Hi, it's Paul here.

I'm running a bit late today, due to a Doctor's appointment (nothing serious), so will be updating this article all afternoon & evening. Please see the header for the announcements that I shall be writing about, plus one or two reader requests.

Update: lots of requests today! I've added the ones that look most interesting into the article header, and will work my way through them this afternoon.

Zytronic (LON:ZYT)

Share price: 490p (down 8.1% today, at 12:42)

No. shares: 16.04m

Market cap: £78.6m

Zytronic is a world-renowned developer and manufacturer of a unique range of internationally award winning optically transparent interactive touch sensor overlay products for use with electronic displays in industrial, self-service and public access equipment.

The current financial year will end on 30 Sep 2018.

This is what it says about trading in the 4 months to end Jan 2018;

Further to the outlook statement given in the preliminary results announcement, current revenues and profits over the first four months of this financial year remain broadly in line with the equivalent period last year.

[published today, 22 Feb 2018]

Checking back, this is what the company said on 12 Dec 2017, in the outlook section of its preliminary results;

The current year has started with orders, revenues and trading along similar levels to that of the prior year, which, together with our strong balance sheet and cash generation, provides a sound base for further growth in dividends and shareholder value. The focus on growth this year will be from expansion in local sales representation in the USA and the Far East, and we shall keep shareholders updated on the progress, and any material developments, over the course of the year.

[published on 12 Dec 2017]

Those two statements essentially say the same thing - trading is flat, or slightly below last year. This is reflected in a share price that is about the same, comparing those two dates.

Valuation - last year normalised EPS was 28.7p, and the StockReport is showing broker consensus of 29.9p for this year. So it sounds as if forecasts might need to be edged down a little, given that the company is struggling to better last year's figures so far this year.

The trouble is, we don't have any information on the company's order book. Nor does it give any outlook statement today. So today's update is rather leaving us in the dark, as to this year's likely outcome. That makes it more difficult to value the shares. Uncertainty also makes investors nervous.

I'd say this year looks to be possibly between 27-30p EPS. At the current share price of 490p, that translates into a PER between 16.3 and 18.1. Initially, that strikes me as being perhaps a little warm, for a company that's not generating any growth at the moment.

Cash - no update is given today on the latest cash position, but this company has a history of generating, and hoarding, cash. When last reported, at 30 Sept 2017, cash was £14.1m, and there was no debt (as the £1.1m mortgage had been recently repaid).

This is material to the valuation, and works out at almost 88p per share - or 18% of the market cap. So investors are really only paying 402p per share for the business (i.e. current share price of 490p, less 88p per share net cash).

The cash neutral PER drops to a range of 13.4 to 14.9 - which is much more palatable.

The big question then, is what are the company's intentions with the cash pile? I've asked this question directly in the past, and the Directors don't seem to have any interest in doing acquisitions. I get the impression they like having a big cash pile, as a comfort blanket. Personally I'd rather see them put that cash to work, doing something productive - e.g. buying another profitable, cash generative business. Why couldn't they emulate Tracsis (LON:TRCS) or Judges Scientific (LON:JDG) and use the strong cashflows to build a larger group, with largely autonomous subsidiaries? Maybe there's a lack of ambition at ZYT? Or maybe management & investors are happy to keep small & focused?

Broker comment - there is one brief comment from a good quality broker, on Research Tree. It makes an interesting point that last year started strongly, so is a tough comparative. Therefore, its full year expectations of adjusted, fully diluted EPS of 29.9p remain unchanged.

If they're right, then that means the PER with the net cash stripped out, would be the lower figure above, of 13.4 - which is getting into value territory.

My opinion - I would like to have seen more detail today, in particular giving some guidance for the rest of this year. The lack of detail introduces doubt into my mind. Maybe the outlook isn't very good?

