Good morning!

Rob Terry's Return?

A couple of newspapers have been running stories on Rob Terry (thisismoney, Telegraph) over the weekend, and his plans to create another stock market vehicle.

It doesn't look like a breaking news story to me. The "entrepreneur" has been threatening to launch another stock market vehicle for several years.

He originally planned to launch one called Quob Park Estate:

But plans to launch under that name have come to nothing, and the website has been converted to showcase his vineyard only.

His new venture is typical of the man: a nebulous business plan, grand financial targets and gobbledygook descriptions of what the business actually does.

The sad fact is that he probably will find a few more unsophisticated people to fleece. But hopefully not too many this time, as his modus operandi has been highly publicised.

The disgraceful element of the story is that he is even allowed to try it on again, for the third (or is it the fourth, or fifth?) time.

It was all the way back in March 2015 when Australian law firm Slater & Gordon bought the core business of Rob Terry's failing Quindell venture for £637 million. Slater & Gordon has since sued Quindell (now trading as Watchstone (LON:WTG) ) for fraudulent misrepresentation in relation to this deal.

My view - not a controversial one these days - is that Quindell would have gone bust if it had not been bailed out by Slater & Gordon.

The Serious Fraud Office began an investigation into events just a few months later. More than three years have now passed and Mr Terry is apparently still free to rip off investors. Progress at the SFO must be glacial!

KPMG admitted misconduct in relation to its audit work at Quindell and was fined £4.5 million. So at least there was some accountability from that angle. But what about Mr Terry?

The tiger cannot change its stripes and I would be supremely confident in any future Rob Terry venture ending the same way that his previous ones did: with him enriching himself, his investors walking away with very little, and with dodgy financial tricks and flowery language being used to camouflage the truth. No economic value will be created.

Different investors put different levels of emphasis when it comes to the importance of backing the right management team. But no matter what kind of investor you are, you can benefit by avoiding outright charlatans such as this man.

Mello London

Some news in relation to Mello London which is coming up in Chiswick in a few weeks. I've agreed to take part in the Masterclass session on Day 2 which will also feature Glen Arnold (highly recommended). There will be two further expert speakers to round out the panel.

It promises to be a great conference, so I hope you'll be able to make it for at least one, if not both of the days!

Right, onto some companies.

Today I'm interested in:

- ADVFN (LON:AFN)

- Draper Esprit (LON:GROW)

The RNS feed is looking a little thin today as far as RNS updates from good companies are concerned. I'll have to look at it again, a little harder!

Cheers

Graham

ADVFN (LON:AFN)

- Share price: 26.5p (4%)

- No. of shares: 26 million

- Market cap: £7 million

It's below our market cap limit but this financial information website will be familiar to many readers.

Crypto seems to have provided the company with a bit of a boost. I hadn't looked at their main crypto page before - here's the link.

Revenues are up 12% and operating profit improves from c. breakeven to £384k. Not bad.

Clem Chambers:

We are very bullish about the potential of future demand for Cryptocurrency information and feel this can be a business multiplier for us in the next 3-5 years.

Anything is possible, but if crypto is a late-stage bubble phenomenon and the coins are basically worthless (as I believe), then it's unlikely to be a business multiplier over the next 3-5 years.

I note this reference to operating costs:

Our main costs are relatively fixed but licence and exchange fees are continuing to rise and it is these we must keep a close eye on and if need be change what we offer.

A reminder of the quasi-monopoly position of London Stock Exchange (LON:LSE) - it's the type of company I would like to own shares in, if I can avoid overpaying. See the LSE Group's Information Services.

R&D: Our R & D investment this year has been £353,000 (2017: £379,000) and all of this investment has been to develop the website and has been capitalised.

I'm going to have to raise an amber flag here. The company has spent £353k on intangible assets, but only amortised £202k. Last year, it capitalised £379k and amortised £302k.

This means that the intangibles have been building up on the balance sheet (at £1.3 million this year, versus £1.16 million last year).

That might be fair enough, but you have to agree with the idea that ADVFN's website is increasing in value thanks to this investment. But the website hasn't improved in any significant way for many years, at least as far as I can tell. Maybe those who subscribe to its premium services would disagree?

Balance sheet: if you subtract goodwill from the balance sheet, the company has a net worth of £1.1 million. Of this, the website is worth £1.3 million - so there is negative tangible net worth.

Outlook: the company is looking to build new opportunities in blockchain/crypto. There is no reference to results vs. expectations.

My view: there doesn't seem to be a great deal to get excited about here, I'm afraid. Unless you think the crypto market is going to multiply again and be around for many years, and that ADVFN is going to be at the forefront of providing information about it. Looks doubtful to me.

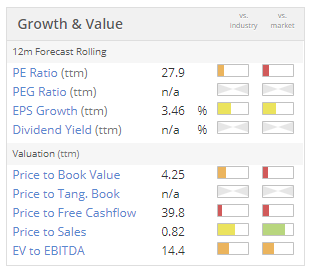

Quantitatively, the shares are overpriced:

Draper Esprit (LON:GROW)

- Share price: 544p (+3%)

- No. of shares: 99 million

- Market cap: £539 million

Draper Esprit (AIM: GROW, ESM: GRW), a leading venture capital firm investing in high-growth digital technology businesses, today announces its interim results for the six months ended 30 September 2018.

This is a proper technology-oriented VC firm (i.e. it's not pretending to be something it's not, like a Rob Terry vehicle would).

I first mentioned it in an SCVR in May. The share price has made good progress since then (up 21%) and it has raised additional funds.

Checking Draper Esprit's portfolio, I note the presence of Revolut. That's quite exciting - I've heard through word-of-mouth from multiple sources that it's an extremely useful product.

Other recognisable names are Currencyfair, Seedrs, TransferWise and Trustpilot.

Performance over the last six months seems very good: "hard NAV per share" is up by 10%, from 402p to 444p. The "fair value increase" is 20%.

The company is dual-listed in Dublin and London, and has a broad mandate to invest in disruptive European companies. So hopefully there will be a smooth continuation post-Brexit. The outlook comment strikes a nice balance of cautious optimism.

My view - there are too many investees for me to be able to get a grip on their prospects in any meaningful way. But I do think GROW is worth investigating in further detail, if you're interested in VC investing.

I would be a little bit worried about the valuation at the current level. As regular readers will know, I have major concerns over tech valuations at the moment, not just in the NASDAQ but among UK firms with themes such as artificial intelligence, blockchain, cloud computing, etc. So I would have some doubts about whether now is a particularly good time to get involved in a VC firm such as this, especially at a premium to NAV per share (officially this is 454p).

GROW's portfolio valuations and return calculations are based on the most recent transactions at its investees - so if somebody puts money into an investee at a higher level, this is booked as an increase in fair value. That's reasonable in isolation but if you have an economic environment where valuations have risen to silly levels, then most of the gains will be illusory.

On the other hand, just one big winner could end up making such a huge return that the current valuation turns out be attractive.

As I said, worth investigating.

I'm not loving the RNS feed today. Lots of junk and not much that's good to write about. So I'll call it a day there.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.