Good evening/morning, it's Paul here.

Revolution Bars

Here are my overdue notes from a recent meeting with management of Revolution Bars (LON:RBG) (in which I hold a long position). The meeting covered the points in the recent interim statement, with a bit more detail, and also some Q&A. It was also a get-to-know-you session with the new CEO, Rob Pitcher, who started in late June 2018.

The original reason I invested in RBG, several years ago, was that it was a self-funding roll-out of highly cash-generative bars, combined with takeover potential. Sure enough, we got a 203p cash bid in 2017 from Stonegate, which bizarrely for a recommended offer, was turned down by shareholders at the last minute. I can't remember that ever happening before, so it was actually a rational (but ultimately incorrect) opinion to wait for either the 203p cash bid to finalise, or a higher competing bid to come in. Sometimes things don't pan out as we hope.

Since then, the share price has collapsed, to only 63p - suggesting that the stock market thinks that the business is going down the pan. Therefore, in assessing this share today, it is a given that performance has disappointed. The question now is simply whether the share price has overshot on the downside, and what upside there might be from here if a turnaround takes place?

Revolution Bars (LON:RBG)

Share price: 63.5p

No. shares: 50.0m

Market cap: £31.8m

Oh no, what's gone wrong now? As management admitted, "we've just hit the market with 4 negatives";

1) Dividends suspended - widely expected (I suggested that it might be wise to suspend the divis, here in Oct 2018). Also, broker notes had floated the idea that divis might be suspended, due to heavy expansionary capex on new sites.

So for anyone paying attention, the divis being suspended should not have come as a surprise at all. My only complaint here is that management could have been more savvy, and slashed the divis to something nominal, say 0.1p per share. That would have suited some institutions, which are mandated to only hold dividend-paying shares.

Management are clear that the company will return to the dividend list in the not-too-distant future - so this should be seen as a temporary suspension.

2) New site roll-out suspended - personally, I'm relieved about this. Continuing quite a rapid expansion programme, when performance of the existing sites is deteriorating, does not make any sense.

I think RBG is too small, and has had serious problems with departure of key members of the (small) management team, that the last thing I want them to focus on, is opening loads of new sites. So for me anyway, this negative, is a positive.

3) Deteriorating LFL sales performance - see the interim results commentary for explanations of why LFL has declined. It's tempting to dismiss talk about the weather as excuses, but in reality, that did make a lot of difference.

What I like most, is that management openly admits to own goals, and what they're doing to fix them (see below).

4) Reduced profit guidance - only slightly reduced actually. The key number is EBITDA - which whilst widely mocked (correctly so in some circumstances - e.g. software companies capitalising much of their payroll). Nevertheless, EBITDA can be a very good starting point for how to value retail & hospitality shares. You start with EBITDA, then you take off an allowance for maintenance capex, interest, corporation tax, to arrive at a smoothed (for working capital movements) cash generation figure.

We may not like it, but it's how banks & private equity value companies. The key concept of EBITDA is that you cannot undo historic capex. Once you've spent £1m on opening a new site, as RBG routinely does, then you cannot un-spend that money. It's a sunk cost. So all that matters in the future, in valuing the business, is what cashflow that site subsequently produces.

You also have to look at depreciation, to see if you're getting a proper return from capex. Obviously you would stop future site openings, if previous capex does not generate an adequate return. However, future cashflows (EBITDA) are more important, in determining whether the business can survive in future, or not. Both are important (conventional profit, and EBITDA), it's not a binary choice between competing ideologies! So I always look at both.

Anyway, as mentioned above, RBG has done the logical thing, and put new sites expansion capex on hold. This is what has caused the recent increase in bank debt, so I'm very pleased that expansion has been halted, whilst the ship is righted.

H1 profit was actually in line with guidance. So the interim figures hit target. We're in a bear market for UK small caps, so any disappointment is punished heavily, before anyone has really assessed it logically. That's just how things are in bear markets. Selectively, that creates some lovely buying opportunities, for those with balls, and patience!

Outlook comments - the company had already told us, in its Xmas trading update, that it was taking a more cautious view of spring 2019. So, as with many other stocks, bad news is being punished twice. Various comments as discussed at our meeting;

- Xmas trading continued pattern of last 6 years of positive LFL sales in peak weeks, then deeper trough in January (e.g., Dry January from heavy drinkers like me).

