Good morning! It's Paul here.

Please see the header for the announcements that I intend reporting on today.

Do let me know, in the comments, if you spot anything else interesting.

Market comments

US markets were wobbly again last night, so we're probably likely to suffer more pain today in the UK. Such is life - corrections happen from time to time.

It seems to me that this market is now throwing up some bargains. Quite a few of the stocks that I own, or are on my watchlist, have reported good figures & outlook, yet in some cases are now 20-40% cheaper than they were only a few weeks ago. That doesn't make sense to me. Maybe they were over-priced to begin with, but not that much.

The falls in price have generally happened on lowish volumes, in most of my small cap stocks. I find that reassuring. It's a combination of a few nervous small shareholders selling up, and a buyers' strike because of concerns over the US markets falling, Brexit, Corbyn, Italian/Eurozone crisis, China, trade wars, and anything else you can think of!

In one extreme case, a very illiquid micro cap stock I hold, Malvern International (LON:MLVN) , some idiot sold a few thousand pounds-worth of the share, and the resulting fall in share price knocked c.£50k off the value of my shareholding! As you can imagine, I wasn't best pleased, but we have to accept volatility & illiquidity as the price we pay for operating in a very imperfect market. That imperfection is also what creates the upside opportunities. So it means that prices rise fast, when good news comes out. If you operate in the micro cap space, you have to learn to live with volatile prices.

It's important to remember that, with illiquid micro caps, the share price is quite artificial. It can go all over the place, in the short term, on tiny volume. Therefore the chart patterns in small caps mean nothing, and the share price isn't a very good way of valuing the company, in the short term anyway.

Someone reminded me yesterday of a good Buffett quote about wanting to be being greedy when others are fearful, and fearful when others are greedy.

Although as always, we have to be very selective in picking the right stocks. I'm thinking about doing some shopping, as there really are some attractive opportunities out there at the moment. After all, BLASH is a good motto (Buy Low And Sell High).

I suspect that the momentum trade may have ended now - i.e. buying anything that keeps going up, without needing to do any research at all. I can't stand it when that approach works so well, as it has in recent years, because that means the laziest and stupidest people make the most money!

Maybe we're now going back into historically more normal market conditions, where volatility has returned, and you can't rely on momentum only to succeed? Instead, stock picking on fundamentals might now be the more important skill once again. I do hope so.

Debenhams (LON:DEB)

Share price: 10.0p (up 17.4% today, at 11:01)

No. shares: 1,227.8m

Market cap: £122.8m

Preliminary results & strategic update

Retailer Debenhams plc today announces preliminary results for the 52 weeks to 1 September 2018, confirming the EBITDA, pre-exceptional profit before tax and net debt data released on 10 September 2018.

Key points;

- Gross transaction value down 1.8% to £2,900.4, of which 79% is UK, 21% overseas

- Statutory revenue £2,277m. The difference is mainly that GTV above includes sales from concessions (stores within a store, operated by third parties)

- Underlying profit before tax down 65% to £33.2m. That ties in with the estimate of c.£33m published by the company here on 10 Sep 2018.

- Pre-exceptional EBITDA is still good, at £157.3m (down 28% on LY). EBITDA is a good proxy for cash generation at retailers. However, department stores are so large, that they require continuous large maintenance capex. So it's fairly meaningless here, in my view.

