Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

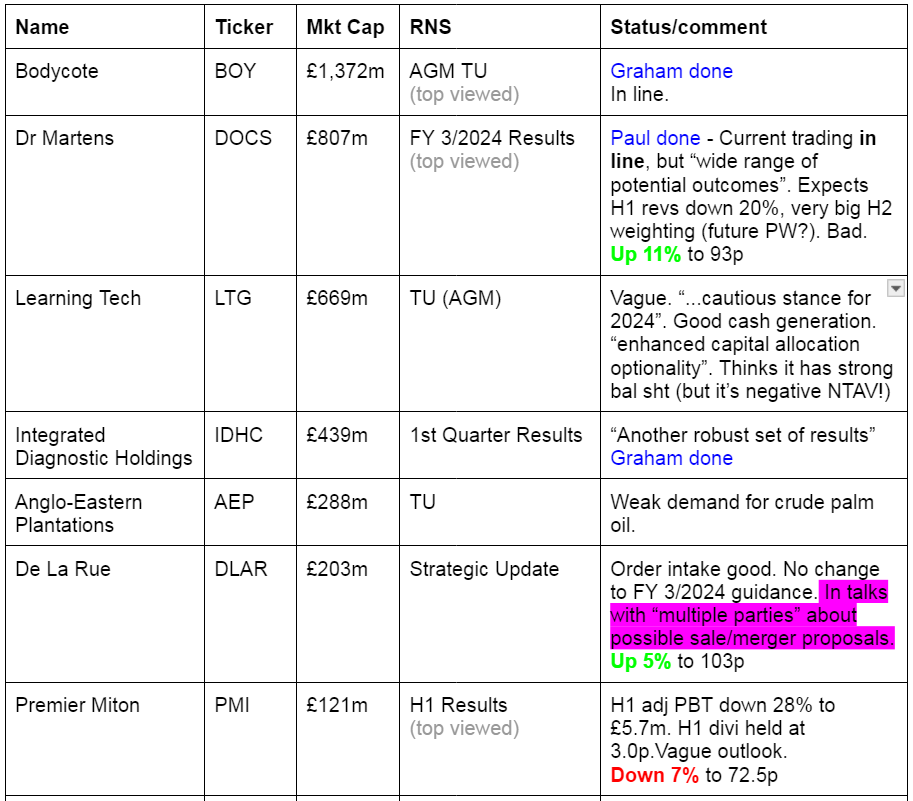

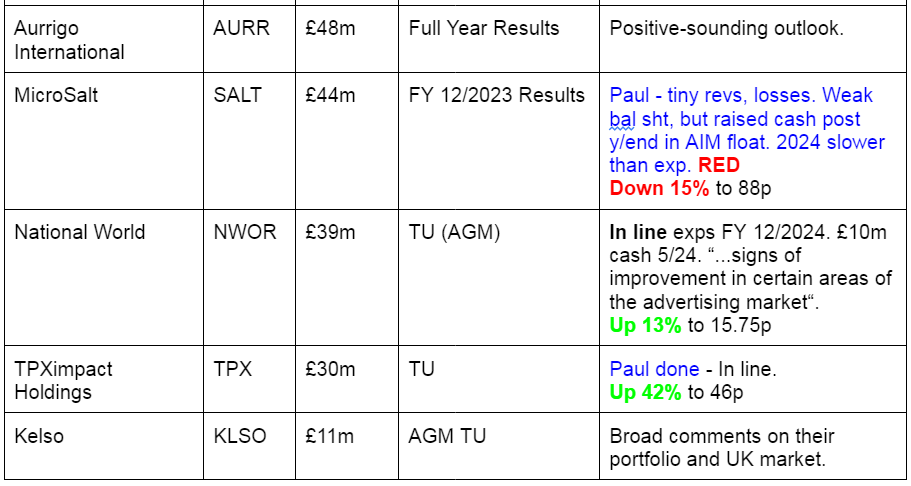

Companies Reporting

Other mid-morning movers (with news)

Auto Trader (LON:AUTO) - up 11% to 815p (£7.31bn) - FY 3/2024 Results - Paul - AMBER

Strong market reaction to results/outlook, adds c.£750m to the market cap today! Shares have broken out to an all-time high this morning. Dominant market position, and ridiculously high profit margins (61% operating margin) - the Rightmove of car advertising in the UK!

Adj EPS up 8% to 29.37p (looks ahead of consensus 27.5p on StockReport), PER 27.7x isn’t cheap, but it’s a quality business. Outlook - “new financial year has started well”.