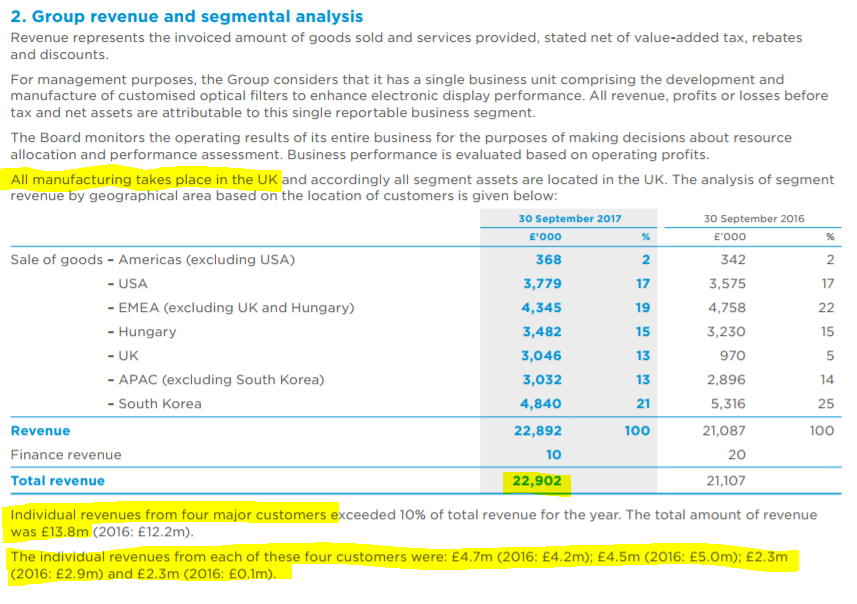

Another point to consider, flagged previously by a reader here, is that Zytronic relies heavily on several major customers. This information can be found on page 48 of the last Annual Report, in note 2;

That works out as 60% of revenues coming from the 4 largest customers - a very high concentration, which introduces considerable risk. This could help explain why management likes to hoard cash for a rainy day?

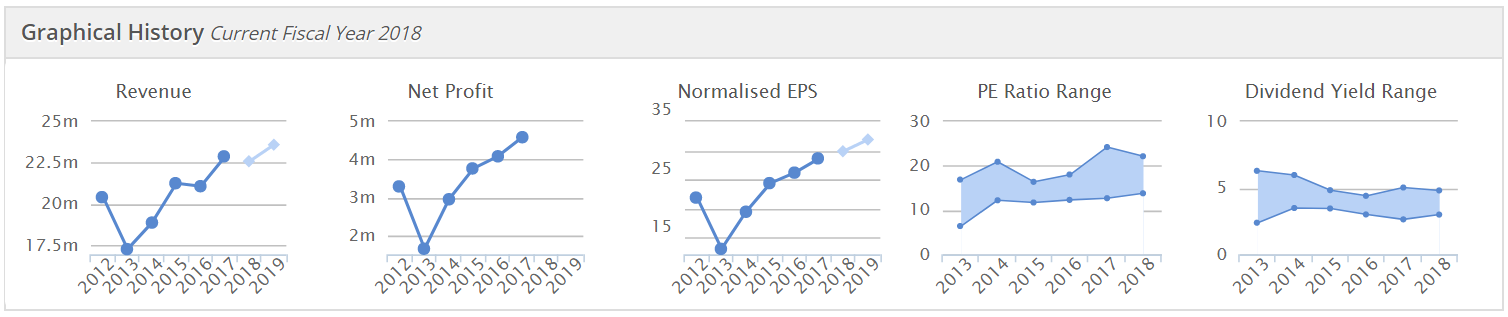

As you can see from the Stockopedia graphs below, the company has really only had one duff year, in the last six, when a gap appeared in the order book in 2013. People who bought that dip (down to about 150p per share) were well rewarded, as the share steadily recovered, and healthy divis were maintained, despite the sharp drop in earnings (another advantage of cash-rich companies).

Overall, I like it. It's not a share I currently hold, but is definitely one that I would buy after a profit warning, if it does run into any problems in future, as problems have been temporary in the past.

The current dividend yield is nearly 5%, and I see that forecasts on which this is based are for dividends to rise considerably. The forecast dividend cover is set to drop from 2 times back in 2014 and 2015, to only 1.16 times forecast for 2019. That makes complete sense - since the company is stuffed full of cash already, it might as well pay out nearly all future earnings in divis.

Therefore, there is considerable appeal to this share - as a reasonably priced, financially strong, high(ish) yielding, high quality niche company.

