Good morning!

I did another big session of writing last night. So yesterday's report was greatly expanded, and now covers results/TUs from: Xaar, James Cropper, Eckoh, SoftCat, Quixant, Cello, CloudBuy, and Van Elle. Please click here to see the full report.

Today I intend reporting on the following results & trading updates:

Sopheon, Tracsis, Science In Sport, Safestyle, The Mission Marketing.

Firstly though, a quick mention of results out from Next (LON:NXT) . As retailing is my sector specialism, I always read Next's figures with great interest, as there's so much information that has wider significance. A couple of things struck me.

As always, its results just reinforced what a fantastic business Next really is. It generates such a high operating profit margin, that most retailers can only dream of. Also, even in a bad year, it throws off huge amounts of cashflow.

Most retailers have a tail of loss-making shops. Next doesn't. 97% of its store turnover is generating at least a 10% profit margin! 74% of its store turnover is generating over 20% profit margin. Truly remarkable figures, this is such a great business.

Selling price inflation - seems to be around 4-5%, driven mainly by the depreciation of sterling. That doesn't seem too bad to me.

Living wage & other cost pressures - look like they're going to be largely absorbed through efficiency & cost-cutting elsewhere. That includes reducing staff incentives - so clawing back by reducing bonuses, etc, presumably.

Guidance on EPS - quite a wide range. The low end is -12.4% drop in EPS this year versus last year. The upper end is a rise of 0.5%. So a fairly gloomy outlook, although isn't it always with Next? They seem to like starting the year with depressing guidance, then usually perform better.

Rents - this is the most interesting bit, a section called "retail space expansion". Next is still opening new stores, and crucially is now being offered excellent deals by landlords. A table is provided showing that rent/sales in existing stores is 6.6% (that is extremely low!). However, on new sites opening in 2017/18, rent/sales drops to only 5%.

The broader point is that any retailers or leisure operators that are currently expanding, are obtaining superb deals for new sites. This counteracts other problems, such as living wage, apprenticeship levy, business rates rises, etc.

The same factor is happening with Revolution Bars (LON:RBG) (in which I hold a long position). When I recently met management, they outlined the amazing deals that are being secured on new sites, e.g. a 6,000 sq.ft. site in central Reading, obtained at a rent of only £90k p.a.! That's a fraction of what I would have expected.

Therefore, any retailer or leisure operator that is expanding at the moment, should be getting fabulous returns on their investment. Next mentions a 2-year payback on its new sites, which is just ridiculously good. RBG obtains an ROI on new sites of 38%, so that's a payback of under 3 years, which is very good indeed.

So I feel that High Street retail/leisure is far from dead. Rents are beginning to adjust downwards. That should, over the long term, improve competitiveness & profitability for those that survive, and especially those that are currently expanding & taking advantage of some terrific deals from landlords desperate to re-let empty shops.

The problem for existing retailers, is that the upward-only rent review system means that they're stuck in expensive shops until the lease expires (usually 15 years at the start). Then when the lease expires, they can either vacate, or renegotiate a much lower rent.

I definitely would not want to invest in any property companies that own retail space, as they're looking at a future filled with pain.

As for Next, I think it looks very interesting at the current level, so am going to buy some now. Pity I wasn't quicker on the uptake this morning, as it's already up about 7% today.

Sopheon (LON:SPE)

Share price: 495p (up 4.2% today)

No. shares: 7.4m (NB. plus 2.614m dilution from convertible loans) = 10.0m

Market cap: £36.6m (increases to £49.5m once loans converted)

Audited results - for the year ended 31 Dec 2016.

This software company is certainly on a roll. It put out a very positive trading update in Jan 2017, indicating that 2016 figures would be significantly ahead of market expectations at the time. This was driven by ;

- large number of licence orders in Q4

- cost efficiencies

- forex gains from the fall in sterling

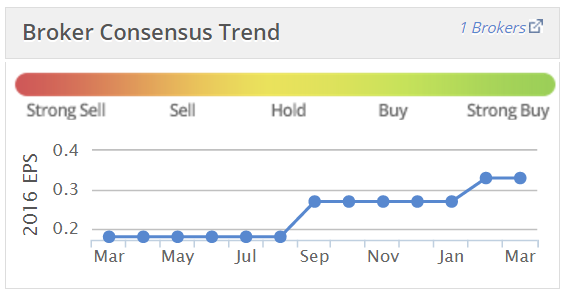

As a result, broker forecasts look to have been raised in Jan 2017 from 27 cents, to 33 cents EPS. You can see from the Stockopedia graphic below that forecast EPS almost doubled over the last 12 months;

Results today are skewed by a $1,275k income tax credit (starting to recognise a deferred tax asset), so the reported basic EPS of 59.05 US cents won't be comparable to the broker forecast, which would have used a normalised tax charge.

Doing some quick sums, if I change the tax credit to a 15% charge, then EPS drops out at 34.8 cents. On a 20% tax charge, EPS is 32.8 cents. So it looks as if today's results are in line with the 33 cents latest broker consensus. An analyst email I got earlier this morning also confirmed that is his view too.

