Good afternoon!

We have 2 reports for you today. Graham's is taking shape here, plus this one of course by me (Paul).

In case you haven't seen it, I did a Part 2 report last night, covering 5 more companies: XL Media, Lakehouse, Murgitroyd, Kalibrate Technologies, Advanced Oncotherapy, Blue Prism. That report is here.

We understand that readers prefer to have 1 report, with our work combined, but it causes all sorts of technical issues. I managed to destroy Graham's report last night, when editing it, but thankfully then managed to retrieve it. Therefore I decided it was safest to write my own, separate report.

LoopUp (LON:LOOP)

(At the time of writing, I hold a long position in this share)

Capital markets day - I'm going along to this event at 2:30 pm today. The other weekend I did a trawl through the list of recent floats, and this company struck me as looking potentially interesting, hence why I picked up a bit of stock.

The product is innovative conference call software, based in the cloud. The company has moved into profit, although care is needed with the numbers, because it capitalises a fair bit of development spend. By my calculations it's really around breakeven right now.

What's interesting though is that organic growth has been consistently around 35% p.a., and gross margin is high at c.75%. So running a few numbers, you can easily arrive at rather exciting profits & cashflow a few years forwards. That's got to happen, because the current market cap of c.62m (At 152p per share) looks very expensive based on the historic numbers.

As with FreeAgent Holdings (LON:FREE) (another recent float that I bought at the same time, and for the same reasons), I've trialled the software myself. In both cases, the product is terrific, and very easy to use.

With LOOP, customer churn is actually negative - i.e. existing customers use the product more, and thereby generate enough revenue growth to more than offset customers who stop using the product.

Anyway, I'll report back tomorrow on how the capital markets day goes. I think it's important that newly floated companies get out there and talk to investors. This is necessary because liquidity in the shares has to be built from scratch. The way listings are done in the UK usually means that large lumps of shares are placed with institutions, which leaves no real after-market. The only way I managed to get any significant position in LOOP was to pay 2p over the offer price. Otherwise it was almost impossible to get hold of any shares, as they're so tightly held. That could change once lock-ins expire though.

Taptica International (LON:TAP)

Share price: 245p (up 14% today)

No. shares: 60.4m

Market cap: £148.0m

(at the time of writing I hold a long position in this share)

Trading update - this share came up on one of my share screens a couple of weeks ago. So I researched it, and it looks interesting - apparently a GARP share (growth at reasonable price). Set against this, it's an overseas (Israeli) AIM share, which I normally avoid like the plague, as so many of them go wrong. It's a digital marketing company, which is a sector I am nervous of, so this was very much a nerve-wracking purchase.

There again, a bit like XLMedia (LON:XLM) yesterday, the figures look great - good growth, genuine profits, and nice divis. I was particularly attracted to TAP by the big, repeated increases in broker forecasts. That tends to indicate a company that's on a roll, hence likely to out-perform.

Taptica's website is also impressive for the quality of its big name clients, which reassured me that the business looks genuine.

Anyway, it's more good news today;

Further to the trading and business update statement of 9 November 2016, the Company is pleased to report that in the last two months of the year, there was better-than-expected growth from the mobile advertising campaigns being run for its new and existing clients as its technology platform delivered better results for them. Specifically, the Company has benefitted from higher-than-expected revenues from the Asia-Pacific region.

As a result, the Company now expects to report FY 2016 revenues ahead of market expectations, with revenues of at least $125m, representing an increase of approximately 65% compared with FY 2015 revenues of $75.8m. Also, due to the Company's platform continuing to deliver operational efficiencies in the campaigns, the Company expects adjusted EBITDA to be materially higher than market expectations at approximately $25m for FY 2016 compared with $7.4m for FY 2015.

Additionally, the Company continued to be highly cash generative and had a cash balance at 31 December 2016 of approximately $21m (30 June 2016: $9.5m), after a $3.5m interim dividend payment in November 2016.

Stockopedia is showing a consensus forecast of $121.4m revenues for 2016. So $125m+ actual revenues is a nice beat. I'm not sure how much of a beat the adjusted EBITDA figure of $25m is, as a net profit forecast figure of $17m is shown on the StockReport, which isn't comparable with the EBITDA figure given by the company. I would have preferred the RNS to give the EPS result, which is more useful than adjusted EBITDA.

The growth rate is tremendous, with EBITDA more than tripling on last year. That's a spectacular performance. Is it sustainable though? I don't know. The low rating for the share seems to indicate that the market has reservations.

Outlook comments sound more upbeat than last time the company reported;

Looking ahead, Taptica has entered the new year in 2017 at a run rate significantly higher than at the equivalent period last year as it continues to benefit from the investment being made into mobile advertising by corporates and advertising agencies. The Company will provide further details at the time of the full year results in March 2017.

My opinion - as with XLM, I'm worried about the sustainability of profits, but with both companies there's no denying that performance is currently very good indeed.

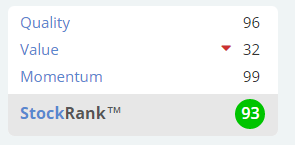

This is reflected in a high StockRank:

I'm surprised the Value score is so low, and would expect that to rise in due course, when the next set of results are processed.

Time is running short, so I have to change gear into quickfire mode.

Koovs (LON:KOOV) - the company reports strong top line growth;

Koovs delivers strong sales growth, increasing 101% YoY to £13.45m for nine months to 31 December 2016, despite the impact of demonetisation^.

I'm surprised the company mentions demonetisation - which seems to have been a bungled change in bank notes by the Indian Government, which led to temporary shortages of cash. Koovs says that it collects cash on delivery, which its says is usual practice in India.

Note that the 101% increase in 9-month sales to 31 Dec 2016 is down from a faster 114% growth rate reported for the first 6 months. So the Q3 growth rate must be well below 101% to have pulled down the 9-month average.

As usual the company is coy about the most important key metric - profitability. That's because it's losing money hand over fist. Is the comment below an in line statement? It sounds like it;

Sales growth will be impacted by demonetisation but with no overall effect on profitability targets for FY2017.

My opinion - this is clearly not yet a viable business, as it's heavily loss-making & cash burning. Therefore repeated fundraises are necessary, which dilutes existing holders. That makes the share unattractive to me.

Successful ecommerce companies ASOS (LON:ASC) and Boohoo.Com (LON:BOO) certainly didn't follow the high cash burn model which Koovs has adopted. In both cases they reached breakeven whilst very small, and without major accumulated losses.

Therefore I am far from convinced that Koovs is likely to succeed. They seem to have got the structure all wrong, with far too heavy overheads. Note that a similar company in the USA, Nasty Gal, also went bust after racking up big losses. More shrewd operators BooHoo are the front runner to acquire its IP & customer list.

Punters are taking a huge risk with Koov - it's likely to be a binary outcome - either bust, or a multibagger (if sales growth continues, and results in losses reducing). It's much too high risk for me, and the business model seems completely wrong to me.

Right, sorry I have to dash to this meeting.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.