Good morning!

So far, I've noticed the following bits of news:

- Murgitroyd (LON:MUR) - interim results

- Begbies Traynor (LON:BEG) - small acquisition

- Getech (LON:GTC) - trading update

- Veltyco (LON:VLTY) - trading update

- IQE (LON:IQE) - response to negative publication by shorter

I'll try to unpack the situation at IQE (LON:IQE) first.

IQE (LON:IQE)

- Share price: 103p (-1%)

- No. of shares: 789 million

- Market cap: £813 million

This opened lower but has recovered most of the losses by mid-morning.

IQE manufactures wafers for the semiconductor industry. It's widely-followed by private investors and has been discussed here on numerous occasions before.

When I last covered it in November, I noted the material amount of short interest outstanding (6.5% was disclosed at the time) and guessed that this was due to 1) its high valuation against conventional metrics, 2) the lack of free cash flow generation, and 3) its reliance on a small number of customers. The share price at the time was 162p.

Since then, reported short interest has risen to 11.7%, although the total short positions outstanding will be higher than this.

Whenever we see so much short interest, we need to sit up and take note - it usually means that a lot of sophisticated investors have noticed something terribly wrong with the company or its valuation.

Bear attack

On Friday night, an investment fund run by respected analyst Matt Earl published a letter detailing the rationale behind its short position in IQE.

Matt did not contact IQE prior to publication of this letter. If he had, perhaps they would have provided answers to many of the questions he raised? We'll never know.

His letter does raise worthwhile questions about IQE's joint venture operations, and provides a good overview of IQE's lack of cash generation over the years.

However, it's not a "smoking gun" publication - it provides searching analysis and raises questions, without going so far as proving any wrongdoing. Matt Earl himself is quoted today in ShareProphets as follows:

We see IQE’s statement as helping to confirm our view that while its accounts may be within the boundaries of reporting standards, that they appear to us to be testing those limits.

IQE's counter-statement answers at least some of the questions raised in the letter. Namely:

- IQE admits it is an "anchor customer" (at first, it was the only customer) to its joint ventures. This has been done to limit the JV losses in their early years, as they attempt to grow into strong stand-alone companies. IQE says that the JVs have made some new business wins in 2017 with non-IQE customers (the size of these wins is not quantified).

- Rather than using its Cardiff JV to "hide" its losses, IQE says that the JV has been making losses thanks to its own independent expenses (management, business development, etc.) and the amortisation of its purchased IP license. The license was paid for with cash and a loan to IQE. it's unusual to pay for something with a loan - IQE may have had a particular need for cash at that time (2016)?

- With respect to the profits which IQE subsidiaries made in selling fixed assets to the Cardiff JV, these came about thanks to an uplift in the value of the assets "as determined by an independent professional valuer mutually agreed by the joint venture partners". More information might have been given, but at least we have the headline explanation. Profits on disposal of PPE to JVs was reported at £4.8 million in 2015.

- Other accounting details with respect to the Singapore JV and the 2012 acquisition of a manufacturing unit in America.

Trading update - guidance is reiterated with a confident outlook.

My opinion

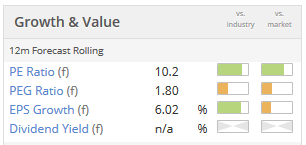

In December 2016, when I first covered this stock here, I said that the 12x PE ratio was a bit cheap. The share price was 38p.

In November 2017, I said that I leaned more toward a short position than a long position, for the reasons mentioned above. The share price was 162p.

At 103p, maybe the market is starting to get the share price about right?

On another comment thread here, bestace has written an excellent analysis of the bear letter.

He makes some adjustments to the cash flow figures offered by the bear, thinking that they overstate the conclusions to be drawn re: the impact of the JVs on IQE cash flow.

The bear himself, Matt Earl, said today:

We firmly believe that were it not for these apparent circular related party transactions, that IQE’s free cash flow would have been weaker and negative in 2015 and 2016 respectively.