- Despite good Xmas, LFL sales overall in H1 (Jul-Dec 2018) were poor, at -4%

- 5 new openings in H1 are performing well (these will not be in the LFL figures, of course)

- Strong cashflows, as usual

- H1 adjusted EBITDA of £6.9m was in line with guidance

Positive outlook for LFL sales - management thinks they could now be at the low point. Reasons? Soft comparatives from now on - due to;

- "Beast from the east" last year hurting Q3 sales

- Hottest summer for decades - drinkers headed for outside spaces, which most RBG sites do not have

- World Cup - drinkers headed for sports bars

Those are not excuses, they are facts. I saw them all in action, at the time, at RBG sites I visited, which were quiet, when local sports bars & outside bars were heaving.

Stuff previous management got wrong - Internal factors. I was so pleased to hear management talk about mistakes made - although it's always easy to do this, when you're new to the job!

- Takeover talks were a major distraction, which went on for a long time, then absence of CEO for some of 2017/18. Several changes in CFO (after previous guy screwed up the forecasting)

- Roll out of new sites was big distraction for senior management

- "Brain drain" - this is key, in my view - uncertainty caused by the above, led to multiple key people leaving the business (as we already knew from key finance people leaving). Also, area managers, uncertain about their future, were poached by competitors. Departing area managers then poached key managers from individual sites (I've seen this happen in my previous retail experience, so it all rings true).

Put that together, and it's obvious that Rev Bars went downhill, in 2017 & 2018, because it didn't have management stability, focusing on the basics. The obvious basics about how to run a multi-site business.

A high gross margin business, with lots of competition, can quickly go downhill in terms of profitability, if it's not well-managed.

What's being done to fix things then?

New management - Rob Pitcher is exactly who I wanted to meet. He's totally focused on hands-on stuff to fix the business. Detail, and overview. The whole meeting was peppered with examples of simple, easy fixes, that he's embarked on, that should improve performance.

When he started in July 2018, he concentrated on getting things right for the key Xmas period. Now that's in the bag (Xmas was good, in the peak weeks), other stuff is being fixed. Examples;

Food - I think this has been a bit of a shambles. A new head of food (since departed) cocked it up, by taking away some best selling lines (e.g. pizzas) and doing fancy stuff, which hasn't worked. They're now getting back to basics, and re-introducing previous best sellers. People at the meeting were aghast at this turn of events, but it's a symptom of the above management vacuum during 2017-18. So some easy wins here. Who in their right mind would remove best sellers from the menu?

Although new CEO points out that RBG's success doesn't come from food, it's from providing amazing nights out for young people. So he wants more focus on that, as their core activity.

All options open, on a site-by-site basis, e.g. not necessarily correct to keep all sites open, all day every day, if there isn't demand.

Cost-savings - I commented that Head Office costs look top heavy. New CEO says he agrees. £1m cost savings have been identified & mostly implemented. Also another £0.5m at individual site level - easy wins, like making sure managers reduce collections for bins, etc, after peak period ended (at Xmas), rather than paying for excess services that are not used. Not enough monitoring & control of this previously.

Key factor - under-investment in site refurbishments - Revolucion de Cuba is doing well. Reason? Well-invested, 19 sites, new decor, etc. Sites that are not doing well, are older Revolution sites - mistake made in not refurbishing them adequately, since IPO (short term focus on profit & divis, after IPO, maybe?).

Core sites will now be refurbished rapidly, typical cost £150-250k, depending on site size. This is proven to rejuvenate sales growth. Ending expansion capex, to focus on refurbs, will turn LFL sales positive again.

Cost headwinds - especially staff costs. Savings achieved have offset wage rises. Other efficiency measures achieved, e.g. energy costs.

Site EBITDA - is enormous, i.e. once Head Office costs are removed. Therefore, if the share price stays around the current level, my [Paul] view is that another takeover approach is highly likely. An acquirer could bolt on RBG sites to its existing support functions, strip out most of the existing central costs, and get a very rapid payback.

Bank debt - last reported net debt at 31 Dec 2018 is £14.8m . Gross bank debt was £18.5m, well within a £25m facility. The debt has arisen mainly from a heavy expansionary capex programme. Now that new sites have been halted, this will reverse.

I didn't perceive any panic at all from management about bank debt. They just want to reduce it, then they'll start paying divis again. I asked if they had a problem with bank covenants, and was told no, no issues.

Refurbishments - failure to update existing core sites - this is the main problem, refurbishments have now been accelerated. All funded from cashflow. Moving up from 10, to 15 refurbs p.a.. Cost £150k (smaller sites), to £250k (larger sites). 3-4 year payback on refurbs. Need to move to a 5-6 year refurb cycle (was longer than this, which has caused current trading issues, partly).

