Morning folks,

I'm on the road, writing to you from a restaurant in rural Ireland. On the menu today we have:

- Tungsten (LON:TUNG)

- AFH Financial (LON:AFHP)

- Seeing Machines (LON:SEE)

- Two new "intentions to float" announcements

Tungsten (LON:TUNG)

- Share price: 52p (-5%)

- No. of shares: 126 million

- Market cap: £66 million

A trading update for the year ending April 2018:

- "Achieved monthly EBITDA2 breakeven during H2-FY18"

- "Operated profitably over January to April 2018 period"

- "FY18 EBITDA loss narrowed to £4.6 million from £11.8 million in FY17"

The language used is a bit unfortunate - "monthly EBITDA breakeven" is not a thing.

Let's assume it means that the company was at EBITDA breakeven during some months, but not during others.

The next achievement: "operated profitably over January to April 2018 period" - again, this is awkward. Profitable businesses should have positive net income, not positive EBITDA. And focusing on the last four months of the financial year reduces the value of the claim.

Don't get me wrong - this is the best the company has achieved so far. But one short period of positive EBITDA does not a viable business make.

The company admits it has no idea when it will be positive on an EBITDA basis, from month to month:

The sales pipeline is well developed, although the nature of Tungsten's business is such that the level of conversion and the timing of sales on a monthly basis is unpredictable. While FY19 operating expenses are unlikely to exceed the levels of FY18, the ability to generate positive EBITDA in any month over FY19 will continue to depend on the quantum and timing of sales conversions as well as discretionary investment decisions in areas such as developing new products.

How about cash?

The EBITDA loss of £4.6 million plus capex resulted in a cash outflow of £11.1 million during FY 2018, leaving it with net cash at the end of the financial year of £6.4 million.

The Board considers that the Company has adequate working capital. In any event, Tungsten is able to flex discretionary spending should the expected level or timing of conversion of the sales pipeline into actual sales be behind management's expectations.

In other words - if sales don't materialise as expected/hoped for, then investment in new products and infrastructure can be curtailed. But would investors really be happy with that? I would expect to see an equity fundraising instead.

Growth - On a constant currency basis, revenue for FY 2018 is expected to post a 9% gain.

In the context of a mature, profitable business, 9% revenue growth would be acceptable to me. In the context of an early-stage, unprofitable business, it's not enough to interest me.

To give credit where it is due, the current management team have taken a company which was a complete wreck a couple of years ago, and turned it into something which looks like it could potentially reach success if given enough time.

For me, it is still too early-stage. I refuse to get diluted and I think existing shareholders in this one may find themselves facing a cash call over the next year or so.

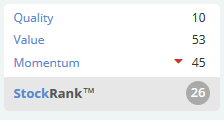

Stocko algorithms seem to agree:

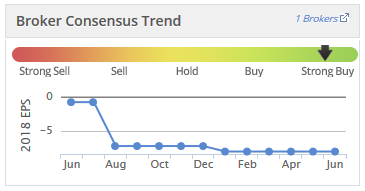

Notice how expectations have trended lower, a pretty serious red flag when you're investing in what is supposed to be a growth business:

Today's trading update refers to the sales miss for the year as relating to a "longer sales cycle" - i.e. business customers not biting as they were expected to.

I've just quickly reviewed my personal portfolio and only 2 of them are purely B2B (business to business sales), although some of the others are a mix of B2B and B2C. In general, I think B2C sales are more valuable than B2B, and it makes to have a bias toward B2C shares in most equity portfolios.

The product - Tungsten offers a range of financial services to buyers and suppliers, with the goal to streamline global trade and make it "frictionless".

I've spent a few minutes this morning browsing the Tungsten website's product offering and there are a few interesting nuggets in there. However, I do have to say that I think the trumpeting of E-invoicing as some kind of revolutionary concept is a bit overblown. I've been issuing invoices to clients for over 10 years and have never in my entire life issued a paper invoice. I now have a nice service from Sage (LON:SGE), the £7 billion market cap, FTSE-100 company which also offers E-invoicing, reporting, analytics, international functionality, etc.