The main risk is that the price could plummet on a future profit warning, if any of the major 4 customers decide to defer or cancel orders. For this reason, I've decided not to buy any personally for the time being, although that was a finely balanced decision.

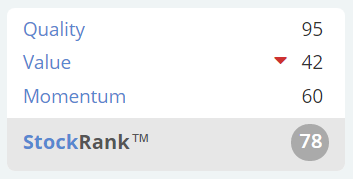

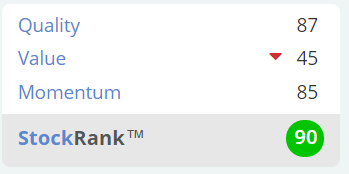

The StockRank is pretty solid too;

D4T4 (LON:D4T4)

Share price: 145p (up 9% today, at market close)

No. shares: 38.1m

Market cap: £55.2m

New contract wins - when I initially read this RNS before 8 am this morning, I incorrectly assumed it was a trading update, but it actually isn't. It's a PR announcement, so is issued via RNS-Reach. Info & click-through link on this from the London Stock Exchange website:

The only way I can see to spot that an announcement is RNS Reach, not RNS, on the investegate website that many of us use each morning, is that the Reach announcements are shown with a grey, not black "RNS" label. The difference is very difficult to spot at 7 am, when lying in bed reviewing announcements on an iPad!

Anyway, as regards this announcement from D4T4, I've started so I'll finish. In any case, I've been meaning to revisit this company for a little while.

Today's update says;

D4t4 Solutions Plc (AIM: D4T4), the AIM-listed data solutions provider, is pleased to report a number of new contract wins in key vertical sectors for its Data Management and Data Collection business areas.

Following the release of D4t4's half year results to 30 September 2017 and the Company's contract wins announcement on 27 December 2017, the Company has recently converted a number of further significant opportunities from its strong pipeline of potential business: ...

This is a very similar announcement to the one in Dec 2017, which I commented on here.

The trouble is, that no mention is made of how trading is versus market expectations. If the company is winning all these new contracts, how come it hasn't said that it's trading ahead of market expectations? The only conclusion I can come to, is that these contract wins must be largely within the existing market forecasts. However, it could be the precursor to increases in broker estimates at a later date, perhaps? That's just guesswork though.

Broker update - the house broker has issued a useful update today. This points out that H1 results (6m to 30 Sept 2017) were poor, and that the company needed a very strong H2 in order to meet full year expectations.

I'm having a quick look now at the H1 results, and they are indeed pretty awful. H1 revenues was less than half that achieved in the prior year H1, at only £4.75m (PY H1: £10.0m). This resulted in an H1 loss before tax of -£581k, versus a PY H1 PBT of £1.92m.

So it seems that the RNS Reach announcements on contract wins in Dec 2017 and Feb 2018 are designed to reassure investors that H2 is indeed seeing the necessary contract wins. Although the fact that the company is holding back on specifically confirming full year performance vs. market expectations, makes me wonder if there is still some doubt perhaps?

Software companies can make tricky investments, as in many cases, performance relies so heavily on clinching contract wins before the year end cut-off date. Smart customers know that too, and hence can increase their negotiating leverage by creating delays.

Valuation - the house broker reckons its 10.1p EPS target for 03/2018 is achievable. That puts the share on a PER of 14.4 - which seems reasonable.

Balance sheet - on a very quick glance, the last reported balance sheet looks absolutely fine to me. There's £3.9m net cash, and a healthy working capital and NTAV position. So no issues there.

My opinion - this looks an interesting software company, and seems worthy of a closer look. I don't understand its product or market, so can't really form a strong view on it either way. However, the valuation looks attractive, if the full year forecasts are met - which is the key issue for now, as a lot has to be achieved in H2 to recoup the poor H1 performance.

Personally, I'd rather play it safe, and wait to see what the full year numbers look like. However, it does look a potentially interesting company, operating in a fashionable space - of data management. If that strong pipeline continues to convert into more contract wins, then the company could see its shares re-rated onto a growth company rating. So I'll keep my eye on this one.

