Good morning!

Today I'm planning to take a look at:

- Luceco (LON:LUCE) - trading statement

- Arden Partners (LON:ARDN) - interim results

- Clipper Logistics (LON:CLG) - preliminary results

- XP Power (LON:XPP) - half year results

2:30pm: Edited this list in response to reader requests.

By the way, I stayed in my first ever AirBnb this weekend: a privately owned, 16th century castle deep in the Irish countryside. Admittedly, not much of the original is left standing from the 16th century. But it was a fun introduction to the world of AirBnb!

Bank of England

In economic news, we are on the cusp of seeing interest rates rise again at the Bank of England, for only the second time since 2008. There is a 90% chance of a rate hike on Thursday, from 0.5% to 0.75%.

Personally, I've been reducing my exposure to GBP-denominated assets in recent months, thanks to the tardiness at the BoE. I now have close to 20% of my portfolio invested in funds which own USD-denominated debt.

Leaving the economic arguments to one side, my viewpoint as an investor is straightforward: I want the biggest returns and yields possible! If the choice is to earn (say) 3% in the US or 1% in the UK, then I don't mind swapping the currency risk and moving funds to US instruments instead.

Long-term, I remain a bull on GBP relative to EUR and perhaps even relative to USD. If we saw several rate hikes along with clarification on trade rules after Brexit, then I still believe we could see a very strong pound Sterling - brilliant news for owners of GBP-denominated assets (like many readers of this report, I suspect), for importers, for British tourists, etc. Not so brilliant for others, of course.

Luceco (LON:LUCE)

- Share price: 33.8p (-9%)

- No. of shares: 161 million

- Market cap: £54 million

It's an H1 update for this LED lighting manufacturer.

I'm amazed to see that this share price has halved since I wrote about it last, in April.

Since then, there have been two interesting bits of news:

- It admitted defeat in the US and announced the closure of its US business.

- At its AGM, 18% of votes went against receiving the company's Annual Report and Accounts. 22% of votes went against re-appointing KPMG as auditor of the company.

This is the company where the financial controller resigned after Luceco failed to value its inventories correctly. The CFO left the company not very long afterwards. It's a fine example of an IPO stock that has failed to live up to expectations (it only listed in 2016). Large numbers of former and prospective shareholders are now evidently giving it the bargepole treatment.

Right, onto this H1 trading update. Key points:

- UK retail did very badly, sales down 20% and poor margins.

- Sales growth remained strong overseas

- Adjusted operating profit "close to break-even" for the period.

Outlook: With cost reductions, a higher order book and improved pricing in place, Luceco expects adjusted operating profit to show year-on-year growth in H2.

My view

It's a pity the company is carrying so much net debt (£41 million), as otherwise it could be a low-risk value play.

Even with the net debt, it could be tempting for some people to punt on it around current levels, betting that profitability will recover.

Personally, it's beyond my risk tolerance. I am looking for good businesses that aren't too accident-prone, and I want to be able to sleep at night!

The attempted revolt against the auditors and the Annual Report by some shareholders hints at the unease and general loss of faith in the business.

For what it's worth, I calculate that Luceco made an adjusted operating profit of £5.7 million in H2 2017. The company is predicting that it will beat this in H2 2018.

The enterprise value is £82 million. So if H2 improves as forecast, and then we get a "normal" H1 in 2019, the current share price will not look too expensive.

This means it's potentially at a good level for a contrarian bet. It passes Stockopedia's "neglected firms" stock screen. I wouldn't say that it's extremely deep into value territory yet, but it's getting there.

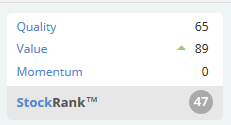

It is categorised appropriately as Highly Speculative and Contrarian. Check out the Momentum score!

Arden Partners (LON:ARDN)

- Share price: 42p (-1%)

- No. of shares: 31 million

- Market cap: £13 million

Interim Results - Six months ended 30 April 2018

This is a small (but full-service) investment bank with offices in London, Birmingham and Bristol.