Paul’s view - superb business, but priced accordingly. I’d rather see it accumulate more balance sheet strength, as it tends to pay out cash in divis & buybacks, but had to do an equity raise in the pandemic. Would be better to adopt a more conservative approach surely, in case something similar happens again? Memories seem short! I wonder if it might come up against monopolistic regulatory problems, as it’s so dominant?

Virgin Wines UK (LON:VINO) - up 7% to 48p - Launches Buyback - Paul - AMBER

Has spent £139k buying its own shares, but not for cancellation, instead they’re to be held in treasury to satisfy future share options.

It also intends to spend another £361k on more buybacks, but also for future share option awards from its LTIP.

Paul’s view - given the disastrous share price performance since its over-priced 2021 IPO, sceptics might be wondering for whose benefit this company is being run? No divis todate, and buybacks being done to satisfy management LTIP, makes it pretty obvious to me this company is listed for the benefit of management. I was amber/green, but this buyback for LTIPs has put me off somewhat. Also on reflection, VINO is too small, and in a crowded market, so I’ll shift down to AMBER. Both Naked Wines, and Virgin Wines, have demonstrated well how difficult their business model is - customers churn a lot, chasing the account opening discounts, so marketing spend is required to keep replacing them. VINO does at least have a decent balance sheet, unlike WINE which looks precarious to me.

Novacyt SA (LON:NCYT) - down 16% to 56p (£38m) - Final Results - Paul - NO COLOUR

Diabolical figures again for FY 12/2023, showing a £29m loss before tax, worse than £20m loss in 2022.

Cash pile has more than halved to £44m, receivables look excessive at £36m which includes £8.5m in VAT receivable, and a £24m unpaid invoice to UK Health Dept [DHSC] - a major dispute/legal action underway. Note 18 says the court case starts on 10 June 2024, and is expected to last 16 days. Note there’s a provision (creditor) for £20m labelled “product warranty”, so that would use up almost half the cash pile if it has to be paid out.

Paul’s view - the court case is highly material, with the outcome set to decide whether shareholders here hold a bargain share, or a dead duck. So it’s a high risk special situation, that I can’t possibly give a view on, as the outcome is uncertain. Obviously I wouldn’t touch it, as there are so many moving parts, problems, and no sign of a viable business at present, based on heavy trading losses again in 2023.

Cambridge Cognition Holdings (LON:COG) - down 9% to 40.5p (£17m enlarged) - Result of Placing - Paul - AMBER

Has raised £2.5m before expenses by issuing 6.25m new shares at 40p, a 10% discount (not too bad in a tough market). This expands the share count from 35.1m to 41.4m, up c.18%.

Also doing a £125k open offer (what’s the point?!) for a ludicrous 1 new share for 113 existing shares.

Paul’s view - I used to own some, as it was a nice turnaround. But I lost interest when management spent the cash pile on a dubious acquisition. Now having to dilute at a low share price looks disappointing. I like the business model, but am not convinced it can scale up enough to make it a decent investment.

Summaries

Integrated Diagnostics Holdings (LON:IDHC) - up 2% to 0.32 US cents (£150m) - 1st Quarter Results - Graham - AMBER/GREEN

This has all the trappings of a high-quality stock: a healthcare company with excellent profitability, excellent return metrics, and well-aligned management. For UK investors, the difficulty is that it’s an Egyptian company and therefore more difficult to analyse. But I do believe that it’s worth a look.

Dr Martens (LON:DOCS) - up 6% to 89p (£847m) - FY 3/2024 Results - Paul - RED

This looks very poor to me, so I'm amazed shares have had a bounce today. It's not justified in my view. Demand in the USA remains very weak, expected to be 20% down in H1, with a "very heavy" H2 profit weighting expected for FY 3/2025. That's the next profit warning booked in then, for later this year! Massively over-stocked, so at some point it will need to do a heavily discounted fire sale, to shift warehouses full of over-priced boots that nobody wants. I think this is a big mess, but I could be wrong of course, it might pull off a turnaround. No sign of that even starting yet though. Why get involved? Risk:reward looks poor to me.

Tpximpact Holdings (LON:TPX) - up 42% to 46p (£43m) - Trading Update & Guidance - Paul - AMBER

FY 3/2024 results are only in line with expectations. So why the 42% share price rise? It dangles us the prospect of good growth, from a strong order book, and much improved target EBITDA margins over the next two years. That's great, if it can actually be delivered. I'm not chasing the shares up based on ambitions, given the poor historical track record of disappointing. Overall though, things seem to be improving, so I'll keep an open mind at AMBER.

