Good morning, it's Paul here.

Please see the header for stocks I am looking at today.

Debenhams (LON:DEB)

Share price: 23.15p (down 0.7% today, at 11:09)

No. shares: 1,227.8m

Market cap: £284.2m

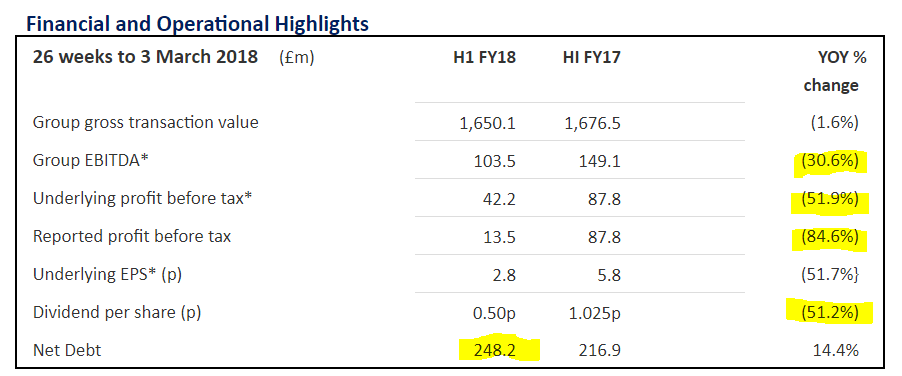

Debenhams plc, the international department store destination, today announces interim results for the 26 weeks to 3 March 2018.

I don't think DEB is investable in its current form. The figures are poor;

I don't accept the "underlying" figures. My reason being that the group is in a permanent state of re-organisation. Hence re-organisation costs are normal, not unusual. So the figure I'm focusing on is the near-breakeven profit of only £13.5m for the half year (which includes busy Christmas trade, so should be much higher).

Dividends - the interim divi has been slashed by just over half, to 0.5p. Given the precarious finances, they should not be paying divis at all. I suspect this 0.5p might be the last divi that DEB shareholders receive.

Like-for-like (LFL) sales - fell by 2.2% (constant currency was worse, at -2.8%). This is not good enough, because LFL increases are necessary to offset widely publicised higher costs, for all retailers. In mitigation, severe weather caused the closure of many shops in the last week of February. This is estimated to have reduced LFL sales by c.1.0%. So adjusting for that, which is an extreme event, LFL would have been down -1.2% - not good, but not a disaster either - plenty of retailers did worse than that, over a period when consumer real incomes were under pressure.

Trends - the problem DEB has, is that the trend is very much not their friend. It seems only a matter of time until the company becomes loss-making. That could lead to a withdrawal of borrowing facilities. So balance sheet strength is the key issue. For that reason, I'm not really interested in all the narrative explaining what they're trying to do to improve performance. They're trying to push water up-hill, in my view.

Balance sheet - this is worryingly weak, and has never recovered from the scourge of private equity - which hollowed out & geared up its balance sheet some time ago.

NAV of £890.4m is a mirage, as it's flattered by worthless intangibles of £995.3m. Remove that, and we get;

NTAV: -£104.9m. My simplest balance sheet test is to never invest in companies with negative NTAV, like this one. That helps avoid most subsequent disasters.

Current ratio looks very weak, at only 0.65. I would want to see a figure of over 1.0 for a retailer (and over 1.3 for other sectors). Trade creditors looks a bit stretched to me.

Longer term creditors are also large, at £633m. Note this includes £353m in "other non-current liabilities". This relates to incentives taken up-front to sign leases with higher rents. This notional creditor is fed into the P&L as revenue or a negative cost, over the life of the lease. Therefore it flatters future profits, increasing them above cashflow.

Pension fund recovery payments have dropped from £9.5m p.a. to £5.0m p.a.. There are additional costs (e.g. payments into the Payment Protection Fund).

Net debt - this is by far the biggest worry. Will lenders be happy to continue lending on a large scale to DEB, if it becomes loss-making, which is looking increasingly likely, or even inevitable?

Net debt is rising, at £248.2m. With a group this size, I would imagine that figure moves about a lot, and could be much higher at peaks during the year.

