Hi, it's Paul here.

Here is the placeholder for Monday's reader comments.

I'm on the afternoon shift today, so estimated time of completion here is 5pm.

Update at 16:36 - today's report is now finished.

Ten Lifestyle (LON:TENG)

Share price: 119p (up 3.5% today, at 11:57)

No. shares: 80.65m

Market cap: £96.0m

Ten Lifestyle Group plc (AIM: TENG), a leading technology-enabled lifestyle and travel platform for the world's wealthy and mass affluent, is pleased to announce the following trading update ahead of its preliminary results for the year ended 31 August 2019.

I was deeply unimpressed with the figures, when reviewing this company after its profit warning here in Nov 2018. The share price has since more than tripled in less than a year. This seems to have been driven by a series of contract win announcements, and a global roll-out.

Looking briefly at its interim results for the 6 months to 28 Feb 2018, revenues were up 24% to £21.5m, but it remained loss-making, with an adjusted operating loss of -£2.9m. Cash was falling quite quickly, with £13.2m remaining. I'm remain not at all impressed so far.

Today's trading update -

The Board expects to report Net Revenue1 in line with market expectations2, whilst it is anticipated that the Adjusted EBITA3 loss for the full year will be ahead of market expectations.

Cash burn - has improved dramatically from H1 to H2. But should a company valued at £96m really still be cash-burning at all? -

The year-end cash balance will be c.£12m with no debt, representing an overall reduction in cash of c.£1m in H2 compared to an overall reduction of £7.5m in H1.

Outlook - its pipeline of new business remains strong.

My opinion - this business appears to be valued on the basis of hopes of further expansion, and breaking into profit in future. Therefore I think prospective investors would need to do more research on its services, and how they compare with competitors.

It's signing up some impressive customers (banks mainly). Also, H2 looks to have been a big improvement on H1.

It might be one to keep an eye on, but in current highly sceptical markets, I really cannot understand why this jam tomorrow share is so highly rated.

I suppose there is a counter-argument that in bad markets, we should be looking at the shares that manage to rise strongly.

Filta Group (LON:FLTA)

Share price: 175p (up 14% today, at 12:53)

No. shares: 29.1m

Market cap: £50.9m

Filta Group Holdings plc (AIM: FLTA), a market-leading commercial kitchen services provider, is pleased to announce its unaudited Interim Results for the 6 months ended 30 June 2019.

Key points;

- Good organic revenue growth of 21% (6.6m LY to £8.0m TY)

- Acquisition of Watbio added a further £4.2m of new revenue, total £12.2m revenues in H1

- Only a modest increase in profitability though - Adjusted Profit before tax** increased 14% to £1.3 million (2018: £1.1 million)- why hasn't profit increased more, given strong revenue growth?

- The commentary indicates that substantial cost savings were made after the half year end, suggesting improved performance in H2 & beyond.

- Share based payments of £303k in H1 seems rather a lot - it's about half of operating profit!

Outlook - nothing very specific & no mention of market expectations;

... Following the acquisition of Watbio, Filta has become one of the leading providers of FOG Services in the UK, making us well-placed to capitalise on recent changes to hygiene regulation. This, in conjunction with the underlying growth in our other business areas, gives us confidence in the outlook for the remainder of the year and beyond.

Balance sheet - just about adequate. If you strip out intangibles, then NTAV is only just positive.

It has £3.6m of cash, and £4.2m of borrowings, giving net debt of £0.6m.

I am ignoring the additional £1.0m of notional debt under the ridiculous new IFRS 16 rules relating to leases.

Cashflow statement - not good. All of the operating cashflow in H1 was swallowed up in adverse working capital movements - in particular a big drop in creditors, see note 5. I'd want to better understand what has driven those movements. I would have expected trade creditors to have risen, given that an acquisition has been made in the period.

The other large item on the cashflow statement is £1.8m paid for acquisitions.

Is it wise for the company to be paying dividends at this stage?

Valuation - it looks as if Filta bought an inefficient operation (Watbio) and is turning it around. That's a perfectly good strategy, but it does rather render these H1 results as unreliable to value the business. Hence broker forecasts are of more use.

There's an update on Research Tree today, which shows a significant reduction in FY 12/2019 forecast - EPS reduced from 10.5p to 8.0p. Normally that would have triggered a sharp fall in shares price. So I'm a little perplexed as to why the share price has actually risen 14% today? That looks an anomaly, unless I've missed something very positive in the commentary perhaps?

Although FY 12/2020 forecasts have been left unchanged at 12.1p adj EPS.

My opinion - the main attraction here is good growth, and recurring revenues.

In summary, I'm not impressed by the balance sheet or cashflows. I feel that at the current price, investors are being asked to pay up-front for the turnaround measures being implemented.

Therefore it's not for me.

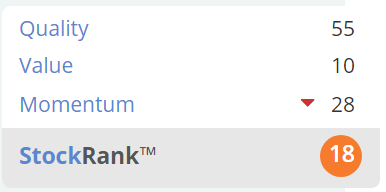

Note that the StockRank is very low. The system doesn't tend to like acquisitive groups.