Bodycote (LON:BOY) - unch. at 734p (£1.39 billion) - AGM Trading Update - Graham - AMBER/GREEN

A solid trading update as you might expect given this company’s long and proud track record. Commercial aerospace & defence are propping up performance, and energy surcharges on Bodycote’s customers have halved as energy prices have fallen. A highly creditworthy company, with decent quality metrics.

Paul’s Section:

Dr Martens (LON:DOCS)

Up 6% to 89p (£847m) - FY 3/2024 Results - Paul - RED

I’m really surprised to see shares up, given what struck me as poor results, and a distinctly wobbly-sounding outlook. The newswire brief comments (very useful, click on “NEWS” on any company’s StockReport) suggest that the market likes the new £20-25m cost savings plan announced with these results. Also shares have fallen so dramatically, there must come a point where things bounce (maybe from short positions buying back?), or anticipation of a turnaround - which has been a poor investing strategy so far, just look at this chart since it floated in 2021 at a massive over-valuation, and has warned on profits since, multiple times, yet it’s still valued at £847m - why?!

Looking at our previous notes here, we’ve been increasingly negative on DOCS fundamentals -

30/11/2023 - 84p - Roland went AMBER/RED on a profit warning accompanying H1 results.

25/01/2024 - 79p - I also viewed it AMBER/RED, on an in line Q3 TU, noting the big 21% fall in Q3 revenues, and a balance sheet with bloated inventories and too much debt. Although I wondered if it might have future turnaround potential?

16/4/2024 - 69p - another profit warning! I went down to RED. The company said FY 3/2025 worst case scenario could see profit fall by two thirds.

On to today’s FY 3/2024, key points -

Results in line (“as expected”)

Continued weak demand in USA, better elsewhere.

Cost action plan to strip out £20-25m costs.

Calls FY 3/2025 a “year of transition”, PR-speak for more bad numbers in the pipeline.

P&L numbers are poor, but at least it was still profitable. These are adjusted numbers below, and note the gulf between EBITDA and adj PBT. When are banks going to realise that lending based on EBITDA multiples is a lot more risky than they seem to realise? It’s not the same as cashflow at all at many companies - for a start, finance costs and corporation tax are not optional! They're real cash outflows.

PER at 89p/share is 12.7x based on 7.0p adj EPS for FY 3/2024. That might be decent value if a turnaround was in the offing, but it isn’t. Forecast for FY 3/2025 shows another lurch down in forecast EPS to only 3.3p (consensus, on StockReport), a PER of 27x this new year's earnings forecast (which I reckon it won't achieve).

Why is it paying divis still, given all the problems?

Outlook - I read this below negatively. It sounds to me like the company has set itself up to deliver lousy H1 figures, and probably another profit warning later this year -

Current trading is in line with our expectations and our planning assumptions for FY25 are unchanged from those shared in our announcement on 16th April. There remains a wide range of potential outcomes for both revenue and profit for the year, dependent on the performance through the key peak trading period.

For the first half, we expect a Group revenue decline of around 20%, driven by wholesale revenues down around a third. Combined with the cost headwinds which impact both halves, the impact of operational deleverage is significantly more pronounced in the first half. Overall results this year will therefore be very second-half weighted, particularly from a profit perspective.

That sounds awful actually. This share should be down today, not up!

Revenues down 20% in H1, with wholesale orders down by a third - that is telling me DOCS has serious problems with a lack of demand. Customers don’t want its products at the price they’re being asked to pay. That’s similar to what has (almost) killed off Superdry. DOCS talks today about doing more marketing in USA to stimulate demand, but that’s expensive, and it might not work. Maybe these products are just going out of fashion? After all, people are not buying these to wear on building sites, are they? There are similar, much cheaper alternatives for workwear. DOCS are fashion products, and hence susceptible to the crowd moving on, and worst case scenario even becoming uncool products that the target market won’t buy at any price. My instincts on this are reinforced by DOCS ongoing excessive inventories on the balance sheet.

Inventories - the scale of the problem here is very considerable, and hasn’t reduced, with £255m sitting on the balance sheet in unsold shoes. Total cost of sales on the P&L for FY 3/2024 was £302m, so it’s holding about 308 days' sales (10 months) in warehouses. 1-2 months would be normal. There’s only one solution for this over-stocking problem - heavy discounting to clear the excess, which itself does a lot of damage to the brand, and of course lowers gross margins in future.