That is true, and is important for IQE shareholders to understand. IQE's cash flow has benefited from the creation of its JVs, even though the JVs have been loss-making.

Even without making these adjustments, free cash flow generation at IQE has clearly been unimpressive, resulting in a growing debt pile.

But on the other hand, valuation is about looking forward to the future and understanding what will happen in 2018 and beyond. If its markets are growing and performance improves, nobody will care about pro forma negative cash flow in 2016.

Additionally, the company raised £95 million in November, at 140p, enabling it to de-gear its balance sheet.

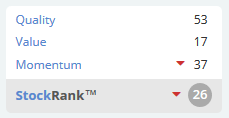

For my part, I do remain cautious about attaching a high valuation to this business. The StockRanks confirm an absence of value in quantitative terms:

Matt finished composing his bear report in early December 2017. So he will have probably taken out short positions at much higher levels compared to the current share price.

Meanwhile, the US-based OppenheimerFunds disclosed today that it has purchased a 5% stake in IQE.

The market is doing what it's supposed to - enabling people with differing opinions to express them and to profit from them, when they get it right.

Murgitroyd (LON:MUR)

- Share price: 552.5p (+2%)

- No. of shares: 9 million

- Market cap: £50 million

This is a Glasgow-headquartered, global group of patent/trademark lawyers. It has 14 offices in nine countries, and 257 staff.

The numbers for six months to November 2017 show improvement versus last year. Revenues are up slightly to £21.6 million and PBT up 13% to £1.67 million. Another year of second-half weighting is forecast (this had already been flagged).

Foreign exchange is a big issue as most revenues are in USD or EUR. In 2016, the weakness in GBP provided a tailwind, which did not occur again in this most recent period. UK clients are only 30% of revenue.

Outlook

The company reckons that intellectual property is a sector with good long term prospects, as trademark and patent filings continue to increase year-on-year. Brexit is a source of uncertainty, but Murgitroyd sees its geographical spread enabling it to continue attracting clients from across the EU.

The interim dividend is increased by 30% and the company continues to invest in upgrading its IT systems. If the final dividend was also increased by 30%, then I calculate that the forward yield would be 4%.

My opinion

I'm not investing in professional services firms these days, but as far as they go, Murgitroyd (LON:MUR) looks like one of the better ones. Cash flow conversion has been good, leaving the company with a solid balance sheet and the ability to increase dividends.

Indeed, Murgitroyd (LON:MUR) has paid a dividend every year since 2002, and has diluted shareholders very little over all this time.

The only concern might be the size of receivables on the balance sheet, implying that it takes clients several months to pay. This hasn't changed much for the company over the years (if anything it has actually improved slightly), so probably nothing to worry about.

It has a Stockrank of 93. If you are taking a more rules-based approach, it might be worth considering this.

Begbies Traynor (LON:BEG)

- Share price: 73.4p (-1%)

- No. of shares: 107.6 million

- Market cap: £79 million

Begbies Traynor, the insolvency specialist, today announces the acquisition of an 11-strong team ("CJM Asset Management") for its property services division.

The target company "specialises in the sale of industrial plant and machinery assets", and will be combined with Begbies' existing machinery disposal activities.

It's a small deal (£0.25 million plus up to £0.3 million in contingent consideration for a team which achieved £1.2 million in revenues last year) but will be of interest to shareholders as Begbies seeks to broaden its activities.

CJM is an auction house which already offers insolvency services (external link). It's not hard to imagine the synergies within Begbies.

There's been a strong uptick in the share price over the past six months or so. As Paul reported recently, increased financial distress in support services, construction and real estate (Carillion!) may be driving this higher, in anticipation of zombie and struggling SMEs finally throwing in the towel.

Games Workshop (LON:GAW)

- Share price: 2225p (-2%)

- No. of shares: 32 million

- Market cap: £718 million

The market as a whole is lower today, so even a positive trading update can't put this in the blue.