Here are a few numbers;

Revenue up 11% to $23.2m

Profit before tax up 125% to $2.7m

EBITDA figures for software companies are meaningless, since that number ignores both development spending and amortisation, which is clearly nonsense.

Outlook comments are rather scattered, throughout the narrative in today's announcement. The order book is up nearly 21%;

Full year 2017 revenue visibility of $14.5m, compared to $12m the previous year.

Directorspeak - the Chairman sounds upbeat;

"I am delighted to report a truly excellent set of results; the board looks forward to building on these results to deliver continued positive development in the strategic and financial performance of our company in 2017 and beyond… Additional investments in new members of our team are another key piece of our strategy to move our business forward and capture the opportunity that we have long believed was coming.

Sopheon has a market-leading solution, global reach, solid financials, a clear corporate structure, an accelerating market, and most importantly great people - a real platform for growth."

Convertible loans - it looks as if the company was financially distressed in the past, and convertible loans of £2m were issued (funded by the Directors, and an investor called Rivomore).

The trouble is that the conversion price of these loans is 76.5p. That was probably perfectly reasonable at the time, but now the share price has soared to 495p, clearly these are now very lucrative instruments for the holders.

So if £2m of loans are converted into equity (which they certainly will be) at 76.5p, then that means the issue of 2.614m new shares. That would increase the share count from 7.4m at the moment, to just over 10m, which represents very heavy dilution for existing holders - it's an increase in the share count of 35.3%.

So the current market cap is not really £36.6m, it's £49.5m.

Therefore it's vital people are aware of this issue, in order to correctly value the shares.

There's also further dilution from about 300k in the money share options too.

My opinion - one of the reasons I rarely invest in software companies these days, is because licence revenues are such high margin (almost entirely profit), that they can lead to extremely volatile profits. It's fine in the good years, but if licence revenues go into reverse, then it can cause a dramatic, geared hit to profits.

For this reason, you have to be extremely certain that a software company is indeed on a roll, and will be growing its licence revenues. Otherwise, trouble could strike very easily, if a shortfall emerges. Think Brady, or Tribal Group, for examples of this happening in recent years.

Sopheon does have some recurring revenue too. The ratio of revenues has been almost static throughout 2016 & 2015, at 29:37:34 ratio of licences:maintenance:services. However, it's the licences which moves the profit dial the most, as they're pure profit.

So shares like this are not without risk. However, at the moment it does look as if Sopheon is really going places, and let's hope it continues. To what extent is the good news already in the price? The share has gone up from c.87p to 495p in the last year, so the market has already recognised a big improvement in profitability.

Tracsis (LON:TRCS)

Share price: 405p (up 7.3% today)

No. shares: 27.9m

Market cap: £113.0m

(at the time of writing, I hold a long position in this share)

Interim results - for the 6 months ended 31 Jan 2017.

Our Graham wrote a section here on 15 Feb 2017, about an update from Tracsis which warned that some sales would slip from H1 into H2. This was due to changes in the Dept of Transport's franchise bid timetable, so clearly something outside of Tracsis's control, and not their fault either.

That update battered the share price, from about 500p, to a low of about 350p. I've been waiting several years for a decent pullback in the share price, to open a long position, so my chance finally came. Unfortunately, the stock is so illiquid, that my broker was only able to get a partial fill on my order at 350p, then the offer price moved up sharply. This is the trouble with lots of smaller caps at the moment - trying to be clever on your buying or selling price can often mean that you can't actually deal in any significant size when that price does briefly appear.

Key figures from today's half year results P&L statement;

- Revenue up 20% to £15.6m

- Adjusted pre-tax profits up 11% to £3.1m

I haven't got any detailed broker forecasts on this company, but have seen one flash note this morning. This suggests that full year expectations should be moderated by 8%, to £7.4m profit before tax (presumably at the adjusted level). This means the company needs to do £4.3m in H2, which looks achievable, or beatable.

If we take off 20% tax from £7.4m, that is earnings of £5.9m, which gives a PER of 19.2. This figure doesn't allow for the fact that the balance sheet contains net cash of £12.7m.

Outlook - some positives in here, but it also sounds as if the delayed contracts may not yet have been signed. The company would have said so today, if they had been signed;

The Group remains focussed on delivering full year numbers, and as communicated previously, the outcome for the full year remains subject to the timely conversion of new sales for our various software products and services.

Our second half trading is also supported by the improvement in gross margin initiatives that commenced at the start of the financial year, and the natural H2 seasonality that is inherent across the Group's operations.

Management is confident that the focus on process and margin improvement puts the business on a solid footing.

Our core target markets of rail technology and traffic and transport data services remain buoyant with good growth drivers and Tracsis remains well positioned for the future.

My opinion - I've not properly read all the narrative yet, so will do that over the weekend. So far though, my general feeling is that the share price had got a bit ahead of itself, so a correction after a bump in the growth path, is maybe not such a bad thing?

