Good morning, it's Paul here!

Internet disruption

This is probably the biggest investing theme of our times. As I've mentioned many times before, many sectors have already, or are in the process of being turned upside down by the internet. Therefore I feel it's essential to carefully think about business models of all companies we invest in, and ponder what opportunities & threats might emerge from the internet.

A wider issue is that internet disruption has made value investing much more dangerous than in the past. We can no longer just assume that mean reversion will kick in, and low PER stocks/sectors gradually recover. All too often, low PER stocks now are companies that are struggling to stand still, as internet disrupters eat away at their market share (e.g. estate agents Foxtons (LON:FOXT) or Countrywide (LON:CWD) ).

It also presents bargains (such as Next (LON:NXT) sub-£40 recently) where the market seemingly ignored its highly successful internet business, and priced it wrongly as a declining business.

Why am I mentioning this again? Well, I read yesterday that Tom Winnifrith wrote about a tiny investment being made by Concha (LON:CHA) in a startup called UcaDO. This company intends to offer a free property listings site. This is intended to not only cut out the need for estate agents, but presumably also cuts out the need for Rightmove (where I have a short position), Zoopla, etc.

The idea is that UcaDO hopes to make money from charging relevant businesses such as removals firms, tradesmen, etc, to connect with people who are moving house, and UcaDO earns referral fees. That sounds a neat idea. Although whether the revenues would be enough to cover the considerable costs of building & maintaining a listings site, is open to question. Above all, the marketing costs of telling people that the free property listings site exists and persaude them to use it, would be very large. A quick google search shows there are other free listings sites already out there.

Then it struck me that surely the above model is ideal for Google? They've got the people & computing power to knock up a simple property listings sites in no time. If they let property agents, and individuals list properties on it for free, then I imagine a fairly quick exodus from Rightmove, Zoopla & the rest, would be likely to occur. After all, with estate agents already under a lot of pressure, surely they would welcome the chance to eradicate fees from property listing websites?

I know Google did ponder this idea a few years ago, but decided against it. That doesn't mean the idea won't resurface. OR that another tech giant may not decide to have a go at the same area - Amazon perhaps?

All the above makes me feel that the supernormal profits made by Rightmove (LON:RMV) may not last very much longer. Therefore, that is a good example of a share which I think could be a terrific short, if the original internet disrupter is itself then disrupted out of existence. At the very least, I wouldn't touch it as a long. Why would you? There's little (if any) organic growth to be had, it's on a high PER, and profit margins are so high that a new competitive threat (from a different angle) could prove destructive.

Whilst the above has focused on Rightmove (LON:RMV) it was one of the things that prompted me to gradually sell out of Purplebricks (LON:PURP) too. That has been a wonderful investment for me, but I feel the bears make very good points about the flaws in its business model. So I've sold out.

Over the weekend I'm going to do more thinking about all my other long positions, and ponder which ones could be vulnerable, and see if there's anything else that needs weeding out.

Revolution Bars (LON:RBG)

Deltic merger proposal - this looks potentially interesting.

I'll circle back to it later today, as I want to quickly publish a couple more sections.

EDIT: I'll revisit the Deltic proposals later - maybe tomorrow or over the weekend, as I want to go through the detail properly, not rush out a response.

AirBnb & ZANE

I'm currently staying in an AirBnB apartment here in Lower Marsh Street, near Waterloo station, London. AirBnB is another great example of internet disruption - of the hotels & travel sector.

I booked a lovely duplex apartment in London, as an 80th birthday treat for my Mum. We were lucky enough to be invited to a lunch at the House of Lords by my favourite charity, ZANE - which does remarkable work alleviating the suffering of the elderly, curing club foot in children, and numerous other projects in devastated Zimbabwe. Even though I don't have any connection with Zimbabwe, it's one of those rare charities which is run efficiently, and alleviates a great deal of human suffering with little resources - all provided by private donors. It's inspiring to hear about their work, and of the terrible state of affairs in Zimbabwe. Many of the pensioners being helped by ZANE actually fought for the British armed services, but have been completely abandoned - a terrible gap in the "Help for Heroes" campaign which, to date seems to have overlooked some of the most deserving cases - the ex-servicemen abroad. I should put on my thinking cap about doing a charity fundraising for ZANE myself. Maybe it's time to dust off my jogging trainers?!

So I thought it would be nice to turn the lunch into a 2-day mini break for Mum. She's absolutely loved it, as have I. The size, and standard of accommodation available on AirBnB (if you pick carefully) is astonishingly good, compared with hotels. Having done this once, I don't think I would ever book a London hotel again - the value for money is just so poor compared with AirBnB.

I'm sure that business travellers will keep using hotels, but for leisure travellers, AirBnB really is becoming a bit of a no-brainer. It's easy to find the best properties - you just look for large numbers of 5 star reviews from people who have stayed there.

So would I buy shares in any hotel companies? Not a chance! Oh, just remembered that I do actually hold shares in Elegant Hotels (LON:EHG) ! There's also the issue of possible over-capacity with hotels - there seem to be so many new ones popping up - maybe evidence of ultra-low interest rates causing misallocation of capital?

I'd better write something about small caps, before people become restless. Although I do organise these reports into sections, with headings, so that you can quickly skip anything that fails to engage your interest.

