Good morning, it's Paul here!

We're up-to-date! Yes, Tuesday's report now includes a rather sceptical commentary on Connect (LON:CNCT) (in which I hold a long position, but am pondering whether to sell or not) here.

Wednesday's report was updated last night, to include six companies in total, so the link for that is here.

Leon Boros - half marathon

ISA millionaire, and all round decent chap, Leon Boros is running a half marathon on May 20th. Leon is always generous with his time, helping to educate and enrich other people through talks at investor shows, etc. His investment track record, based on a clear focus on high quality companies, is extraordinarily good. Stunning actually. So he's very much a person to follow.

Here's a link to Leon's eBook and articles about his highly successful strategy. If you're looking for a proven strategy to adopt, then I think Leon's approach is second to none.

The fundraising cause is for ShareSoc, which as many of you know, is a not-for-profit organisation which campaigns for private investors on numerous topics. The Directors & other supporters are unpaid, and put in a tremendous amount of work on our behalf.

I feel that we should do more to support ShareSoc, and hence it's a good thing to become a paid member. Also, if you can spare a bob or two to sponsor Leon run for ShareSoc, then I know he would appreciate it very much indeed. Here's Leon's sponsorship page.

Trinity Mirror (LON:TNI)

Share price: 84.7p (down 2% today, at 12:43)

No. shares: 299.3m

Market cap: £253.5m

This newspaper group updates us today;

Trinity Mirror plc is issuing a trading update for the 4 month period from 1 January 2018 to 29 April 2018 ('the period'), ahead of its 2018 Annual General Meeting later today.

A reader left a very interesting comment here yesterday, suggesting that newspapers might see a resurgence because people are becoming disillusioned with all the lies on social media. That's a nice idea, although newspapers don't exactly have the best of reputations for accurate reporting! It's more about reflecting the prejudices of the readership, sadly. Although that's less the case with local papers.

Also, Facebook seems to be doing a great job of trashing its own reputation, because it happily collects in the advertising revenues, but seemingly does not adequately vet the advertisers, let alone all the nonsense that people post on their timelines. So could we have reached peak social media? I find that quite a compelling argument, and am considering whether or not to place a short on Facebook shares.

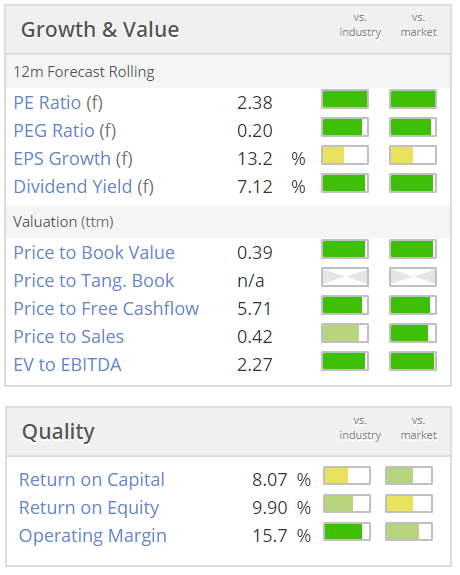

Trinity Mirror could possibly surprise everyone, and see its advertising revenues go up, maybe? On a PER of just 2.4, and with a dividend yield of about 7%, I am wondering whether this share might do what it did back in 2009 - it bottomed out at 25p, then rose to about 173p within 6 months. Sentiment has radically changed towards this share in the past - could it happen again, I wonder.

A well-crafted statement today starts with the key information;

The Board anticipates performance for the year to be in line with market expectations*.

Ooh, there's an asterisk! Hopefully this will tell us what market expectations are - because post MiFID II many private investors no longer have access to broker notes (well done regulators, great work, muppets!)

* The market consensus range for adjusted PBT for the 52 weeks ended 30 December 2018 is £131.7 million to £133.9 million.

This range only includes estimates from analysts that have updated forecasts since our annual results announcement on 5 March 2018. Adjusted PBT excludes operating adjusted items (costs in relation to restructuring charges in respect of cost reduction measures, pension administrative expenses, amortisation of intangible assets and transaction costs in relation to the acquisition of Express and Star) and the pension finance charge.

Fantastic stuff, well done to TNI & its advisers. This is exactly how all companies should report.

Other points in today's update;

Acquisition of Express & Star (a Midlands-based local newspaper group) has been referred to competition watchdog & Ofcom. Board confident that there are no competition issues.

Like-for-like group revenues down 9%

Revenue trends are still grim, so any hope of stabilisation looks way too optimistic;

Publishing revenue for the period fell by 9% on a like for like** basis, with print declining by 11% and digital growing by 2%.

Publishing print advertising revenue fell by 17% and circulation revenue fell by 7%. Improved national advertising performance over Easter resulted in print advertising revenue falling by a reduced 15% in March and April.

We continue to grow digital display and transactional revenue which grew by 7% during the period. Digital classified advertising, which is predominantly upsold from print, fell by 16% during the period.

Net debt - for a business in (arguably terminal) decline, it's astonishing how cash generative TNI still is;

The Group continues to generate strong cash flows with net debt at the end of April estimated to be £85 million. This is after payments of £88 million in relation to the acquisition of Express and Star and increased pension contributions but before the payment of the 2017 final dividend of £10 million.

My opinion - unfortunately, I can't see any signs of the business stabilising, so am reluctant to punt on a recovery in share price. If these declines in revenue continue, then it's only a matter of time before profitability collapses - costs can only be cut so far.

The elephant in the room is the gigantic pension funds. Although the prodigious cashflows generated by the business have, so far enabled it to reduce debt, pay decent divis, and service the pension scheme. The deficit could reduce once interest rates begin rising.

I'll keep a watching brief, but at the moment, I can't see any reason to invest here.

On paper this share looks stunningly cheap - high quality scores, and a dividend yield over 3 times the forward PER! I can't recall ever seeing such a situation where the yield is that much higher than the PER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.