Good morning, it's Paul here!

Cloudcall (LON:CALL)

As promised, here are the videos from the Cloudcall (LON:CALL) (in which I hold a long position) Capital Markets Day, which I reported on here, on 22 Jan 2019. Clicking on the links below will take you directly to the videos, on Vimeo.

Staffline (LON:STAF)

(suspended at 670p)

Not another accounting scandal?

What on earth was AIM thinking of, allowing Staffline shares to continue trading yesterday, after a bombshell announcement at 7am that results would be delayed? Investors understandably started panic selling, and the shares dropped by about a third. Only at 3:50pm were the shares suspended. This is madness/incompetence.

With some sort of accounting problems probably having emerged (why else would results be delayed?) then shares cannot be allowed to trade, as it's a false market. People don't know what's going on, hence the shares have to be suspended.

The company update given at 6:14pm yesterday says very little. Key bits;

... concerns were brought to the attention of the Board relating to invoicing and payroll practices within the Recruitment division.

Given the nature of the allegations, the preliminary results will not be published until the matters have been fully investigated.

The Board is confident that its policies in relation to these matters are appropriate, particularly given that these practices have been the subject of prior audits.

However, if the allegations are substantiated this could have a material impact on the Group and its profitability and until further investigation has been undertaken the Board cannot assess the potential materiality.

Materiality is usually defined as 10% of profits. So it looks as if the problems, if genuine, could be at least 10% of profits.

There doesn't appear to be any cash impact, as far as we know;

Other than that noted above, the financial position of the Company is unchanged, as reported on 8 January the Company expects to report net debt of c£63m for the year ended 31 December 2018 and can also report that in July 2018 the Company refinanced its £150m lending facilities.

My opinion - this sounds as if sales & hence receivables might have been overstated in some way? Hopefully that shouldn't have any cash impact - so probably not another Patisserie Valerie, but we don't have enough to go on at the moment to be sure.

We'll just have to wait for more information from the company.

Surely the time has come for a comprehensive overhaul of corporate governance? We seem to be getting numerous problems emerging at companies - often not long after floating, and/or when founders have disappeared into the sunset with a large bag of swag.

Investors have lost £billions in recent years, with accounting scandals - e.g. Quindell, Globo, Patisserie Valerie, and of course numerous Chinese frauds, and junior resource sector semi-frauds. This is bound to affect investor confidence. Yet so few of the people perpetrating such accounting scandals ever seem to be punished - and certainly not in a timely manner. No wonder accounting scandals are proliferating. You do start to wonder, is anything safe?

Best Of The Best (LON:BOTB)

(in which I hold a long position)

Tender offer - I'm not terribly au fait with tender offers, as they rarely happen in my portfolio. I understand the basic principle - it's a share buyback, but offered to all shareholders simultaneously, for the same percentage of their holdings. Take up is optional.

Management at BOTB are very open, so I asked for a quick update, to answer my basic questions. I recorded the call (with permission of course), and published it here, in a 10-minute audio. I left the blooper in, as it might amuse people - after all, shares don't have to be deathly serious all the time!

Sosandar (LON:SOS)

(in which I hold a long position)

Your questions please for CEO/CFO interview

My next audio interview will be with Julie Lavington (CEO) & James Bowling (CFO) of this small fashion eCommerce brand. As mentioned before, this is my largest position in the market, and I foresee a very exciting long-term future for the company, due to;

- Bespoke product styling & fit, to suit an overlooked gap in the market

- High levels of repeat business - indicating customer loyalty is building fast - lifetime value of customers should be very high

- Extremely rapid growth (albeit from a low base)

- High gross margins & rapid full-price sell through (indicating that the product is in demand, and allowing inventories to be kept low)

- Scaleable, out-sourced business model, using the successful "test & repeat" model pioneered by BooHoo

- Funded to breakeven

- Above all, this is all about backing experienced & highly capable management.

However, both brokers used by the company (originally Turner Pope, and now Shore Capital) produce research, but don't seem to want anyone outside the City to read it, which is ridiculous. Therefore, many private investors don't understand the business very well. This is evidenced by numerous bulletin board posts which are often factually incorrect, and display little to no understanding of the business.

There also seems to be a malicious element who are anti- Adam Reynolds, who reversed Sosandar into a cash shell originally. I had lunch with Adam recently, and found him to be charming, and very clever/experienced. Nobody is obliged to buy any of his companies' shares, and Sosandar is the only one from that stable which currently interests me.

Anyway, please either leave questions for SOS management in the comments below, or email them to me at QSCquestions at gmail DOT com . Deadline - midnight this Saturday.

