Hi, this is Paul,

Thanks for your requests - I've got enough to be going on with now.

Please try to limit requests to small caps (under c.£400m market cap, and above c.£10m), and only in sectors that I cover (so no resources, property, financials, or pharmas/biotech). Also, please limit requests to companies which are reporting trading updates or results, as that's what drives these reports. Thanks!

Yesterday's report was extended to cover 2 more companies, so here's the link for that.

On to today's news

Connect (LON:CNCT)

Share price: 66.5p (up 2% today, at 09:29)

No. shares: 247.66m

Market cap: £164.7m

(at the time of writing, I hold a long position in this share)

Disposal of books division - This has been a rather strange turn of events. The buyer backed out, and it looked like a legal battle would ensue. We're informed today that the deal has now been done, at a reduced price - £6m cash received, instead of the previously agreed £10.6m plus £1m deferred. I can't shake off a feeling that we've perhaps not been told the full picture? Maybe the buyer found something during due diligence that they didn't like?

I'm not really sure if this is good, or bad news? Anyway, it's a done deal now, and not material to the market cap of £161m. The disposal is useful in reducing debt a bit, so on balance it's probably a good thing to have jettisoned a small division which might have been a distraction for management.

I've recently topped up my holding here a little, as I think the market possibly over-reacted to the recent profit warning. It wasn't a big miss, yet the share price almost halved. The forecast dividend yield is 15%, which is the market clearly telling us that the divis are likely to be cut, or passed altogether.

Maybe I made a mistake, recently averaging down on this one? I might go through the figures again over the weekend, to decide whether to ditch them, or buy more. It's not a big holding for me, as I don't usually like to put too much money into wobbly situations.

Graham sounded unimpressed when he reviewed the profit warning here on 22 Jan 2018. So this looks a polarised situation, where some people see value, and others see a dying business. Interesting! Comments in the comments please, I'm interested to hear your views.

Stadium (LON:SDM)

Recommended takeover bid - at 120p cash.

The buyer is TT electronics (LON:TTG) , which is rated on a much higher PER than Stadium, so it makes sense for it to buy in some growth relatively cheaply.

This looks a fair deal to me, and if I held Stadium shares, I would be happy to accept it. Stadium hasn't impressed as a standalone listed company, and it's too small really. Shareholders also get a 2.1p special dividend, so it's 122.1p in total.

This doesn't look a done deal yet - irrevocables are only 25.2%, so it will be interesting to see whether shareholders decide to cash in their chips, or hold out for more (which in my view would be unwise). I think it's sensible to grab this type of liquidity event, if you're a large holder in an illiquid share.

No doubt smaller holders will belly-ache that the takeover price isn't high enough, but it's a 43.7% premium to last night's close, which looks fair to me.

As you can see from the 5-year chart, something has gone wrong every time Stadium shares peaked in the 120-140p level. So if the shares can't hold that price of their own accord, then a clean exit for everyone at 120p looks fair to me. It's not up to me though, so I'm only giving an opinion. The problem is, if shareholders reject the 120p bid, then the share price just goes back down again to 80p. We saw that with the failed bid for Revolution Bars (LON:RBG) - so a bird in the hand, and all that.

Best Of The Best (LON:BOTB)

Share price: 255p (up 3.7% today)

No. shares: 10.1m

Market cap: £25.76m

(at the time of writing, I hold a long position in this share)

Transaction in own shares - I wouldn't normally mention this, as share buybacks are not particularly noteworthy. However, in this case, I think it's rather interesting. The reasons being that, firstly BOTB is not just a micro-cap, but it's a particularly illiquid one. The reason for that is because management owns most of the shares.

In the past therefore, anyone trying to buy or sell even a smallish amount of shares (say 2-5k shares) would struggle, and would move the price considerably, especially if they tried to drip-feed sell or buy. This is why the share price has been so volatile.

With the company now apparently taking out sellers, this could change the dynamic for the better - i.e. sellers now shouldn't affect the share price, whereas buyers will. So it's possible that the company buybacks might put a floor under the share price around 250p, maybe? The RNS today says that the company bought 7,000 shares at 250p.

I'm a bit disappointed with the rather pedestrian growth rate at this company, as mentioned recently when commenting on its last trading update. I can see considerably potential with this company, but the online growth hasn't taken off as quickly as I'd hoped.

Sanderson (LON:SND)

Share price: 89.5p (up 4.1% today)

No. shares: 59.33m

Market cap: £53.1m

(at the time of writing, I hold a long position in this share)

Trading update (AGM statement)

Sanderson Group plc ('Sanderson' or 'the Group'), the software and IT services business specialising in digital retail technology and enterprise software for businesses operating in the manufacturing, wholesale distribution and logistics sectors....

There's quite a lot of detail given, but this is the key bit;

...the overall trading performance of the Sanderson Group is in line with management's expectations...

The company is about 4 months into the current financial year, ending 30 Sep 2018.

- Revenues about a third ahead of last year, driven mainly by acquisition of Anisa

- Organic revenue growth is 5%

- Operating profit is 10% ahead of last year, which I read as being the organic profit growth, although the statement is a little ambiguous on that.

The company says it has a strong balance sheet (often a warning sign that they don't!). On double-checking to the last published balance sheet, dated 30 Sep 2017, it's certainly not strong the way I look at things. NAV is £27.9m, but of that, £30.4m are intangibles. So NTAV was negative, at -£2.5m. Although there has been a fundraising since then, so I'll review the next published balance sheet to update on this.

