Good morning, it's Paul here.

Firstly, my apologies for yesterday's (lack of) report. I've set aside all day today, with no meetings, to cover both yesterday & today's RNSs of interest. I'll do today's report first, then circle back to yesterday's report this afternoon.

The header shows the 5 company announcements that I'll be tackling first today.

Empresaria (LON:EMR)

Share price: 82p (unchanged, before market open)

No. shares: 49.0m

Market cap: £40.2m

Empresaria, the international specialist staffing group, will hold its Annual General Meeting today at 1.00pm ...

The most important bit is a brief trading update;

"The Group remains on course to meet market expectations for the full year. A trading update will be published on 25 July 2018 and interim results for the six months ending 30 June 2018 will be published on 22 August 2018."

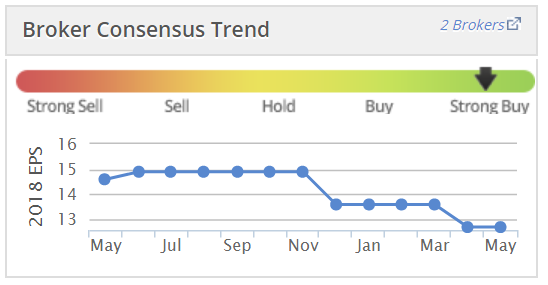

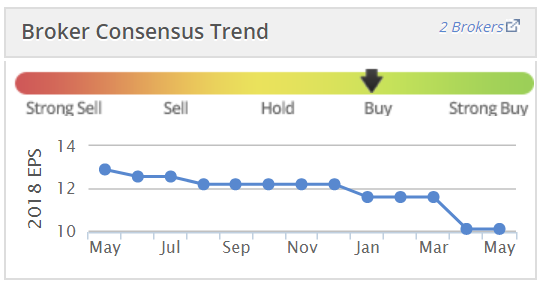

The first thing I check is the graph on each company's StockReport, which shows the movements in consensus broker forecast EPS. In this case, as you can see below, broker expectations for earnings have fallen a fair bit recently;

This might possibly be related to forex movements. Empresaria has considerable overseas earnings. The relative strength of sterling against the dollar in the last year, means that the forex translation of some overseas earnings into sterling is now adverse on a year-on-year comparison. Whereas earnings at this group had previously benefited from weak sterling in 2016, and the first half of 2017.

Having said that, checking the figures, sterling has been relatively flat against the Euro in the last year. So currency movements are more an issue for sterling-dollar.

Change of CEO - Joost Kreulen is standing down as CEO today (not seeking re-election at the AGM), but will continue as a part-time consultant. This suggests no animosity, which is reassuring for investors (if it's true).

Spencer Wreford (currently COO, and formerly CFO) is taking over as CEO.

My opinion - I met these two Directors a year or two ago, and it struck me then that Wreford seemed to be a CEO-in-waiting. Kreulen didn't look in the best of health, so having a reduced role in the business, with less travel seems a sensible move.

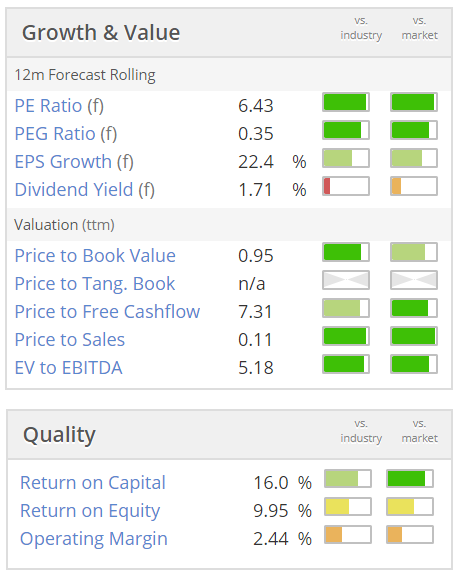

As you can see from the StockReport section below, Empresaria looks good value on a PER basis;

The issue for me, is the balance sheet, and debt position. It's very difficult to decide how to treat invoice discount financing. You could argue that it doesn't matter, as it's related to receivables. The interest cost is absorbed within earnings, so maybe we can just ignore it?

The problem with that approach, is that you would make no distinction in valuation between companies with lots of invoice discounting debt, and those with none. Clearly that doesn't make sense.

