Good morning!

This list is final.

- Aeorema Communications (LON:AEO) - interim results

- Spaceandpeople (LON:SAL) - preliminary results

- Spectra Systems (LON:SPSY) - preliminary results

- Medica (LON:MGP) - preliminary results

- Brady (LON:BRY) - preliminary results

- Leeds (LON:LDSG) - trading update

Aeorema Communications (LON:AEO)

- Share price: 26p (-15%)

- No. of shares: 9 million

- Market cap: £2 million

Perhaps I shouldn't mention a company this small, but I am just wondering why it is still listed at this small size?

I take an interest in it as a former shareholder - I took a loss when I sold out of it a few years ago.

It's a live events agency, trading as "Cheerful Twentyfirst". It's the type of people business that seems to have difficulty scaling up for investors.

We have an H1 operating loss of £140k, due to "recruitment costs and increased salaries".

New staff have been hired, who will hopefully deliver increased revenues in future periods.

Trading is said to be in line with expectations. Investors were clearly hoping for a bit more, though, based on the share price reaction. Meeting expectations for the full year is now dependent on achieving a stronger second half. As we know, this is often the precursor to a fully-fledged profit warning.

At least there is £1 million in cash on the balance sheet, underpinning the low valuation.

My view - I can't see the logic for this being publicly listed at this stage.

Spaceandpeople (LON:SAL)

- Share price: 11.15p (-23%)

- No. of shares: 19.5 million

- Market cap: £2 million

Very similar story here. We have a tiny market cap that doesn't justify the stock market listing.

High hopes had previously been attached to this one.

For 2018, Spaceandpeople has generated an operating loss after revenues declined by about 20%. This is attributed to bad weather in Q1, good weather in Q2 and Q3 (SAL couldn't source outdoor locations quickly enough), the World Cup, staff and service cost increases, and the tough retail backdrop.

There is no specific "outlook" section in today's statement. We get this sentence:

Despite the disappointing performance in 2018, our strong cash position, improved expectations for 2019 and a good pipeline of potential new business gives us the confidence to announce a dividend of 0.5p per share, subject to shareholder approval at the AGM.

My view - Difficult to find evidence that this is ultimately going anywhere for shareholders. Might be better off as a private company.

Spectra Systems (LON:SPSY)

- Share price: 113.5p (-8.5%)

- No. of shares: 45.8 million

- Market cap: £52 million ($69 million)

Spectra Systems Corporation, a leading provider of advanced technology solutions for banknote and product authentication and gaming security, is pleased to announce its preliminary results for the twelve months ended 31 December 2018.

This is a US-headquartered company I've commented on before.

Its end-markets are difficult to analyse, e.g. Asian central banks who need anti-counterfeit measures, and Chinese cigarrette manufacturers.

For this reason, I have described it as a "black box".

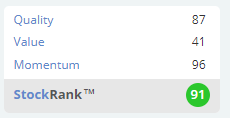

It has a super StockRank in its favour:

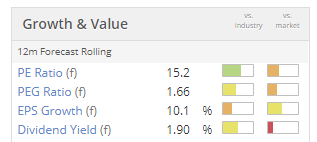

Today's FY 2018 results are ahead of its own broker's estimates.

Additionally, its broker has upgraded estimates for FY 2019. Adjusted pre-tax profits are now forecast at $4.4 million rather than $4 million.

So I'm a bit perplexed about today's share price decline. I suppose there is occcasionally a mismatch between what a company and its broker expects, versus what the company's investors expect.

Maybe a stronger top line was needed to support the current valuation? Revenues increased by only 3% year-on-year.

I've just gone back to the 2017 report to remind myself of the potential customer concentration risk. In 2017, 3 customers accounted for 64% of Spectra's revenues, In the same year, 2 customers accounted for 64% of accounts receivable.

I believe that improved customer diversification was achieved in 2018, but even so, anything resembling this level of concentration is far beyond my risk tolerance. I have no ability to predict how the relationship between Spectra and its top handful of customers might evolve in the years ahead, so it's not something I'd want to bet on.

Today's report does include some noteworthy musings on the banknote industry. Spectra reckons that "the poor are disproportionately dependent on banknotes on a global scale and most of the world requires banknotes as a financial transaction option".