I do think that Tungsten might evolve into a profitable and successful business given enough time (and perhaps more funding). But I haven't see any unique competitive advantage to it yet and given its current size (sales of c. £34 million) and cash balance (£6.4 million), could not at this stage justify its near-£70 million market cap.

AFH Financial (LON:AFHP)

- Share price: 335p (+8%)

- No. of shares: 37.8 million

- Market cap: £127 million

Results for six months ended April 2018

This is a new one for me - thanks to Paraic for suggesting it in the comments.

It's "a leading financial planning led wealth management firm".

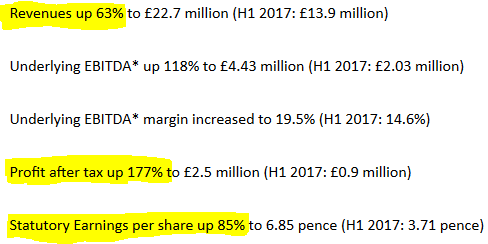

Numbers are going in the right direction:

It has an acquisition-led strategy, funded via Placings, so the share count has been increasing.

This has the consequence that that earnings per share growth is lagging profit growth, as you can see from the yellow highlights above. But the EPS growth is still really strong (85% growth).

The outlook is confident too, with the company arguing that it has a "proven acquisition methodology", and cash reserves of almost £24 million to continue this strategy.

The company's financial aspiration is to achieve "underlying EBITDA margin of 20%" - not a terrible aspiration, but I do prefer companies which target their return on capital, since it tends to produce a bit more discipline in how they use their balance sheet.

Anyway, things do seem to be going well at AFH. Funds under management are up 45% to £3.2 billion and the company refers to the beneficial effects of increased economies of scale contributing to the more-than-doubling of underlying EBITDA.

The business model involves buy up the clients of retiring financial advisers and wrapping them up inside the AFH model.

The statements look clean to me at first glance, albeit with the complications which arise when a company is raising additional funds and ploughing them into acquisitions. Pre-tax profit of £3.2 million translates to £3.5 million of cash generated from operations, or £4.4 million in cash generated once you add back the negative working capital movement. Not bad over a six-month period!

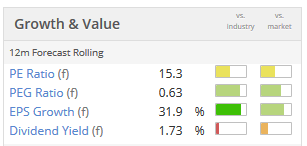

The StockRank is only average, but this looks like a decent little financial stock to me. Profitable, rich balance sheet, generating cash, and executing its strategy well so far.

Seeing Machines (LON:SEE)

- Share price: 9.15p (+17%)

- No. of shares: 2240 million

- Market cap: £205 million

Automotive design win with US OEM for FOVIO chip

I'm bowing to consumer demand by covering this - it's not a results statement, or even a trading update. So I wouldn't normally cover this.

Seeing Machines had a sales warning last month, which we covered in this report and which knocked the share price below 8p. Here's the previous comment.

For newcomers, this company creates technologies which can monitor human behavior. The major application so far is in driver safety, a market set to grow significantly in the years ahead.

Today's announcement:

Seeing Machines Limited (AIM: SEE, "Seeing Machines" or the "Group"), an industry leader in computer vision technologies which enable machines to see, understand and assist people, has secured a program design win, working with a major Tier 1 partner, with a global US-headquartered automotive OEM. As a result of the design win, the Group expects to deliver its FOVIO driver monitoring technology into multiple vehicle platforms for mass production from 2020.

The progress made in contract wins is impressive: automotive customers now include "six global Tier 1s and four OEMs with numerous new vehicle models launching in the 2020-2022 timeframe."

There is an army of bulletin board participants who believe in this company, and they may well be right.

But I think I should make the following points about today's announcement:

- The A$50 million number mentioned is worth c. £29 million at latest exchange rates, and this is an estimated revenue value.

- Seeing Machines has very recently announced a revenue miss and has a track record in the short period since I've been watching it of failing to hit forecasts.

- Furthermore, I haven't got any guidance on the profitability associated with these sales. Are they high-margin sales? Will the company be in the black? I don't know.

