but also the £159.6m deferred tax liability, which mainly relates to the intangible assets (see below). That arrives at NTAV of -£114.2m - not good, but not a disaster either - especially considering the group is so strongly cash generative. Also the main reason for the negative NTAV is the pension scheme, which is a long-term, manageable liability - unlike say bank debt, which can be pulled if the covenants are breached.

Here's the note from the last Annual Report on deferred tax:

Outlook - sounds fine, it's in line:

Whilst there are uncertainties arising from the UK's exit from the European Union, we are confident that our strategy will enable continued progress to support profit and cash flow.

The Board anticipates trading for the year to be in line with market expectations.

Bull case - this is still a fantastically profitable & cash generative business, however counter-intuitive that may seem. It's extremely cheap on a PER basis, and paying a high dividend yield.

The cashflow statement shows that it can currently easily afford the pension deficit recovery payments - operating cashflow after tax was £66.6m, which comfortably covered the £24.5m pension deficit payments, with enough left over to pay out £11.2m divis, fund minimal capex of £1.6m, fund the debt interest, pay down £20.3m in bank borrowings, and still left cash up by £7.6m. Remember these are just 6 month figures too. That's an astonishing level of cash generation.

Digital revenues are becoming quite significant at c.£100m annualised, and growing,

Bear case - newspapers are a dying sector, so earnings not likely to be sustainable. Reach has made acquisitions & cut costs to maintain profits, but that can only last so long.

Size of pension scheme dwarfs the market cap. Recovery payments could end up consuming future cashflows, meaning divis might only last a couple more years before finishing for good.

My opinion - I've got to conclude that I'm neutral on this share. It's impossible to say what scenario might play out. I'm probably leaning more towards being long than short, as the short term outlook looks fine, and the ultra-low PER and high divi yield could attract buyers. Someone might bid for the whole thing, you never know - although that would require agreement with the pension fund trustees.

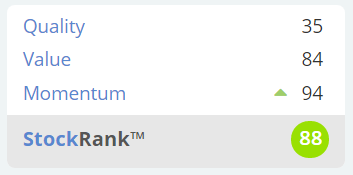

The StockRank system likes it a lot, and seems to suggest that the downside is more than priced in;

YouGov (LON:YOU)

Share price: 569p (up 7% today, at 12:23)

No. shares: 105.2m

Market cap: £598.6m

YouGov, the international research data and analytics group, today announces a pre-close trading statement for the full year ending 31 July 2019.

This is a positive update, with the key bit saying;

We are pleased to report that the Group's trading for the year ending 31 July 2019 is now expected to be comfortably ahead of expectations for the year.

With these results, YouGov has achieved another year of strong revenue and operating profit growth. Notably, revenue has continued to progress substantially ahead of the global market research sector.

Valuation - you can't argue with the strength of today's update. We can however argue with the valuation, which looks bonkers to me.

Last year it made 7.3p in diluted EPS. At 569p per share, the historic PER is 78.

Why so high? The company seems to have been successfully steering investors towards its adjusted figures, which is 16.6p adjusted EPS for FY07/2018 - a PER of 34.

The adjusted figures are nonsensical, because they ignore both capitalised internal costs, and the amortisation relating to them. I've been pointing this out for years, but nobody seems to care. The shares have done very well, so maybe ignoring a ton of costs and pretending they don't exist is the way to go?!

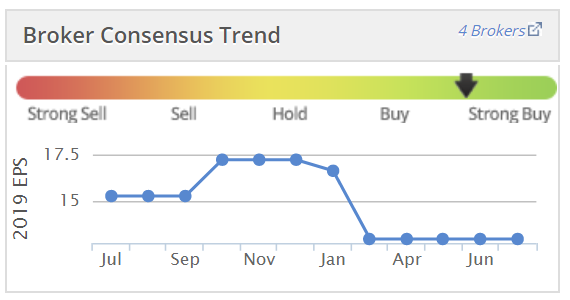

Broker forecasts - note that the bar was lowered considerably in early 2019. So beating lowered forecasts is not as impressive as it might initially look.

My opinion - this looks a good business, and is a well-known brand name. Growth in revenues & profits is good.

It's only the accounting, and the valuation that I have issues with.

The share looks wildly over-priced to me. I cannot get to anywhere near a £600m market cap. I would only be interested in looking at this share if it had more than halved in price. That would be getting closer to a more sensible starting point for considering a purchase.

Still, it doesn't matter what I think, look at what the share price has done in the last 2 years!

S4 Capital (LON:SFOR)

Share price: 155.5p (up c.3% today, at market close)

No. shares: 364.2m

Market cap: £566.3m

I've been asked to look at this by a subscriber. Coincidentally, this company also cropped up in a phone call with an investor friend, who texted me this picture of Sir Martin Sorrell's original business headquarters at WPP. It went on to become rather larger.

S4 Capital is Sorrell's latest vehicle, focused on digital advertising.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.