Net debt is quoted as an alarming £358m, but that includes lease liabilities. I make the real net debt figure (excluding leases) a more reasonable £184m. Lease liabilities total £182m, adding them up I get £366m, which is near enough to the £358m figure the company quotes. So overall net debt is not such a massive problem as the highlights table suggests. A presentational own-goal. The real net debt number is £184m, which looks survivable, although if trading really seriously drops this year, then covenants and renewal could come into focus. I wonder what the average net debt figure is, it’s usually higher than a window-dressed year end figure. So I’d say no immediate cause for alarm over borrowings, but it could well become a problem if (as I expect) DOCS delivers another profit warning later in 2024.

Balance sheet overall is looking stretched I think. Inventories stand out like a sore thumb, and the long-term debt is necessary to finance those warehouses full of shoes that nobody wants. NAV is £368m, and if we whip off the £270m intangible assets, NTAV becomes £98m. Note that NAV is falling too, it was £404m at 3/2023, and was down to £368m at 3/2024. Why? Because it (irresponsibly I think) spent £51m on share buybacks, and paid out £58m in dividends during FY 3/2024 (see the cashflow statement).

I’m listening to a 6-part podcast about the Titanic at present, from “The Rest is History” (highly recommended). Drawing a parallel with DOCS shares, I’d say it looks up to about episode 2, or maybe 3, in its arguably similar decline.

Paul’s view - as you’ve probably already gathered, I think this looks a complete mess. The problems seem to me far worse than a £847m market cap suggests. Hence I’m sticking at RED. There’s no sign at all of a turnaround, and I think another profit warning looks very much on the cards for later in 2024. At some point they’ll (new management maybe?) have to bite the bullet and sell off the unsold shoes in a heavily discounted fire sale. That could kill off its margins, and brand image.

Maybe I’m being overly dramatic, and a turnaround could be pulled off? Who knows, but for me risk:reward looks firmly negative. Why get involved, when all you’re doing is guessing, and hoping, that it might be turned around?

It’s fine to sit on the sidelines. It doesn’t matter to me if the shares do soar, as I think there are much better risk:reward opportunities out there. I’m more concerned about avoiding a loss from taking the plunge here, when the fundamentals & outlook are looking so ropey.

Tpximpact Holdings (LON:TPX)

Up 42% to 46p (£43m) - Trading Update & Guidance - Paul - AMBER

TPXimpact Holdings PLC (AIM: TPX), the technology-enabled services company focused on people-powered digital transformation, is pleased to provide an update on its Q4 and full-year trading for the year ended 31 March 2024 (FY24) and to provide guidance for the full years ending 31 March 2025 and 2026 (FY25 and FY26 respectively).

As we noted on our list of companies reporting, this update is only in line (hence why we didn’t focus on it earlier today) -

…the Board expects the full year results to be in line with previous guidance.

FY 3/2024 revenue is £84m (upper end of £80-85m guidance)

Adj EBITDA margins in middle of 5-6% guided range.

CFO Retirement - no cause for alarm, as it looks orderly, and is scheduled for Dec 2024.

Net debt was a big problem previously, but improved markedly when it announced on 18/9/2023 a £7.5m disposal (Bulgarian subsidiary) to reduce debt, which made me move up from red to amber/red.

Graham then moved us up again to amber on an in line Q3 update on 12/2/2024.

Today’s news on debt improving further is reassuring -

Net debt (excluding lease liabilities) reduced to just over £7 million at 31 March 2024, the lowest level in over three years and well ahead of our £11 million target, due to effective working capital management. The Group comfortably satisfied its debt covenants at year end and expects to report a net debt to Adjusted EBITDA ratio of less than 1.6x.

Outlook - this is the interesting bit, and has clearly got people excited -

The Board is pleased to reiterate its previously announced FY25 targets of like-for-like revenue growth of 10-15% and further margin improvement of 2-3% on top of that achieved in FY24, which we expect to be weighted to the second half of the year.

The new financial year has started well, with a strong pipeline of new opportunities and committed (or backlog) revenues in respect of FY25 amounting to £67 million, which equates to around 70% of target full-year revenues. Whilst our FY25 financial performance will be subject to a degree of disruption resulting from the General Election in July (a macro risk equally relevant to our competitors), we believe the Company is well-positioned for continued growth and increasing profitability.

