Good afternoon, it's Paul here.

Today I've covered:

Crawshaw (LON:CRAW)

Proactis Holdings (LON:PHD)

WANdisco (LON:WAND)

Redstoneconnect (LON:REDS)

Plus brief comments on: HML Holdings (LON:HMLH) , £D4E , and Dillistone (LON:DSG)

Crawshaw (LON:CRAW)

Share price: 23.75p (down 21.5% today)

No. shares: 79.2m

Market cap: £18.8m

Final results - for the 52 weeks ended 29 Jan 2017.

This is a chain of butchers + hot takeaway food, mainly based in the North and Midlands. The company added 11 new sites in the year, taking the total to 49 sites at year end.

As is clear from the figures today, this is a roll-out that has gone wrong. We already knew that though, as a series of poor trading updates have already crashed the share price from a peak of about 95p 18 months ago, to just 24p today. It's been even lower too - I sold mine near recent lows and only got something like 16-18p for them, from memory. Poor timing, as usual on sells! It's just so difficult to decide when to sell, I'm hopeless at that aspect of investing.

A few key figures from today's results;

- Revenue up 19.3% to £44.2m

- Operating loss of £1.4m (prior year £0.4m loss)

- EBITDA of £0.1m positive (prior year £1.0m positive)

So a clear deterioration in performance - which isn't what's supposed to happen when you're doing a roll-out. Each new store is supposed to bring additional profit, so clearly things are not working out very well here.

New sites - opening 11 new sites will definitely create additional pre-opening costs, and so the company does what Tasty (LON:TAST) did recently, and massages the figures to report a supposedly higher underlying EBITDA performance.

I think it's fine in principle to flag up genuine pre-opening costs (e.g. wages for staff being trained, before the site actually opens), and perhaps some Head Office costs related to new site openings. However, the same as with Tasty, I think Crawshaws has been way too aggressive with this process, and hence the numbers lack credibility.

Crawshaws says today;

*Adjusted EBITDA is defined by Group as profit/loss before tax, exceptional items, depreciation, amortisation, profit/(loss) on disposal of assets, net finance costs, share based payment charges attributable to the LTIP Growth Share Scheme and Accelerated Opening Costs.

Accelerated opening costs are defined by the Group as the overhead investment in people, processes, systems and new store pre-opening costs i.e. costs directly associated with our accelerated store opening programme.

In the period these costs amounted to £1.2m (2016: £1.6m) resulting in an adjusted EBITDA of £1.3m (2016: £2.6m).

Those figures look daft to me. Claiming accelerated opening costs of £1.2m, for 11 relatively small sites, is £109k per site! That's ridiculous. A credible figure, for this type of business, would in my view be about £20k per site. So I am just treating the adjusted EBITDA figure with the contempt it deserves.

Also, given the dismal share price performance, why are there any share based payment charges at all?

Director remuneration - shareholders may well question why the CEO is being paid so much? A salary of £326k for Noel Collett, looks ridiculous to me - given that he's made a complete hash of the job so far. This seems a good example of how a bigger company executive can often flounder in a smaller, more entrepreneurial business.

He's made basic mistakes - including not understanding that Crawshaws is a discounter, and instead alienating customers by pushing up prices, to drive higher gross margins. That strategy has failed - as demonstrated by these poor figures.

LFL sales were significantly negative for the year, at minus 7.3%. The company can however point to an improving (but still negative) trend;

Like-for-like sales have improved from -13.0% in Q3 to -7.4% in Q4 further progressing to -4.5% in the first 10 weeks of the FY2018

So current trading is still below prior year, which is clearly a concern.

Balance sheet - isn't strong any more. It looks acceptable to me, but there's not much cash left for any new stores.

Net cash is down to £2.0m.

Working capital looks OK to me (retailers can operate with a lower current ratio than other companies, because they get cash immediately from sales to customers) - so whilst a current ratio of 0.9 is quite low, it's not a concern, in my opinion. Although I wouldn't want that to go any lower.

Cashflow - when a roll-out goes wrong, companies can often remain cash generative, once they stop opening new sites. In this case however, reversing out the depreciation charge of £1.2m only gets them to about cashflow breakeven. Not good.

£2.9m was spent on capex in the year - expect that to fall drastically in 2017/18, as it no longer makes sense to open new sites.

Dividend - is passed (prior year 0.47p). I think shareholders can probably forget about divis here for the foreseeable future.

