Good morning!

Well done to everybody reading this - you've survived a tricky couple of weeks in the markets.

The FTSE has stabilised around 7150, which from my perspective seems to price in lots of bad news, especially with the pound also rather weak.

The papers suggest that this is a critical seven days for Brexit negotiations. I'm sure we're all completely fatigued when it comes to that subject, however, so let's not dwell on it!

Personal trading update

I like to be as transparent as possible when it comes to my personal portfolio, so please note that I have today closed both my short position in Tesla and my long positions in the FTSE Index. That's why this morning's report has got off to a slow start - I've needed to tidy up a few personal matters.

To be clear, this has not been driven by any change in my view of the merits of these trades. I still view them both as extremely attractive. The reason is that I am in the middle of a house-buying process, and need to use the collateral for the deposit and fees. The potential returns from a trading account must be swapped out for the certainty of home equity.

On that subject, I wonder if readers here have any views on the home equity vs. stock market equity question? Do you carry a large mortgage while also building a stock portfolio? Or would you prioritise building home equity first, before venturing into the financial markets? I've always found this an intriguing question, and now I have to answer it.

Today's news

This is what I plan to discuss today:

- Duke Royalty (LON:DUKE) - primary bid fundraising, announced on Friday

- Ramsdens Holdings (LON:RFX) - trading update

- Audioboom (LON:BOOM) - Q3 trading update

- Angling Direct (LON:ANG) - interim results

- Gooch & Housego (LON:GHH) - trading update

Duke Royalty (LON:DUKE)

- Share price: 45.5p (-4.4%)

- No. of shares: 197 million (pre-fundraising)

- Market cap: £90 million

Fundraising of up to £20 million

Retail offer via PrimaryBid.com

This was announced on Friday, after the market closed.

It is no surprise that Duke wants to raise more capital. But I was a little surprised to see it using PrimaryBid, which I associate with very small deals.

As it turns out, the amount raised on PrimaryBid was just £461k. So while it was a nice gesture to use the PB platform, the amount raised there is hardly going to move the needle.

A further £3.45 million is available to existing shareholders via an open offer, on top of a £16.1 million placing. So we get a £20 million increase in total.

What the money will be used for

The money raised in this fundraising, plus new borrowed funds, will be used as follows:

- £8 million for a new royalty partner in Ireland, to support a management buyout. The company "supplies teams of expererienced managers to its clients (mainly governments and government agencies)". Initial yield 13.2%.

- £16.4 million in follow-on investments to existing partners. £8 million of this is for an Irish recruitment company, to fund an acquisition.

My view

As noted previously, I sold out of Duke several weeks ago. While I still think it has some attractions, it is no longer safe enough versus my risk tolerance.

For example, I don't personally invest in the recruitment sector. Duke has announced today that it is financing an MBO and an acquisition for two recruiters. Debt-funded MBOs and acquisitions in a competitive sector like recruitment strike me as rather risky.

And then we have to consider that Duke itself is using a rather large debt facility. Duke is borrowing at LIBOR plus 7.25% (let's call it 9%, using 1-year LIBOR), in order to make investments yielding 13%+.

Is that something you'd do with your own funds - borrow at 9%, to invest at 13%? This is what Duke is doing, while also paying large dividends.

It could (and probably will) work out fine for shareholders. There is an equity cushion, so I wouldn't expect a handful of defaults to topple the company. But I value my sleep, so it's much more comfortable watching this from the sidelines.

Ramsdens Holdings (LON:RFX)

- Share price: 196.8p (+2%)

- No. of shares: 31 million

- Market cap: £61 million

Trading at Ramsdens is in line with expectations in H1.

There's an interesting snippet in relation to inventories:

...during the first half, Ramsdens' management took the decision to scrap some of the Group's slower-moving jewellery stock to take advantage of a relatively high gold price. As a result, the Group will report an additional, non-recurring gross profit of approximately £600,000 in its first half results.

H & T (LON:HAT) (in which I have a long position) recently reported lower gross margins, after it took the decision to dump some slow-moving inventory such as watches.

From the sounds of the RFX update, there won't be any hit to margins from this particular inventory dump. It sounds more like an opportunistic move, to take advantage of the high margin on offer.

