Good morning, there are quite a few companies making announcements today.

- T Clarke (LON:CTO)

- XP Power (LON:XPP)

- Seeing Machines (LON:SEE)

- SCS (LON:SCS)

- Rosenblatt (LON:RBGP)

- Portmeirion (LON:PMP)

T Clarke (LON:CTO)

- Share price: 104.5p (-11%)

- No. of shares: 43 million

- Market cap: £45 million

This sounds fine at first:

- Revenue +12%

- Underlying op. margin up to 2.9% (from 2.6%)

- Dividend increased

- Full year performance trending in line with expectations

So why are the shares down? A few issues:

Firstly, the Order book (very important for a contractor!) is merely flat.

The CEO comments:

We remain very selective about the quality of the work that we take on and despite some competitive pressures, our order book has been maintained at £370 million.

T Clarke helpfully breaks this down, saying that "£182 million is secured for 2020 and £34 million for 2021 and beyond."

I'm not a sector expert, but I do know that revenue visibility in this sector is not great. The revenue forecast for next year is c. £360 million, versus £182 million secured so far. So there is a lot of business which needs to be won over the next six to nine months to help them achieve that. And just as importantly, they need to remain prudent and not bid for low-quality work.

Secondly, net cash has reduced, with the company saying that this reflects "the Group's typical working capital profit and the cycle of our contracts". The company doesn't give us any additional information such as the average or minimum net cash balance. These would be helpful, though it sounds like the company should be fine from a cash point of view (it has £25 million in banking facilities).

Pension scheme deficit increases to £26 million, from £19 million, thanks to lower interest rates.

Outlook - the company very helpfully states what the market expectation are. Good job! Underlying EPS this year is expected to come in at 17.5p.

The Board is "cautiously optimistic". I think we have to price in the increased possibility of a revenue miss for 2020, and that's what the market seems to be doing this morning:

Our long-standing client base, particularly in the London market, is frustrated by the ongoing political uncertainty and we are seeing some new schemes being held back as a result. Despite this, we remain busy and there are many active discussions with our clients indicating that schemes could be accelerated once the political situation becomes clearer.

My view

I believe these companies should be priced cheaply, so I suspect that CTO is priced about right.

While it may look too cheap at current levels, you have to bear in mind that things can easily go wrong and cause several years of weak performance - this happened as recently as 2012 to 2015.

For my part, I find it extremely hard to predict how a contracting business will perform, and I suspect that even those inside the company find it difficult!

Whatever its long-term effects may be, Brexit is clearly creating some uncertainty in the short-term which is inhibiting some economic activity. Rightly or wrongly, there are people who believe that events over the next few months may be damaging to their plans, and they are waiting to see what happens before committing funds.

In this environment, it's only fair to price CTO and other contracting firms a little more keenly.

We also have to accept that growing revenues by 6% in 2020 (in order to hit forecasts) doesn't seem particularly likely, when the order book is flat.

In summary, the market has rationally marked this one down for now.

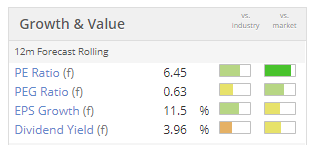

Stats as of last night:

XP Power (LON:XPP)

- Share price: 1946p (-4.6%)

- No. of shares: 19 million

- Market cap: £374 million

XP Power, one of the world's leading developers and manufacturers of critical power control solutions for the electronics industry, today announces its interim results for the six-month period ended 30 June 2019.

These shares have come off a lot over the past year.

Profits had gone up consecutively for six years, leading to a big re-rating, but that record has been broken now.

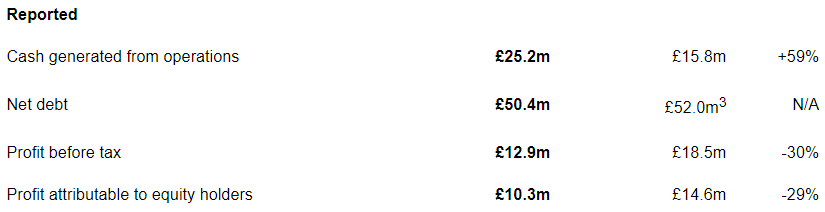

Diggint into the income statement, I see that there was a big increase in operating expenses: they increased to nearly £30 million, from less than £25 million.

The company reports "adjusted operating expenses" to strip out certain items, but these also made a significant increase. It says that it spent heavily in Product Development, expanding its engineering capabilities to take on "more sophisticated and complex programmes with many of our key customers". It says that competition in these complex projects is less crowded.

That might very well be true, but it's very difficult for me to judge. How can we determine if funds are being spent wisely on future capabilities? Note that £4.4 million of expenses during the period were capitalised, meaning that they do not even appear on the income statement.

One thing I will say is that I have a positive impression of XPP's long-term track record and culture, so I tend to think that it deserves the benefit of the doubt.

