Good morning, it's Paul here.

Please see the header for the results & trading updates which caught my eye, on my initial sweep of the RNS first thing.

Estimated completion time - I'm writing mainly this afternoon, so should be finished by about 8pm. Update at 17:19 - I'm exhausted, and need a break. So will finish off later this evening. Actually, I'll put any further updates from now on into tomorrow's placeholder, so that people don't have to keep checking back to see if this report is updated or not. Hence this report for today is now finished.

Cloudcall (LON:CALL)

Share price: 98.5p (down c.7% today, at 12:48)

No. shares: 26.6m existing shares + 12.0m new shares = 38.6m

Market cap: £38.0m

(at the time of writing, I hold a long position in this share)

CloudCall is a software-as-a-service ("SaaS") and unified communications business ("UCaaS"), that has developed and provides a suite of cloud-based software and communications products and services, which enables organisations to leverage data in CRM systems to enable more effective communications.

There are 2 announcements today, interim results, and yet another placing

This is a conditional placing & open offer, at 100p per share. This is a pleasingly small discount to the previous market price, which I am pleased about. Placings are only a problem, if existing shareholders are diluted a lot, at a big discount, which is not the case here.

What is striking is how much larger this £12m placing is, compared with previous fundraisings. The company seems to be significantly scaling up its ambitions, stating;

Funding customer led growth capital opportunities, with ambitions to achieve >£50 million in annualised run-rate revenue by 2025

To put that in context, the annualised run rate of revenues at June 2019, was £11m, so increasing that to over £50m in the next 5-6 years is a big deal, that could trigger a re-rating of the shares, possibly.

To have got away such a (relatively) large placing, in very tough markets, demonstrates that management must have told a very convincing story to institutions & high net worth investors, in the meetings that usually precede placings.

A couple of more general points;

Liquidity - for companies this small, the institutional & private investor markets are almost completely separate, which can create strange anomalies where private investors are negative and constantly selling, at the same time as institutions are enthusiastically putting money into placings. The CEO of a listed company told me that most institutions don't tend to transact in the open market for any share unless/until the free float has reached about £250m - under that level, there isn't usually enough liquidity for institutional transactions.

Public vs private? - my view is that a stock market listing often holds back UK growth companies, because UK investors starve them of funding, and prioritise reaching profitability over more rapid growth. This is why so few UK small tech companies achieve decent scale. The approach in the USA is the complete opposite - they throw big money at startups, and don't care about profitability. That may seem crazy to us, but it's a key reason (aside from its economy being 6-7 times the size of the UK's) that the USA produces so many globally dominant tech/growth companies.

Back to CloudCall - this is a great example of a company that has consistently under-estimated the funding it needed, and had to repeatedly come back to the stock market for more money. Every time it assured us that it now had enough money, but despite this, came back over & over for more. This has held back growth, held back the share price, and annoyed investors - denting confidence in management.

I think growth companies like this are far better off in private ownership, with shareholders that are prepared to pile in enough money to rapidly scale up right from the start.

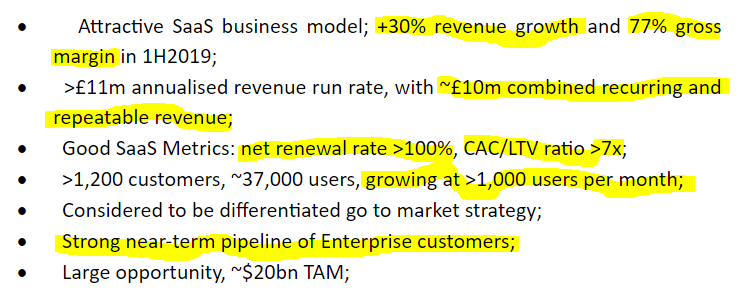

There's a neat summary of the upside case in the placing RSN;

(note: CAC/LTV >7x, means that the lifetime value of a customer is estimated to be more than 7 times the original cost of acquiring the customer)

My view - I'm surprised the company has gone the other way this time, and raised more money than it needs. This is confusing, because in the past management has been reluctant to dilute their own holdings, which in retrospect was a mistake.

Having raised so much additional funding, management clearly intends spending a lot of it. This implies faster growth, but also an increase in operating losses. Therefore the mirage of future profitability looks likely to have disappeared even further into the future. Historically, broker forecasts have been consistently too optimistic about profits & cash balances, so should be taken with a large pinch of salt.

Having said that, CALL has an excellent product, and should be commended for having gained significant traction in the (huge) US market. Therefore, on balance I like the fact that management has decided to go for it, in terms of more rapid growth.