Incidentally, I don't have a strong view on the current share price, as the business is still quite early stage. So it's currently worth whatever people are prepared to pay for the shares. Some people think it's expensive (as it's small & loss-making). Other people (e.g. me) think it's longer term potential could be a serious multi-bagger, so I see it as cheap.

My investing time horizons are much longer than for most people. I fully understand that most investors are happy to wait until the company is nearer to, or has passed through breakeven, before investing. That's fine, but of course you would then have to probably pay a lot more for the shares.

In the meantime, I thought it would be useful to help inform private investors about the company & its business model, and of course debate its pros & cons.

Here's the link again to an excellent, fairly recent investor presentation done by Sosandar.

Belvoir Lettings (LON:BLV)

Share price: 92.5p (up 2.2% today, at 11:28)

No. shares: 34.9m

Market cap: £32.3m

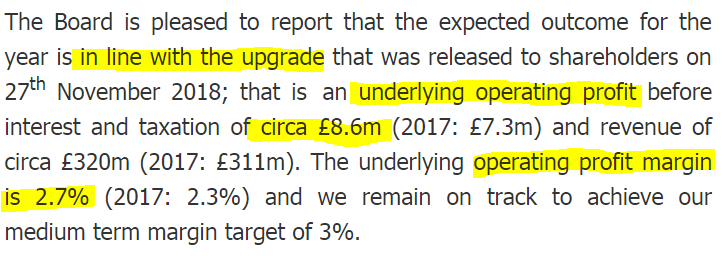

Belvoir Lettings PLC (AIM: BLV), the UK's largest property franchise, today provides the following update on the outcome of the financial year ended 31 December 2018 and the outlook for 2019.

Today's update reads well. I'll summarise the key points;

- Acquisitions have helped drive growth, but good organic growth too

- 2018 results in line with market expectations

- Dividends will be increased further (very high forecast yield of c.8%)

- Franchise model & strong bias towards lettings, has insulated Belvoir from downturn in property market

- Govt ban on tenants fees - from 1 June 2019 - has been mitigated. Initially 6% reduction in gross profit, dropping to 3% (previous guidance was 8%)

Outlook - vague, but upbeat;

The Board believes that Belvoir is well-prepared to both meet the challenges and take advantage of the opportunities anticipated in 2019."

My opinion - this share looks great value, especially the excellent dividend yield. The market has priced the share as if earnings and hence dividend yield are under threat, but that seems misplaced negativity. Therefore I think this share looks worthy of a closer look.

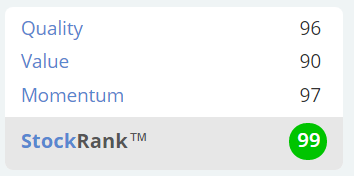

Stockopedia's computers like it too, which is encouraging, as overall that should improve the chances of picking a winner, if used on a whole portfolio;

Foxtons (LON:FOXT)

Share price: 52.6p (down 1.7% today, at 12:33)

No. shares: 275.1m

Market cap: £144.7m

Foxtons Group plc (LSE: FOXT) (the "Group"), London's leading estate agency, issues its trading update for the year ended 31 December 2018 ahead of its preliminary results on 28 February 2019.

(I can't seem to get rid of the bolding, sorry - it was like that in the RNS)

- Lettings business has been resilient, a bit like (on a smaller scale) above, with Belvoir

- Writing off £16m, mainly goodwill, but also £3m cash cost of branch closures

- Branch closures will deliver £3m of cost savings in 2019

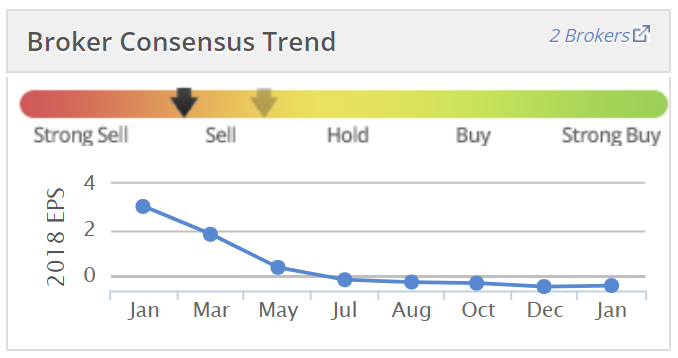

2018 performance in line with management expectations. Although note from the Stockopedia broker consensus graph, that expectations have been considerably reduced over the last year.