Factory shops - this is probably the only reason to continue holding Crawshaw shares. This is an out-of-town concept, like a small, drive-in discount store. This format does seem to be working well;

Strong performance from our 5 standalone Fresh Meat factory shops, giving confidence for a further targeted rollout of this format in FY2018

Outlook comments don't sound too bad;

"The momentum in second half sales, followed the successful opening of our new stores in the first half of the year. We now have 49 sites in the portfolio, each benefitting from the innovation and expansion within our fresh meat and food-to-go categories. In 2017, we expect to open a further 5 stores, with specific focus on the fresh meat factory shop format."

"Looking ahead, the momentum built through the last six months has continued into the new financial year, and trading is recovering in line with our expectations. With the business stabilised and having returned to cash generation, we are returning our focus to the store roll out programme."

Although I think the tone of that commentary seems somewhat detached from reality. Talking about momentum, when your LFL sales are still significantly negative, is stretching credibility in my view.

My opinion - despite all the negatives mentioned above, the situation does at least sound like it's being stabilised. So I don't think Crawshaws is likely to go bust - there's no debt to worry about - which is the usual killer when companies experience poor trading.

Therefore, if you want to take a positive stance on this share, upside could come from management efforts to improve trading - e.g. localising the product offering, making sure price points are correct, and attractive to customers - really just basic stuff.

The exciting upside from a rapid store roll-out seems to have gone for now. There again, if the 5 new factory outlet stores planned for this year all do well, then there's a possibility the company could drive a more rapid expansion of that format.

So optimists, who are also prepared to be patient, could possibly be rewarded in the future, if a revised roll-out plan does work.

Overall though, for me, once a roll-out has gone wrong, and the upside looks limited (in the short term anyway), then it's difficult to rekindle any interest. There's also the issue of stale bulls - I'm not sure what Hargreave Hale's current view is, but they can be very aggressive sellers once they lose faith in a share.

Also, the results today don't really mention competition. My feeling with this share has always been that it's vulnerable to supermarkets fighting back. Whilst CRAW only had a few shops, selling surplus stock cheaply, they were not a threat. However, with 49 shops now, and clearly trying to take market share from supermarkets, then it's inevitable the supermarkets are going to fight back, with their own offers to attract back lost customers.

So the key missing ingredient is that CRAW lacks pricing power. Also, in the background are possible risks from meat contamination. Putting it all together, I'm probably 70% wanting to keep away, and 30% vaguely interested in having a punt on it, but probably not at the current price.

Many thanks for the reader prompts for me to look at the additional RNSs from Crawshaws today, which actually look more important than the results statement.

"Transformational partnership" with 2 Sisters Food Group - this looks a very intriguing deal. It requires shareholder approval, but the key points seem to be;

2 Sisters is said to be "one of Europe's largest meat & food manufacturers".

Its founder, Ranjit Boparan is intending to subscribe for 33,794,490 new shares in Crawshaws, priced at just 15.2p (a deep discount). This will give 2 Sisters a 29.9% holding in the enlarged share capital of Crawshaws.

This will raise just over £5.1m in fresh cash for Crawshaw.

Why is the price so low? Because this deal was put together when the market price was around that level. It has shot up recently.

Warrants - this looks odd. It's a 12 month scheme, which seems to be designed to push up the share price to 40p - which would then trigger 2 Sisters being entitled to buy another 45.4m shares at the same price of 15.2p - giving an instant profit of £11.3m, and obviously diluting existing holders significantly more - as 2 Sisters would then hold, in total 50.0% of the company.

Chairman - Richard Rose is stepping down at the AGM on 28 Jun 2017. He is to be replaced by Jim McCarthy, who seems to have an impressive CV.

Roll-out - the funds are intended to be used to accelerate the store opening programme - focussed on factory shops.

My opinion - Crawshaws shareholders are being asked to give away half the company for £12.0m in fresh cash (79.2m shares at 15.2p, if the warrants are exercised).

The funds will enable an accelerated roll-out of factory shops. Also, there are likely to be benefits from securing access to cheaper meat supplies through 2 Sisters, as this is structured as a JV - hence 2 Sisters looks incentivised to provide cheap product to Crawshaws, and thereby increase its profits - and share price, of course - benefiting 2 Sisters as 50% shareholder (after exercising warrants, if they do so).

I don't suppose shareholders would be complaining about this deal if the share price does rise to 40p, which is necessary to trigger the warrants.

