Good morning! It's Paul here.

This is initially just a placeholder article (created the night before), so readers can post your comments on the day's results & trading updates from 7 am. I will then update the article in the usual way, once I've digested some interesting news.

Good morning properly! It's a quiet day for small cap trading updates & results, but I will be reporting on 4 companies (as shown in the article header). This has to be early, due to other commitments today.

Connect (LON:CNCT)

Share price: 95.5p (up 5.2% today)

No. shares: 247.7m

Market cap: £236.6m

(at the time of writing, I hold a long position in this share)

Preliminary results - for the year ended 31 Aug 2017.

This group is;

a UK leading specialist distributor

By far the largest (in both revenues and profits) part of the business is Smiths News;

Smiths News is the UK's largest newspaper and magazine wholesaling business with an approximate 55 per cent. market share. It distributes newspapers and magazines on behalf of the major national and regional publishers, delivering to approximately 27,000 customers across England and Wales on a daily basis. The speed of turnaround and density of Smiths News' coverage is critical to one of the world's fastest physical supply chains.

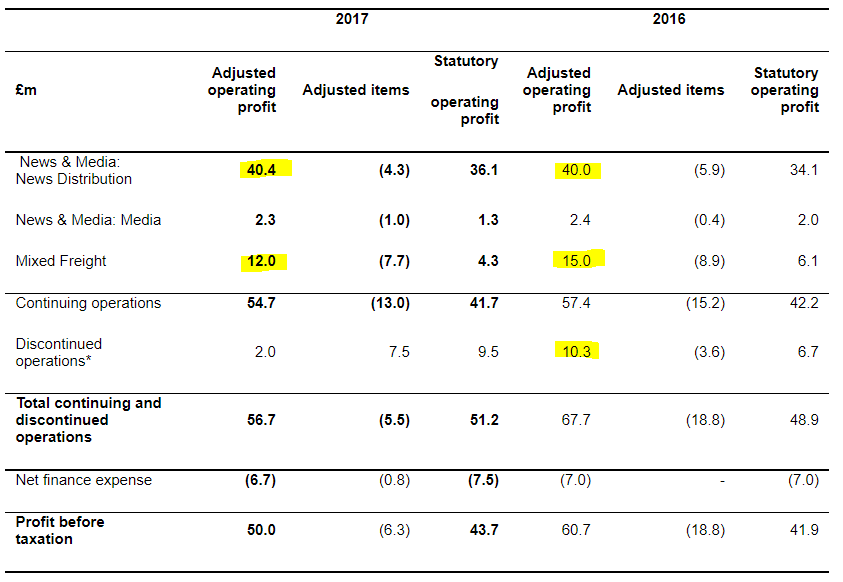

This raises the obvious question whether this is a dying business? As we know, newspaper circulation is relentlessly falling, due to the popularity of smartphones, and online generally. Well, that doesn't seem to be the case just yet. The Smiths segment reports profits that are flat on last year (well, up 1%, on an adjusted basis). It's shown as the first item in the table below "News & Media - News Distribution";

"Mixed Freight" is the other significant division, which is parcel delivery firm Tuffnells. Note that £15m cost savings are planned in the next 2 years, through integrating Smiths News and Tuffnells. So that should hopefully see profits cope with further likely falls in newspaper & magazine circulation. Price rises are offsetting some of the circulation falls.

The other thing to consider, is that if you have a sophisticated & fast network for delivering to newsagents & other shops, then you can distribute other things to them at the same time. So I suppose the challenge for this group is to generate sufficient new business to offset declines in the old.

Pass My Parcel - this is an interesting part of the group. It's one of several competing parcel services, which collect/deliver from 3,500 local shops in the UK. A great idea, but it's loss-making. So today's results include increased losses of £6.3m (PY: £4.0m). Mounting losses here do concern me, but I imagine it would be fairly simple to close down, if it fails to become viable. So there's an argument for ignoring the losses here, and increasing earnings accordingly. I'd like to see some forecasts, as to when this business is expected to reach critical mass and become profitable.

Doing a CTRL+F search for "Pass My Parcel" within the RNS, I've just found this comment, which reassures somewhat;

We aim for volumes to increase significantly in the current financial year and losses to reduce as a result.

There's strong growth in Pass My Parcel volumes, which is encouraging. The key differentiator from other delivery services seems to be rapid overnight delivery, hence enabling early morning next-day collection. So this looks quite interesting actually, and seems a nice way to leverage a delivery fleet which is already visiting those locations to drop off newspapers & magazines.

Adjusted profit of £48.0m is down by £2.4m on the previous year. So it would have been flat, if the increased losses at Pass My Parcel are stripped out. So it seems to me that the core business looks surprisingly robust.

Balance sheet & Disposals - my main concern with this company in the past has been its weak balance sheet (negative NTAV), over-burdened with debt, and a pension deficit.

However, on reading today's results, I'm pleasantly surprised. Net debt of £82.1m is a considerable reduction from £141.7m a year ago), and at 1.2x EBITDA it now looks much more reasonable. The main reduction in debt has been achieved by the sale of its Education & Care business for net proceeds of £58.2m.