Mr Wreford did email me quite recently, asking if I wanted to discuss how the debt is accounted for, but (as usual) I was overwhelmed with work, and didn't get round to responding. At some point though, I would like to get my head around the balance sheet of this company a bit better.

Balance sheet - overall this fails my basic tests.

NTAV is negative, at -£5.2m - whilst not disastrous by any means, I do like to see positive NTAV before investing in anything.

Current ratio - not great, at 0.97, which is below my usual cut-off of 1.3. Although it should be noted that nearly all the bank borrowings are shown within current liabilities (as opposed to being in long-term liabilities), so that suppresses the current ratio.

Conclusion - this is a tricky one. This seems a well-managed group, which has performed well in recent years. However, it has a balance sheet which is a little too weak for comfort, in my view. This means that the apparently low PER is not really such good value, once you adjust the figures for fixing the balance sheet with a hypothetical equity raise.

The alternative, is something like Gattaca (LON:GATC) which is now on a similar market cap to Empresaria (LON:EMR) . Gattaca has a much better balance sheet (on the two measures above), but seems to be a serial disappointer, and badly run.

The question then is, do I want a fairly decent business with a rather weak balance sheet (EMR), or a poor business with a stronger balance sheet (GATC)? I'm not really feeling that either is particularly compelling right now.

Pendragon (LON:PDG)

Share price: 28.9p (down 3% today, at 08:52)

No. shares: 1,417.5m

Market cap: £409.7m

(at the time of writing, I hold a long position in this share)

This Interim Management Statement for Pendragon PLC, the leading online automotive retailer in the UK, covers the period from 1 January 2018 to 1 May 2018. Unless otherwise stated, figures quoted in this statement are for the three months ended 31 March 2018.

I'm struggling to understand some of this announcement, with some oddly worded sections, e.g.;

During the month of March, where we were unable to retain sufficient used stock to meet demand and sales suffered as a result. We are increasing used inventory levels in quarter two with a view to capturing an increased volume of activity at an improved margin, as this stock will increase our proportion of newly acquired used stock.

When I can't understand or struggle to interpret specific details, I tend to look for the overall conclusions. In this case, it sounds like the business is performing in line with expectations;

"Our profitability in the first quarter of the year is in line with our expectations against a backdrop of an exceptionally strong comparative in the prior year...

The strong performance last year was caused by changes in vehicle tax;

In the first quarter of 2017, the industry experienced the effect of the vehicle licence tax changes which brought forward vehicle revenue into quarter one of 2017.

The financial difference in Q1 2018 versus Q1 2017 is quite marked;

Underlying profit before tax fell to £15.0m from £32.4m in the prior year.

Clearly the group has a lot of catching up to do for the rest of 2018. Although Q2 2018 should see the benefit of the prior year vehicle tax changes reversing.

Outlook - this is quite interesting, and has read-across for other car dealers;

The Group has a clear focus and direction to transform the business and double used vehicle revenue by 2021, enabled by our market leading software and investment in used car and aftersales stores in the UK.

The expected market conditions in quarter one impacted profitability. We anticipate our performance in 2018 to be in line with expectations given our assessment of a stronger second half versus a weak 2017 comparative.

I don't normally like H2-weighted trading updates. However, in this sector demand is relatively easy to predict. It's not as if they are dependent on a couple of big contract wins (as is often the case with software companies, or project-based businesses). This is a retail operation - of cars, and of course the lucrative after-sales work too.

Therefore, I think we can probably rely to some extent on the more optimistic H2 outlook. This also ties in with my macro view, of rising real incomes (wage rises recently crossed over, to overtake the inflation rate - which is now falling). Hence I've been positioning myself into good quality consumer-facing stocks this year, anticipating something of a recovery in consumer spending later this year.

Overall then, I think this might be a good time to reassess car dealer shares, with possibly some recovery potential later this year. Share prices seem to be recovering a bit at Pendragon (LON:PDG) and Vertu Motors (LON:VTU) . I like Vertu (but don't currently hold any) due to its very good asset backing. Cambria Automobiles (LON:CAMB) also has a decently strong balance sheet, full of freehold property, as with Vertu. So these shares in particular are really a hybrid of a car dealer, and a property company.