Overall, this certainly looks a game-changer. The dilution is nasty, but this deal could inject some significant upside from better sourcing, and faster expansion. Overall, I quite like it.

I hadn't intended on spending most of the day on Crawshaws, but it's such a fascinating situation, it was worth trying to get my head around it!

EDIT: after writing the above, and pondering the position further, I bought some CRAW for my personal, and fantasy portfolio (which closely mirrors my real world portfolio, largest positions) here. Obviously, as always, please DYOR and don't rely on me - as only some of my ideas will actually work!

Proactis Holdings (LON:PHD)

Share price: 179p (down 4.5% today)

No. shares: 50.2m

Market cap: £89.9m

Interim results - for the 6 months ended 31 Jan 2017.

This is a stock I've previously held, but decided to sell and watch from the sidelines recently, as the price looked to be possibly up with events.

This is a spend control software & services business. It's grown organically, with growth typically in the low teens. Then a series of acquisitions have bolted on companies with complementary services.

Today's figures look solid, rather than exciting in terms of growth - with revenue growth up 35.6% to £11.8m, but the organic growth element was +13.4%.

I'm not keen on using EBITDA figures here, because the company capitalises around £2m p.a. in development spend. Whilst that it perfectly permissible, it does of course render EBITDA meaningless. This is because EBITDA ignores both the capitalised development spend, and the amortisation charge. You can't do that, as doing so produces a nonsense number. That doesn't stop companies & brokers still using it as a (bogus) performance measure though.

In other sectors, EBITDA can be a useful proxy for cashflow, but not in the software sector, due to capitalised development spending.

Recurring revenues - this is a positive factor. The company says that annualised contracted revenue is now £22.9m. FinnCap predicts total revenue for FY 07/2017 of £26.2m, so this means that the bulk of revenues are recurring. That should make a profit warning fairly unlikely in future, due to good visibility.

Profitability - the market cap here only makes sense if you use adjusted profit.

FinnCap is predicting adjusted profit before tax of £5.4m for the current financial year (ending 31 Jul 2017), which is the equivalent of 8.7p adjusted EPS. So that's a PER of 20.6 times.

Next year's numbers should benefit from a full year contribution from recently acquired Millstream, and more organic growth. So the forecast of 10.7p EPS would lower the PER to 16.7, which looks about the right price to me.

Dividends - are negligible really, with 1.4p forecast for this year, a yield of 0.8%. People don't buy growth companies for the divis (short term anyway), so this is not a concern.

Balance sheet - the problem with being acquisitive in the software sector, is that you're buying almost entirely intangible assets. So the balance sheet can quickly become very top heavy with intangibles, which is exactly what has happened here.

The company did a placing to raise £12.5m, at 135p, to fund the bulk of the Millstream acquisition. Despite this, I feel that the balance sheet is still rather weak.

NAV of £26.3m drops to negative territory once the mainly acquisitions related intangibles of £38.1m are written off. So NTAV is negative at -£11.8m. Personally, that's a concern. The business is being funded by up-front cash paid by customers - note the £9.6m deferred income, which reflects the element of cash which customers have paid up-front, but not yet received any services. Services which of course cost money to provide, in future.

Acquisitions - expect more, by the sounds of it;

The Group's M&A pipeline remains strong as it seeks further acquisition opportunities.

I hope placings are done to finance any further acquisitions. This has actually been positive for the share price in the last year. It underpins that this share seems attractive to Institutions, which seem happy to fund acquisition-related placings.

Supplier commerce opportunity - this is the most exciting development at Proactis. I've written about it before. It's a new service which seeks to tap into the supplier base of Proactis's large clients. The idea is that each supplier on the purchase ledger of a Proactis client would be required to pay £50 p.a. in order to get access to their customer's purchase ledger. This would enable many functions to be automated. Advantages would be that suppliers could check online to see when they're to be paid. They can update their own details (e.g. if they move premises, or change banks, etc).

This should bring considerable advantages for both the client (fewer staff required in purchase ledger), and its supplier base. As Proactis customers typically have a large purchase ledger, with many suppliers on it, then the £50 per supplier fees could mount up to millions of extra, high margin revenue for Proactis, if this new service takes off. Suppliers will also be able to use this platform for early payment (for a fee), which also enables Proactis to make a profit - not unlike what Tungsten (LON:TUNG) tried to do.