Summer weather - if it's anything like normal this year, we'll be fine. Although last year's exceptional weather has led us to look at adding open air top floor areas to some existing sites. E.g. if renewing a lease, will try to create a retractable top floor sky bar, as part of refurb. Creates lovely area which act as magnet for customers in warm weather.

Problem leases - a number of problem sites. Trying to turn them around. Example given of new manager brought into one site, which transformed performance, allowing them to release onerous lease provision.

General managers - after previous neglect, standard is improving. Some way to go. New teams have to be trained, takes time.

Big research project done - with thousands of customers & staff - flagged up key problems;

- Price points too high

- Service too slow (cocktails slows down people just wanting a pint - I could have told them this a long time ago, gratis!)

- Too many sweet & sticky cocktails, so they're bringing back some classics

- Better music & entertainment at peak times - it's all about customer experience & atmosphere

- Men in grey suits don't know what young, trendy customers want - so now getting ideas from staff & customers

- New food menu coming in, on 21 March, also Deliveroo

Summary -

- Good turnaround plan

- Mgt focussed on the business, not corporate action

- Soft comparatives from now on - allows a good run at it

- Divis - short suspension

- Headroom on bank facilities - want to get debt down, should come down quite quickly with expansion capex & divis suspended

- Focused on revamping the tired older sites, that have been left too long

- Short term pain, but we're doing the right things to fix the business

- Experienced management who know what they're doing

My (Paul's) opinion - as regulars here know, I'm a glass half full person. For that reason, I only meet management of companies where, to me, the figures already stack up.

My opinion with RBG is certainly tainted, in that I had the wool pulled over my eyes by a previous, short-serving CFO of RBG, who came out with some old codswallop about how he hadn't realised how much time he would have to spend away from home, and he didn't want to harm his young family with absence of parental time. Looking back, I must have taken leave of my senses to believe that pack of lies! This was such obvious nonsense, that I am embarrassed to admit I fell for it. I think several readers here, at the time, rightly chastised me, for being so gullible.

The past doesn't matter though. All that matters now, is whether RBG has a decent turnaround plan - which it very clearly does. The new CEO impressed me very much, with constant talk of detailed day-to-day ways of improving the business. That is the crux here - RBG has been neglected, due to management distraction with takeover bids. It now needs a period of repair, from down-to-earth, hands-on new management. From what I can tell (and no outsider really ever knows for sure), Rob Pitcher seems to be doing the right things. Things that make sense to an average person.

We don't know whether his plan, and its execution, will work or not. Time will tell.

I think the enormous site EBITDA (of almost £20m p.a.), means that a fresh takeover approach reasonably soon, seems almost inevitable to me. The net debt is small, for the sector. Refurbished sites by next year, should have things humming along very well, with a return to positive LFLs - and the geared boost to profits.

What is this share worth? I'd say 120-150p, with a bit of patience.

It should be emphasised that this is one of my largest personal shareholdings, and therefore my views are biased. Hopefully rational though, too. I'm just giving my honest personal opinion. Please feel free to add your comments & opinions below - whether positive, or negative.

Debenhams (LON:DEB)

Statement from Sports Direct, of proposed loan

I have no idea what is going on here, make of it what you will:

Sports Direct refers to the announcement of Debenhams plc (Debenhams) to the effect that Debenhams is in negotiations with its current lenders as regards entering into additional facilities of approximately £150m, £40m of which would be used to refinance the new secured £40m bridge facility announced by Debenhams on 12 February 2019.

Sports Direct wishes to confirm that it has made an alternative proposal to Debenhams.

Under Sports Direct's proposal, on or before 31 March 2019:

Sports Direct would make a £150m unsecured term loan (of 12 months) to Debenhams. Of the total amount of the lending, £40m would be used to repay Debenhams' £40m bridge facility with an attendant release of security. The remaining £110m would be available for general working capital.

Debenhams would agree to put a proposal to its independent shareholders to approve the issue of circa 5% new shares at the prevailing market price to Sports Direct (so as to increase Sports Direct's shareholding to circa 35%). If the 5% share issue and related "whitewash" was approved by Debenhams' independent shareholders, the £150m loan would be guaranteed to be interest-free. If such approvals were not forthcoming, the loan would bear interest at 3%.

Mr Mike Ashley would become a director and the CEO of Debenhams.