Another interesting angle, is that the Government has caused considerable confusion over the status of diesel cars. So some of the recent softness in demand for diesel cars might well be buyers deferring purchases until there is more clarity. That has the potential to trigger a bounce-back in demand at some point.

Overall then, quite an interesting sector, offering good value, and tangible asset backing in many cases. I only have a smallish long position in Pendragon, and have no plans to buy any more for the time being. I like its 5% dividend yield. Also, it has an interesting & decently profitable software business, which might at some point be spun off on a higher rating than the rest of the business - so potential upside there.

The downside with this sector is that it could just be dead money - with shares oscillating in a sideways direction, which has an opportunity cost. Investor sentiment seems firmly negative on the sector generally, hence low PERs, despite asset backing.

As you can see, PDG has not been a good investment over the last 2 years. In the roaring bull market of 2016-17, much better gains were available on more growth-orientated companies;

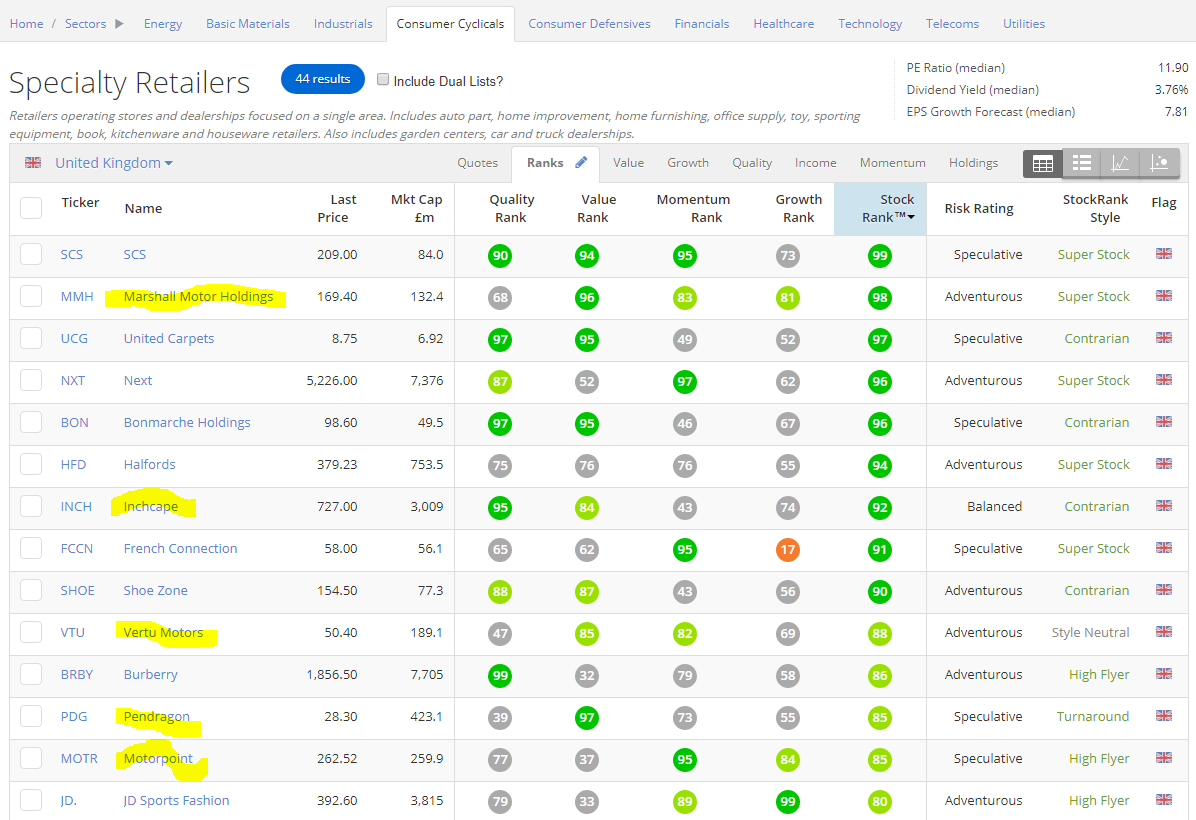

Note that you can click through from any company's StockReport to its sector. I sometimes do this, and then sort the sector by StockRank. This can be a very quick way of finding potentially interesting companies to research, in a sector, which you might otherwise miss.