The forecast risk means that, at the moment, the market is being sceptical on valuation, as you can see;

Xpediator (LON:XPD)

Share price: 43.5p (up 13% today)

No. shares: 117.4m

Market cap: £51.1m

Xpediator, (AIM: XPD) a leading provider of freight management services across the UK and Europe, is pleased to announce a trading update for the year ended 31 December 2017 ("FY 2017").

This share listed in August 2017, and it's a new one for me. Thankfully Graham wrote a nice review of the company at the time of its interim results, here on 25 Sep 2017. Thanks Graham, that review has saved me time today!

Today's update says;

Group revenues for FY 2017 will be up by approximately 59% to 116 million (2016: 72.8m) reflecting approximately 10 million of revenue contribution from the three acquisitions completed during 2017, and positive performances from all three of the Group's trading divisions.

Trading profit is also expected to be significantly ahead of the previous year despite investment in strengthening the Company's key operating functions to support the current and future growth of the business.

The Group trading results for FY 2017 are expected to be in line with market expectations.

That section gets less & less exciting as you read it - we end up with just an in line with market expectations outcome. As Graham points out in his earlier report, a lot of revenue is just pass-through revenue, so it's the profit figures that matter.

More acquisitions are in the pipeline. There seems sound logic behind making acquisitions in this area, providing management bandwidth can cope;

We are capitalising on the positive market environment and growing organically whilst executing our strategy of being a market consolidator through acquiring sub-scale business which are immediately earnings enhancing with the potential to flourish as part of the Group.

I'm pleased with the performance of each of the three businesses acquired during the year and their integration within the Group is proceeding in line with management expectations.

I've had a quick look at 2 previous acquisitions, Benfleet Forwarding here in Oct 2017, and Regional Express here in Nov 2017. They look sensibly structured deals, using a mixture of cash, shares, and earn-outs, to buy decently profitable businesses at what seem attractively low prices. I'm starting to warm to this share.

Valaution - the StockReport shows (as always, the data comes from Thomson Reuters) broker consensus of 3.15p EPS for 12/2017, based on profit after tax of £3.15m. That is a 2017 PER of 13.8.

Placing - a small placing raised £2.8m (before expenses) in Nov 2017, being 7m new shares issued at 40p. The purpose of the new funds was to help make more acquisitions, and to increase profits by taking advantage of early payment discounts offered by suppliers.

Balance sheet - I've had a look at the 30 Jun 2017 balance sheet, which looks odd, with enormous debtors and creditors, both of which look too big for the size of business. This was pre-IPO, so I'll reserve judgement on the balance sheet until I've had a chance to properly go through the 31 Dec 2017 post-IPO balance sheet.

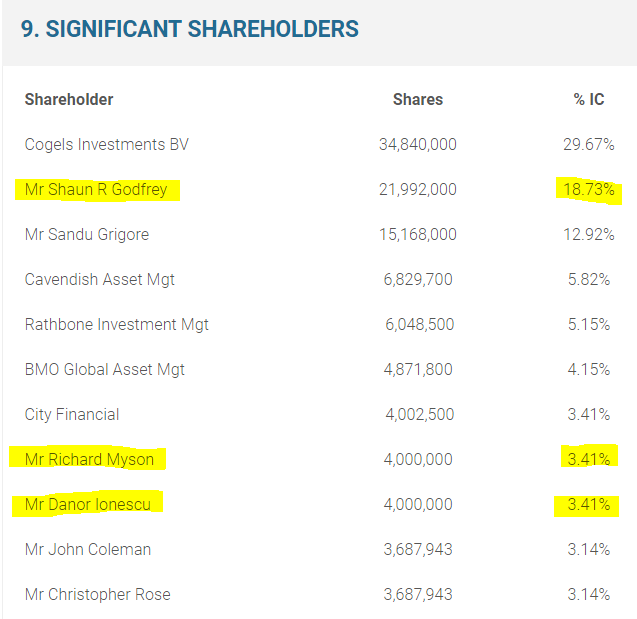

Major shareholders - the shareholder register is very concentrated, so little free float means that this share will be extremely illiquid;

I've compared this list (from the company's website) with the page showing its Directors, and have highlighted the shareholders who are also Directors. Note that Shaun Godfrey is a divisional CEO, not a main Board member.

The impression from the short CVs on the company website, is that management seem experienced in the sector, entrepreneurial, and have a decent amount of skin in the game - which is positive.