I think the most likely outcome is a US investor bidding for the company at some stage. If the premium offered is good, then I'd be very happy with that outcome. The shareholder register has already had a US investor, Kinderhook, join with a significant sized stake, so the company is clearly already attracting some attention over the pond. Note that Kinderhook is putting in £1.4m into this placing. This could get interesting at some stage, although private investors don't seem impressed, given the share price dip this morning.

Interim results - Given that the strategy has now changed, to accelerate spending & growth, then I don't know how much value I can add by poring over the details of these now historic numbers?

Key numbers;

Revenue up 30% to £5.2m (all organic growth)

Operating loss of £1.7m - slightly down from £1.8m in prior period

Outlook statement - trading in line with management expectations post period end

Balance sheet - not very relevant, as the £12m placing will transform it to bulletproof status, at least for a couple of years or more. One slight oddity is that receivables fell from £1.86m at end Dec 2018, to £1.36m at end Jun 2019. Given that revenues rose by 30%, then I would have expectected receivables to rise by a similar amount (implying c. £2.4m), so the actual figure of £1.36m implies an improvement in collection of funds of about £1m. I'll query this with management & report back.

Cashflow statement - the faster collection of receivables has helped the cashflow figures look better than would otherwise be the case.

Capitalised development spend of £700k in H1 is not excessive.

My opinion - the company has a terrific product (I've used it for several years, finding it reliable & useful), and has a good niche in the recruitment sector. It's suitable for many other sectors in due course, so the potential for growth here is almost open ended. That's what makes it such an interesting share to me. Customer retention is very high, which combined with high gross margins, and monthly recurring revenues, is an attractive business model once it passes breakeven.

On the downside, the road so far has been bumpy, with repeated failure to meet budgets, and repeated fundraisings. Every time breakeven looks to be on the horizon, management loads on tons more costs, and breakeven is pushed out again.

Therefore I think we have a situation where there are probably plenty of stale bulls in the share, yet at the same time clearly more enthusiastic institutional shareholders, prepared to fund a large new placing. It might be logical for the company to use some of the placing proceeds to buy out stale bulls in the market? (i.e. small to medium shareholders who are suppressing the share price).

This is a classic glass half full, or half empty situation. I completely understand why many private investors will point to the track record, and dismiss this share. However, it's the future that interests me, because that's what drives share prices, not the past. Hence with the bank soon to be bursting with cash, and faster growth then possible, I remain a bull on this share.

Here's the 3 year chart. With £12m fresh funding secured at 100p, I reckon the downside on the share price looks fairly limited. It could dip to say 70-80p, if private investors who don't like the new more aggressive expansion strategy, decide to bail out. But really, who cares? For longer term shareholders like me, I think upside to say 200-250p is more likely, if the growth plans work out as planned. 250p equates to about £100m market cap, which is the ballpark figure I have in my mind as the medium-term outcome I'm looking for.

EDIT at 15:36 - I can't find any updated broker notes yet. Arden has put out a one-pager today, saying that it needs to re-work its model, so I'll keep an eye out for that, hopefully in the next few days. Also, I have a phone call booked in with CloudCall for later this afternoon, so will update here if anything interesting comes out of it.

Water Intelligence (LON:WATR)

Share price: 284p (up 8% today, at 14:17)

No. shares: 16.96m

Market cap: £48.2m

Water Intelligence plc (AIM: WATR.L) ("Water Intelligence", "Group", or the "Company"), a leading multinational provider of precision, minimally-invasive leak detection and remediation solutions for both potable and non-potable water is pleased to provide its Interim Results for the six months ended 30 June 2019.

The market likes this announcement, with the share price up 8%, so let's take a look.

Summary at the top of the RNS - a good idea, by the way, more companies should do this, as it helps us sort the wheat from the chaff more easily/quickly in that very pressurised hour from 7-8am:

Results are ahead of market expectations for annual revenue and comfortably in-line with expectations for profit before tax. The Company continues to perform strongly on its growth plan based on key performance indicators ("KPIs") identified in more detail in the Strategic Report to the Annual Accounts with 1H KPI results discussed herein.

Here's my quick review of the figures;

- Strong revenue growth in H1, up 34% to $15.9m (note that it reports in US dollars)

- Important to note that some sales are via franchisees, so the end customer sales were >$50m in H1 - hence the business is bigger than the published revenue figure suggests

- Adjusted profit up 29% to $2.0m - the only questionable adjustment is for share based payments - I see this as remuneration, so tend to add it back in as a cost

- Balance sheet looks OK to me. Although note that there is a $2.1m creditor for deferred consideration, which will have to be paid out

- Cashflow statement not great, as increased receivables consumed most of operating cashflow. Receivables generally look high. $1.7m spent on re-acquisition of franchises, all of which was funded by a $2.7m placing, and a $1.4m increase in borrowings.

