Good morning! It's Paul here - bright-eyed & bushy tailed!

I've added 5 companies in the article header above, which have been interesting companies before, and have issued either results or trading updates today. There might be time for 1 or 2 reader requests too.

Lamprell (LON:LAM)

Share price: 63.4p (down 9.5% today)

No. shares: 341.7m

Market cap: £216.6m

(at the time of writing, I hold a long position in this share)

Project update (profit warning)

Lamprell plc is a United Kingdom-based provider of fabrication, engineering and contracting services to the offshore and onshore oil and gas, and renewable energy industries.

The company really should have entitled this announcement as a trading update. By giving it the apparently harmless title "project update", this announcement didn't appear in the "results & trading updates" categorisation used by investegate. It's actually a profit warning;

... While we expect revenue for FY2017 to be in line with current guidance, we now expect earnings and EBITDA to be materially below current market expectations.

The problems seem to be relating to one particular project;

Lamprell provides an update in relation to the East Anglia One offshore windfarm project. As announced previously, there were start-up costs and inefficiencies in relation to the project and the learning curve has proven to be steeper than anticipated.

We remain confident of meeting our client's expectations in terms of schedule and quality but we will incur extra costs to achieve this.

As a result, we now expect the project to make a significant loss, which will be booked in 2017.

I hate to say it, but that sounds like management shortcomings. Should Lamprell really be undertaking projects where it has to learn on the job?

It sounds like the full financial impact is not fully known yet, which usually means it's likely to be more than expected;

... the Company will be in a position to make an announcement with respect to the financial impact in due course.

My opinion - we might expect this type of profit warning to trigger a 20-30% fall in share price. So why has Lamprell only dropped 9.5% today? It's still early days (I'm writing this at 09:15), so there could be delayed selling yet to happen. However, I think a more likely explanation is that this is a value share - with the valuation mainly underpinned by the balance sheet (large net cash balance), rather than the more usual multiple of earnings.

Lamprell has already warned on profits before, and broker consensus is for it to trade at a loss this year and next, before today's further bad news.

Balance sheet - the last reported figures were as at 30 Jun 2017. This is a pretty remarkable balance sheet, considering Lamprell only has a £216.6m market cap. Key figures;

NAV: $559.4m

NTAV: $526.6m

Working capital (net current assets): $389.1m

Long-term liabilities: $61.6m - of which $32.3m is a pension deficit, the balance being borrowings.

If you convert these figures into sterling, then the company is worth less than its own working capital, less all liabilities. That seems unduly harsh - or maybe it's fair, considering the company is not profitable. Also, what an amazingly inefficient use of all that capital - which is tied up generating an overall negative return.

It's cyclical though, as Lamprell's main business is related to the oil industry - building & servicing oil rigs, which has tailed off since the big oil price drop a few years ago.