It came to my attention again recently when Glen Arnold reported that he had sold out, for a variety of reasons.

One of these was that Luke Johnson, an 11% shareholder, had decided to step down as Arden Chairman. This could be interpreted in different ways, but it is at the end of the day a bad news announcement from the company.

These results, for a period during which Mr. Johnson was in office, are as follows:

- Corporate client list up by one third, from 40 to 53

- Research service agreements in place with "a significant number" of clients, enabling it to charge them for equity research following the implementation of MIFID II.

- Strong start to H2

Despite all of the good news, we unfortunately see a pre-tax loss of £2.3 million, on reduced revenues of £2.6 million.

The outlook for H2 should be better, after completing what the CEO describes as "a root and branch restructuring". The number of clients is up significantly, the equity research team has doubled, and Arden reports "a significant pipeline of well-advanced corporate transactions".

My view - the main attraction with this stock, in my opinion, is the balance sheet and the potential that it could buy back more chunks of its own shares or go private in an attractively-priced deal.

It reports net assets of £10 million, with zero intangibles and very liquid assets including £5.1 million cash. Buying the shares at a discount to NAV or at just a modest premium to cash would be attractive, in my view.

The one in this sector that looks most appealing to me in the short-term is Cenkos Securities (LON:CNKS). It has a well-known activist investor who is calling for a sale (thank you for pointing this out in the comments last week).

If Cenkos did sell up, I imagine that a trade buyer would be willing to pay more than the current share price. This values it at 1.6x its December 2017 net asset value, or just 1.35x its December 2017 cash balance.

Clipper Logistics (LON:CLG)

- Share price: 313.5p (-23%)

- No. of shares: 101.5 million

- Market cap: £318 million

I don't follow the logistics sector closely. There is plenty of reader interest in this announcement, however, so let's take a look.

Many of you who follow the e-commerce business Sosandar (LON:SOS) will know that Clipper provides warehousing and logistics services to that company. It has also started doing some work for Boohoo (LON:BOO) subsidiary Pretty Little Thing, for Marks and Spencer (LON:MKS) and for ASOS (LON:ASC).

These are good headline numbers from Clipper. In summary:

- Group revenue up c. 18% to £400 million

- Group EBIT up c. 16% to £21 million

- Dividend up 17%

There are no references to expectations, except that net debt is said to be in line with expectations at £31.7 million.

In fairness to Clipper, it followed a similar format last year.

It's a general problem with the market that companies don't state clearly what they expect to achieve, and some companies don't state whether performance has been good or bad, relative to their own expectations.

This means that only those with access to some kind of broker research can compare results to forecasts.

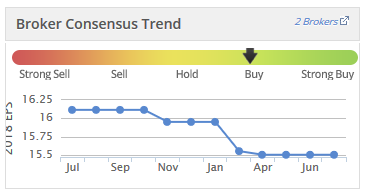

Another option is to check on Stockopedia or other investment software for forecasts. On Stocko, for example, we can see that Clipper's 2018 "EPS Normalised" was forecast at 15.5p. The actual EPS achieved by Clipper is 14.2p. A substantial miss.

I can see a broker note where the broker had an even higher EPS forecast: 16.5p. So it's an even bigger miss by Clipper against that target.

The outlook has deteriorated, too. Today's statement brings with it some caution, mentioning "wider forces affecting the UK retail sector".

We are mindful of the wider economic climate, and in particular of the headwinds facing our customers in the retail sector. We continue to monitor the situation closely and engage with our customers to find new ways to pro-actively assist them.

My view

I think it's an understandable fall in the share price.

The EPS result is 7%-14% below broker's forecasts.

For a highly-rated stock (P/E multiple in excess of 20x), you always run the particular risk of suffering the double whammy of an earnings miss and a compression in the valuation. In a nutshell, that is what is happening with CLG.

Given the earnings miss and the cautious outlook, brokers have reduced PBT forecasts by about 10% for FY 2018 and FY 2020. Cutting the share price by 20% from a high level seems reasonable to me, in that context.