It has £520m committed financing facilities, which looks crazily high. This constitutes a £200m 5.25% senior bond. that's good news, as bonds adjust in price according to the likelihood of default. I don't know whether the bonds have financial covenants, or not. That's a key question. Repayment is due in July 2021, so not an immediate worry. Bonds are currently priced below par, at 92-94, indicating that bond investors are not entirely comfortable.

Banks provide £320m in revolving credit facilities. I can't see that being renewed in June 2020, unless trading improves.

The net debt: EBITDA test is currently 1.4 (worse than 0.9 a year earlier), and I would expect this to worsen further. It's not stated what the level is which would constitute a breach.

Leases - this is what I think could bring down DEB in its current form. It is now becoming clear that many retailers will only survive, if they can exit from shops which have unaffordable rents. Rents are the only major cost which can be reduced. Therefore, rent reductions are essential if DEB is to re-build its profitability.

The problem is that the average lease term is a whopping 18 years. DEB points out that it has low rents per square foot. That's only true because many of its shops have multiple floors, and anything other than ground floor space is charged at low rents, as it has much lower footfall.

I think the only solution for DEB is to copy CarpetRight, and do a CVA, to enable it to exit from unprofitable stores, and downsize the rents & space in other stores.

In the meantime, DEB is doing some sensible things to sublet unprofitable store space, e.g. Franco Manca (owned by Fulham Shore (LON:FUL) ) has taken some space on the ground floor, for pizza restaurants. Upper floor space is being let to gyms, and flexible workspace companies. That's very sensible, but whether it's enough to stem the tide of falling profits, I'd be sceptical.

Forex - DEB had unusually long forex hedges in place, which protected its margins from the Brexit-related drop in sterling. Those hedges are now being replaced by far less competitive hedges of £1: $1.30 (15% below last year). This is below the current spot price of £1: $1.42. Therefore I would imagine DEB will probably continue to struggle with its gross margins. On such large revenues, it wouldn't take much more margin erosion to tip the company from profits into losses. I think that's very much on the cards for next year.

CFO leaving - a separate RNS today explains that the CFO of 3 years, Matt Smith, is leaving to become FD of Selfridges. You can hardly blame him. DEB should get in a new CFO with retailing, and specific restructuring experience. Or even split the role into 2 perhaps? One FD to run the business, and one to restructure its finances. They're very different skill sets.

Profit guidance - not exactly a profit warning, but hardly positive either;

Based on our current view of the second half of the financial year, FY2018 PBT is expected to be at the lower end of the current range of broker forecasts of £50m to £61m

Well done to the company for providing crystal clear guidance. All companies should do this please. Less waffle, and more specifics are needed, generally, in RNS releases.

My opinion - In my view, DEB is in a precarious state, and a CVA is likely to be necessary in order to extricate the company from excessively long & over-rented leases. I doubt whether shareholders would be willing to repair the balance sheet unless & until a CVA was done. Everybody surely now knows that's the way forward for retailers with problem, over-rented leases.

Personally, I wouldn't buy, or short this share, because that short is already such a crowded trade, and the share price has collapsed - so the smart money has been made already. There can be powerful rallies in heavily shorted shares, when the shorts are squeezed and become forced buyers. I've had some horrible experiences like that in the past, hence why I don't now short anything other than large caps. Even then, I only occasionally short things.

You never know what might happen. What if say an overseas retailer/manufacturer decides that they want to grab a big chunk of the UK market, and sees DEB as a way of buying lots of space quickly? It would take years to replicate something as big as DEB, and they might be prepared to take on its long leases. I'm not saying that's likely, but it's possible.

The banks are crazy to rely on EBITDA as a key measure to support borrowings, because the huge stores operated by DEB need constant, and very expensive maintenance capex. So EBITDA is a mirage.

DEB is trying to use partners where possible, for its new initiatives, but ultimately people will only see Dept Stores as aspirational "destinations" if they are well invested, looking modern & attractive. That costs a lot of money. My local Debenhams is really run-down, it's like going back to the 1990s. I appreciate that there are other, much more modern DEB stores though.