My opinion - it's impossible for me to ascertain what's going on here, without more information.

The lease liabilities, and falling footfall, remain the core problems.

Mike Ashley is also a core problem - being arguably an egomaniac. I don't like his rivalry with Philip Green - trying to out-do each other, in terms of mogulness, over many years. Can Ashley single-handedly transform our High Streets? What's his strategy? Beating landlords into submission (to lower rents), only works if you go through some kind of insolvency process.

Although owning a lot of the existing DEB shares, maybe he wants to preserve some value in the existing equity? Who knows? It's impossible for any of us to know what's going on, without inside information, and then we couldn't buy or sell the shares.

A fascinating situation!

UPDATE: here's the response this morning from DEB

Debenhams acknowledges Sports Direct's statement issued at 6.30pm last night and confirms receipt of its proposal to provide a £150m, unsecured 12 month term loan to the company, subject to certain conditions.

Any third party loan offer on these terms would require both the consent of our RCF Lenders and Noteholders and material amendments to existing facilities.

Nevertheless, the board will give careful consideration to the proposal and will engage with Sports Direct and other stakeholders regarding its feasibility in the interests of all parties.

I don't have any further comment, as I can't fathom what Mike Ashley's agenda is here. If he wants to preserve the value in the existing equity, then maybe the shares are not as risky as they look? For me though, it remains uninvestable.

Impellam (LON:IPEL)

Share price: 465p (down 15% today, at 11:30)

No. shares: 49.4m

Market cap: £229.7m

Impellam announces its unaudited final results for the 53 week period ended 4 January 2019

This is a staffing group. I'm not going to spend long on this, as the sector is not something that interests me at the moment. Recent events at Staffline (LON:STAF) have rattled me, and reminded me that staffing companies have huge flows of money in & out, and hence seem vulnerable to accounting problems occurring.

Impellam's performance in 2018 was poor - adjusted basic EPS fell 23.9% to 56.8p.

I don't like the balance sheet, with its gigantic working capital balances, and slightly negative NTAV.

The narrative today refers to;

Challenging market conditions in the UK Healthcare, Education and Retail markets...

Further negative comments are;

Ongoing strategic IT investments, the increased cost of doing business compliantly and the downturns in the markets noted above resulted in adjusted EBITDA1 of £50.2m (2017: £59.5m).

Outlook comments are a bit mixed;

Looking forward, we anticipate continued market and technological disruption and downward pricing pressure, as well as ongoing uncertainty from Brexit.

Notwithstanding this, we anticipate an increasing return from our strategic investments in 2019, and this, coupled with a rigorous portfolio, operating model and cost base review means that we expect to see a return to higher levels of conversion of gross profit to EBITDA and profit before tax.

My opinion - Staffline has rattled me, even though it turned out to be a bit of a storm in a teacup. It has reminded me of the unfavourable aspects of this sector. It doesn't feel the right time to be investing in staffing companies, with various headwinds noted. Why get involved?

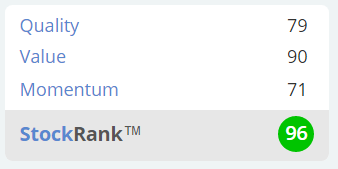

The Stockopedia computers like it, here's the StockRank;

The Stockopedia classification is: "Balanced, small cap, Super Stock"

There's very little else of interest today, so just a few quick comments;

DFS Furniture (LON:DFS) - results out today, for a 22 week period. The headline figures look quite good, but its ridiculous balance sheet makes it uninvestable for me.

If I had a burning desire to invest in a sofa retailer, then SCS (LON:SCS) would be my choice. It has an excellent balance sheet, bumper dividend yield, and resilient recent trading.

Superdry (LON:SDRY) - the founders are trying to take control of the company, having been dismayed by the poor performance of the current management. The company issues a rather unpleasant statement today here, in which it says;

The Board unanimously believes that Mr Dunkerton's return to the Company, in any capacity, would be extremely damaging to the Company and its prospects...

That strikes me as a very arrogant position for new management to take, given that they've messed things up. Without knowing all the detail, my instincts would be to boot out the current management, and welcome back the founder with open arms, to sort out the company, which remains an excellent brand.

This is a good reminder that many fashion companies need the vision of the founder(s), even when they become large. It sometimes doesn't take long for outside management to kill off a great brand.

It will be interesting to see how this one pans out, and which side shareholders back. I don't have a strong view either way on the current share price - which looks about right, given the uncertainty.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.