My opinion - this is not a sector that I would normally want to venture into. Although it's important to note that this group of companies are middle-men, not actual operators of lorries. It does operate warehouses though, including 10 in Romania. It's cheap and easy to procure, and operate leased warehouses, which usually don't need much capex either.

I like the growth through acquisitions of profitable businesses, at low prices with earn-outs. If lots of acquisitions can be managed and integrated (a difficult task), then this could become a bigger and altogether more interesting group.

So it's going on the watch list as potentially interesting, subject to me having a good rummage through its 2017 accounts, when they are published.

It's still early days, but so far this IPO has been successful;

Macfarlane (LON:MACF)

Share price: 84p (down 2.3% today, at market close)

No. shares: 157.5m

Market cap: £132.3m

Final results - for the year ended 31 Dec 2017.

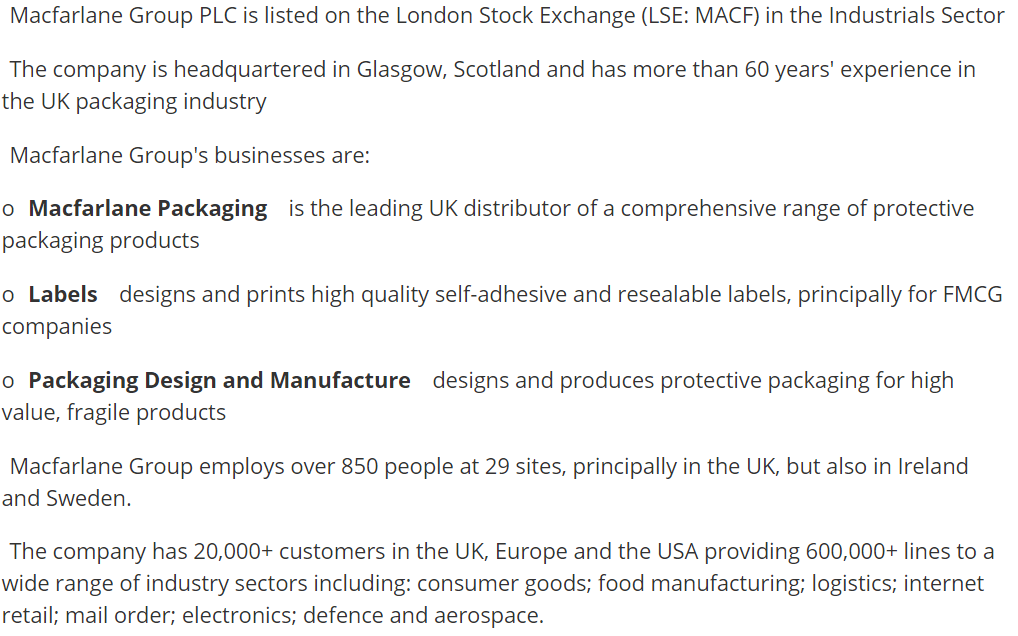

To save me some typing, here is a copy of the company's self-description given in today's results announcement;

Headline figures look good;

Macfarlane Group PLC achieved another year of growth in 2017 with;

- sales of 196.0m, (2016: 179.8m) 9% ahead of the previous year ,and

- profit before tax of 9.3m (2016: 7.8m), 19% ahead of 2016.

- The trading performance continued the positive trends of recent years and the results were in line with market expectations.

Diluted EPS of 5.22p is up 13% on 2016. Whilst the company says that this is in line with market expectations, I'm seeing a higher figure, of 6.1p on the StockReport (which ties in with a research note from Arden, from Nov 2017).

The difference seems to be due to adjustments made by analysts, but not made in the reported numbers by the company. It would be useful if the company would in future also report adjusted EPS, to make its results more easily comparable with broker forecasts.

Arden show 6.09p adjusted EPS forecast, and 5.02p reported EPS next to it. The reconciling item is probably the £1,580k charge for amortisation of intangibles, which looks to be about the right size for that EPS discrepancy. Analysts usually disregard amortisation of acquisition-related intangibles, so this fits together OK. I just wanted to satisfy myself that the results are indeed in line with market expectations, which it looks like they are.