Here is the speciality retailers sector, sorted in descending order of StockRank. I have used the wonky highlighter to show the car dealerships in the list;

EDIT: Note that the AGM voting didn't go smoothly;

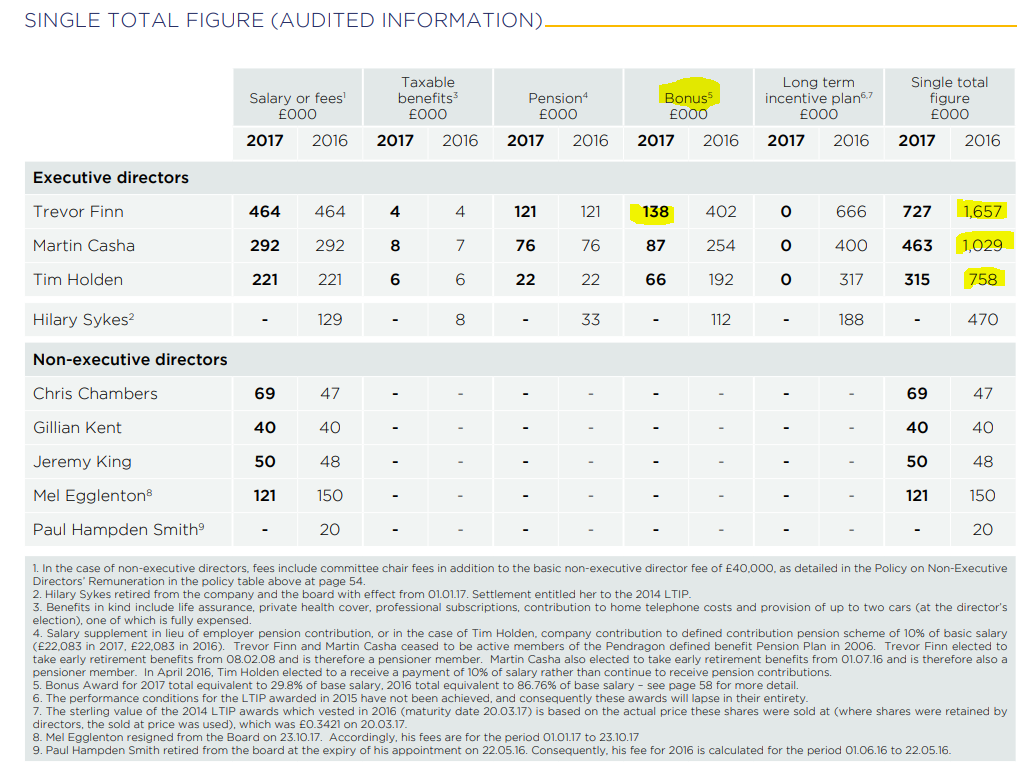

17.12% voted against Directors Remuneration

25.94% voted against re-election of Chris Chambers (Non-Exec Chairman)

Whilst the motions were carried, companies should recognise that, given the difficulty of voting at AGMs (many private shareholders are excluded, due to the awful nominee arrangements), that a significant vote against any motion is a serious matter. It shows that shareholders (probably institutions) are sufficiently unhappy to take the trouble to vote against.

So clearly, Pendragon needs to re-assess its Directors remunerations, as some shareholders are not happy. Also, the new Chairman seems to be unpopular, so should maybe consider resigning?

I've had a look at the 2017 Annual Report. Below is the table of Directors remuneration. The 2017 figures are not a huge concern (although why were any bonuses at all paid, given that profit fell?). However, look at the 2016 figures, which are just ridiculous.

This group seems to have bonus arrangements, an LTIP, and a so-called Value Creation Plan (which is legalised theft as far as I'm concerned). How many incentive schemes do they need? I'm not surprised that some shareholders are unhappy. Executive greed really does need to be tackled. If companies don't sort this out themselves, then a future probably Government will do.

My view on various incentive schemes, is that they tend to pay out when the macro picture happens to be favourable. Directors may have had little overall input into a big rise in profits. They just happen to be in the job when the economy is booming & profits soar across the sector.