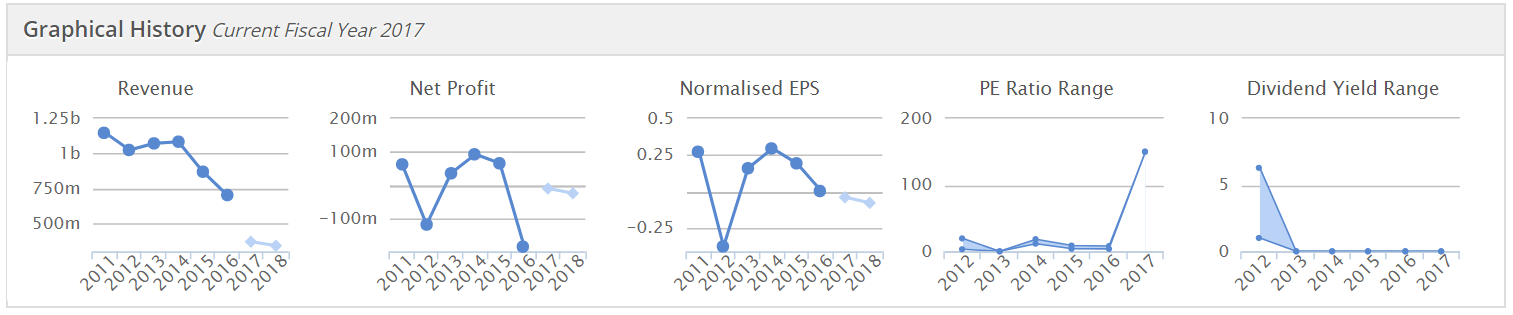

Even in the good times its performance was erratic though, so it doesn't look like a very good quality business;

Dividends seem to have stopped in 2011. All that capital tied up in the business, and shareholders don't see any of it - which does make you wonder just for whose benefit this company exists?

So you might be wondering why I bought some shares in it? The reason is because at the current valuation the business is in for free, with the entire share price backed by liquid assets. Therefore the downside should (in theory) be well protected, but the upside is in for nothing. I noticed that the oil price seemed to be rising, so thought that might provide a catalyst for earnings to improve in 2019 and beyond, maybe?

Today's muted share price reaction to this latest profit warning tends to confirm my feeling that the downside is mainly already in the price. So there could be healthy upside if any good news comes along. Also, I imagine the company is in the sights of potential bidders, at such a lowly valuation.

James Latham (LON:LTHM)

Share price: 862.5p (down 8.7% today)

No. shares: 19.64m

Market cap: £169.4m

Half year report - for the 6 months to 30 Sep 2017. James Latham plc is a timber and panel products distributor.

This company last updated the market on 23 Aug 2017 at its AGM. It mentioned pressure on margins, due to higher import costs, and other increased costs from relocating a depot. On the positive side, it reported revenue for Apr-Jul 2017 was up 6%.

Today's interim results show profits falling, which looks to have taken the market by surprise on the downside, hence an 8.7% share price fall today. Key points, remember these are half year figures;

- Revenue up 7.0% to £107.3m

- Cost of sales rose faster, at +8.9%

- Gross profit fell 1.2%

- Other costs were also up, resulting in operating profit falling 11.2% to £6.96m

- Diluted EPS fell 10.9% to 27.7p.

There seems to be an H1 bias to profitability, so it looks as if full year EPS is heading for about 50p per share on a diluted basis. Stockopedia shows broker consensus as 54.4p for this year, ending 31 Mar 2018, so this looks as if full year expectations may now be missed. The company doesn't say anything about market expectations in today's announcement.

Outlook - the way I read the comments below, it sounds like things might be improving a bit compared with H1. Maybe they're hoping to recoup some of the H1 profits shortfall in H2?

The second half of 2017/18 has started well with growing revenues at slightly higher margins. Trading conditions continue to be mixed, but despite the uncertainties in the economy, we and our customers remain busy.

We are confident in the long term prospects of our key product drivers, and this underpins our plan to continue to invest in our business to further improve the offering to our customers. Following the successful relocation of our Yate depot, we are looking forward to a relocation of our Wigston depot to a site closer to the motorway network in Leicester ahead of schedule in January 2018.

Balance sheet - remains very strong, in fact it's got stronger mainly due to a big fall in the accounting valuation of the pension deficit - down from £23.2m a year earlier, to £8.5m at 30 Sep 2017. Remember though that in the almost incomprehensible world of pension scheme accounting, the deficit recovery payments are calculated on a triennial actuarial valuation, which is usually considerably larger than the accounting deficit;

The calculation of the pension deficit remains very sensitive to changes in assumptions, and the pension deficit under IAS19 is now calculated as decreasing from 16.6m at 31 March 2017 to 8.5m. This is largely due to updated membership data and an increase in the discount rate. Positive asset performance and changes to the mortality base tables also reduced the net liability. The triennial actuarial valuation as at 31 March 2017 is currently being calculated.