Accrol Group (LON:ACRL)

Share price: SUSPENDED

Trading update & temporary suspension of shares - sorry, I've only just noticed this announcement. I would have led with it above if I'd spotted it earlier. This looks to me a potentially disastrous announcement.

This company processes paper to make toilet roll & other tissues.

I've always been wary of the risks with this share. I reviewed the admission document here in Nov 2016, finding too many red or amber flags to consider it investable.

It's the latest high dividend yield Zeus float to go wrong.

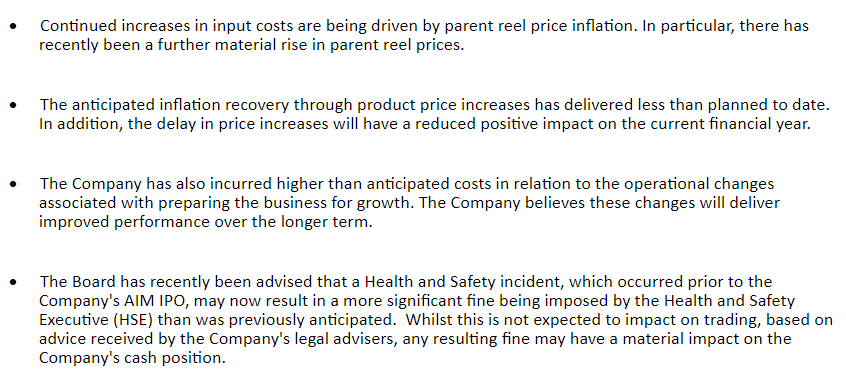

Trading has deteriorated;

The Company is currently experiencing more challenging trading conditions which are having a significant effect on the trading performance of the Company for FY18.

These factors are likely to have less of an impact on the Company's trading performance in FY19.

It then goes on to specify what these issues are;

The announcement then gets worse & worse...

Whilst the revenue expectations for FY18 remain broadly in line with market expectations, the Board has reviewed its expectations of the Group's performance.

Based on current market conditions, the Board now anticipates that earnings will be significantly below existing market forecasts for the current financial year, and as a consequence net debt will be correspondingly higher at year end.

Dividends - are to be reviewed - that's code for that the divis will be cancelled, I reckon.

Review of the business will be undertaken by the new CEO. So expect exceptionals, restructuring, etc.

Suspension - here comes the most worrying bit, the dreaded "pending clarification" - which usually means that a company is about to go bust;

Whilst the Board considers the anticipated impact of the above on the Company's net debt position, pending clarification of its financial circumstances, the Company has applied for suspension of trading in the Company's ordinary shares on AIM with effect from 7:30 a.m. today.

My opinion - a total disaster.

It looks like the company is in real trouble with debt. I imagine some urgent phone calls are being made to big shareholders, to gauge support for an equity fundraising, as it sounds like one may be needed.

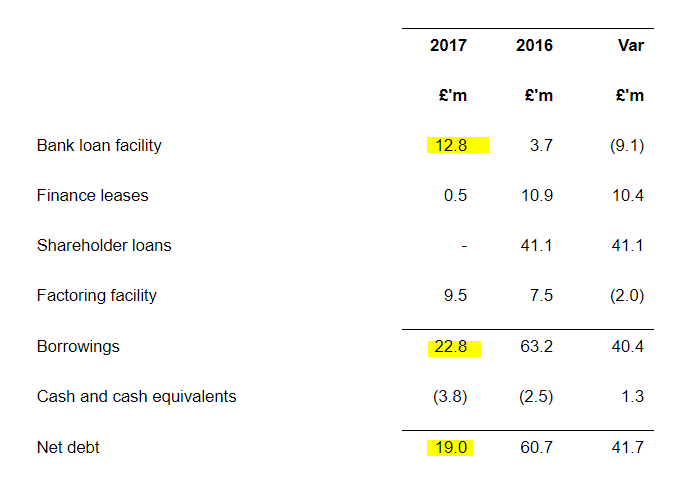

Although the last reported net debt at 30 Apr 2017 doesn't look particularly worrisome;

So providing that situation hasn't got a lot worse, then maybe the bank will be accommodating?

Overall though, it looks as if this share is likely to come back from suspension. I'd be very surprised if a £122m market cap company is put into Administration over £19m of (last reported) net debt. But it depends how bad the trading outlook is, which we don't really know.

Sadly, I think this share could re-open maybe 50-60% lower, if there are still unanswered questions. However, if the shares return to trading together with an announcement that the bank has waived convenants, and is supportive, and/or that major shareholders have agreed to support an equity fundraising, then the damage might be more limited?

Shareholders should however brace yourselves for a hefty loss. I hope the situation is fixable.

This type of situation does raise the question of how IPOs work, This company floated less than a year ago.

EDIT: apologies, factual error, it actually listed in Jun 2016, so just over a year ago.

The founder shareholders have gone off with the money. Will they now have to repay that money to the shareholders who got stuffed with the stock? They jolly well should! There's a strong argument for having clawback arrangements, or money held in escrow for say 1-2 years, and only released in stages to the vendors, with new floats.

There are only a handful of small cap Instis that matter - Miton, Hargreave Hale, Woodford, Henderson, and one of two others. So they really need to kick some butt here, and only agree to buy into new floats if the vendors agree to escrow & clawback arrangements on the sales proceeds. Because as things stand, too many floats look like vendors stitching up the buyers by selling out ahead of problems emerging.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.