With the company still profitable and winning new business, we do have a potential buying opportunity for anyone who has been on the fence with this one.

I'm happy to sit it out, as I find logistics to be a tricky sector to invest in.

Note that earnings momentum has been poor for a while at Clipper:

When it comes to the UK retail sector, the numbers haven't been that bad. Perhaps the issue is that Clipper doesn't have enough of the Sosandar (LON:SOS) / Boohoo (LON:BOO) / ASOS (LON:ASC) type of business, relative to mainstream retailers who are finding life more difficult?

I'd welcome further comments on this.

XP Power (LON:XPP)

- Share price: 3650p (+2%)

- No. of shares: 19 million

- Market cap: £701 million

A nice H1 report from this developer of power controllers (converters, etc). You can get a comprehensive list of its products via its website.

These results leave expectations unchanged for the full year.

XPP is an example of a stock that no longer fits our market cap limits, thanks to the successful execution of strategy:

The Group has applied a consistent strategy of moving up the value chain and our growth derives in part from the targeting of key account customers. Once we are approved to supply these larger customers, we have a strong track record of successfully gaining a larger share of their business.

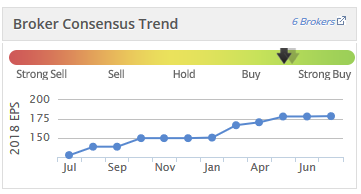

Besides this organic growth, it has also made some successful acquisitions. It hasn't put a foot wrong, and EPS expectations and the share price have reflected this. The EPS trend chart:

Currency effects are huge for this stock, and can distort things. So I always urge people to focus on the "like-for-like" results. Latest numbers:

- Order intake increased by 9% to £101.4 million (+17% in constant currency and 10% on a like-for-like basis in constant currency)

- Revenue increased by 16% to £93.2 million (+25% increase in constant currency and 13% on a like-for-like basis in constant currency)

These are some decent organic growth rates. XPP describes the global capital equipment markets as "buoyant", making for a benign external environment.

Other forms of progress

- Own-design products now 78% of total revenues (H1 2017: 75%).

- Book-to-bill ratio greater than 1 (i.e. more orders coming in the door than being done).

- Second manufacturing facility in Vietnam is on track to complete, production on stream in H1 2019.

Margins - XPP reports "some shortages of components together with component price inflation", causing a minor decline in gross margin in H1. I would guess that the XPP management team will be able to manage this supply chain risk, as they have managed so many other challenges. It's probably the most obvious and important risk mentioned in today's report.

Balance sheet - It's holding some debt now after paying for dividends, acquisitions and inventory growth. Doesn't look excessive.

My view

I've consistently had a positive view of this stock, and continue to do so.

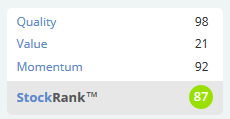

Being value-oriented, I tend to resist paying up for High Flyers, and that's how this share is rated by the Stocko algorithms:

Given the track record and continued progress, I am heavily inclined to think that XPP deserves its high rating.

Foxtons (LON:FOXT)

Half-year Report - Fascinating to see this London estate agent swing to a pre-tax loss in H1.

Despite bouncing higher today, the Foxtons share price is looking rather sad now at 53p compared to the 2013 IPO price of 230p (and 350p was breached in early 2014).

The lettings business has been mostly flat (revenue down 1%), as anticipated.

The volatile sales side of the business, on the other hand, sees revenue down 23%.

CEO comment:

The property sales market in London is undergoing a sustained period of very low activity levels with longer and less visible transaction outcomes, which clearly impacts our business.

What will it take to see a resumption of normal activity levels in London? A capitulation by sellers, perhaps? Or perhaps once Brexit is sorted out, that will drive lots of capital back in, and things can get moving again?

At least Foxtons enjoys a £12 million cash balance and no debt.

If your timeframe is long enough and you can see activity levels returning to normal (which presumably they must, sooner or later), then this could be another interesting contrarian play.

All done. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.