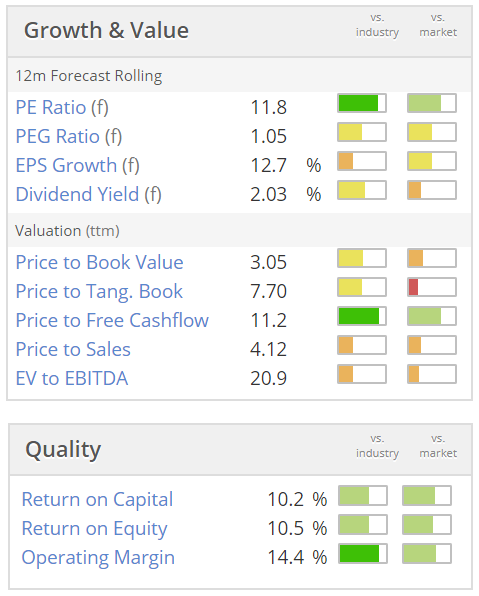

Consensus is currently for 6.9p EPS for 2018, giving a current year PER of 12.2 - looks good value, at first sight. Although a packaging distribution company wouldn't normally attract a high rating.

Acquisitions - seem to be generating most of the growth in revenues and hence profits. There's nothing wrong with this per se, but we should avoid giving too high a PER to a group that is buying in growth, as opposed to more valuable organic growth;

Packaging Distribution increased sales by 10% to 171.8m (2016: 155.9m) with 3% achieved from organic growth and the remainder from acquisitions, both those in 2017 and the full year benefit of those completed in 2016, all of which continue to perform well.

There is also balance sheet risk from growing via acquisitions, so I'll check that next.

Balance sheet - there are several points of interest here.

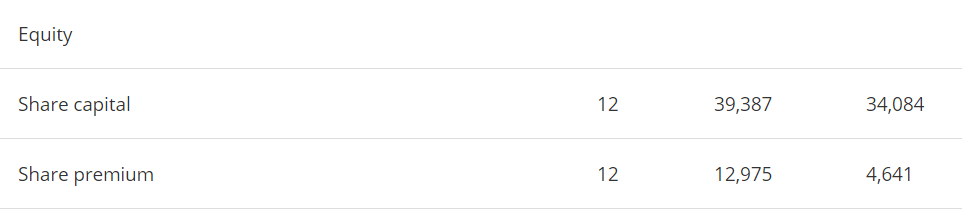

NAV has shot up, from £39.3m a year ago, to £57.2m at 31 Dec 2017. There must have been a fundraising, which can be quickly confirmed by seeing that the share capital and share premium lines on the reserves section of the balance sheet have risen considerably;

Adding the two lines together, total share capital rose from £38.7m at end 2016, to £52.4m at end 2017. This suggests that an equity fundraising of £13.7m occurred in 2017.

Following this through to note 12, it all reconciles, hooray! There was a fundraising of £8.0m in Sep 2017, issuing 12.1m new shares at 66p each. Then another equity issue of £6.0m occurred also in Sep 2017, being part of the consideration paid to the vendors of Greenwoods. Costs were £363k, which arrives at £13.6m, which allowing for rounding, ties in with the £13.7m figure above.

NTAV is less impressive, since as I suspected, the balance sheet is top-heavy with goodwill related to acquisitions, totalling £57.2m. Deduce that from NAV of (coincidentally) £57.2m, and NTAV drops out at a big fat zero! Not very good at all.

Part of the reason is a pension scheme deficit of £11.8m, within long-term liabilities. This has reduced from £14.5m a year ago. Assets are £81.0m, and liabilities are £92.8m. The word "pension" appears 38 times in today's announcement.

I tend to focus on the cashflow impact of pension schemes. In this case, there seems to have been company contributions into the pension scheme(s) of £3.39m in 2017, and £3.0m in 2016. Those are big numbers, relative to profitability. So it would certainly be wise to adjust the valuation of the shares to reflect this burden of cash outflows which would otherwise had been available for dividends. So the lowish PER isn't such a bargain, when you consider that a lot of the cashflow has to go into the pension scheme. That also explains why divis are rather modest, with a forecast yield of about 2.7%.