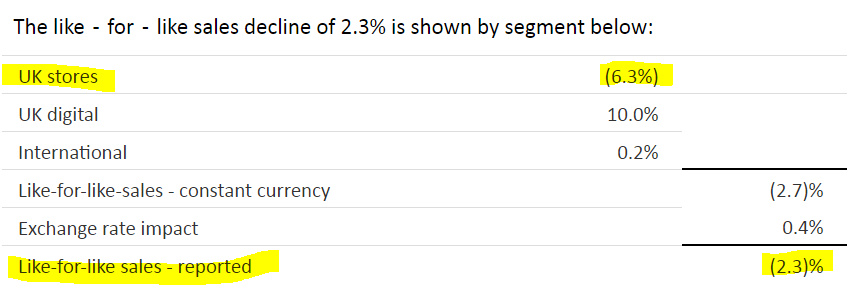

Like for like ("LFL") sales decline of 2.3% sounds quite reasonable at first sight, given how tough retailing is right now. However, further on, the commentary discloses that it's far worse at UK stores;

This is the key point to understand: If LFL store sales keep declining at that rate, then profitability will inevitably collapse, into ultimately heavy losses. This is because most of the costs relating to stores, are fixed costs, or even rising. Rents cannot go down, as DEB is locked into long term leases, unless deals are done with landlords, who are not known for their generosity.

Other big costs, like business rates, and staff wages, are rising. I cannot see how DEB can survive in its current form, if these trends continue, as seems highly likely. The only way out, is to do a CVA, or pre-pack administration, which is what happened with House of Fraser. It seems to me that DEB is just delaying the inevitable, unless it can pull off a miraculous turnaround fairly soon - very unlikely in the current climate.

Store closures - the company already had 10 stores ear-marked for closure. Today it adds another 40 to that list, over 3-5 years. It says that these 40 are not currently loss-making, but are likely to become loss-making if current trends continue.

It's all very well wanting to close stores, but as we know, it's the leases that are the problem. If you're locked into a 15 or 25 year lease, then you can't close a store, unless you can find someone else to assign the lease to, which could mean having to pay a huge dowry (known as a reverse premium). Even then landlords can veto lease assignments, if they don't think the proposed assignee is sufficiently strong financially (known as a weak covenant).

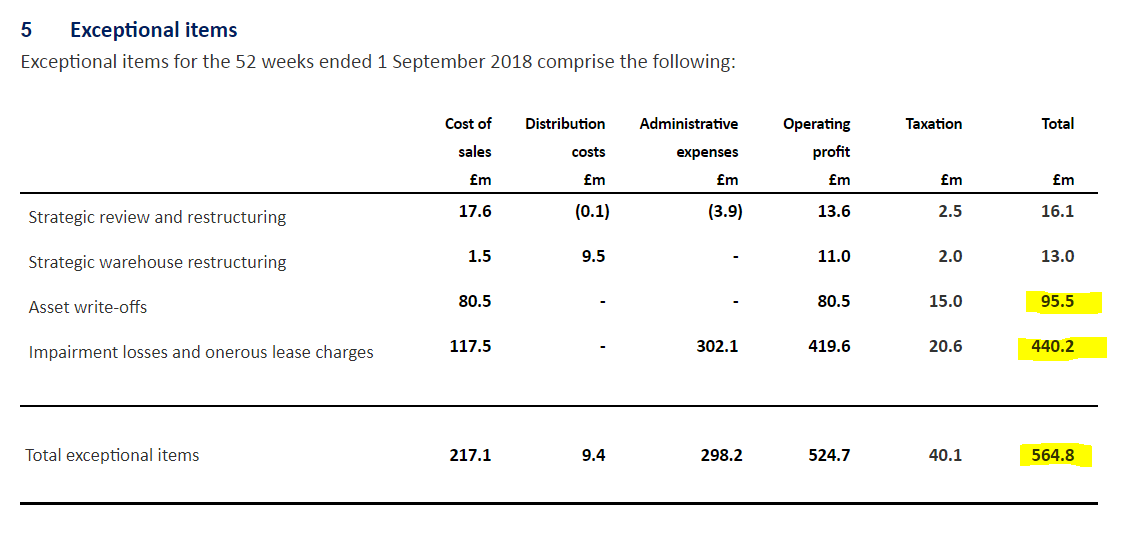

Exceptional items - these are huge, but mainly non-cash balance sheet write-offs;

Dividends - the final divi has been eliminated. Don't expect DEB to ever pay any divis again. As with many companies in financial distress, management were too slow to stop the divis. This should have been done years ago, and it has left the balance sheet in a more precarious position.