Games Workshop is a wargame manufacturing company which many Stocko readers own shares in.

The half-year report was issued in early January. Less than a month later, we are informed as follows:

Following on from the Group's update on 9 January 2018, the good growth trends have continued to the end of January. Sales and, given the high operational gearing of the business, profits for 2017/18 to date are therefore slightly above expectations.

Year-end is in May, and we just had an update last month, so this is just a tweak to existing expectations for the full fiscal year.

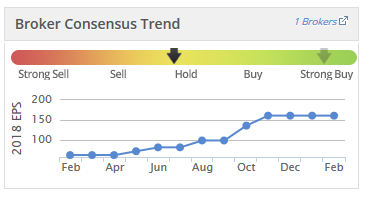

EPS expectations have almost trebled over the past 12 months. They were last seen at 161p, making a PE ratio of 14x.

The product cycle at Warhammer is irregular and depends on the success of big new launches. This is probably why the market hasn't given it a particularly high earnings multiple versus this year's EPS.

Getech (LON:GTC)

- Share price: 27p (+4%)

- No. of shares: 37.6 million

- Market cap: £10 million

Trading update: 17 months to 31 December 2017

This is a small group providing geo-scientific data and related consultancy services.

Its fortunes are traditionally tied to natural resource exploration budgets and therefore to the oil price.

This cyclicality has been punishing at times, and in H1 2016 it swung to a pre-tax loss. But through very careful cost control, it managed to return to profitability in H2.

It is changing its accounting period to match the calendar year, so today it updates for the 17 months to the end of 2017.

In AP 2017, under the leadership of a new management team, Getech undertook a wide-ranging programme of organisational and cultural change. Through cost control, customer engagement and a repositioning of how we invest our operating cash flow, we have significantly enhanced both the Group's cash profitability and the commercial positioning of our Products and Services.

Annualised revenue has increased in the accounting period 2017 ("AP 2017") versus 2016, coming in at £10.9 million (17 months) versus £7 million in 2016 (12 months).

Like-for-like costs have been reduced in a big way. The total cost base is now around the same level as revenues for AP 2017, if you include the costs of developing Getech's products:

The cost base, excluding one-off restructuring costs, remained on a flat trajectory, totalling £10.6 million across the 17 months. Within this figure product investment was £1.2 million.

The Cash Balance remains admirable, at £2.4 million. The strong balance sheet has been part of the argument for investing here in recent times.

Inventory write-down: sadly, not all of the balance sheet has survived. £0.5 million is written off, presumably software or other assets due to be sold but which are now obsolete.

My opinion: possibly too small for many of us, this is nevertheless an interesting little business with a useful niche which has navigated through its cyclical downturn. I don't know if or when it will regain momentum with its product offering. Maybe on the back of recent development spending, things will pick up? It's worth keeping an eye on, in tandem with the oil price.

Veltyco (LON:VLTY)

- Share price: 85p (+5.5%)

- No. of shares: 74 million

- Market cap: £63 million

Veltyco is a marketing company which uses affiliates to generate leads for the gaming industry. I covered its interim results here.

Results for the year ending December 2017 will be significantly ahead of expectations. The following numbers are given:

"net revenues in excess of €14.5 million (2016: €6.1m) and the operating EBITDA for the full year 2017 in excess of €8 million (2016: €2.1m)."

There are no other details given. At the interims, I remarked that management disclosures were a bit thin.

Nonetheless, these are fascinating growth rates. There has been some acquisition activity, so I do need to figure out what is happening on an underlying basis.

And there are a couple of big risk factors, not least the fact that, as with companies like IG Group (LON:IGG) (in which I hold a long position), a very small number of customers are responsible for most of the revenues.

Accepting that it is in all likelihood at the upper end of the risk spectrum, I can't avoid taking a bullish view on these shares, given the trading momentum.

That's all for today, thank you for dropping by.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.