I think we have to accept that the internet is changing everything. Things will not be reverting to the mean. Consumers are still spending, but we're buying lots of stuff from Amazon now. That means, for physical retailers, it feels like a permanent recession, with some of their business slipping away to online competitors every year. Whilst their costs rise relentlessly. Something has to give, and the only thing which can give, is rents - drastic reductions are needed, if High Streets and malls are going to survive.

The only retailers which interest me, are ones which are successfully transitioning to profitable online operations, and have affordable closure plans for their unprofitable shops. Next (LON:NXT) is the obvious one, and this is now my largest long position - being remarkably cheap for such a cash generative business. It is managing the decline of its stores with tremendous skill, and is achieving 28% rent reductions on lease renewals, and only taking on average 7 year new leases. It even gets the landlord to pay for a refit, when signing new leases. Meanwhile its online operations are strengthening, and now generate the majority of its profits.

French Connection (LON:FCCN) (in which I hold a long position) is a special situation, which offers amazing value. With less than 3 year average lease term remaining, we should see it extricate itself from the heavily loss-making retail division over that time. That will leave behind its highly profitable wholesale & brand licensing businesses. The catalyst for a good outcome here, is likely to be a retirement sale by the founder.

With its 18 year average lease term remaining, DEB just looks high & dry. Hence why I think a CVA is really the only option to ensure the long-term survival of the decent shops. The problem is, we don't know what that action would do to the share price. Investors might demand a huge discount to fund the CVA, wiping out existing holders. Or, the existing holders, like Sports Direct, might be supportive and want to protect the share price. There's no way of knowing, as it's a hypothetical situation at this stage.

If DEB does a CVA, there could be a very nice business emerge - with lower rents, and having ditched all the loss-making stores. This is the way forward, but whether it happens or not, is another matter. The danger is, if DEB management preside over further deterioration in trading (which looks very likely), then it might be too late to save the good parts of the business.

It would make sense for DEB to reduce its gearing by selling off its overseas business, including the decently profitable Magasin du Nord in Denmark, which could fetch a decent amount. Maybe it could use proceeds from such a sale, to finance a CVA on the struggling UK business?

So DEB does still have options, but I think management need to take bold action.

In the meantime, we mustn't fall into the trap of trying to value DEB on a PER or yield basis. When profits are wafer thin, and in a down-trend, they can quickly turn into losses. Also, the divis are best seen as over now, I think.

All rather depressing, but I'm absolutely not tempted to catch this falling knife - the problems are deep, and structural, and could take years to resolve. If they can be resolved.

Mothercare (LON:MTC)

Share price: 18.6p (down 3.4% today)

No. shares: 170.9m

Market cap: £31.8m

Another struggling old school retailer, which is trying to restructure.

Out goes the "calm leadership" of Alan Parker, who is retiring as Non-Exec Chairman.

In comes the Interim Executive Chairman Clive Whiley, who has "specific refinancing and restructuring experience". I see that he is also a Director of Stanley Gibbons (LON:SGI) which has been a messy restructuring, but has survived thanks to being bailed out by a major shareholder. Graham reported on that here in Feb 2018.

This comment is interesting;

Clive's appointment comes with the support of a number of our key shareholders and strengthens Mothercare's leadership with specific refinancing and restructuring experience. He has the skills required to help stabilise the business and take it forward."

Reading between the lines, that suggests to me that shareholders might be prepared to support a fundraising, under new management. This is also hinted at by the new Chairman's comments today;

"I am pleased to have been invited to become Interim Executive Chairman of Mothercare, a business with an undoubted heritage and an exciting future both in the UK and internationally. Given the pressures the business is under, I greatly value the support already shown to me and the business by our financing stakeholders - including our shareholders, banking partners and pension fund trustees - and I will work tirelessly for them to return this business to its rightful place.

Working with the team in Watford and our franchise partners around the world, I will endeavour to return Mothercare to a sound financial footing and deliver a successful plan to improve performance on behalf of all of Mothercare's stakeholders."

Q4 trading update - this was released last week, but I didn't get round to looking at it. So let's have a quick look now. The year end is late March.