Balance sheet - is very weak. Writing off intangibles, and the accounting pension surplus, then NTAV comes out at negative -£289m.

There is an argument for eliminating the £354.4m creditor detailed in note 12, which is an accounting adjustment for previously received lease incentives (i.e. cash and rent-free periods received from landlords as inducements to enter into leases). These are not actual liabilities, but are accounting entries which are gradually fed into the P&L over time. If this creditor is eliminated, then NTAV moves back into positive, at £65.4m.

Working capital is not good, with current assets of £528.1m, but current liabilities much larger at £807.0m. That's a current ratio of 0.65 - very low. Therefore, it is the banks & the trade creditors which are funding the business.

Net debt is much too high, at £321.3m. There's no breakdown given on that, but in the past it included £200m in a July 2021 5.25% bond. Finding out what the covenants (if any) on those bonds are, is very important in considering whether the equity is worth anything or not. Quite often in distressed situations, the bond holders end up calling the tune, and equity is wiped out.

When I last looked at DEB here on 19 Apr 2018, the bonds were trading at 92-94p in the £1. They're now trading at 73.8 bid - 75.7p offer. Therefore bond investors (who are often more astute than equity investors) are losing confidence in being repaid in 2021. Remember that bonds rank ahead of equity. So the bond market is telling us that the shares are probably worth nothing.

Cashflow & debt reduction are mentioned as key aims.

DEB has probably left it too late to do a meaningful equity fundraising, unless that is combined with a CVA.

Capex - has been reduced, with plans for only £70m in FY2019. Is that going to be enough to maintain the quality of the stores? Probably not. Although the commentary mentions that capex is being focused on the best performing stores, which makes sense. We should expect the stores ear-marked for closure to become more & more tatty, as they are starved of capex. Unavoidable, but it will cause damage to the brand.

Trade credit insurance - the company has had problems with this cover being reduced or removed, for suppliers. This is bound to cause difficulties - some suppliers may now demand pro forma (cash on delivery), or might only be prepared to trade at reduced levels, without insurance.

That said, persuasive buyers & finance staff should be able to work around this issue, and switch to alternative suppliers. DEB is so big, that many suppliers may assume it's too big to fail. It could even bring some positive results, in forcing DEB to move stock faster, and carry lower levels of inventories, calling stock from suppliers when needed. It's certainly a big issue, and a test of the calibre of staff DEB has at head office, in terms of whether they can manage this problem well, or not.

My opinion - this looks a precarious situation.

The figures as they currently stand are not too bad - the business still generates decent EBITDA, for example. The problem is the direction of travel. As the commentary admits, stores which are currently still profitable, are heading towards becoming loss-making in future, if current trends continue.

In order to survive, DEB needs to shed a load of stores with no future, and concentrate on its best stores. By far the best way of doing that, would be a pre-pack administration, as HoF did. The trouble is, that usually means finding a new owner with deep pockets (Mike Ashley?) who is able to renegotiate all the leases onto much lower rents, or hand back the ones where no agreement can be reached. There are also heavy losses to be funded whilst that process is underway. It's also difficult to procure supplies after a pre-pack, as suppliers that have just been hit with a huge bad debt might go bust too, or at the very least are reluctant to continue supplying, unless they're paid cash up-front.

If DEB had cash in the bank, then it could restructure solvently, as on a much smaller scale, French Connection (LON:FCCN) (in which I hold a long position) has been doing. Unfortunately though, DEB has debt, and far too much of it. The risk is that bank facilities could be withdrawn or reduced. It's being squeezed from all directions.

The commentary says that £350m of cashflow is set to be released by FY2020, before asset disposals. That sounds preposterous to me, and I would certainly like to see how they're arriving at such a huge number?