One broker makes an excellent point today, saying;

One soft half does not wipe out ten years of shareholder value generation.

That's my feeling too. Smaller companies will, from time to time, experience unforeseen delays in contracts, etc. That can provide a good entry point into a decent quality share, which is how I see things here.

The downside risk is that the contract delays continue, and H2 might be soft as well?

Upside is that the contracts get signed, H2 is strong, and the lowered forecasts are beaten.

It's not just about this year's numbers anyway. I think we can sometimes get fixated with the current year's numbers. When actually, buying a share is buying part of all the company's profits, in perpetuity. So people who take a patient, multi-year view, tend to make the really big gains (providing they buy the right shares in the first place).

CEO Interview - Tracsis

Anyway, the good news is that we can put questions to Tracsis's CEO, John McArthur.

I will be doing one of my audio interviews with him this coming Monday, 27 March. As usual, the questions come mainly from you, so please add a comment to this article, if you have a question for John which you would like me to ask.

I beg you to keep questions, simple, and clear. It creates nightmares for me, trying to unpick great rambling, incoherent streams of consciousness that people submit to me sometimes for these interviews. So basically, the simpler & clearer the question, the more likely I'll be to ask it!

Science in Sport (LON:SIS) - final results - I've only had a very quick skim of the figures. This is a sports nutrition products company. I like the increased revenues, up nearly 30% to £12.2m for calendar 2016.

Also, I like the decent gross profit margin, of 60.3% - so there's a lot of operational gearing here, if they can really ramp up sales.

It's still loss-making though, generating an underlying £0.8m loss in 2016, worse than the £0.25m underlying loss in 2015. That's not a horrendous loss though, and it sounds like the company is spending on marketing, etc, to drive brand awareness & sales.

I very much dislike the £1.6m charge for share based payments. Should a loss-making company really be dishing out such large rewards to management (presumably)? In a word, no.

Balance sheet is strong, with net cash of £6.1m there, so no solvency worries, and the extent of the loss looks fine, given the cash reserves.

Outlook - it says 2017 has started well.

My opinion - just an initial quick view really - this company looks potentially interesting. Although for me, the £36m market cap (at 83.5p per share) is too much of a leap of faith. I don't like investing in anything where you have to hope that a viable business will emerge after more growth has happened.

The key thing is to look at the company's products, and ascertain if they're any good. What do customers say about the products? Is repeat business building? If those questions return very positive answers, then it might be worth considering this share. There are lots of competitors offering sports nutrition products, so I would want to see some key advantage for this company.

Do any readers have a view on this one?

WYG (LON:WYG) - looks like a profit warning here today - it's down nearly 24% to 97.5p.

It's a project management, technical consultancy type of company, which just don't interest me, so I'm not going to spend any time on this.

I like the clarity of the announcement, quantifying revised profit expectations, all companies which warn on profit should give clear guidance like this;

The Board expects revenue for the year to exceed £150m representing year-on-year growth of c. 13%, in line with market expectations, but has revised its expectation of operating profit (before separately disclosed items and share based payments) to a figure approaching £9m. This nevertheless represents a profit improvement of close to 25% year-on-year.

Net debt at the year end is expected to be around £6m. Separately disclosed items, excluding amortisation of acquired intangible assets and share based payments, are expected to be approximately £2.5m including, as explained below, a charge for the restructuring of our Polish operations.

Net debt doesn't sound like a problem level.

The cause of the problem seems to be contract delays, on higher margin work.

Expectations for the following year are unchanged, and it says the order book is strong.

This sounds a fairly mild profit warning, and might be an opportunity to buy in cheap, if you like this type of company. I've had so many problems with contracting, consulting type companies, that I avoid this sector altogether now. Just too accident prone. Why get involved, when you don't have to?

Safestyle UK (LON:SFE) - this uPVC replacement windows & doors company seems to have had a decent 2016. Revenue up 9.5% to £163.1m, and underlying PBT up 13.9% to £20.5m.

Basic EPS of 19.0p, and final divi of 7.5p.

Balance sheet looks fine to me, with no debt, and £13.5m in cash.

Outlook sounds positive.

At 292p the valuation looks about right to me. However, remember that this type of business is very cyclical, so I'm not sure I'd want to pay more than a PER of maybe 8-10 during fairly buoyant times.

Not the type of thing that interests me really. I'm scarred for life after a terrible experience with another company in this sector, Entu (UK) (LON:ENTU) .

Right, that's all I have time for today. No night shift today I'm afraid, as I'm heading up to London, then off to Luxembourg in the morning, for a long weekend. I've never been there, and thought it would be fun to check it out, and have a change of scene.

Graham's kindly holding he fort here tomorrow, and I'll chip in anything by email if something interesting crops up.

Best wishes, Paul.

(usual disclaimers apply - we're just giving opinions on the day's results & trading updates, not recommending anything. Please always DYOR, as there's bound to be stuff we'll miss, since we cover so many companies in brief).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.