This is not necessarily a problem though, as software companies benefit from favourable working capital - customers paying up-front, which is quantified as deferred income. Technically a creditor, but it's not actually payable. The company does however have to provide future services, which incurs P&L costs, hence why future income is parked on the balance sheet, until it's gradually released through the P&L. This flatters the company's cash position, as with most software companies.

So this claim needs to be taken with a pinch of salt, to a certain extent;

...the Group continues to hold net cash 'at bank'.

It jolly well should do, considering customers pay millions up-front for services not yet delivered. I'm not quite sure why the quote marks were added around the words "at bank".

Outlook - everything sounds pretty positive in this RNS, concluding;

The Board remains cautious and conservative in its approach, but the good start made by Anisa, the strengthening and robust business model of Sanderson, the cash-backed balance sheet and the positive business momentum provide the Board with a good level of confidence that the Group will make continued progress in the current financial year ending 30September 2018."

My opinion - I hold a small long position in this share, but can't really remember why I bought them. Reviewing the StockReport, this seems to be a reasonably-priced share, on a forward PER of about 14. Divis are pretty good, with a yield of over 3%, which is quite unusual for a small, acquisitive software group - this type of share usually doesn't pay out much in divis.

Note also that it has a stand-out StockRank of 98, and is styled as a "Super Stock". Together with an upbeat-sounding statement today, this one looks pretty good to me.

Please remember that a high StockRank does not guarantee success. Rather, it has been statistically proven that a basket of high StockRank shares is more likely to out-perform than a basket of low StockRank shares.

Lidco (LON:LID)

Share price: 6.6p (down 10.5% today)

No. shares: 244.2m

Market cap: £16.1m

LiDCO Group Plc (AIM: LID), the hemodynamic monitoring company, provides the following trading update for the full year ended 31 January 2018.

Revenues excluding China (where sales fell due to a licensing issue) were up 9%, but up only 1% once China is included.

A lot more detail is given, but let's cut to the chase;

As expected, the year ended 31 January 2018 was a year of investment for the Company as LiDCO expands its commercial presence. As a consequence 1.67m of cash was invested and the Board expects to report a loss for the year before tax and share based payments.

The Company remains debt free and year-end cash balances were 3.23m (2017: 4.90m).

A transitional year, or a year of investment, is really just code for "bad year".

The company mentions slow sales cycles, and this is the big problem generally with medical devices companies, and why I rarely go near them now. Even if a product is good, it can take years before hospitals start buying it. Meanwhile companies have to maintain all the costs of a sales team, product development, etc.

Contract wins - there's a separate RNS today, talking about new contract wins. I don't know anything about the company, so cannot comment on how significant these are.

My opinion - this type of company always seems to be on the cusp of great things. Positive newsflow about future prospects is enough to keep investors interested, and stumping up fresh cash every now and then for a placing.

To be fair, Lidco seems to have had fairly modest cash burn historically. It's just that the growth hasn't really kicked in meaningfully yet (if it ever will?).

Investors are obviously hoping that they'll hit the jackpot at some point, with huge new orders materialising. However, major success stories are few & far between, in my experience of small, jam tomorrow companies on AIM.

If you want to speculate on something, Lidco actually looks quite reasonable - the cash burn seems modest, and the share price has come back down to roughly where it was a year ago.

This type of thing doesn't interest me at all - what possible edge could I have, trying to guess whether a medical device will sell in increased quantities or not? It would just be a total punt. So it's not of interest to me, but good luck to holders!

Trifast (LON:TRI)

Share price: 254p (up 3.3% today, at market close)

No. shares: 121.1m

Market cap: £307.6m

"HOLDING THE WORLD TOGETHER"

Leading international specialists in the engineering, manufacturing and distribution of high quality, industrial fastenings to major global assembly industries

This update is for the year to date, ending 31 March 2018.

Various details are given, in a slightly strangely worded statement. However, all that matters is this bit;

Accordingly, the Board remain confident that the Group will deliver its expectations for the year ending 31 March 2018 when it reports in mid-June 2018.

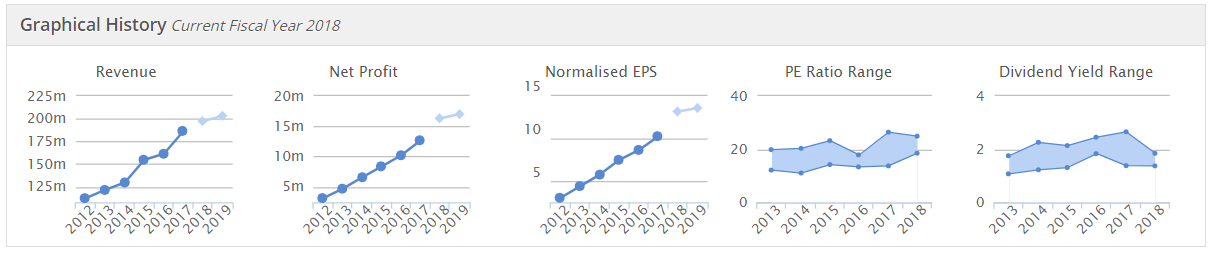

The outlook comments also sound upbeat. Is it good value? Not really, but with a track record as good as this, that's hardly surprising;

My opinion - despite making acquisitions, Trifast has still got a very good balance sheet.

Note also that the share has rebounded strongly from the recent spike down.

Well done to people who spotted the potential here. It's clearly a well-managed, successful group of companies. The last interim results stated that 70% of business is outside the UK, so it looks well protected from any sterling or Brexit worries (more imagined than real, in my opinion).

Sorry, I didn't get round to looking at Innovaderma (LON:IDP) or Laura Ashley Holdings (LON:ALY) today, due to fatigue.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.