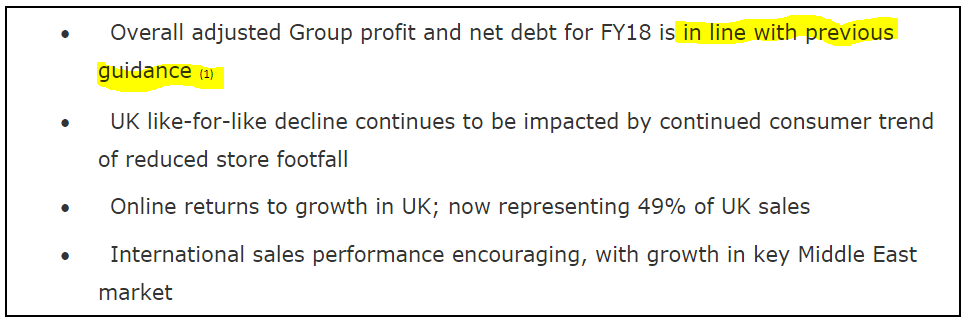

A few comments on the above;

- Encouraging that things haven't got any worse (in line with previous guidance)

- Negative trend in UK on footfall - this is the fundamental problem - people are buying stuff online, from competitors with lower costs than Mothercare. I don't see how they can resolve this fundamental problem.

- Let's hope new management drops this disingenuous reporting of 49% of UK sales being online. This is rubbish! They classify a customer using an iPad instore, as online sales, which it clearly is not. How can investors trust management that publish such utter nonsense?!

- Good news re international sales - as that's the decent part of the business, which was historically very profitable.

Update on refinancing - nothing specific unfortunately;

We remain in constructive dialogue with our financing partners with respect to our financing needs for FY19 and beyond, and we continue to explore additional sources of financing to support and maintain the momentum of our transformation programme. All of these discussions are on-going and further updates will be given as appropriate."

My opinion - this share is also uninvestable for me. I normally don't invest in anything that has a need to raise more equity financing, as existing holders are often lambs to the slaughter, when deeply discounted fundraisings happen. Why take the risk?

Press reports about 10 days ago suggested that MotherCare is pondering whether to do a CVA. It should press ahead with that route, in my view. It's the obvious way to resolve the problem of too many stores, many on unaffordable rents.

Importantly, note that if handled well, a CVA allows the business to continue trading as normal, and does not impact on trade creditors (see the process being undertaken by Carpetright (LON:CPR) ). It's only the landlords that take the pain, although their support is necessary to approve a CVA. CarpetRight very sensibly is doing its CVA in conjunction with the British Property Federation. I reported on that here.

There's no doubt that CarpetRight, MotherCare, and others, should emerge as stronger, more viable businesses, once their CVAs are done & dusted. The big problem though, is that we have no way of knowing what slice of the upside that existing shareholders are likely to get? They could be diluted to almost nothing, if providers of fresh equity funding play hardball. There's also the risk that landlords could reject CVA proposals.

Therefore, at this stage, these shares are really only for punters, not for investors. The risk is extremely high, but if things go well, there could be good upside. I'm not interested in making investments by guessing at the outcome of a high risk process. So it's not for me. Although I would look at potentially buying shares in both CPR and MTC, once the CVAs have been approved, and the refinancing completed.

A CVA process can create a highly attractive business, with no legacy issues, and stripped of all its problem, loss-making stores. Although as we saw with JJB Sports, it can also be a deferral of the end for a terminally sick business whose day has passed. I can't help thinking that MotherCare might fit into that category - it just seems so old-fashioned, and its customer base of young parents is likely to be permanently tired & busy - so ordering online from cheaper competitors seems the natural thing for them to do.

Gattaca (LON:GATC)

Share price: 150p (down 22.3% today, at 14:10)

No, shares: 31.8m

Market cap: £47.7m

(for the avoidance of doubt, I no longer have a position in this share)

Gattaca plc ("Gattaca" or the "Group"), the specialist Engineering and Technology (IT & Telecoms) recruitment solutions business, today announces its Interim Results for the six months ended 31 January 2018.

The company seems to have used a grey-coloured font, which makes the figures difficult to read. Actually that's not a bad idea, that I'm sure PR companies will pick up on - if the figures are rubbish, make them illegible!