This brings me on to the general tone of today's announcement, which strikes me as over-optimistic, even delusional. They're clearly trying to gloss over the seriousness of the company's situation, and that just undermines the overall credibility of the commentary. Sometimes the PR people over-egg the pudding, and cause more harm than good, which is what I'm seeing here. Other people may view it differently, that's what makes a market.

I admire management determination to do their best in trying to turnaround Debenhams, but the odds seem stacked against them. There's no doubt that Debenhams will survive in some form, but shareholders need to understand that there's a very high likelihood that they will be wiped out or severely diluted here, sooner or later. So this share comes with a major wealth warning from me.

Possible upside could come from the mooted disposal of Magasin du Nord, Debenhams' Danish operation, which is profitable. Although that would then tip the remaining group into losses - you can see from today's segmental analysis that international generated all the underlying profit.

Risk/Reward looks terrible to me for this share. Your chances of getting a multibagger on the upside are basically nil. Your chances of getting a 100% loss are high. So why on earth get involved? It's little more than a gambling chip at this point. Short term traders could get lucky though - if a decent asset disposal is agreed for Magasin du Nord, then that would certainly be a short term boost to the share price - maybe a 50% bounce? Is it worth risking 100% loss, to get a 50% gain though? Probably not, in my view.

Increased competition from a revitalised House of Fraser is another issue, once Mike Ashley has renegotiated rents onto a dirt-cheap basis, and refitted HoF stores to make them the "Harrods of the High Street" - although that would take several years to accomplish. It would be worth looking into how many towns/cities in the UK have both a Debenhams and a House of Fraser in competition with each other.

I can't see any good reason to punt on DEB shares at this stage. For gamblers only, I reckon.

SCS (LON:SCS)

Share price: 218p (down 1.4% today)

No. shares: 40.0m

Market cap: £87.2m

Trading update & House of Fraser concessions

ScS Group plc, one of the UK's largest retailers of upholstered furniture and floorings, today provides a trading update for the 12 weeks ended 20 October 2018 and an update in relation to its House of Fraser concessions.

- Core business doing very well, with LFL order intake growth of 4.5% - surprising, but we have to take it at face value, and assume it's correct

- Trading in line with management expectations

- House of Fraser concessions have slumped - LFL orders down a whopping 52.5% - luckily they're a relatively small part of total sales (2.7% in the period being reported today)

- Closing all HoF concessions by end Jan 2019 - sounds sensible, given the appalling recent sales

My opinion - ScS never struck me as a good fit for HoF, as ScS product is really too down-market for a more aspirational outfit like HoF - especially as new owner Mike Ashley plans to take HoF considerably more upmarket.

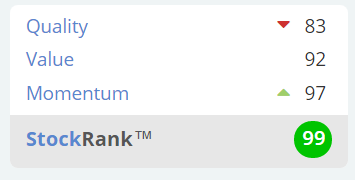

Stockopedia's algorithms like ScS a lot;

It's classified as: Adventurous, Small Cap, Super Stock.

The balance sheet is very good, as is the high dividend yield.

I covered it in more detail a little while ago, here on 2 Oct 2018. I was tempted to buy some, after writing that report & pondering things. In the end I decided not to - despite the attractive figures, rightly or wrongly I just don't want to own shares in a sofa retailer.

The house of Fraser situation isn't a big deal overall, so that doesn't alter my view of this share.

