Good morning, it's Paul here, for Thursday morning's report.

Please note that I was adding new sections to yesterday's report all day, up until finishing at 11:30pm! So it covers 10 companies in total. The new sections added later in the day/evening were: LoopUp, Redde, Topps Tiles, The Works, and Purplebricks. To see the full report, please click here.

Associated British Foods (LON:ABF)

Primark - is owned by ABF. It's a large cap obviously, but noteworthy for its comments today about retail. When the woes of the High Street are mentioned, it's often the internet that is blamed - rightly so, as something like 20% of retail sales in the UK have migrated online - devastating for physical retailers.

However, few people mention the impact on other clothing retailers & department stores, of the astonishing success & expansion of Primark. I think Primark's success probably had a lot to do with the demise of BHS, for example. Primark will also have eaten into the market share of many other retailers too. It's classless too. Plenty of middle class people shop there, jokingly calling in "Primani", so it's not just the lower priced chains that will have suffered.

I always used to buy my basics from M&S, but now get them from Primark instead, at about a third of the price, for product which does the same job. Only the other day, I bought a rucksack full of holiday basics - 15 pairs of socks, 6 undercrackers, and 4 swimming shorts, all for about £36. Why go anywhere else, and pay vastly more?

This is what ABF says today about Primark recent trading;

Sales at Primark in the year-to-date were 4% ahead of last year at constant currency and actual exchange rates, driven by increased selling space partially offset by a decline in like-for-like sales.

In the UK the sales growth recorded in the first half continued in the third quarter and Primark recorded a further significant increase in market share. Like-for-like sales were held back by unseasonable weather in May which compared to a favourable market environment in the corresponding period last year. We have seen an improvement in sales in June.

That echoes the comments made yesterday by comparatively miniscule Sosandar, giving credence to what they said.

Weather is very important for clothing retailers. Last year we had the longest, hottest summer since 1976 (good for clothing sales & margins). This year was lousy weather, until about a week ago, with just one or two brief interludes of nice weather previously. This will undoubtedly have caused mayhem for clothing retailers, as in my experience, typically sales are about +/-30% weather-dependent at this time of year. When good weather does happen belatedly, there is usually a sudden surge of catch-up sales. Therefore, I reckon clothing retailers should be doing very well right now (last week or two).

Sosandar

A couple of brief additional comments.

As we heard from Sosandar (LON:SOS) yesterday, the poor weather in April-May led them to hold back marketing spend, which has resumed now the weather is better - to give a better return on investment. That makes complete sense to me, but I also understand the more bearish point of view, that Q1 sales should have grown faster, even without the extra marketing spend.

I noted that Graham tweeted that he's sceptical of the +122% increase in repeat business. I think he's wrong to be sceptical about that - this is actually probably the single main reason to be bullish about Sosandar - namely that once a new customer is recruited, they tend to be very loyal to the brand, or many do anyway.

Perhaps a more credible statistic, for sceptics, is in the latest house broker update yesterday, which says that in FY 03/2019, 54% of all customer orders were repeat business. That's a tremendously impressive statistic, if you think it through, given the rapid sales growth that year. i.e. I would have expected most business to come from new customers, not repeat customers, in a rapidly growing business.

Note that the house broker has slightly trimmed current year (FY 03/2020) revenue forecast from £9.5m to £9.3m, but the adjusted PBT remains unchanged at a loss of £-1.6m (down from £-3.6m LY). As I mentioned yesterday, management are genuinely confident about hitting these numbers, despite the modest growth in Q1.

The share is riskier now, because the company has to deliver a knock-out autumn/winter season. If that happens, as management expect, then I would expect the growth story to be back on track, and the share price to respond strongly upwards.

If they fall short of forecast, by a significant to a large extent, then I think we would be looking at further share price weakness, and dilution from another fundraising. If forecasts are hit, then no further fundraising would be necessary.

Of course, all of this is in the price - it's dropped by about two thirds from the peak. That's understandable, as sales growth has slowed down dramatically, whatever the reasons given.

The way I look at it, is that the share price is volatile, and long-term holders like me just have to live with that & are currently dug in, with hard hats on. Yesterday won't go down in my diary as a particularly pleasant day. Such is life in the micro caps space.

Today's announcements are few & not very interesting, so I'll circle back to something that was on my to do list from earlier this week;

Johnson Service (LON:JSG)

Share price: 162p

No. shares: 369.7m

Market cap: £598.9m

Trading update (from 2 July 2019)

JSG, a leading UK textile rental provider, is pleased to provide a trading update for the six months to 30 June 2019.

This used to be a dry cleaning business, but sold that off. It now concentrates on textile hire - e.g. tablecloths, napkins, and uniforms, for restaurants, & hotels, plus workwear for other sectors.