Underlying profit before tax has fallen from £8.3m in H1 last year, to £6.9m in H1 this year, down 17%.

The fall in underlying, diluted EPS is greater, at 25%, to 14.5p, so the tax charge must have gone up to cause this.

Interim dividend has been halved from 6p to 3p.

Net debt is £36.2m, up from £27.9m a year earlier.

I've heard several people say that the net debt here is too high, but I disagree. My reasoning is that the £103.5m receivables book is so large, that net debt of £36.2m to finance part of it, seems perfectly reasonable.

The overall NTAV position is sound, at £32.0m.

The current ratio looks very good, at 1.85

Providing the bank remains comfortable lending against the receivables book (and I can't see any reason why they wouldn't be, as this is effectively secured lending, so very low risk - almost risk-free actually, providing there is a decent spread of financially sound customers within receivables), then it should be fine.

The only potential risk I can see, is if the bank covenants are too tight, and falling profits end up triggering a covenant breach. That might need a bit more research before I could be tempted back in to this share.

Impairment - there's a £17.1m non-cash charge to reduce the intangibles relating to the Networkers acquisition.

Profit warning - bad news, but at least the company has given us specific guidance, which removes the guesswork in valuing the shares;

Our business is going through a period of significant change, in particular in UK Technology and in some International operations outside of the Americas, where we do not have critical mass. To counteract this we have instigated a program to reduce the cost base of the business within the current financial year and beyond.

In February and March the business broadly traded in line with the Board's expectations. However, the changes being implemented in the Technology division in the coming months, alongside the economic challenges facing some of our sectors and territories make the backdrop to our full year expectations, which have a final quarter weighting, more challenging than at the time of the trading update of 7 February 2018, with the consequence that the Board now expects underlying profit before tax for the full year to be approximately 15% below its previous expectations.

My opinion - I lost patience with this company a while back, and have just accepted that I got it wrong - which happens to all of us, quite often!

I like cheap companies, which are undergoing a turnaround, as these can often become big future winners. However, in this case, the commentary sounds rather hesitant. It's dawning on me that this just isn't a very good business. I'm sceptical about management competence too, although noting that the old CEO has gone, and they're looking for someone new. It might be worth revisiting, if a heavyweight CEO with a great track record is recruited.

Another thing that bothers me about this company, is that it has massive pass-through revenues, and hence a huge receivables book. Given that there are question marks over the quality of management, how comfortable can we be that there are strong financial controls in place - which are vital for companies with big revenues & large volumes of invoices to raise, and chase for payment.

The company has repeatedly failed to achieve forecasts. So if it can't forecast accurately, I'm not convinced that other aspects of the finances would necessarily be fully under control.

Overall then, I think this is a share I probably won't revisit. I got it wrong in the past, so don't have confidence in my own judgement about this share in the future.

Xeros Technology (LON:XSG)

Share price: 145p (down 5.5% today)

No. shares: 99.2m

Market cap: £143.8m

Xeros Technology Group plc (AIM: XSG, 'the Group', 'Xeros'), the developer and provider of patented polymer based technologies with multiple commercial applications, today publishes its final results for the 12 months ended 31 December 2017.

I don't normally cover blue sky or jam tomorrow companies, but have mentioned this one before, so might as well provide a brief update.

The figures are so bad, they're scarcely believable. Here's a snapshot;

- Revenues of £2.3m (down 8% on prior period, which was unusually long at 17 months)

- Loss before tax of (drum roll please...) -£31.9m

- Net cash is £25.1m, which was raised in a £25m placing in Dec 2017. So clearly the institutional shareholders really believe in this company's prospects. At this rate of cash burn, it's probably going to burn through that cash during 2018.

Indeed, the company says that it will need more cash in future;

The Group expects to raise further funds in 2018 for the execution of specific commercialisation strategies.

The company seems to be trying to target multiple potential markets simultaneously, without having made a significant commercial breakthrough in any of them yet. That seems a crazy strategy to me. Surely it would make more sense to focus management time & energy on the most promising potential market, and make a meaningful breakthrough there first. Then develop other markets?