NAV: £83.8m

NTAV: £83.6m - as you would expect, this is little different to the NAV figure, as wood yards don't tend to generate much intangible assets, unless acquisitions of other companies are done.

It's been a heavy year for capex, presumably on the new depots opened recently. So property, plant & equipment has increased 26.2% to £31.9m, compared with the equivalent number a year earlier at 30 Sep 2016.

Working capital is very strong indeed - current assets are £92.7m, versus current liabilities of £30.3m. Divide one by the other, to get the current ratio of 3.06. Even if you deduct the £12.26m long term liabilities from net working capital, there's still a very strong surplus. Does this matter? Very much so - it means the company should not need to dilute shareholders, and it should also survive any future recession. There's also the possibility that the company might acquire competitors using its surplus cash.

Valuation - if we assume that the company is probably heading for around 50p full year EPS in its current financial year, then the PER is 17.3 . That may not look particularly good value for a fairly basic, cyclical business. However shareholders also get a load of surplus assets too, which we should attribute some value to. The way I look at things, I'd say about 20% of the share price could be seen as surplus assets on the balance sheet, which would bring the PER down to just under 14 - which looks reasonable value.

My opinion - maybe the share price here ran a bit ahead of itself? The same could be said of many shares at the moment - we've had a long bull market, and lots of things look over-priced now.

In this case though, I don't see any collapse in its end markets being likely - housebuilding has gone up the political agenda a lot lately, so Lathams seems likely to see continued strong demand from builders.

It sounds as if the company is starting to pass on some cost increases to customers. So this could be seen as a bit of a blip in profits in these results today.

Overall, I like the company a lot, and think it looks sensibly priced at the moment. I would like to see the company pay much more generous dividends, instead of hoarding cash.

ST Ives (LON:SIV)

Share price: 79.25p (up 7.1% today)

No. shares: 142.8m

Market cap: £113.2m

St Ives, the international marketing services group, provides the following trading update covering the three months to 3 November 2017.

I like the format of this announcement - starting off with summary, then giving more detail below.

Overall, trading in the period has been positive and ahead of management's expectations, with Group revenue running approximately 4% ahead of the equivalent period last year.

Management expectations must have been rather low, if a 4% uplift is ahead of it. More detail is given on the divisional split of trading. One part of the business seems to be trading well, with other parts struggling. This was explained in more detail at the last results, which I wrote about here on 3 Oct 2017.

My opinion - the balance sheet is the deal-breaker for me with this company.

Also, given macro headwinds, I'm trying to avoid marketing companies. It can often be the first cost that customers slash, when they encounter difficult trading conditions. Plus there seems to be a flow of marketing spend towards Google & Facebook, to the detriment of others. Although SIV does mention today positive progress in its digital businesses, so it looks like they're getting a slice of that particular cake.

Overall, this one's not for me. I think it would require a lot more research to get my head around all the issues. Whereas I prefer much more simple investment propositions.

That said, the chart above is looking attractive - having formed a good base this year, and having moved above the moving averages. So there could be some mileage in it, possibly?

On The Beach (LON: OTB)

Share price: 444.75p (up 11.5% today)

No. shares: 130.4m

Market cap: £580.0m

Preliminary results - for the year ended 30 Sep 2017. This is an online travel agent.

Today's results are very impressive. This could be the last time we report on this company, as it's now above our usual upper end market cap (of c.£400m) - although we bend the rules if something looks interesting.

Both Graham and I have written positively about this company before. Looking through today's accounts, it strikes me as a growth at reasonable price company, and am kicking myself for not buying some a while ago, when it was on a cheaper rating.

All the P&L measures are up today, e.g.

- Revenue up 17.2% to £83.6m (14% organic, and the balance being from a small acquisition called "Sunshine".