It thinks that banknotes will remain a pillar of the global financial system for the foreseeable future and this will lead to plentiful opportunities for it in the years ahead.

Prospects - development and testing of products with various central banks and more opportunities in tobacco, too.

This sounds tasty:

We believe that we have a number of transformative opportunities ahead in several aspects of our business that will sustain and potentially accelerate our earnings for our shareholders.

My view - As I've said above, this is beyond my risk tolerance as I don't feel capable of analysing it fundamentally.

That said, if somebody wanted to build a highly diversified portfolio of high-StockRank shares, not considering any other criteria, then clearly it would be eligible for inclusion with a StockRank of 91.

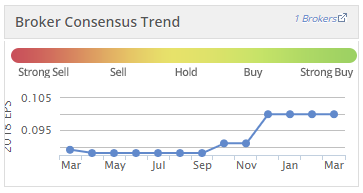

Earnings momentum for FY 2018 looks nice (and this chart is before today's upgrades):

Medica (LON:MGP)

- Share price: 127.8p (+2%)

- No. of shares: 111 million

- Market cap: £142 million

This company provides "teleradiology", i.e. radiologists working remotely to analyse scans.

This type of service is useful out-of-hours or when no radiologist is available locally, and is part of a wider trend of outsourcing by NHS trusts who need more services at lower cost. See my comments last year on the stock.

It now has Australian and New Zealand radiologists working for UK clients, and its total number of radiologists increased from 306 to 362 by the end of 2018.

These results show revenues in line with expectations and net debt eliminated.

Outlook - 2019 has started well. Revenue growth is expected "to remain at double digit levels similar to 2018" (revenue growth in 2018 was 15.6%).

Analysis - The company makes excellent gross margins of c. 50% and has achieved a fine operating margin of 25% in 2019.

The balance sheet is a bit thin when you strip out intangibles but it looks healthy enough, assuming continued strong cash flows from operations.

The company raised money at 135p two years ago for its IPO. Shares then rallied as high as 235p before returning to the current level.

My view - this looks genuinely interesting to me, the more I look into it. It has plans to open more international centres, and I can't see any immediate obstacles on the growth runway.

The long-term strategy is to provide a more diverse range of services, with customers from the private sector in addition to its traditional customer base. I would imagine that its proposition will only become more attractive to customers as it grows.

The rating isn't too expensive, the cash flow generation looks good, and the business model makes sense to me. Sending scans to someone who is available to review them immediately, wherever they are in the world, is a good idea! And perhaps Medica's scale can give it a sustainable competitive advantage.

Definitely worth looking into in more detail, in my view.

Brady (LON:BRY)

- Share price: 57.5p (+2%)

- No. of shares: 83.4 million

- Market cap: £48 million

This software company is in turnaround mode. Today it posts its fourth consecutive annual operating loss.

It provides "trading and risk management software for the commodity and energy markets".

There is a new CEO appointment as of last month.

Outlook - the company is confident, despite the poor results. It has net cash (£4.6 million) and committed revenues (£18 million), and says it is on track to achieve the plan set out in the previous two annual reports.

My view - I have to agree with Paul's previous views on this company. He has said that the valuation was asking shareholders to pay up for a turnaround before it had been achieved, and I feel the same way. There is still a lot to prove before we could justify a near-£50 million valuation, I fear.

StockRanks feel the same, with a ValueRank of only 24.

Leeds (LON:LDSG)

- Share price: 23p (-2%)

- No. of shares: 27 million

- Market cap: £6 million

Trading at this German textile wholesaler has deteriorated, due to "market conditions", and no short-term recovery is foreseen. Pre-tax profit is going to be below expectations for the year ending May 2019.

No numbers are given, so shareholders are left without much to work with.

Two general points.

Firstly, companies should always provide some range of expectations, or quantify their profit warnings with some percentage figure in relation to sales or profits.

Secondly, value investing without giving due regard to quality considerations can be hazardous to your financial health.

Net current asset value at Leeds (current assets minus total liabilities) was last seen at £11 million. So this company could be of interest to an asset stripper.

Two individuals, including a well-known deep value investor, already own 53% of the shares between them. I wonder what are their plans?

There was little to excite me on the RNS today, apart from Medica (LON:MGP). It can't be helped - there will be days like this.

At least I managed to avoid mentioning the "B" word!

Have a great day.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.