My opinion - I wouldn't touch anything like this with a bargepole. My experience over the last 20-odd years of smaller company investing, is that hardly any jam tomorrow companies actually deliver what they set out to deliver. Even the ones that do succeed, usually take far longer, and require loads more funding, than the original business plan.

Despite this, institutions and mug punters alike, still queue up to invest in them.

Ceasing to invest in jam tomorrow shares, is the single best decision I made a few years ago, to improve my investment performance. Of course we're all human, and every now and then succumb to a convincing-sounding story. Very occasionally, we get lucky and buy something that actually works out well. The occasional success is needed, to keep punters punting.

Xeros technology (which seems to be based around cleaning, and other processes, using polymer beads instead of water) sounds interesting, and it might work out, I don't know. The problem is that we have no way of knowing if it will work.

I tend to only look at jam tomorrow shares once they are totally bombed out, trading at a valuation equal to, or below their own bank balance, and when cash burn is low. If there's enough cash in the bank for 2+ years continued operations, then it might be worth a flutter. The other key consideration is that revenues must be starting to grow very strongly in percentage terms. Put that lot together, and risk:reward can be quite attractive, occasionally.

Xeros doesn't fulfil any of those criteria. It's way too expensive, is valued at multiples of its own bank balance, has less than a year's cash in the bank (despite recent fundraising), and there's not (yet?) any sign of sales growth.

It could all work out great, if some massive orders are landed. But how can you or I assess how likely that is? It's incredibly difficult & time-consuming to introduce new technologies, where there are established vested interests. I wish Xeros well, but this type of investment is really just gambling, until there are signs of a serious commercial breakthrough.

The chart seems to be suggesting that some shareholders are tiring of the story;

Sprue Aegis (LON:SPRP)

Share price: 123p (down 9.6% today, at market close)

No. shares: 45.9m

Market cap: £56.5m

Today's update from this smoke alarm seller covers several matters.

Graham reported here on 23 March 2018, on Sprue's last update. That indicated problems had emerged with its major shareholder, and provider of some products, BRK. As I'm sure you'll agree, Graham has a good nose for these situations, and wisely struck a cautious tone in his conclusion then (when the shares had fallen 23% on the day, to 146p).

This is what today's update says;

BRK dispute - nothing much seems to have changed;

The Company continues to take legal advice, and is in communication with BRK, with regard to the Termination for Breach Notice, the allegations made by BRK and its position. The Company disputes the allegations made by BRK. A further announcement will be made in due course.

The amount of disputed stock is not huge, but is significant in relation to Sprue's £56.5m market cap. I also worry that, if the legal action goes against Sprue, what could any compensation, and costs add to this figure? Would disputed stock have to be destroyed, or sold off at below cost? Who knows, we haven't been told.

The gross book value of the disputed stock of unsold BRK products was £4.3m as at 31 March 2018.

I feel that the company could have been clearer in explaining this dispute, and its possible consequences. When left in the dark, investors tend to become increasingly nervous, and hence the share price falls as some sell out.

Late accounts - the dispute is delaying publication of its accounts. This can't carry on forever, as there would be a 30 June 2018 deadline before the shares would be suspended. So at some point Sprue might have to just make some hefty provisions in its accounts, and publish them;

Whilst discussions with BRK continue, the Company is unable to confirm the expected date for release of its audited final results for the year ended 31 December 2017. A further announcement will be made in due course.