UP Global Sourcing Holdings (LON:UPGS)

Share price: 74.5p (up c.4% today, at 14:55)

No. shares: 78.9m

Market cap: £58.8m

Ultimate Products, the owner, manager, designer and developer of an extensive range of value-focused consumer goods brands, announces its trading update for the financial year ended 31 July 2019 ("FY19").

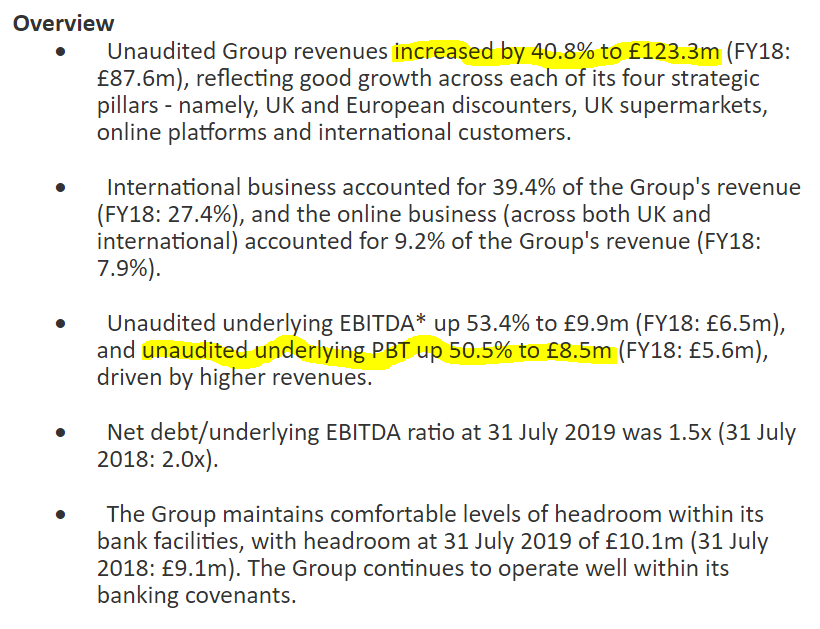

The highlights section looks very impressive at first sight;

Stockopedia is showing £121.7m forecast revenues, so the actual result above is 1.3% ahead in revenues.

Profitability looks to be ahead of expectations - a new note today from Equity Development increases its forecast from 7.9p to 8.1p for FY 07/2019.

Forecast for FY 07/2020 is increased from 8.3p to 8.5p - giving a PER of 8.8 - which looks reasonable.

Outlook & current trading sound OK;

· Currently trading in line with market expectations with the FY20 order book moderately ahead of this time last year.

· Over the longer term, the Board is confident in the resilience of the Group's business model, and in particular the adaptability and versatility of its strategy.

Balance sheet - looking back at the last interim balance sheet, it looks adequate. NTAV is £10.4m, which is OK.

There's some net debt, about £14m, but this is supporting inventories + receivables combined of about £38m. Therefore debt is not excessive. It's fine for companies with decent stock turn to finance some of that with bank debt.

Dividends - forecast yield is a very attractive 5.8% - that's good for a company which is going profits strongly, and has a sound balance sheet. Providing nothing goes wrong with future trading, then the decent divis should be sustainable.

My opinion - my preconception was that this was a rather low quality company. But when the facts change, so does my opinion - it's so important to approach every share with an open mind.

There's a lot to like here;

- International, and online sales, are impressive & growing

- Excellent divis

- Strong profit growth

- Solid outlook

- Balance sheet is reasonable, with debt under control

- Management has loads of skin in the game - see here

On the downside, it's basically a distributor (although owns/licenses some brand names too), so not likely to ever command a premium rating. My other concern is over potential bad debts, from retail customers going bust.

Overall though, I think this share looks attractive, for investors seeking a decent, and probably sustainable, income from dividends.

It was a disastrous float in Mar 2017, with the share price plummeting just 6 months afterwards. That dents investor confidence very badly, with IPO investors naturally likely to feel that they were stitched up. It's good to see the company getting back on track, with a strong update today. Therefore, despite the chequered track record, this gets a thumbs up from me today.

Here is the full chart since it floated:

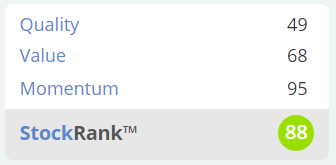

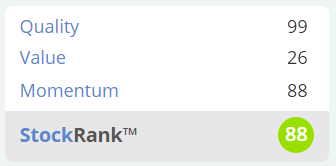

We also have the reassurance of a high StockRank:

Medica (LON:MGP)

Share price: 130p (down 1% today)

No. shares: 111.1m

Market cap: £144.4m

Medica Group PLC (LSE: MGP, "Medica", the "Company" or the "Group"), the UK market leader in the provision of teleradiology services, today announces its unaudited results for the six months ended 30 June 2019.