There was also a much bigger finance charge, due to "increased average borrowings... and the requirement to build additional inventory..."

Note that period- end net debt has actually fallen, year-on-year. This is why investors should be curious about the average net cash/debt situation, not just the position at the end of reporting periods.

What else is going on?

There was margin erosion due to trade tariffs by the USA on China, and other non-political factors named as "product and geographic mix, and the impact of component price inflation incurred in 2018 when supplies of critical electrical components tightened".

Outlook

Chairman comments:

We are well positioned to take further share and will benefit from any recovery in the Semiconductor Equipment Manufacturing sector. While we remain mindful of potential short-term risks and macroeconomic challenges, we continue to expect an improved revenue performance in the second half of the year as a result of the increase in our order book since the year end.

My view

Based on the last few years of observing this company from a distance, I maintain my positive impression of it.

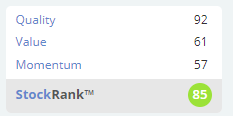

It enjoys a QualityRank of 82, helped by Quality metrics such as an ROE of 24%.

Therefore, if I had been thinking about buying into it for some time, and if I believed in the Product Development story, perhaps with the help of some industry expertise, I'd probably be a keen buyer of these shares today.

Those of you who have been following it more closely than I may be tempted. The reasons for the loss of earnings momentum seem believable to me, and at least to some extent temporary. As a long-term buy-and-hold idea, I can definitely see some reasonable arguments to be made for this share at current levels.

Seeing Machines (LON:SEE)

- Share price: 4.5p (+2%)

- No. of shares: 3.4 billion

- Market cap: £151 million

I don't get this one. Revenues for FY 2019 are due to come in at A$31.8 million, or £18 million. This is lower than the prior year.

Annualised recurring revenue is now A$12 million (£7 million).

The cash balance is more impressive, at A$64 million (£37 million).

But all of these numbers seem rather small in comparison to the £151 million market cap.

Thanks to my experience with Tesla (short), I am immediately sceptical whenever I read about autonomous vehicles and self-driving cars. Seeing Machines wants to be considered a player in this field:

The Company's Guardian Backup-driver Monitoring System ("BdMS"), a retrofit system designed specifically for autonomous vehicles, was launched to the market during the year and Seeing Machines secured its first contract with one of the world's leading self-driving car companies based in North America.

Forecasts

Revenues are forecast to increase by 66% next year and then by more than 40% in 2021. But the expense bill tends to be enormous, and heavy losses are expected for the foreseeable future.

My view

Very high-risk, especially at a big multiple of the cash balance.

SCS (LON:SCS)

- Share price: 220p (+1.6%)

- No. of shares: 40 million

- Market cap: £88 million

ScS, one of the UK's largest retailers of upholstered furniture and floorings, today issues the following trading update for the 52 weeks ended 27 July 2019 ahead of announcing its preliminary results on 1 October 2019.

This short update is in line with expectations, so I won't dwell on it.

Pleasingly, there is a bounce back in performance at SCS, due to the nonrecurrence of the very hot weather (and World Cup) of 2018.

It's easy to be cynical when weather is trotted out as an excuse, but in this particular instance, SCS has reported like-for-like order intake growth of 4.2%, thanks to the weak comparatives created last year. Kudos to them for coming up with the goods at a later date.

I also see that Paul had positive words to say about SCS in March. Although he reckoned that big ticket items in out-of-town centres were generally selling well, e.g. at DFS Furniture (LON:DFS). So he couldn't quite pin down whether the performance by SCS was better than its peer group.

This share enjoys an enormous StockRank of 98, with some amazing quality and value metrics - a rare combination! But it carries retailer risk, and after so many blow-ups in the sector, people are rightfully cautious.

As retailers go, this looks like one of the better ones. Personally, I know my limitations, and so I'm content holding Next (LON:NXT) and none of the others.

Rosenblatt (LON:RBGP)

- Share price: 95p (-6%)

- No. of shares: 80 million

- Market cap: £76 million

This professional services group says that it's full-year expectations are unchanged, but with slightly more of a H2 weighting. That alone is usually worthy of a small dip in share price.

But it also says that corporate transactions have slowed down in advance of Brexit. This uncertainty will surely linger for at least the next three months:

...the Corporate division, which is focused on commercial transactions, remains impacted by the cautious business environment in part caused by Brexit uncertainty. When this uncertainty clears, the indications are that there will be an increase in the volume of transactions, which have been delayed, including M&A from which the Group will benefit.

Knocking the shares back by around 6% seems fair to me.

Portmeirion (LON:PMP)

- Share price: 1000p (+1%)

- No. of shares: 11 million

- Market cap: £110 million

Everything is in line with expectations. I continue to have a positive view of this stock and to think that its shares look decent value, in line with the StockRanks.

I hoped to write more in the report today, but my mental bandwidth has been exceeded - sorry about that. Paul returns tomorrow, and is taking care of the report next week, too.

Have a great evening!

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.