The group's books division is also up for sale. This is expected to raise £15m, so that should further help reduce net debt.

A going concern note further reassures on bank debt - in particular with regard to covenants, and long expiry of the borrowing facility;

The Group meets its day-to-day working capital requirements through its new bank facilities of £175m, agreed in October 2017, with a term to January 2021.

The Group's forecasts, taking into account the Board's future expectations of the Group's performance, indicate that there is sufficient headroom within these bank facilities and the Group will continue to operate well within the covenants attaching to those facilities.

That looks fine to me. So I no longer have concerns about the net debt position.

NTAV is still negative at -£81.4m though, which is outside of my comfort zone. However, given that the bank facilities look secure, I'm (just about) prepared to make an exception in this case.

Pension deficit - on the balance sheet it's only small, but costs the company £5.2m p.a. in recovery payments & costs. However, this is small relative to the £24.0m paid in dividends to shareholders - giving a monster yield, which I'll cover below.

Dividends - this is the main reason that I've dipped my toe in the water with an initial small purchase of this share. Arguably I must be brave, stupid, or a bit of both to buy a share with a chart like this!

Looks terrible, doesn't it!

This chart suggests fairly obviously that there is relentless selling going on. I closely monitored the price movements this morning, and it seems to me that there's a risk of the share price falling some more. The initial flurry of buying seemed to conk out fairly quickly, and the price tried to break through 100p, but has since fallen back to 94p, on total reported volume of about 727k shares at the time of writing (10:00am).

However, for me, fundamentals trump the chart, and I don't really care if it carries on falling - I'll just buy more.

For me, the clincher is that the monster dividend yield of 10.4% actually looks sustainable. That's very unusual. Usually a dividend yield of that size, is a precursor to a profit warning and a dividend cut. Not in this case (for now anyway). Management has actually increased the divis too, up 3.2% to 9.8p. Again, this is very unusual - extremely high yielding shares don't usually increase the divis, as it's usually already too onerous a financial burden. In this case, the cashflow looks perfectly adequate to maintain this level of payout, in my opinion.

Therefore, I think the huge dividend yield could be the catalyst to trigger a positive re-rating of the share.

The proposed final divi of 6.7p is set to be paid on 9 Feb 2018, to shareholders on the register on 12 Jan 2018, subject to shareholder approval at the AGM on 23 Jan 2018. Something nice to look forward to.

Valuation - adjusted EPS is reported at 15.5p (down 4.3%), giving a PER of 6.2. I can understand why the PER is low - due to the risk of earnings falling from reduced print circulation in future. However, given that the balance sheet is no longer burdened by excessive debt, then this PER seems excessively mean to me.

Outlook - management sound pretty confident;

Despite a challenging year in FY17, significant underlying progress was made in refocusing our strategy and operating structure to support future growth. We are now moving at pace, and as we integrate the Group's core businesses we are confident of delivering the key targets that will underpin our future success. We expect a return to growth in FY18.

The Group expects to deliver solid financial returns throughout the period of transformation, maintaining strong cash flows that will allow for both investment and continued strong returns to shareholders.

My opinion - another point to consider is that the market is still going crazy for growth shares (which Connect isn't). This causes people to chase more sexy shares up in price, and dump their boring value shares. I remember that clearly in 1998-99, during the TMT boom. Many perfectly decent companies fell to extraordinarily cheap ratings (PERs as low as 4-6, for quite good companies, e.g. retailers & housebuilders especially). They turned out to be good entry points, as everything reversed in 2000-2002 - with many former sexy shares joining the minus 90% club, then eventually with many, the minus 99% club. Whilst a lot of value shares re-rated back up again.

To a certain extent, I think we're seeing a similar sector rotation effect now. Therefore I feel myself just starting to rotate a little bit back into value shares - but only where the price is right. A PER of just over 6, and a dividend yield of over 10% here at Connect, is good enough for me to start buying. It may get cheaper of course, who knows? People following a Minervini-style approach might wait for the share price to bottom out, and start making new highs. That might take some time, who knows? But they'll miss out on the divis of course, in the meantime.

If you tot up the dividends which the company has paid in recent years, then the total shareholder return hasn't been too bad, if you bought in 2009 or 2011. I wish we had a button to press, that would add dividends paid to the share price, and thereby give a total shareholder return. That would be quite useful.

Overall then, I like it for the massive & (I think) sustainable dividend yield. That said, I am worried about potential declines in the core business. Also, sentiment seems so bombed out that, I've only dipped my toe in the water to begin with. I'll hold back on buying any more until it's clear that the share price downtrend has ended.

What do readers think? Is this a "Value trap", as suggested by the Stockopedia computers?

I like to not only look at the StockRank, but to think about what could change it. In this case, value is high, quality is medium, and momentum is low. So if the company gets a bit of earnings & price momentum behind it, then the StockRank could actually start to look a bit more attractive;

Collagen Solutions (LON:COS)

Share price: 3.9p (down 8.2% today)

No. shares: 324.3m

Market cap: £12.6m

Trading update - covering the 6 months to 30 Sep 2017.