Note (from Google):

Teleradiology is the transmission of radiological patient images, such as x-rays, CTs, and MRIs, from one location to another for the purposes of sharing studies with other radiologists and physicians.

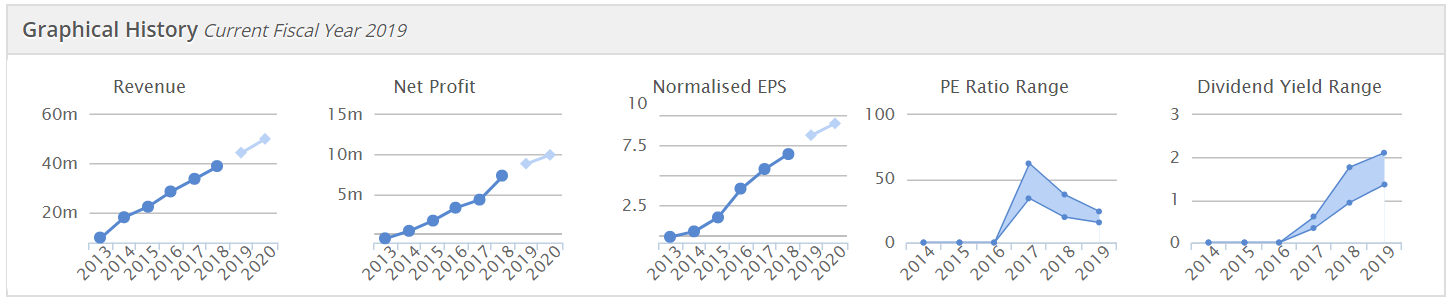

The Stockopedia historical graphs look terrific;

I don't seem to have written about this company here before. Graham's notes on the last full results, were published here in late Mar 2019. It's quite tough to impress Graham, but this share did so! It's currently at a similar price to when he wrote that article.

Results today have impressed me too;

- Revenue growth of +18.2% to £22.0m in H1- this appears to all be organic, from what I can tell, which is impressive

- Adj operating profit is only up 7.0% though, indicating lower margins

- Operating margin has fallen from 26.8% to 24.3% - overseas setup costs are blamed - but this is still a very high margin business - maybe too high margin, as this is likely to attract competitors to join the party

- Adj EPS is 3.98p, up 9.5%. Double that for a full year, and we're at about 8.0p, which is consistent with the 8.34p broker consensus forecast shown on Stockopedia. At 129p per share, that's a current year PER of 15.5 - which strikes me as very reasonable, for a growing, high margin business

Outlook - full year heading to be in line with expectations

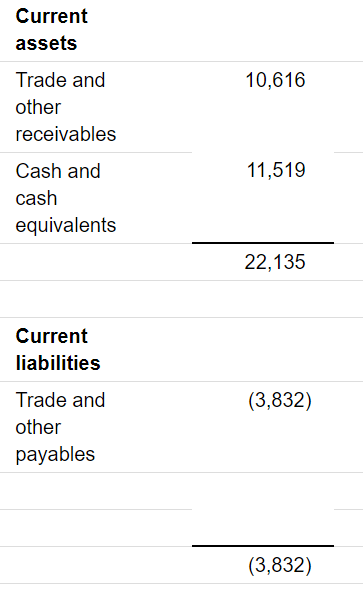

Balance sheet - slightly odd. There's a remarkably strong current ratio -

Tons of cash sitting there, and hardly any current liabilities. Very nice.

But then in longer term liabilities, there is £12.5m of "borrowing & other financial liabilities". How strange. Why have a lot of cash sitting there earning next-to-nothing in interest, then opposing borrowings, attracting debt interest? That doesn't make sense to me. Unless the cash pile is a seasonal spike perhaps, which could be atypical for the rest of the year?

Curiosity got the better of me, so I've checked the 2018 Annual Report. Page 29 indicates that the company has a £12m bank loan, and £1m overdraft facility. These are payable in Mar 2022, and attract interest at LIBOR + 1.75%. So cheap borrowings. I wonder though, why the company hasn't at least partially repaid this facility, to save on interest charges? That's a good question to ask management, if anyone speaks to them.

My opinion - I like this. It's a very high margin business, with good growth, available at a reasonable price of fwd PER of about 15. There's a 2% dividend yield, which looks to have scope to grow.

My only reservation, is that the operating margin is so high, this is bound to attract competitors, offering the same services at a keener price. There again, there seems to be much inertia within the medical sector - i.e. hospitals often seem to keep using the same products & services, once they are established. So competitors might find it difficult to dislodge Medica?

Overall then, a thumbs up from me for Medica.

In more normal market conditions, I would see this trading on a PER of at least 20. So this could be a buying opportunity. It's not likely to be affected at all by Brexit, either.

Stockopedia likes it a lot too;

For more information, there's a presentation slides pack from Medica to accompany these results, available here.

That's me done for today, thanks for dropping by.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.