Big fall in profitability versus last year;

Adjusted EBITDA(1) for the year is expected to be approximately £3m (2017: £15m). The reduction in Adjusted EBITDA compared to the prior year was driven mainly by the fall in sales volumes alongside planned increases in operating expenses as we invested in our people, technology and brand.

Those are very badly timed increases in opex. You would think that Foxtons would know, and be able to predict, the London property market, but clearly it can't.

Cashflow & balance sheet - today the company says;

Cash flow was good in the period, supporting a strong balance sheet with no debt. Year end cash was circa £17m (2017: £19m).

Checking back through my historic notes, I last looked at the balance sheet here in Nov 2018, finding it adequate - low risk of insolvency.

My opinion - the sales side of the business is really struggling, and has been for a while, so that's not news. Lettings is doing OK. Overall then the business looks to be resilient enough to survive, and to do better when the sales market improves. Cost-cutting in the meantime looks to be a sensible move.

This share is therefore a straightforward bet on the London property market improving in due course.

Flowtech Fluidpower (LON:FLO)

Share price: 117.75p (down 2.5% today, at 13:34)

No. shares: 60.9m

Market cap: £71.7m

AIM listed specialist technical fluid power products supplierFlowtech Fluidpower (LSE: symbol FLO), is pleased to announce the following unaudited update on its performance for the year ended 31 December 2018 and to the period up to this announcement

- Strong revenue growth - up 42% to £111.1m, although only 6% of this growth is organic, the rest from acquisitions

- Gross margins in line with prior periods

- Underlying profit before tax for 2018 expected to be £10.6m to £10.8m

- Debtor days seems a bit high, at 75 days (I prefer 60 days or less)

- Sounds like Q4 might have been boosted by customers stockpiling on Brexit worries maybe?

- Acquisitions from March 2018 are performing in line

- Final dividend will be raised 5% on prior year, which looks in line with forecast

Outlook - self-explanatory;

Within the fluid power market sentiment generally remains positive, and this is reflected in the order book for our PMC division businesses which provides some insight on Q1 2019. The Board is therefore expecting a solid start to 2019 on which we will report in April.

Beyond that our sector shares the general unease with the potential effects of Brexit, although with a strong element of Group revenues generated from repair and maintenance, and refurbishment programmes, coupled with a widely spread sector base of OEM customers, the Board believes the Group has developed a sensible defensive position.

Further progress has been made regarding the Thames Tideway project with work now likely to take place over a three-year period.

The new Executive Management team is fully focussed on extracting synergies and creating a strong platform for future organic and acquisitive growth. Therefore, the Board remains confident in both the strategy and long-term outlook for the Group.

Net debt - reported at £19.9m which doesn't seem excessive to me. It's supporting largish inventories & receivables, so you could regard it as being asset-backed.

My opinion - confident in long-term outlook, means somewhat hesitant in short to medium term outlook. Overall though, the above looks pretty reasonable, in the circumstances.

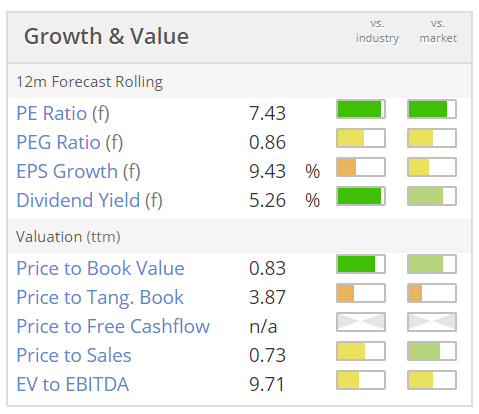

Here are the valuation figures, with favourable scores on PER & divi yield;

It's worth noting that, if you were to adjust out the debt, then the PER would rise to something nearer 10, so maybe not such a bargain? Also, I'm not keen on companies paying dividends which also have significant levels of net debt.

Overall then, to me it looks OK. I can't see any reason to rush out and buy this share now though, given all the macro uncertainty that pertains.

Fireangel Safety Technology (LON:FA.)

Share price: 30.0p (down 23% today, at 14:20)

No. shares: 45.9m

Market cap: £13.8m

Trading update (profit warning)

FireAngel (AIM: FA.), one of Europe's leading developers and suppliers of home safety products, announces a trading update ahead of the release of its audited final results for the year ended 31 December 2018

Profit warning - 2018 results;

... are expected to be below market expectations, specifically at the underlying operating loss level. The figures set out in this announcement are subject to audit.

Quantifying things (helpfully), it says today;

For the year ended 31 December 2018, sales are now expected to be approximately £37.6m (2017: £54.3m) and the underlying operating loss1 is expected to be approximately £2.0m (2017: underlying operating profit of £4.7m).