- Adjusted profit before tax is up 33.8% to £28.5m

- Adjusted proforma EPS up 35.4% to 17.6p - a PER of 25.3 - that's a whisker ahead of broker consensus of 17.5p

Note that this share has re-rated a fair bit - when I reviewed it here on 2 Feb 2017, I thought it looked a nice GARP share, and at 280p per share then, the forward PER was only 15.3. In the 10 months since, the shares are up 59%. So this was clearly a missed opportunity for me, and am kicking myself for not having bought some, when the value was so obvious.

Forecasts - looking through broker notes today, earnings are forecast to continue growing strongly, as follows;

FY 09/2018: EPS 21.9p - forward PER 20.3

FY 09/2019: EPS 26.1p - forward PER 17.0

Those multiples don't look stretched to me, considering this is a fast-growing, profitable online business. If anything, I could see scope for this share to re-rate upwards more - in a bull market this is very much the kind of thing that would be attributed a premium rating.

Reading through today's narrative, the company's business model seems to focus on having a low cost overheads base, and negotiating deals (sometimes exclusives) directly with hotels.

Marketing costs - reaching sufficient scale to be able to fund a large & growing marketing budget, and increase profitability too, is what all online businesses seek to do. Many fail to achieve the necessary scale. In this case, the company has clearly succeeded, and manages to generate a high net profit margin too. I'm really warming to this share.

Note that the marketing spend in FY 2017 was by far the largest cost, at £40.3m. To be able to spend that much, and still achieve a £28.5m adjusted profit for the year, is really impressive.

The blurb today says that OTB has 20% market share of UK online sales in the short haul beach holiday market. I find it remarkable that this relative newcomer has managed to grab that sort of market share from the bigger, established holiday companies. So whatever OTB is doing, it's clearly very good at it.

Current trading - is going well;

"The Board is pleased to report that current trading is in line with expectations and believes the business is well positioned for the key trading period that commences in late December and continues into Q1 2018."

Balance sheet - is nothing special. However, travel companies can often manage with quite weak balance sheets, as they receive payment up-front from customers. So this isn't a worry.

Cashflow statement - I've reviewed this, and am happy with it. There aren't any funnies - this is a genuinely cash generative business. It

My opinion - as you've probably already gathered, I really like these numbers.

OTB is currently a mainly UK-focused business, but is also expanding (from a low base) in Scandinavia, with a launch in Denmark imminent too. If it can crack some overseas markets, then that could drive a further re-rating.

There is also potentially more M&A, and expanding the product range into longer haul destinations.

Overall, this looks a very nice business, at a reasonable price. It's not easy to buy into a company which has more than doubled in price in the last year, but in some cases that can still make sense.

HML Holdings (LON:HMLH)

Share price: 34p (down 4.2% today)

No. shares: 45.4m

Market cap: £15.4m

Half year report - for the 6 months to 30 Sep 2017.

This is a property management services group, which is growing by multiple small acquisitions.

- H1 revenue is up 25% to £12.7m

- Profit from operations is only up 5% to £713k.

- If we add back the amortisation charge, then operating profit of £993k is up 9.5% against H1 last year.

- Adjusted diluted EPS actually fell from 2.0p in H1 LY, yo 1.9p in H1 TY. That occurred because the average number of shares in issue has risen from 39.9m a year earlier, to 46.2m.

The balance sheet is also showing the strain of multiple acquisitions, with £18.6m of intangible assets, within a total NAV of £13.5m. So NTAV is negative, at -£5.1m - something I wouldn't be happy with if I were invested here. Trade payables looks stretched to me, although this type of business does tend to have a favourable working capital profile.

My opinion - I can't see much attraction here. Maybe management should re-assess their strategy of multiple acquisitions, and why that is not feeding through into much profit growth?

The comments about increased regulation sound interesting though, as that could increase business for HMLH and other regulated companies, as unregulated competitors might be forced out?

With a weak balance sheet, and questionable strategy/execution, I can't see any particular appeal to this share.

All done for today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.