Good morning, it's Paul here with today's SCVR.

As usual, I'll write the article gradually throughout the morning. I post it in sections, so that my work is saved & doesn't disappear in the event of computer problems, etc. Also some readers like to see the earlier sections as they're written, because I try to write first about the most price-sensitive announcements - e.g. positive or negative surprises.

Please see the header for today's running order.

Estimated timings - should be finished by 1pm today, as the workload looks just about right.

Update at 13:20 - today's report is now finished.

Futures fell overnight, which my broker tells me is on continued concerns over the spread of the virus in China & elsewhere. This looks set to cast a cloud over things for some time, both in terms of human misery, and economically. I see this disrupting a lot of shares, because the world is so interconnected these days. Let's hope some kind of cure or effective treatment/prevention is found fast.

Here are a couple of snippets to start with, of interesting things that caught my eye.

Tesla (TSLA) - I see the bandwagon here continues, with shorts being massacred by its continued rise. It rose from $580 per share to $650 in extended trading last night, on a positive update. By my calculations that makes the market cap now $117bn. That valuation seems complete madness, but there's nothing to stop it going higher still, once it has already detached from reality.

Plus of course, it was very heavily shorted (nearly a quarter of the shares at one point apparently), so the short squeeze we're seeing now means that there is a huge supply of forced buyers. A fascinating situation & a good reminder of how dangerous shorting can be.

Frasers (LON:FRAS) - seems to have largely resolved its Belgian VAT dispute, so that's a big potential financial hit which now seems to have been dealt with.

Walker Greenbank (LON:WGB) - announces that it is developing a new range of fabrics with the National Trust. How twee! I don't suppose this would be price sensitive on its own, but it does highlight the value of the company's design catalogue & history. It did a lucrative licensing deal for clothing with H&M a while ago, proving the value. This share is on my watchlist as a potential buy in future. Performance has been a bit erratic in recent years though, hence why I'm hesitating.

Belvoir (LON:BLV)

Share price: 163p (up 10% today, at 09:17)

No. shares: 35.1m

Market cap: £57.2m

Belvoir Group PLC (AIM: BLV), the UK's largest property franchise, today provides the following positive update on the outcome of the financial year ended 31 December 2019, which marks the 23rd year of uninterrupted profit growth for the Belvoir Group.

They certainly want us to think that this is a good update! Let's see if it really is.

The Group has achieved a year of outstanding growth with revenue up 43% to £19.5m* (2018: £13.7m) and consequently the Board expects that the performance for the year, including profit before tax, will be comfortably ahead of management's expectations.

That sounds very good.

There is a caveat though. As I reported here on 6 Sept 2019 at interim results time, Belvoir has grown through acquisitions, and in doing so has stretched its balance sheet. NTAV was negative, at -£6.7m, and debt looks excessive to me, with net debt of £9.5m. Excessive dividend payments further weaken the balance sheet. Companies with a lot of debt really should not be paying big divis. All this heightens risk.

Abolition of letting fees - seems to have been a false alarm, as Belvoir says it has now fully mitigated the impact. So this can be crossed off the list of negatives.

Assisted acquisitions programme - this sounds interesting. It helped 24 franchisees acquire local portfolios (of managed rental properties). That seems to have accounted for all the total increase in managed properties, to 67k. Looks like no organic growth in property numbers then.

Net debt - my concerns here are eased, as net debt has reduced to £6.9m (from £9.5m six months ago). However, a £2m (cash) acquisition post year end will have put that back up to £8.9m, barely changed, and still too high in my view.

Presumably the bank must be comfortable with that level of gearing though. With recurring revenues, based mainly on rentals, perhaps it's not too bad for this company to push the boat out a bit with debt? That's for each investor to decide for themselves. I prefer a more solid & secure financial base, but that can sometimes mean missing out on riskier but successful investments.

Outlook - comments are upbeat, and I particularly like this bit (which has read-across for the property sector and beyond);

The Board remains committed to its growth strategy of capitalising on further consolidation within the property sector and through diversification into other property-related services.

With January 2020 signalling a marked improvement in both sales and mortgage transaction numbers, I am optimistic about the growth opportunities for Belvoir in the year ahead."

My opinion - there's a positive update note out from Finncap this morning. Forecast EPS for 2020 is 14.8p, a PER of 11 - not cheap for a highly indebted small cap, but given the impressive performance & track record here, I think this valuation is justified.

If the company is going to embark on more acquisitions, it would make sense to strengthen its balance sheet with an equity fundraising - fix the roof when the sun is shining. A fundraise of £5-10m would sort out the balance sheet, and leave scope for more bolt on acquisitions, without causing excessive dilution. Now is the time to do it - when performance is good, and the share price is rising.

Well done to holders here, this looks a good business.

Best Of The Best (LON:BOTB)

Share price: 450p (up 12% today, at 10:19)

No. shares: 9.38m

Market cap: £57.2m

(at the time of writing, I hold a long position in this share)

Best of the Best plc runs competitions online to win cars and other prizes.

This is a long-term, hold forever, type of share in my portfolio.