Opinions on pension deficits differ. We do seem to be, tentatively, moving into an era of interest rates starting to rise, which could be helpful in reducing pension scheme liabilities in future.

Receivables - look too high, at £52.6m, for a business with revenues of £196m. That would need looking into.

Current ratio - not great, at 1.05. This is not necessarily a concern, providing the bank remains happy to continue extending borrowing facilities. I can't see any reason why they wouldn't.

Outlook - key excepts below;

... Group profitability in the year to date is ahead of the same period in 2017...

Macfarlane Group's performance in 2017 reflects the successful implementation of this strategy and we are confident that the Group will demonstrate further progress in 2018.

My opinion - it looks a good group of businesses. However, I'm not particularly happy about its balance sheet. The big pension deficit recovery payments are sucking quite a bit of cash out of the business at the moment. So I would be more comfortable with a single-digit PER, to compensate for this.

Interestingly, Macfarlane, and Norcros (LON:NXR) are examples of companies which seem to be making acquisitions as a way of diluting the pension deficit into a growing group. That looks a good strategy.

This share has been in a decent, gradual up-trend over the last 5 years. If it can keep growing earnings, whilst keeping debt & pension deficits under control, then that trend could continue.

Packaging is a very competitive sector though, so on balance it's probably not for me. I can see why some investors might like this company though. It has a high StockRank too, and a favourable "High Flyer" classification;

Beeks Financial Cloud (LON:BKS)

Share price: 60p (down 7.7% today, at market close)

No. shares: 49.1m

Market cap: £29.5m

Beeks Financial Cloud Group plc (AIM: BKS), a niche cloud computing and connectivity provider for financial markets, is pleased to announce its unaudited results for the six months ended 31 December 2017

I'm having a quick look at this, following some reader requests in the comments section below. This is a new one for me - the company floated on AIM, on 27 Nov 2017.

Here is the AIM Admission Document. I've read through most of it, and have made notes as follows;

- 49m shares listed on AIM at 50p placing price, in Nov 2017 - original market cap £24.5m

- New cash raised in placing 9m new shares - £4.5m gross, £3.76 net of fees - ouch!

- Existing shares sold by employees, including about half by CEO was total of 5m sale shares.

- 30th June financial year end

- Strong revenue growth, but profits going down, reaching losses in 2017 (although exceptional listing costs caused most of the deterioration in profitability)

- CEO is founder (a big plus in my view), and still owns 61.8% of the company post IPO.

- Directors CVs look good - credible people, considering how small the company is.

- Heavy capex - in computer systems (£1.6m capex on computers in 2017) - some financed via finance leases.

- Strapped for cash prior to listing, now resolved - balance sheet OK now.

- Staff costs rising fast.

- Directors pay is very low - which flatters historic figures - total £143k in 2017 (highest paid £59k!) - how refreshing to see modest figures like that, but they will rise rapidly in the future, I imagine, thus absorbing some of the future profit growth.

- Historically didn't capitalise development spend, but I see this has started on a modest scale in today's interims.

- Most revenues overseas, and has a focus on the Far East.

- High level of recurring revenues.

Interim results today don't look great, but perhaps that's to be expected for a small, rapidly growing company?

- H1 revenue up 40% to £2.57m

- H1 operating loss of £44k (2016 H1: loss of -£135k)

- Balance sheet has been fixed by the Nov 2017 placing/IPO, and looks fine. Hopefully growth could be self-funding?

My opinion - I don't know anything about this sector, but can see that there must be a good market for cloud-based, low latency links for financial exchanges. It would be interesting to find out what the competitive situation is? There must be other companies offering the same service?

The market cap of almost £30m looks a bit rich, considering the company is so small, and not yet making meaningful profits. Although at least it's not burning cash.

Overall, I don't have a view on this either way. It could have potential, but I don't know how to assess that. I'd be interested in learning more about the company, and maybe meeting management at some stage. Although with the CEO owning most of the shares, this share would probably be too illiquid for me.

Another worry would be that if the IT fell over catastrophically, then the business could quickly implode. I'm sure their systems are excellent, but everyone thinks that, before they get hacked. It would be good to find out what actual users of the software think of it - that's the crux for this type of business.

That's it for today!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.