Trading is going well;

Following the update in early May trading has continued to be strong, with encouraging levels of organic growth, and we now expect results for the full financial year to be slightly ahead of current market expectations.

Very good.

Operational update - again, sounds fine;

Planned capital investment across the business is continuing in order to increase capacity and productivity for the busy summer months. As mentioned in May, construction of our new Leeds hotel linen site remains on schedule and within budget and is expected to be operational in the second quarter of 2020.

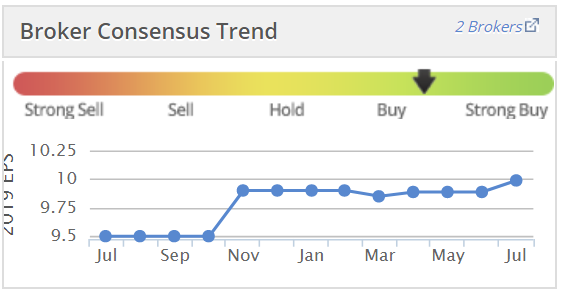

Valuation - note that the broker forecasts have been creeping up, a good sign;

Using that 10.p EPS forecast, and the share price of 162p, the PER is 16.2

However, the business has a fair bit of debt, which needs to be taken into account, so the real PER is higher.

My opinion - things are going fine now, but remember that this business is highly cyclical. If an economic downturn is on the cards, then watch out! Look back at the chart, and you can see that the share had been trading at over 400p in 2006, collapsed in 2007, to a low of about 10p 2009. It looked likely to go bust at the time, with problematic bank debt, and big write-offs when clients went bust (rendering their branded workwear worthless).

For this reason, I think it's probably best to avoid this share, now that we've got an economic recovery that's very long in the tooth, and some signs of economic clouds on the horizon. I would definitely not want to buy anything this cyclical, and with rather too much debt on the balance sheet.

The hospitality sector seems to have significant over-capacity at the moment, so it seems inevitable that, at some point, JSG could suffer from clients closing sites & hence reduced demand for its services.

On the other hand, if you don't think a recession is likely, then this share might continue doing well, who knows? For now anyway, the sun is shining;

The long-term chart strikingly shows what happened in the great financial crisis:

Gresham Technologies (LON:GHT)

Share price: 115p (up 2.2% today, at 15:46)

No. shares: 68.2m

Market cap: £78.4m

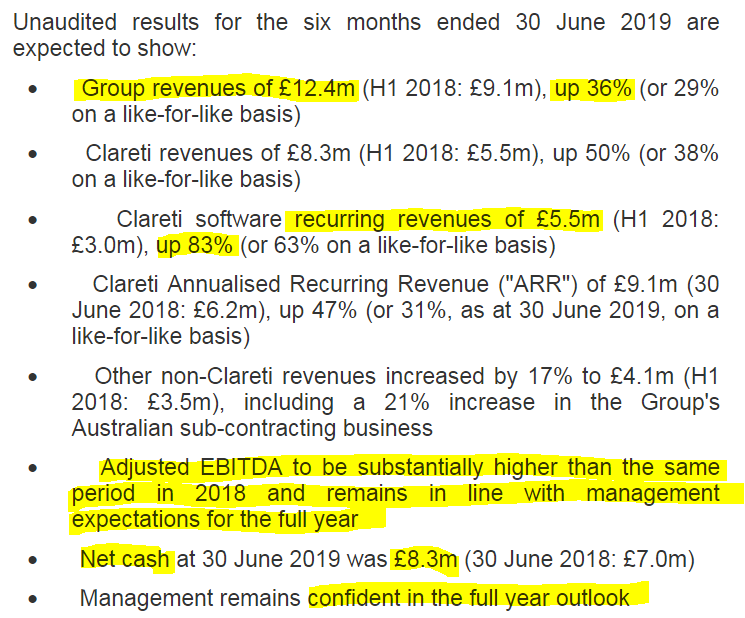

Gresham Technologies plc (LSE: "GHT", "Gresham" or the "Group"), the leading software and services company that specialises in providing real-time data integrity and control solutions, is pleased to provide a trading update for the half year to 30 June 2019.

I'm flagging this to readers, as it might be worth a closer look, for people who understand the company (I don't). The reason being a positive update today;

Some nice stuff there.

Valuation - this is where it comes unstuck for me. The latest broker note on Research Tree shows adj PBT of only £1.0m in FY 12/2019. That's adj EPS of only 1.4p, rising to 2.1p in 2020.

At 115p per share, that means the 2019 PER is 82, and 2020 PER is 55

My opinion - maybe readers can explain to me why this company is worth such a high rating?

It would have to have explosive earnings potential, way above existing forecasts, to justify such a high valuation.

That's me done for today, there's nothing else of interest.

See you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.