I like everything about these figures. Highlights for me are;

- 14p special divi from surplus cash

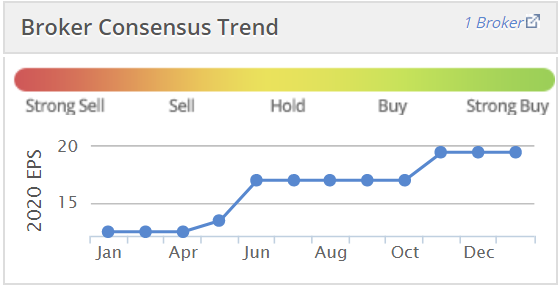

- Full year profit FY 04/2020 expected to be ahead of market expectations - this follows a series of previous upgrades as you can see;

This graph is before today's upgrade.

Finncap raises its forecasts again today - which is remarkable considering we're three quarters of the way through the FY 04/2020 year already. The new forecast today goes up from 19.5p to 22.7p.

Next year's forecast goes up from 21.5p to 26.9p - a big rise of 25%. Remember this is all organic, self-funded growth, whilst the company is also spewing out divis & special divis on top. It's now an entirely internet business, so growth is not held back by any physical restrictions, it's open-ended potentially, and business is international, not just UK.

More out-performance? Given repeated forecast raises, what's the betting that the actual result for FY 04/2021 could even be over 30p EPS? I reckon that's possible, because the business seems to be on a roll. If I'm right, then a PER of 20 would be 600p per share.

In that situation, I would expect to also see multiple expansion (i.e.a higher PER). If that rose to say 30, in view of the strong performance, we could end up at 900p per share - about double the current level. That looks feasible to me, hence why I'm certainly not even thinking about banking any profits here. I should probably be buying more, but it's so difficult to find stock in any size.

This share might be a good way of winning a supercar, without even entering BOTB's competitions! I mustn't get too carried away, as there are no guarantees, and something could go wrong. You always have to be a bit wary of possible regulatory clampdowns, with gaming shares, and tax rises.

My opinion - I don't have to tell you, as you already know from the above! I'm bullish about this share, increasingly so, due to excellent performance and profit upgrades. So I intend holding forever, or at least for as long as the facts remain positive. This is the type of share that I would be happy to run to an over-valuation, if the newsflow remains this good.

Foxtons (LON:FOXT)

Share price: 84p (up 3% today, at 12:31)

No. shares: 274.9m

Market cap: £230.9m

Foxtons Group plc (LSE: FOXT), London's leading estate agency, today issues its unaudited full year trading update for the year ended 31 December 2019.

Not a very clear update, as I'm struggling to work out if they've missed, met, or beaten market expectations. Surely the whole point of a trading update, is to give us that key information? There's no broker coverage on RT unfortunately.

We're given these figures;

Revenues - c.£107m - down 4% on prior year, and 1.5% higher than the forecast that Stockopedia has. So a small beat, as MrC says in his (as always excellent) quick-fire commentary below.

EBITDA - note the huge difference between pre-IFRS16 and post-IFRS16 EBITDA. This is really important to grasp, because for many companies that have a lot of leased properties, post-IFRS16 EBITDA is totally meaningless, and artificially high, because a load of costs have been stripped out and moved down into finance charges. I think this is really dangerous, and could lead to us seriously over-valuing businesses without realising it, if we apply a multiple to post-IFRS 16 EBITDA.

The resilient revenue performance, including a stronger end to the year, combined with continued control of operating costs means Adjusted EBITDA1 post-IFRS 16 is expected to be in the range £13.0m to £13.5m (Adjusted EBITDA pre-IFRS 16 £2.0m to £2.5m).

The Group's cash balance at the end of the year was £15.5m (2018: £17.9m).

It's absolutely crazy that post-IFRS 16 EBITDA is inflated to £13-13.5m, whereas the real figure is £2-2.5m. For this reason, we must always be 100% sure that EBITDA figures have had the IFRS 16 entries crossed out. A little while ago, Graham flagged this point very well, when he demonstrated how one company had mis-matched pre & post figures in their results table, which created a false comparative.

Outlook comments - I read this as tentatively positive;

Looking forward, with the uncertainty of the general election removed, early signs are that the sales market may improve during 2020 and our sales pipeline is ahead of last year.

It is, however, too early to predict how the market will behave during the year with structural issues like affordability and stamp duty continuing to act as a brake on sales volumes.

Competition in the lettings market remains fierce.

Overall though Foxtons has successfully navigated a very difficult period and is well placed to benefit from any lasting improvement in market conditions."

My opinion - the big picture is that Foxtons is currently trading around breakeven, in lousy market conditions - not too bad really. The London market was messed up by George Osborne's foolish & excessive hikes in Stamp Duty. We now have a bold Government which is dealing with this type of issue, and I think that's why Foxtons shares have been rising of late. I reckon Stamp Duty is likely to be slashed, to stimulate the top end property market, which would be very good for the operationally geared profits of Foxtons.

Therefore this share looks quite interesting.

James Halstead (LON:JHD) - trading update - sorry, I've only just realised this is £1.26bn market cap, so well above my normal level.

This is another poor update - it doesn't tell us what we need to know - whether the company has missed, met, or beaten market expectations. Presumably its in line, but why not say so?

I like this company, good performance and margins, and steadily rising EPS. But it's valued on a forward PER of 29 times. Why on earth would anyone want to pay that for a carpet distributor, when you can buy the best companies in the world in the US on a lower rating?

That's all I have time for today, sorry I didn't manage to cover a couple of reader requests.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.