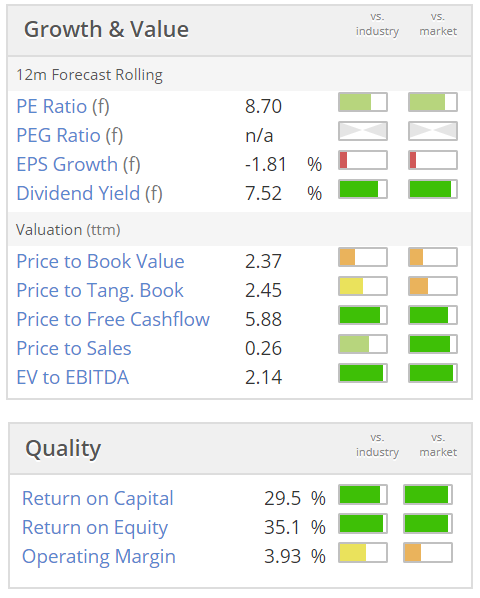

Here's a reminder below of the attractive valuation metrics - perhaps why this share has been impervious to the recent sell-off - which suggests shareholders are solid holders, rather than the irritating fly-by-night characters that are constantly buying & selling other small caps, depending on which way the wind is blowing!

(that's a bit tongue in cheek, before traders start haranguing me for being offensive towards them!! I'm just having a bit of fun. Or ban-ahhhh as they say now)

Due to popular demand, Graham has kindly emailed me the following section for inclusion in today's report. What a star!

Distil (LON:DIS)

Share price: 2.55p (+16%)

No. of shares: 502 million

Market cap: £12.5 million

(Please note that Graham currently holds DIS shares.)

Graham Neary writes - Encouraging news from this developer of spirits brands as H1 revenue is up by 42%, an acceleration compared to previous top-line growth (last year, sales growth was 23%).

We also have an improvement in gross margin to 61%, as revenue growth exceeded volume growth. Gross margin was 56% in H1 last year, or 58% for the full-year.

International distribution continues to improve with new listings in France and Canada.

Marketing spend is a key executive decision and driver of sales growth: it increased by 57% in H1. Despite that increased spending, the company does enjoy the benefits of operational leverage as other administrative expenses increase at a much slower pace (c. 10%).

Add it all together and Distil has generated its first ever H1 profit. H2 (the winter period) tends to be much stronger again.

I’ve been doing some projections and I think that if H2 sales growth can remain high at 40% in H2, at the same high gross margin, and assuming continued 57% growth in marketing expenditure, then Distil could generate operating profit for the current financial year in the region of £400k. This is double the level that is currently forecast by official estimates.

I have also made projections for the next couple of years, and I can see Distil potentially making £500k of operating profit in FY 2020 (from April 2019 to March 2020) before making £650k of operating profit in FY 2021. The official estimates before today’s results were for operating profit of £400k in FY 2020 and £600k in FY 2021, respectively.

Using my own projections, the price/EBIT multiple relative to FY 2020 comes out 25x, falling to 20x in FY 2021.

I think my assumptions to arrive at these projections are conservative:

FY 2020: 55% growth in marketing spend, 35% sales growth, and reduction in gross margin to 60%.

FY 2021: 35% growth in marketing spend, 30% sales growth, and reduction in gross margin to 58%.

If these assumptions turn out to be too pessimistic, then the shares could start to look tasty on an earnings multiple basis by FY 2021. For example, if marketing spend increased in FY 2020 by only 50%, and achieved 35% growth in sales, then my operating profit estimates would increase to £550k (FY 2020) and £700k (FY 2021).

Balance sheet: the company has £1 million in cash and is careful with how it spends its money.

Outlook: Christmas will be competitive, but the company has its promotional plans in place along with new PR/social media campaigns.

Graham's view: Happy to continue holding this one.

Paul's view: I defer to Graham having done much more work on this share than I have.

My impression is that this company has been around for donkey's years, and repeatedly failed to gain traction with its products. The share used to be called Blavod Black Vodka, see the long term chart below. Maybe it's finally getting somewhere, but how can we be sure that growth continues? Drinks come in & out of fashion too, so any growth now could conk out later?

Also, it's too illiquid for me to consider for my portfolio. The danger is that, if you do accumulate a decent sized position, you may not be able to sell, especially in nervous markets that we have at the moment.