Collagen Solutions plc (AIM: COS), the developer and manufacturer of medical grade collagen-based biomaterials for use in research, diagnostics, medical devices, and regenerative medicine

I'm not really sure why I'm writing this, as this share is not my sort of thing at all. I was distinctly unimpressed when last looking at it, in Jan & Dec 2016. The shares are down by about a third since then.

Today, it makes the usual excuses for why revenues have not risen in H1;

Revenue and other income is expected to be 1.86m, (H1 2016: 1.89m). Whilst the quality and scale of our sales pipeline are both at their highest levels to date, our first half revenues have been impacted by revenue recognition issues (150k) and anticipated orders which, for various reasons, have either not materialised or have been delayed by our customers' own internal issues (2016 equivalent 341k).

Those revenues affected by revenue recognition will flow through positively during the second-half of the financial year. As already highlighted in our August AGM statement, revenue growth this year is expected to occur in the second-half of the financial year and the Directors believe that the strength and quality of our sales pipeline continues to have the potential to deliver in line with these expectations.

I don't like the sound of that. There's no revenue growth at all in H1. Yet the forecasts shown on Stockopedia indicate full year revenue growth of 36% to £5.36m. That means H2 revenues will need to hit £3.5m, almost double H1 revenues. Is that achievable? I have no idea, but it sounds ambitious.

Even if the company does hit full year forecasts, it's still anticipated to generate a thumping great loss for the year. So what's the point of it all?

Cash - what is interesting, is that looking back at the last accounts, the company had £9.0m in cash sitting on its balance sheet. This was mostly raised in a Placing at 5p, but also it has some bonds + warrants from a venture capital outfit. So it would be worth checking out the terms of these.

My opinion - I like the big cash backing, which to a certain extent de-risks things. Presumably the financial backers see something interesting with this company, so it might be worth a bit more research, if you like small, loss-making companies. If they're decently cash-backed, then punting on them is probably less risky, as there shouldn't be any immediate dilution.

It's not my sort of thing at all.

Caretech Holdings (LON:CTH)

Share price: 428.6p (up 2.5% today)

No. shares: 75.5m

Market cap: £323.6m

Trading update - for the year ended 30 Sep 2017.

This is a provider of social care services.

The Board confirms that trading during the period was in line with market expectations.

Occupancy levels in mature sites look good, although the figures below suggest that newer sites are operating at lower occupancy levels;

Occupancy levels in the mature estate remain strong at 93% (2016: 93%) and the blended occupancy remains approximately 86%.

Fee increases - with this type of business, the absolutely crucial necessity is being able to increase fees, as costs rise;

Annual fee rate negotiations with local authorities have again led to a positive outcome this year.

The key to improving fee rates remains our work on reconfiguring services that we own and repositioning them for the needs of more complex service users in line with commissioner demand.

For me, this is the deal-breaker. I remember how Southern Cross Healthcase went bust, because it couldn't persuade Local Authorities to pay higher fees. So I wouldn't invest in anything that has large fixed costs, but needs to get fee increases from LAs.

There's plenty more detail in the RNS, if you're interested.

Alumasc (LON:ALU)

Share price: 166p (down 3.5% today)

No. shares: 36.1m

Market cap: £59.9m

AGM statement (trading update) - the key sentence is this;

...the group's financial performance is expected to have a greater weighting towards the second half than was the case last year.

and this...

Whilst we are mindful of the risks of ongoing economic uncertainty, we are confident that our strategy will enable the group to continue to outperform its underlying markets and the Board's expectations for full year results remain unchanged.

Normally I would be unhappy with this. However, the RNS contains considerably more detail, explaining why specific projects are going to be in the H2 figures. That gives some comfort that they're not just hoping to hit stronger H2 numbers, but that there's supporting evidence for this optimism.

Pension deficit - care is needed in valuing this company, as the pension fund recovery payments are substantial, relative to earnings. Graham covered this issue in his report here on 31 Jan 2017. He likens pension deficits to bond repayments, which is an excellent way of looking at things - i.e. treat a pension deficit as if it were debt repayment. Thus we would need to factor in this notional debt repayment within our Enterprise Value calculations.

Or, in short, we need to value this company on a much lower PER than if it didn't have a pension deficit. Although it also depends on how you imagine pension deficits might change. So that PER of 7.8 should probably be adjusted up to something like 10-11, to reflect the pension fund deficit.

There's quite a good dividend yield of 4.6%, I see. Although it;s worth noting that more cash is being paid into the pension scheme, than is being paid out in divis.

If you ignore the pension deficit, then the rest of the balance sheet looks fine to me, so I don't have any concerns over solvency.

My opinion - I don't have a strong view either way. It looks okay, and probably priced about right, once you adjust for the pension deficit. The share price seems to have oscillated between about 80p and 200p over the last 20 years. Surely our money would be better invested in something with a bit more upside than that?! Although adding in the divis would improve the overall return. I just can't get excited about this company.

I have to leave it there for now, due to travelling this afternoon.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.