With respect to FY26, management are targeting like-for-like revenue growth of 10-15% and an Adjusted EBITDA margin of 10-12%, in line with our previously announced, three-year strategic goals.

The problem with TPX is that the current level of EBITDA turns into very little proper profit. For example, H1 saw good revenue growth to £41.6m, but £2.0m adj EBITDA (4.8% margin) became only a paltry £0.6m adj PBT.

Full year adj EBITDA margin is only a little higher at 5.5%. Nothing to write home about there.

The target adj EBITDA margin is nearer 8% in FY 3/2025, which is starting to get a lot more interesting, IF they achieve this - it’s only a target for now, and comes with an H2 weighting.

The FY 3/2026 target margin is a lot higher again, at 10-12% adj EBITDA. If that’s achieved then these shares would be much higher.

Paul’s opinion - I’m wary of relying on multi-year targets from companies that have badly disappointed in the past, which this has.

The target guidance sounds almost miraculous, and I’d want to know how they expect to suddenly become much more profitable, when performance in the past has been so erratic and unreliable, missing forecasts by miles, which is why the share price has done this -

Overall then, the targets sound exciting, but let’s get some actual results under our belts first, before putting out the bunting.

Overall, I’ll go with AMBER for now, and would like to see the full numbers to be sure the balance sheet is actually improving, rather than just seeing a temporary squeeze on working capital to flatter the debt figure.

Based on its poor track record, I think the shares are high enough for now. Although I can also see that this might be an intriguing speculative punt! Previously management did an acquisitions binge, and messed things up. That has left a still-weak balance sheet, last reported at £(8.2)m NTAV. So I would need to see evidence that they've learned from past mistakes, and won't repeat them.

Graham’s Section:

Integrated Diagnostics Holdings (LON:IDHC)

Up 2% to 0.32 US cents (£150m) - 1st Quarter Results - Graham - AMBER/GREEN

We rarely cover this one - it was Jack who last covered it in Nov 2021.

It’s a healthcare business that seems to post excellent financial results every year (with great quality metrics), and it only trades at a PER of about 10x.

A quick description of the services offered on its website:

IDH offers more than 3,000 diagnostic pathology tests ranging from routine to advanced. Common tests include those for cholesterol, diabetes, pregnancy and substance abuse; whilst specialized tests would be performed as part of genetics, immunology, oncology and endocrinology diagnoses.

The catch for UK investors is that it’s headquartered in Egypt, operates in the Middle East and Africa, and publishes results in the Egyptian Pound. And the shares are quoted in US dollars, despite being UK-listed. So it’s a bit trickier to analyse than your typical domestic stock!

Let’s take a look at these Q1 results and see if the company’s financial performance remains as attractive as ever.

In what follows, it’s important to bear in mind that inflation in Egypt is running at 32.5%.

Key bullet points -

Revenues +28% to 1,171m EGP (c. £20m)

Gross profit +32% to 428m EGP (c. £7m)

Op. Profit +71% to 220m EGP (c. £3.7m)

Adj. net income +70% to 100m EGP (c. £1.7m), adjusted to exclude foreign exchange gains.

The company explains its strong growth as follows:

Sustained top-line growth continued to be driven by higher test volumes and average revenue per test, which increased 8% and 18% year-on-year, respectively.

Test prices rose thanks to “strategic price increases implemented by IDH to counteract inflationary pressures in its home and largest market, Egypt”.

I suppose you could argue that 18% growth in revenue per test is still not keeping pace with official inflation.

More positively, a higher gross margin is explained by “the effectiveness of IDH's cost optimization efforts as well as the normalization of margins as the effects of the devaluation of the Egyptian Pound in 2022 and early 2023 begin to fade”.

IDH’s recent profitability has benefited from many different factors:

Higher EBITDA profitability came on the back of increased gross profitability combined with lower SG&A outlays as a percentage of revenues as IDH continues to optimize its cost base and reduce expenses where possible. In addition to the Group's optimization efforts, it is important to highlight that outlays in the comparable period had been boosted by higher-than-usual salary increases and higher depreciation expenses to support the rollout of several new branches in IDH's network.

Branch network: growing at a modest pace, with 11 more branches bringing the total to 587. The branch network is seen as “a primary barrier to entry for newer players looking to penetrate the diagnostics market”.

Geographically, the company is now active in Saudi Arabia (and very excited about prospects there) but has shut down in Sudan to the civil war.

Egypt is responsible for 84.5% of total revenues, while Jordan is in second place with 14%.