Accsys Technologies (LON:AXS)

Share price: 80p (up 3% today, at 10:55)

No. shares: 111.5m

Market cap: £89.2m

Purchase of Arnhem land & buildings

The opportunity has come up for this maker of specialised processed wood to buy the freehold of its site in Arnhem.

It seems to have exercised a right of first refusal, from the landlord wishing to sell.

It doesn't look a done deal yet though, as the E23m+VAT cost has yet to be financed. Discussions with a bank are underway.

I very much prefer it when companies own their freeholds. It gives certainty, and also long-term valuation upside.

Trading update - for the year ended 31 Mar 2018.

This sounds quite interesting. Key points;

- Accoya sales volumes up 15% in H2 (improvement from H1, as FY is +7%)

- Total revenues up 8% to E61m. This rather pedestrian growth is due to well-known production capacity constraints.

- Gross margin improved, due to price rises.

- Capacity expansion of 50%+ soon to come on line. This is the interesting bit, as if increased production is lapped up by customers, then it could lead to a step change in profitability (which has been non-existent in the past).

- Strong pent-up demand - a very good sign, indicating that some or all of the new capacity will find willing buyers.

- Tricoya plant in Hull - construction should be completed in mid-2019.

My opinion - this is a share I held in the past, but it was taking too long to develop. So I sold, and have kept a watching brief.

It's tempting to buy back in, with production soon to make a step-change upwards.

How do we value it, though? I can't find any broker research, so it's difficult to know where to start. Generally I'm not keen on capital-intensive businesses like this, which have to build factories, and then expand them to increase production. Although, it sounds as if there might be licensing opportunities too.

It's tempting, although this company has been promising jam tomorrow for a long time. Maybe we're on the cusp of better things, with production rising 50%+ shortly?

I think on balance, I'll pass on it, given that I don't know how to value it. Although for punters, who are prepared to take on more speculative positions, this one looks to be at quite an interesting stage.

Plastics Capital (LON:PLA)

Share price: 118.5p (up 1.3% today, at market close)

No. shares: 39.0m

Market cap: £46.2m

Plastics Capital (AIM: PLA), the niche plastics products group, is pleased to announce that it expects trading for the financial year ended 31 March 2018 to be broadly in line with market expectations.

Slightly below, then. Stockopedia is showing 10.1p forecast EPS, so that's a PER of 11.7.

I do wish companies would always include a footnote, explaining what market expectations are (in their opinion), as there can be differences.

Note that broker expectations have fallen a lot in the last year. Therefore being slightly below considerably reduced forecasts really isn't particularly impressive;

Net debt - finished the year at £14.7m - a considerable amount, at nearly 32% of the market cap.

The business seems to be capex-hungry too, and doesn't seem to generate much free cashflow.

Directorspeak - this positive tone (below) doesn't seem consistent with results being slightly below the considerably reduced forecasts, or maybe I'm missing something?

"We are pleased to report exceptionally strong organic growth. Generating sustainable organic growth has been a challenge in recent prior years but after two consecutive years of strong growth we can see that the investments that we continue to make in people, business development, product development and new capacity are making a sustainable difference. We can see this continuing as we move into the current financial year."

My opinion - I see this as (at least partly) a lifestyle business for the Directors.

Returns for shareholders are scant, with the divis being slashed last year. Hence the yield is now only about 1.8%. I'm not keen on indebted companies paying dividends anyway.

The other problem is the opportunity cost of holding this share. Look at the 5-year chart below - it's not really going anywhere, is it? What's likely to change, to drive the valuation higher?

The other problem is that the group already has more debt than I would like. So to make further acquisitions, it would need to either further over-gear the balance sheet (risking disaster in the next recession), or dilute shareholders with more equity raises.

Given that PLA shares are on a fairly low rating, then it makes no sense to issue new shares for acquisitions, unless exceptionally cheap acquisitions can be found. So overall, the group is in a bit of a catch-22 situation.

I really can't see any attraction to this share, unless it is able to meaningfully lift future profits above the current level. It's on a low PER for a good reason - because it's a collection of not particularly good businesses.

STOP PRESS! This announcement came out this afternoon, shortly before the Takeover Panel deadline:

Airea (LON:AIEA)

Share price: 58.5p (up 3.5% today, at market close)

No. shares: 41.4m

Market cap: £24.2m

What's PUSU, I thought? It must be Put Up or Shut Up. I thought that was a slang term, but it seems to be a real term used in takeover situations, which are governed by the Takeover Panel.