There's not much detail on progress in today's update. There are 3 pilots underway ("early adopters") with Screwfix, Flintshire County Council, and P&O Ferrymasters. Today's update only says;

The early adopter programme, is progressing well and is providing informative data together with commercial and operational know-how that will be invaluable as the concept evolves to product and the early adopter customers become referenceable.

Maybe shareholders wanted a bit more red meat on this, which could explain why the shares have drifted down today?

The size of the opportunity is reiterated today;

The Directors estimate that these opportunities could increase the revenue per customer significantly from level which is currently being achieved. The Group has more than 800 customers with an estimated spend of more than £100bn with over 1m suppliers.

1 million lots of £50 p.a. is clearly a decent market opportunity. Although it's probably sensible to assume a take-up rate of maybe 10% at this stage, to be prudent? That's just a guess.

My opinion - I like this share, but feel that, for now the price is possibly up with events.

Any signs of the supplier commerce product taking off in a big way would entice me back in. So I shall watch carefully from the sidelines.

WANdisco (LON:WAND)

Share price: 462p

No. shares: 37.4m

Market cap: £172.8m

(for the avoidance of doubt, I do not currently hold this share)

Q1 update & significant customer win - this announcement came out on Monday. I didn't have time to report on it that day, as I was out & about. Several readers have asked me to circle back to it, so here goes.

I flagged to readers here on 16 Jan 2017 that the newsflow seemed to be turning more positive at this company. Good thing too, as its longer term track record has been appalling - huge losses & cash burn, with little growth being delivered.

The contract win is for $4.1m, with a "major financial services multinational", and is WAND's largest ever contract. What's interesting about WAND is that it claims to be unique;

Fusion was selected after an extensive period of testing by the Client and was deemed to be the only enterprise-grade solution able to support critical Cloud and Big Data applications.

Central to selecting WANdisco was Fusion's capability to enable the Client to move active, critical data seamlessly between both primary and disaster recovery sites and the Cloud without any downtime.

Although as one analyst has pointed out, if WAND's software is so special, how come the major internet companies out there seem to be able to function fine without it?

Cash burn - this is a bit disingenuous, as there have clearly been one-off factors which flattered cashflow in Q1. These factors are mentioned, but not quantified. So the question remains, what is underlying cash burn excluding these factors?

The Company is also pleased to report that it ended Q1 2017 with cash of $7.6 million, reducing cash burn in the quarter to zero.

The combination of strong prior quarter bookings, good cash collection and expense efficiencies realised in the quarter, along with the receipt of the annual R&D Tax Credit from HMRC all contributed to zero cash burn in the quarter.

Outlook comments sounds positive;

"We continue to see increasing traction with WANdisco Fusion, which is providing the foundation for our strong order book and sales pipeline for the current financial year."

My opinion - I sold my last tranche of WAND shares on the big move up on Monday. For me this was an interesting trade, a bit of a punt really.

There was some broker coverage on the day basically saying that the newsflow is good, but don't get too carried away - it's still loss-making.

I shall monitor things with interest, but personally the temptation to bank a big gain in just 3 months, on a very speculative stock, was too much. So I did.

Redstoneconnect (LON:REDS)

Share price: 1.68p

No. shares: 1,645.1 (per company website)

Market cap: £27.6m

(at the time of writing, I hold a long position in this share)

Final results - for the year ended 31 Jan 2017.

This company is basically the good bits from Coms, with good new management. So it's been a turnaround, that seems to be working. I visited the company's HQ last year, and like what they're doing.

A few key numbers;

Revenue up 3.5% to £41.5m. Whilst this looks somewhat disappointing, the company has been focusing on higher margins, rather than higher turnover.

Gross profit rose an impressive 33%, to £9.2m, which is an increase from 17% to 22% - a very good improvement.

Profitability - is difficult to ascertain, as there is a confusing variety of measures provided. In such situations, I tend to revert to the cashflow statement, as I find that much easier to understand, and is less prone to manipulation.

Note that there's a negative tax charge in the P&L of £0.6m, which flatters the profit after tax, and hence EPS figures too.

Cashflow - this looks quite good, and much improved from last year. The operating cashflow (before movements in working capital) was an inflow of £1.9m, versus an outflow of £617k last year.

Only £367k of development spending was capitalised, so the accounting doesn't look aggressive to me.