As someone who is bullish on the long-term prospects for gold, it wouldn't bother me if RFX assumed that the positive momentum in gold was set to continue, and managed their inventory accordingly. But clearly they prefer to grab the cash while it's available now!

And there's some positive news on Money Shop, along with a reference to Albemarle & Bond:

The stores acquired from The Money Shop have performed well and the Board continues to appraise acquisition opportunities in this highly fragmented market. The widely publicised recent collapse of one of the Group's largest competitors has again highlighted the importance of our outstanding and highly-trusted customer proposition.

It's good news for Ramsdens and I think it has to be encouraging for H&T, who are also integrating stores from Money Shop. I'm very pleased to continue holding the latter, while keeping a watchful eye on the former.

Audioboom (LON:BOOM)

- Share price: 168.9p (-6%)

- No. of shares: 14 million

- Market cap: £24 million

This company lost its CEO recently.

At the time of departure, he said:

The business is now entering a more mature phase and I believe that the time is now right for me to pursue more entrepreneurial opportunities.

While I wish him well, I find this rationale difficult to take seriously.

Audioboom has never made any money, and is set to remain loss-making for the foreseeable future.

As the driving force behind the company for many years, it strikes me as odd that he prefers to leave at this moment, rather than see the company through to financial success - that is, unless financial success is not on the cards.

Audioboom is not a mature company, and whether or not it survives to maturity is an open question.

Q3 update

Today's trading update reflects the fact that the company is trying to be a mini-Netflix, funding content creation.

The Netflix/Audioboom business model is really quite old-fashioned: buying content, and hoping to profit later through the sale of advertising spaces.

By contrast, I own shares in Alphabet ($GOOGL) and this is partly because YouTube is a place where content creators want to be. Content creators get a share of advertising revenue at YouTube, but YouTube doesn't have to devote resources to funding any content itself. Creators go to YouTube and upload their stuff there automatically.

Today's update from Audioboom is in line with expectations, showing revenue growth of 86%, but the shares are still down by 6%. This might be due to the cash balance declining by nearly $1 million during the quarter, leaving the company with $2.5 million left.

Audioboom has a track record of equity issuance/dilution, and I would assume that more dilution is on the cards. Will the interim CEO have the same fundraising skills as his predecessor?

Angling Direct (LON:ANG)

- Share price: 61p (+4%)

- No. of shares: 64.6 million

- Market cap: £39 million

These interims are again in line with expectations.

This expanding group of fishing stores is one that I've been moderately impressed by - the financials look "ok", even if profitability hasn't exactly taken off yet.

Today's results show more progress: in-store like-for-like sales up 13.3%, online sales up 26.7%, from June to August inclusive.

The Board remains "highly optimistic for the future growth and success of the business".

Own websites - I like this strategy shift. The company manages and sells from its own websites, rather than 3rd party. Sales via eBay are now immaterial. Although the company's own fishing brand, Advanta, is still very small.

Outlook

H2 has started "very positively", with like-for-like store sales up by 11.8%. The company is on track to meet market expectations for FY January 2020 (a small after-tax loss).

My view

This company's updates continue to suggest that it has the potential to generate nice profits, a couple of years from down the line. As such, it might be worth researching in greater detail. It does have quite a lot to do, to justify the almost-£40 million in market capitalisation.

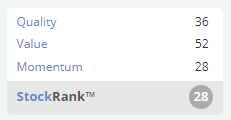

The StockRanks are rightly cautious:

Gooch & Housego (LON:GHH)

- Share price: 1196.25p (+2%)

- No. of shares: 25 million

- Market cap: £299 million

This one is also in line with expectations.

G&H is a "specialist manufacturer of optical compenents and systems" (lasers, to you and me).

It reiterates that the macro trends it faces are somewhat mixed:

G&H has long been aware of the risks associated with cyclical downturn in microelectronic and semi conductor manufacturing and more recently the impact of the US/ China trade dispute. G&H believes that technological innovation in end market applications, such as 5G and the introduction of new manufacturing techniques, combined with our market leading position will ultimately drive improved demand for our industrial laser products.

My view - no strong opinion on this one, but its long-term financial track record is solid and it could be one to watch.

Out of time for now. Thanks for all your comments on the home equity vs. stock market equity question. Lots for me to chew on over the next few days and weeks (and years!). Finding the right balance between highest expected return and minimum stress will be my objective.

Have a great evening,

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.