I hope it works out well for Graham & other holders, but it's not for me. The valuation doesn't look cheap either. Although there could be upside, if its products really take off & smash forecasts, and someone comes along and offers a premium takeover price.

OK, I'm taking a break now for lunch.

I'm trying out the new food menu at £RBG (one of my largest holdings) at the moment. I went there last night too, and had 3 "grazers" which were quite good, and a "MotherClucker" burger (with chicken, hence the name - I had to be careful typing that lol!). Initial impressions are that it's an improvement on the old menu, but still far too deep-fried orientated, and not a very good fit with a bar that's supposed to be all about premium. Pricing isn't competitive enough either.

Today I shall be sampling RBG's £6.25 lunch deal. There's a danger I might succumb to the temptation to have a pint or two, and pass out on the sofa when I get home. If so, I'll finish off this report tonight.

Update: the prawn caesar salad + diet coke was good value for £6.25, although a bit too much lettuce. I've succumbed to temptation, and had a pint of Magners as well! Brought my laptop with me, so am finishing off today's report from Revolution Bar in Bournemouth! Maybe I could organise a Bournemouth shares social at some point? Anyone interested, let me know. If there's enough demand, II'll organise it.

Begbies Traynor (LON:BEG)

The useful red flags report is out today for Q3, from the UK's only listed insolvency practitioner.

There's nothing much of interest in it.

Filtronic (LON:FTC)

Share price: 16.9p (down 20.5% today, at 15:07)

No. shares: 207.0m

Market cap: £35.0m

Trading update (AGM) - this is for the year ending 31 May 2019.

Filtronic plc (AIM: FTC), the designer and manufacturer of antennas, filters and mmWave products for the wireless telecoms and critical communications markets, is pleased to provide the following update ahead of its Annual General Meeting to be held later today.

Trading is in line with expectations, so far this year. So why is the share price down 20% today? I think it's probably due to the uncertain outlook;

Whilst we continue to enjoy good baseload volumes from our long term defence contracts, the uncertainties regarding the timing of the market take-up for mMIMO and the rate of tail-off of our legacy filter sales make near term forecasting very difficult. However, we are confident that our position overall continues to strengthen and our outlook remains positive.

My opinion - erratic performance has always been this company's Achilles Heel. I don't think it is at all suited to a stock market listing. Although the ability to raise fresh capital did stop it going bust a few years ago.

There are no divis, and performance is highly erratic, depending on which products are hitting a sweet spot, or in decline. That makes it uninvestable for me.

Alumasc (LON:ALU)

Share price: 128.5p (unchanged today, at 15:30)

No. shares: 36.1m

Market cap: £46.4m

Trading update (AGM)

Alumasc (ALU.L), the premium building products, systems and solutions group...

The current year ends on 30 June 2019.

Some detail is given, but the conclusion is;

... In view of the above, management's expectations for the full year performance remain unchanged.

My opinion - the PER is very low, and there's an excellent dividend yield too.

However, there's a big pension scheme deficit. If equity markets continue falling, then companies with pension deficits could once again become a no-go area, so some caution is needed.

Eckoh (LON:ECK)

Share price: 38.5p (down 1.3% today, at 15:55)

No. shares: 252.7m

Market cap: £97.3m

Eckoh (AIM: ECK), the global provider of secure payment products and customer contact solutions, today issues a trading update for the six months ended 30 September 2018.

- Trading is in line with market expectations in H1

- USA secure payments - "excellent momentum"

- UK also going well

- Net cash of £3.4m

My opinion - this company has been around a long time on the stock market, and I question whether the revenue and limited profit growth justifies such a high rating? Particularly given that we're having a sharp correction at the moment, with growth companies taking a battering.

The upside case seems to rest on some impressive contract wins with big customers. If those can be replicated more widely, then I can see why investors would be prepared to pay an apparently high price now - the company could grow into the valuation maybe?

Good, I think that's everything for today! See you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.