2018 was a year of significant disruption and distraction for the Company which has been well documented in previous announcements.

There's a note from Stockdale, available on Research Tree today, which shows that this is only a relatively small miss on the 2018 numbers. Just £0.4m lower on revenues, and £0.6m increased loss, compared with previous forecast.

About £1m profit has been shaved off 2019 forecasts too.

What's caused this latest profit warning?

Since release of the Company's trading update on 22 November 2018, sales remained broadly in line with market expectations. However, a warranty provision release which the Board had expected to make has been prudently retained based on current higher product costs, which are described in more detail below. Levels of product returns in 2018 were in line with the Board's expectations.

Net debt - this is the most worrying bit, in my view;

The Company has operated within its banking facilities throughout the year. Net debt at 31 December 2018 was £4.7m (31 December 2017: net cash of £3.3m).

The group has burned through a previously large cash pile, at an extraordinary rate, due to a catalogue of mishaps, and now has net debt. That's a big worry.

Outlook - production problems are ongoing, which increases the current cost or production.

The Board remains confident that its expectations for revenue growth are achievable. Gross margins and profitability are forecast to grow, but the impact of higher current product costs has led to a reduction in the overall level of profitability expected in 2019.

Both the Company and its primary manufacturing partner are focused on reducing production costs. In addition the Company is undertaking a range of other initiatives to improve profitability.

My opinion - it's been an unbelievable catalogue of woes from this company, in recent years. The unavoidable conclusion is that the root cause has been poor management.

I've had worries about this company's solvency for a while, and I consider it uninvestable for that reason. Why take the risk on a turnaround, at a badly managed company (historically anyway), which has burned through a huge cash pile, and is now in debt?

The upside case, is that if the company returns to decent profits, then the shares could multi-bag from here. The new, internet of things, fire safety products look interesting, and there have been some apparently good contract wins recently.

I wish the company luck, but it's not something I would want to gamble on. Let's hope the ticker is not an omen for the eventual shareholder value.

SCS (LON:SCS)

Share price: 228p (down 2.6% today, at market close)

No. shares: 40.0m

Market cap: £91.2m

ScS, one of the UK's largest retailers of upholstered furniture and floorings, today issues the following trading update ahead of announcing its interim results for the 26 weeks ended 26 January 2019 on 19 March 2019.

Overall, trading has been OK;

The Group has traded in line with the Board's expectations in the first half of the financial year. Whilst we are mindful of the risk from the impending Brexit outcome, we believe the Group's increasing resilience puts the business in a strong position to manage the continued economic uncertainty and take advantage of opportunities.

LFL order intake - growth is still positive for H1, but has slowed down somewhat.

When I last reported on ScS, here on 25 Oct 2018, LFL order intake growth for the first 12 weeks of FY 07/2019 was up 4.5%

Today, the company is saying that LFL order intake growth for the first 26 weeks is up 1.5%. Thi suggests that the later 14 week period must have had flat, to slightly negative LFLs, to have brought down the overall 26 week average from +4.5% to +1.5%. Even so, it's still not a shabby performance, given macro headwinds & deteriorating consumer confidence.

House of Fraser concessions - have now all ceased trading, so we can forget about that issue.

Valuation - remains attractively low, as I've mentioned several times recently.

Low PER, high dividend yield, and a strong balance sheet stuffed with (customers') cash - is a very attractive combination.

My opinion - this sofa retailer has remained resilient in tough market conditions. The share looks attractive, providing we don't see a meltdown in consumer confidence.

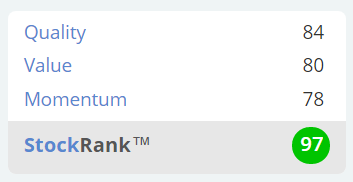

StockRank remains exceptionally good;

T Clarke (LON:CTO)

Share price: 97p (flat on the day)

No. shares: 42.9m

Market cap: £41.6m

TClarke plc ("TClarke" or the "Group"), the Building Services Group, announces a year end trading update for the financial year ended 31st December 2018.

It's an in line update;

Year end cash is £12.4m

Order book - is up decently, standing at £411m (up 22% Y-on-Y

My opinion - it's good to see the company trading well, and having a good outlook.

I looked into this group quite closely a few years ago, and in the end decided it's not the sort of sector I would want to invest in going forwards. The margins are too low, and these are often large, complex contracts. So the risk of something going wrong, on low margin contracts, would worry me too much to want to hold this share.

All done for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.