CEO comment:

…I am pleased to report yet another robust set of results which have seen us deliver solid consolidated top-line expansion and improved profitability at all levels. This sustained growth trend continues to showcase the adaptability of IDH's business model in the face of economic and political challenges across our geographies and the potential of our business going forward…

Looking ahead, our strategy and priorities at home and across our footprint remain unchanged. In Egypt, we are beginning to see the early signs of a sustained economic recovery supported by the float of the EGP in March 2024 and the policy changes enacted by the government and central bank in recent months. As such, we expect volumes to continue growing steadily as inflation declines and patients' purchasing power improves.

Listing news: since 2021, IDH has been dual-listed in Egypt and in London. However, liquidity in Egypt has been below expectations, and that listing will be cancelled. IDH will keep its standard listing on the LSE.

Graham’s view

With companies like this, the first and main question is around governance: can UK-based investors trust it?

Firstly, I would point out that it’s not a recent IPO; it has been listed since 2015. That is plenty of time for problems to emerge:

It’s true that share price performance has been poor, but an important reason for that is the depression of its earnings multiple. It’s currently trading near record lows in terms of PER:

It’s a standard listing, rather than an AIM listing, which in general should allow investors to have great confidence.

In terms of dividends it has paid out some, and is expected to pay dividends again soon:

However, future dividend payments may be complicated (as acknowledged by the company) by foreign exchange shortages and legal restrictions in Egypt. So that is one major problem for investors.

More positively, I note that the CEO is the largest shareholder and she has been a consistent buyer of shares. HENA is her holding company:

Overall, I do trust this company. But that’s a judgement call, and a personal view.

If you wish, you can review the Board of Directors here.

In conclusion, I’m going to take an AMBER/GREEN stance on this share. My main worry is around the difficulty of making dividend payments - hopefully that issue can be resolved before too long.

(Paul adds: I'm more sceptical, so it wouldn't be something I would touch personally).

Bodycote (LON:BOY)

Unch. at 734p (£1.39 billion) - AGM Trading Update - Graham - AMBER/GREEN

Bodycote, the world's leading provider of heat treatment and specialist thermal processing services, issues a trading update covering the four-month period from 1 January to 30 April 2024 ("the period"), ahead of the Company's Annual General Meeting, which will be held at 10.30am today.

This is another one we don’t cover too regularly, due to the high market cap, but it has been on Stockopedia’s “Most Viewed” widget today.

Paul looked at it for the first time in March, taking a positive view.

Here are the key points from the AGM update, for the first four months of the new year:

Organic revenue falls 2.2% due to lower energy surcharges being charged to customers.

Excluding the effect of lower energy surcharges, organic revenue was up 2.7%. (By default, the company excludes the effect of energy surcharges in the results which follow.)

Bodycote acquired the US-based company Lake City Heat Treating in January; revenue growth is 3.9% if you include its contribution.

Performance is being driven by “Specialist Technologies” (rather than by Classical Heat Treatment) and by the Aerospace & Defence sector:

The decline in Automotive reflected “a subdued market environment and the high growth in the corresponding prior year period”.

In General Industrials, there is a year-on-year decline but nevertheless a sequential improvement vs. the end of 2023.

Share buybacks: £10.8m of shares have been bought back out of a total £60m programme. That’s a substantial figure even for a company of this size!

Net debt is £45m (previously the company had net cash) due to the acquisition and buybacks. That’s a modest amount of leverage given expectations of £95m of net income for the current financial year.

Outlook:

Trading year-to-date reflects the strength of Specialist Technologies and the benefits of our diversified end-markets. The performance supports our expectation of further progress in 2024, including another step towards our medium-term operating margin target of more than 20%.

New CEO comment:

"Bodycote continues to demonstrate good growth against a mixed picture of end market dynamics and the Group is well positioned for the remainder of 2024…

Over the coming weeks I will progress the review of our strategic and operational priorities, and look forward to sharing my early observations about the Company at our interim results presentation on July 30th."

Graham’s view

This company has been around for a long time and kept its nose clean while also generating decent returns for long-term investors:

As an industrial stock, it tends to generate good but not great returns:

These quality metrics are good for the category (industrials) without hitting the extremely high levels that I seek in potential investments.

The StockRanks are a little more impressed than I am:

For me, this is AMBER/GREEN. Lots of institutions like it. At a cheaper valuation or if the company keeps buying back its shares at this level, maybe I could turn fully positive on it at a later date.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.