Hi, it's Paul here.

This is the placeholder for Thursday's reader comments.

Estimated timings for today's report: as usual this week, I'll be writing mainly from late morning, until estimated completion time of 5pm.

To get the early birds started, here is the link to yesterday's completed report, which I think had some useful & interesting stuff in it, including reader comments, which early risers might have otherwise missed.

Focusrite (LON:TUNE)

Share price: 530p (up 6.4% today, at 11:50)

No. shares: 58.1m

Market cap: £307.9m

Trading update - y/e 31 Aug 2019

Focusrite Plc (AIM: TUNE), the global music and audio company supplying hardware and software products used by professional and amateur recording engineers and musicians, is pleased to update the market on another successful year in which revenue and profits have grown strongly.

This sounds good - ahead of expectations;

The Company expects revenue for the financial year ending 31 August 2019, to be ahead of market expectations at approximately £84 million, up from £75.1 million last year.

This growth comprises an increase of approximately 10% for the existing business (c6% on a constant currency basis) and approximately six weeks of revenue for ADAM Audio, a German studio monitor company, which was acquired on 16 July 2019 for a total consideration of £16.2 million in cash.

Margins have remained consistent with the prior year and as a result EBITDA is also expected to be ahead of market expectations.

Cash - Focusrite spent £16.2m on an acquisition (which seems to have been a full price, considering the acquired company only made a profit before tax of E1.0m). Despite this, the group still has £14.9m in net cash. It's a very well funded business, with an excellent balance sheet.

Outlook - sounds upbeat;

Our product roadmap continues to strengthen with significant new product releases planned for the first half of the new financial year. We continue to execute on our growth strategy while closely monitoring unpredictable global issues such as US tariffs and Brexit and have in place action plans to mitigate any foreseen negative impacts to our business."

Valuation - is high, therefore the company really did need to perform ahead of expectations in order to justify the rich PER. I can't find any broker updates today unfortunately.

Stockopedia shows consensus forecast revenues for FY 08/2019 of £80.4m. Actual has come in at £84m, usefully ahead. Although I don't know if the broker forecast included revenues for the recent acquisition or not.

Forecast EPS of 18.6p looks to have been beaten, but we don't know how much. We're possibly looking at around 20p EPS actual. At 530p per share, that's a PER of 26.5 - certainly not a bargain. But it's a good company that has been performing very well since listing in Dec 2014. So quality comes at a price.

My opinion - I like the company a lot, but personally am not prepared to pay such a high price. Risk:reward doesn't look right to me, at a PER of 26.5. Strong trading for several more years is already priced-in, but what happens if there's a blip in trading? You could wake up and find that the price is down 30%.

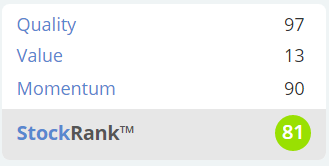

Stockopedia likes it, but not for the value.

Comptoir (LON:COM)

Share price: 11.25p (unchanged today, at 12:43)

No. shares: 122.7m

Market cap: £13.8m

Comptoir Group Plc (AIM: COM), the owner and/or operator of Lebanese and Eastern Mediterranean restaurants, is pleased to announce its results for the six months ended 30 June 2019.

Unfortunately, these results have been really messed up by adoption of IFRS 16 - re property leases. The balance sheet is now dominated by a huge notional asset of £22.9m within fixed assets. Creditors now includes lease liabilities of £3.26m in current liabilities, and £22.0m in long term liabilities.

Worse still, the P&L is messed up by IFRS 16 too, with notional finance charges of £481k relating to property leases. Total finance charges are £502k, therefore the real interest costs are actually only £21k.

Therefore, we can no longer look at the finance charge on the P&L and compare it for reasonableness with net debt. We have to adjust out the IFRS 16 finance charge to find out what the actual interest cost on borrowings is. This is just all nonsense. Whoever came up with this ridiculous new accounting standard, should be severely reprimanded. I'm counting the days until this mess of IFRS 16 is repealed. It has made accounts much more difficult to analyse, and really doesn't provide any useful information at all, as far as I'm concerned.

H1 trading - the highlights look quite positive, but that mood evaporates when you get to the actual numbers.

Profit before tax was a loss of £528k in H1.

Cashflow is OK though, as there is a hefty depreciation charge of £1.9m in H1.

Adjusted EBITDA is positive at £2.0m.

Balance sheet - once we strip out the daft IFRS 16 entries, it looks OK. Net cash of £3.4m means that solvency is not a problem.

My opinion - this company looks more resilient than I expected. Providing management is careful with the cash, then it should be around for a while, and might even be able to take advantage of favourable deals on new sites.

It's also expanding via franchising, which is an interesting idea.

The only restaurant share which interests me is Fulham Shore (LON:FUL) (in which I have a long position).

Comptoir looks a bit of an also-ran. I don't see any attraction in the shares, and the risk of de-listing concerns me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.