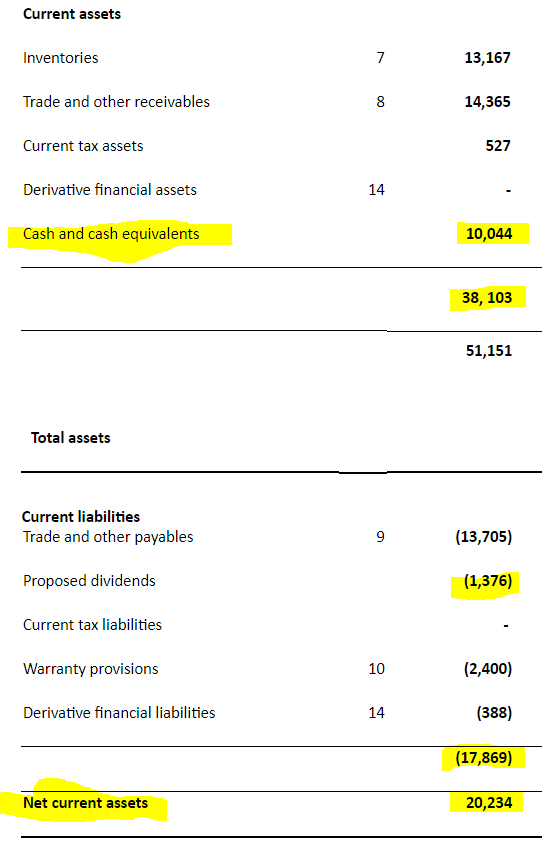

Bank facility - this is very concerning. As others have commented, Sprue's last balance sheet showed £10.0m of net cash at 30 Jun 2017. So why does it now need an overdraft?

The Company announces that in late January 2018, it entered into a committed 3 year revolving credit facility with HSBC Bank plc for £7.0 million to fund the Company's working capital. On 29 March 2018, the Company drew down £3.0 million of this facility.

So where has the £10m cash gone? I can see that there was a nearly £1.4m creditor for dividends, which would have been paid by now. That should leave £8.6m net cash remaining. Yet we're today being told that the company has drawn £3m on its bank facility.

This suggests to me that there must have been a big increase in inventories & receivables.

Looking at the working capital section of Sprue's 30 Jun 2017 balance sheet, I am flabbergasted that it now needs any bank facilities at all. There must have been a huge increase in inventories;

My opinion - I don't like the look of this one bit.

As Graham said in his report about a month ago, we don't have enough information to make a judgement. That the company has seemingly run out of cash, and is now borrowing from HSBC, seems to me a significant amber flag.

This leads me to suspect that there could be more bad news to come from this highly accident-prone company.

I'll look at it again, once all the bad news has been flushed out. The sudden need for bank borrowings, suggests to me that there's more bad news to come.

I think management has lost credibility now - there have been too many screw-ups, which lead me unavoidably to the conclusion that they're not as good as myself & many others previously thought.

Dividends - if the company is no longer cash-rich, then the generous divis could be cut perhaps?

Sorry to slag off the company, as I know many friends hold the shares, and are smarting at the moment, with the heavy losses lately. But I have to tell it how I see things, as I'm sure you understand.

For me, given the sequence of events, and uncertainty, it's not a share I would want to hold at all. It's impossible to value at the moment, as we have incomplete information.

Look at how many lurches down we can see on the 3-year chart below. A solid red bar on candlestick charts is where the closing price is much lower than the opening price. Whilst these can be caused by general lack of liquidity in small caps, there shouldn't be this many. The red lurches down in price are normally driven by nasty surprises on the RNS. Sprue seems highly accident-prone. So it really deserves a low rating now, unless/until it can rebuild investor trust.

I've just had a quick look at the RNS, and see that the long-serving (since 2010) FD resigned on 5 Mar 2018, just before serious problems emerged. Isn't that interesting?! In the past, I've tended to give very little importance to FD resignations. However, I've learned in the last year or so, that an FD resigning can often be an amber or red flag that something could be going wrong. Or at least that the upside may not be as great as investors imagine.

I am wondering whether to add a rule to my portfolio that an unexpected FD resignation should trigger an automatic sell of half my shareholding? What do readers think?

I remember a while back, when the FD of Revolution Bars (LON:RBG) resigned (in which I have a long position), I had passionate battles with people on bulletin boards, saying that everything was fine, he just wanted to spend more time with his family (after being told this at a meeting with management).

What a fool I was! Of course they were all lying. He was actually leaving because the forecast figures contained basic errors, were all over the place, and the company was going to miss forecasts. It didn't actually matter, as the share price then doubled on a bid approach, but has since fallen back again, oh I'm getting dizzy! [Austin Powers quote].

Anyway, for me, at the moment, Sprue has got a lot of explaining to do, and even if it's temporary, I don't like a cash-rich company suddenly needing an overdraft, with inadequate explanations of what's going on.

All done for today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.