5pm today was the original deadline for James Halstead to either withdraw its possible takeover interest, or announce a firm intention to bid.

At 3:20pm this afternoon, Airea issued a statement saying that it had requested, and been granted, an extension of this deadline by 21 days.

What's interesting about this, is that Airea is clearly taking seriously the approach from James Halstead. Otherwise it would have terminated discussions, which it hasn't. Therefore due diligence is clearly underway.

... Discussions between both parties commenced following the 5 April 2018 announcement, and are ongoing. The purpose of this extension is to provide the directors of both Airea and James Halstead with the opportunity to continue their discussions, including the provision of certain key information to assist James Halstead in assessing the value of the Company...

My opinion - I'm relaxed about whatever happens here. James Halstead can have it, if they pay up a decent price (in my view the company could be worth up to 100p per share).

On the other hand, if bid talks fail, then there would obviously be a hit to the share price in the short term, but there could be a bigger result for Airea shareholders in the longer term. I explained in detail in this 18 Mar 2018 article what the opportunity is for Airea shareholders.

The abbreviated version is that the highly profitable core commercial floor-coverings business ("Burmatex") is doing very well, and expanding with new products & new geographies. The heavily loss-making carpets division ("Ryalux") is being closed down, after several years attempting in vain to turn it around.

Hence overall group profitability should soar from historic levels, once those Ryalux losses have gone, in future. That's what is driving the current re-rating, and I think it could have further to go, potentially.

The downside issue is a large pension fund, which although supposedly fully funded now, is still sucking cash out of the main business, to de-risk it. This could prove an impediment to a takeover approach, as agreement of the trustees would be needed, I think?

I'm keeping some powder dry, to buy more Airea shares, in case the bid approach falls through. This share is very illiquid, and buying can be tricky. I dread to think what it would be like trying to sell, if bad news comes along in future.

Some people might be just in this share for the bid approach. So I'll be happy to take their shares off their hands, at a lower price, if the bid approach falls through! Overall, I think this is a very interesting special situation.

Note also that Airea appears within one of the best-performing Stockopedia screens, called Tiny Titans, which is modelled on the work of James O'Shaughnessy. I tend to look at stocks in this screen about once a quarter, and have picked up some nicely profitable stock ideas from this, in the past few years. It's a good place to look for overlooked small companies.

OnTheMarket.com

Share price: 147p (up 6.5% today, at market close)

No. shares: 60.5m

Market cap: £88.9m

This is the property portal site, challenging the duopoly of Rightmove & Zoopla.

It announces today that it has increased to 7,500 the number of estate agents signed up to its portal. This is up 2,000 since the shares listed in Feb 2018.

Amazingly good progress, until you realise that they're on special offers, predominantly free of charge!

The offering of predominantly free or discounted introductory rates is a key element of the Company's growth strategy, which aims to increase the core agent customer base, the number of their property listings on the portal and the traffic the portal attracts.

This is not as daft as it seems. After all, how else could they hope to dislodge Rightmove (in which I have a short position), unless they offer an alternative service free of charge? The reason I'm short of Rightmove, is because it makes excessive profits, and this is bound to annoy its customers. If someone else comes along offering a free service (initially), then why not give it a go?

Website visits are rising, but that's because OTMP now has a refreshed advertising budget, after the recent fundraise.

My opinion - I think the chances of OTMP succeeding commercially are very small indeed, since Rightmove has such an entrenched position. However, the prize for this lucrative market, is very big. Therefore, if OTMP makes decent progress, it could rise considerably.

I'm keeping a watching brief for the moment. I'd like to see what OTMP's cash burn is like too. It's all very well driving traffic to a website with TV adverts, but you can burn through plenty of cash very quickly that way. Then when the adverts stop, web traffic goes back down again.

I don't see anything different about OTMP's portal. So why would customers stop looking at Rightmove, where most properties are to be found, to use a different portal with far fewer properties on offer?

For this reason, OTMP's business model really doesn't seem to have any killer blow potential. But you never know! If it does work, then the shares would be a major multibagger. So I suspect some people may have bought the shares on the basis of it being a call option on success, that would probably end up worthless, but has an outside chance of major success.

All done for today!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.