My opinion - I'm not convinced by this. The headline growth is good, but some of that is coming from re-acquiring former franchisees. Therefore you could argue this is inflating the headline organic growth figures. Also, presumably the franchisees were not successful, hence being re-acquired by the company, which puts a question mark over whether the franchise model is any good?

Is this company really worth nearly £50m? That's my main issue here - challenging the valuation. It doesn't pay dividends either, which to me reinforces the reality that it's not very cash generative. Although you could argue that it's spending the cashflows on expansion.

The other issue is that we're in a market which brutally punishes every company that disappoints on earnings. So why pay an elevated price for something, when that risk is ever present, and you might lose say 30-50% of your money, if you wake up to a profit warning. Sure, trading now is OK, but there are no guarantees with any share that will remain the case. Hence why, personally, I'm not interested in paying a premium price for anything right now.

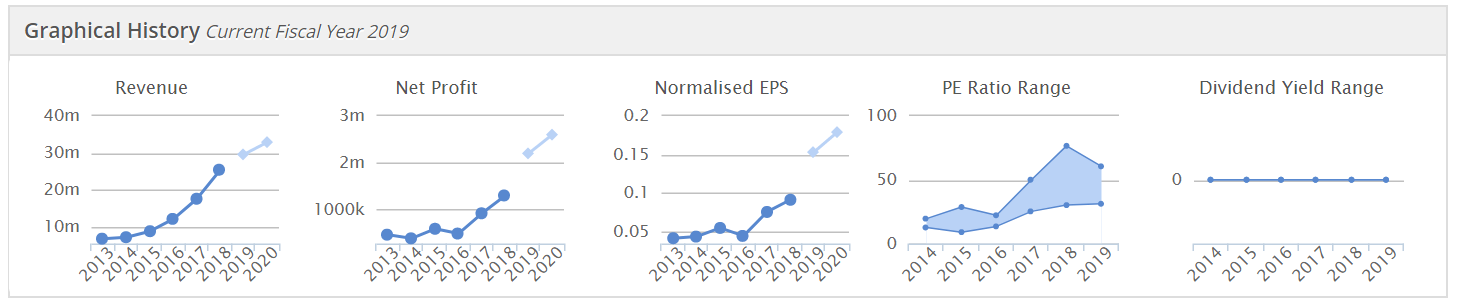

As usual, the Stockopedia graphs neatly summarise things - good progress, ambitious forecasts, PE rating has gone up a lot in recent years, and no dividends;

Christie (LON:CTG)

Share price:

No. shares:

Market cap:

Christie Group plc ('Christie' or the 'Group'), the leading provider of Professional & Financial Services and Stock & Inventory Systems & Services to the hospitality, leisure, healthcare, medical, childcare & education and retail sectors, is pleased to announce its Interim Results for the six months ended 30 June 2019.

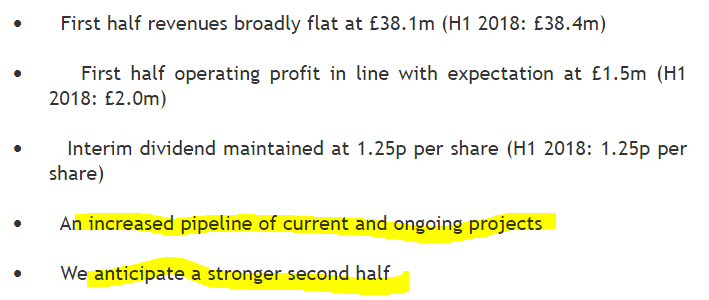

This sums it up quite well - interim results not great, but better H2 expected;

Sale & leaseback of property -

Away from day to day trading matters, following a review, we have decided to have realised the freehold value of Pinder House in Milton Keynes. The recommended reserve exceeds book value by approximately £2.8 million. We will continue to operate from these offices under an occupational lease.

Balance sheet - is unsatisfactory, with NAV negative, at -£2.3m, which worsens to -£5.5m once I write off goodwill & other intangibles.

The main reason for the balance sheet weakness is the £12.6m pension deficit. Given that (guessing here) interest rates appear to be permanently low, and it's difficult to see what would change that any time soon, this means that pension deficits are an ongoing problem and likely to be a drain on cashflows for many years to come.

Valuation - given the weakish balance sheet, and operating in a boring & seemingly ex-growth sector, then I cannot see the attraction here. Stockopedia has the forward PER at 8.8, and the dividend yield is unexciting at c.3%.

My other concern is that the retail & hospitality sectors are under well known pressure, which must be a drag on Christie, even though it has other sector exposure too.

My opinion - it looks OK, but not a particular bargain.

Why invest in this, when there are so many other companies with probably better prospects out there?

It's gone nowhere in the last 5 years;

A couple of updates from today will go into tomorrow's placeholder now.

Thanks for your reader comments.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.