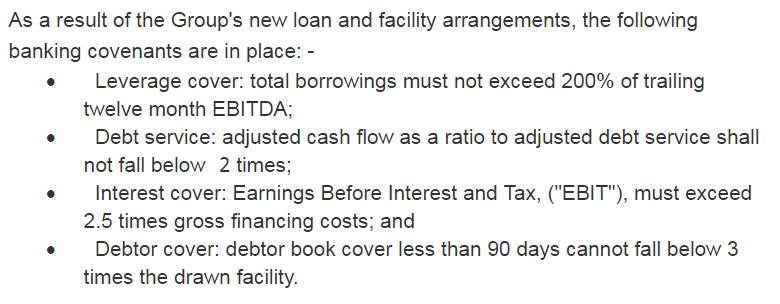

Bank covenants - I really like that the company has disclosed its banking covenants in today's announcement. This should be compulsory for all companies in my view, because it's vital information for shareholders to assess risk;

Balance sheet - looks a bit weak to me.

NAV is £14.5m, but that includes intangibles of £14.3m.

Therefore NTAV is just £0.2m. That's not a worry particularly, because the company is now profitable & cash generative. Although it should be borne in mind that there's basically no asset backing to speak of.

Outlook comments - sound generally positive, although light on specifics.

The pipeline & order book are described as strong.

My opinion - so far, so good. The turnaround under new management seems to have worked well, with a decent move into profit. The finances look stable now too.

I like the area in which this company operates - smart office management, and services. It's also got a very impressive client list. So it will be interesting to see how this develops.

A few quick comments to round off with;

HML Holdings (LON:HMLH) - a trading update for y/e 31 Mar 2017.

Earnings are anticipated to be in line with market expectations.

This property management company is expanding with lots of small acquisitions.

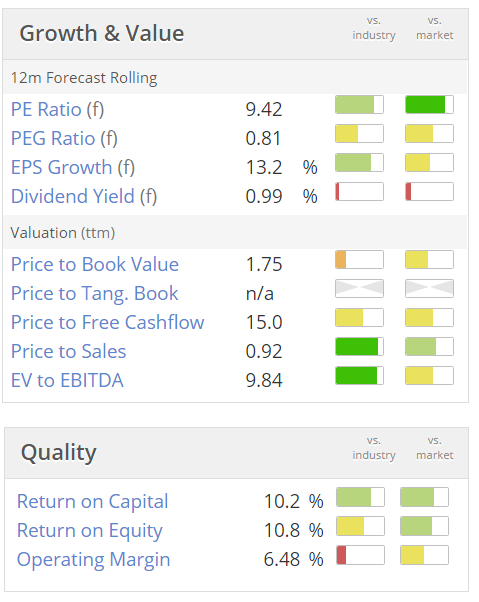

It looks good value, with a forward PER of only 9.42.

Although bear in mind that it's an illiquid stock;

£R4E - very late results for y/e 31 Dec 2016 are out today.

I looked at this one recently. It was a complete basket case, but a clever restructuring in 2015 resulted in some of the bank debt being written off. As a result, the balance sheet is looking more viable now, but is still weak.

Performance in 2016 was OK - operating profit of £0.85m on turnover of £96.6m, suggests a lot of "pass through" revenue perhaps. The company does marketing for theatre shows.

This is a Nigel Wray stock - he owns 26.9% of it. Although looking at today's unexciting numbers, I'm struggling to understand what the attraction is. Probably the best thing that can be said about it so far, is that it managed to avoid going bus, and has moved into modest profits now.

The still-weak (not not as bad as it was) balance sheet means no divis.

Who knows, maybe there are hidden charms to this share?

Dillistone (LON:DSG) - another company reporting calendar 2016 results very late. The figures look reasonable. Adjusted operating profit is up slightly at £1.46m. Although note there are large adjusting items of £1.05m, so the net operating profit is only £412k (down from £1.1m in 2015).

Checking note 7, the adjustments are all non-cash things, basically writing down intangibles, so that's OK.

Note that there's an unusually good dividend yield for a small software company here - almost 5%.

Recurring revenues are strong, and cover the basic admin costs, which is good.

The narrative has some interesting & positive outlook comments. Regulatory changes could drive improved sales. Also, the company mentioned a new product which they sound excited about, but no specifics.

Overall, I like this company, but have found it impossibly illiquid to deal in, in the past. Pity, as if it was more liquid, I'd probably buy some.

That's me done for today.

I've not had a chance to look at Boohoo.Com (LON:BOO) results yet, so will do that now, and may comment on them in the morning.

See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.