- Finally, the sales won't start to be recognised until FY 2021. How many years after that will it take until the full estimated A$50 million of revenue to be achieved - five or ten, maybe? We do need to consider the time value of money when we are counting revenues so far ahead into the future.

Perhaps this design win will lead to a lot more success and new contracts for Seeing Machines, but I do believe that the standalone value of this deal is probably very small in today's money relative to a £200 million market cap.

Knights Professional

I think plenty of you find new IPOs to be of interest, and I certainly do. It's good to see whats coming down the tracks in advance.

Knights Professional is another law firm joining the public markets. Last month, I reported on events at Gateley Holdings (LON:GTLY), the UK's first publicly-listed commercial law firm.

I've made no bones about the fact that I think this is a worrying phenomenon, with stock market investors paying up for shares in companies which were always traditionally considered best-suited for private ownership.

I do see how it's good for the companies themselves and their staff - they get access to a lovely new funding source, and insiders are about to sell off large chunks of equity. But the businesses aren't scalable and in the long-run, I don't see why the executives at these companies would want to hang around to fund shareholder dividends instead of setting up new companies and keeping the profits for themselves.

So I'm personally inclined to steer away from this sector, even if there are some shares which can defeat the above logic. Begbies Traynor (LON:BEG) has done well for investors in recent years, Gateley Holdings (LON:GTLY) has been a big success (so far), and the litigation finance house Burford Capital (LON:BUR) has seen its valuation soar. It may be possible to pick stocks in this sector. On the other hand, many people did get burned with Fairpoint (FRP), which entered administration.

Knights Profession is described as "one of the UK's leading regional law firms". Revenue per partner is growing from its current level:

Knights is ranked within the UK top 100 largest law firms by revenue and first against all UK law firms for its percentage increase in revenue per partner (2016 to 2017).

The CEO, rather unsurprisingly given the context, believes that the partnership model is dead:

"I firmly believe that the old model for the legal sector is rapidly becoming redundant and, as pioneers in the sector following the Group's early adoption of the ABS structure in 2012, we are well placed to benefit from the continued trend of commercial clients demanding an ever more relevant and value-based service offering."

ABS means alternative business structure. It's the new (by historical standards) form of company which allows non-lawyers to own shares in law firms.

The first two reasons for admission are given as follows (the bold is mine):

- Part of the proceeds from the IPO will be used to pay down the majority of the Group's existing debt facilities, general working capital and corporate purposes.

- In addition, broadening the Group's shareholder base by trading on AIM is hoped to provide an alternative financing option to the Group to further assist its strong acquisition strategy.

There is no doubt that it's great for these companies and their staff to have access to all of this stock market cash. If they have been borrowing to fund salaries (their biggest expense by far, one presumes), then a public listing lets them wipe the slate clean. Owners of smaller companies in the sector will also doubtless eagerly await being bought out and crystallising the capital value of their stakes at attractive valuations with stock market cash. But will it really lead somewhere good for minority shareholders in the end? I'm a doubting Thomas.

Tekmar Group

Another imminent admission, this one looks a bit more interesting in terms of the type of business being put up for sale.

It is "a recognised market leader in the protection of subsea assets", based in County Durham.

It protects power cables for offshore wind turbines and cables and pipes for the oil and gas industry, and has in recent years experienced "consistent, strong organic growth" (we wouldn't expect anything less from an IPO).

The numbers given are as follows:

The Group reported revenue of £21.9 million and Adjusted EBITDA(1) of £4.9 million for the year ended 31 March 2018, representing a CAGR from the year ended 31 March 2016 of 12.7 per cent. and 28.5 per cent. respectively.The "potential aggregate sales value" of the current sales pipeline is £68 million over 60 projects, i.e. more than 3x historic annual sales. It could take several years for that to feed through, of course.

According to The Times, a valuation of between £70 - £80 million is being sought in the IPO.

That's a valuation of up to 16x historic adjusted EBITDA. Likely to be on the adventurous end of the scale, then.

Ok, that's it from me for now. See you soon!

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.