Good morning!

Today I will cover Patisserie Holdings (LON:CAKE), Victoria (LON:VCP), Zotefoams (LON:ZTF), Elektron Technology (LON:EKT) and PCF (LON:PCF).

Patisserie Holdings (LON:CAKE)

I thought I'd add a quick preamble on Patisserie Holdings, as news flow is expected later today. The shares remain suspended.

Timeline of recent RNS announcements:

12 October (1/3): Finance Director arrested by police and released on bail.

12 October (2/3): Immediate cash injection of £20 million is required to prevent administration. Historical financial statements likely to have been affected by fraudulent activity and mis-statements. Rough estimate/guess is that revenue and EBITDA before exceptional costs for the year ending September 2019 could be £120 million and £12 million, respectively. But this is highly uncertain.

12 October (3/3): 31.4 million new shares placed at 50p.

16 October: General Meeting called for 1 November (i.e. for today) to vote through the fundraising.

24 October (1/2): Disclosure that the grant of options to the CEO and FD in 2015 and 2016 was not appropriately disclosed and accounted for in CAKE's financial statements.

24 October (2/2): HMRC's winding up petition against CAKE's principal trading subsidiary is dismissed.

26 October: The FD resigns with immediate effect. CAKE reserves its position in respect of any potential claims it may have against him.

31 October: In response to an article by The Sunday Times, restaurateur David Scott says he has no intention and no interest in acquiring any shares in Patisserie Valerie.

1 November: That brings us to today. Watch out for an RNS or two!

Today's update

Sadly, the company is not in a position to provide us with any useful information today. See the RNS. It doesn't want to prejudice the investigations from "multiple regulators and authorities".

The comment thread below always contains useful contributions. Thank you to the reader who shared this link to a Reddit thread.

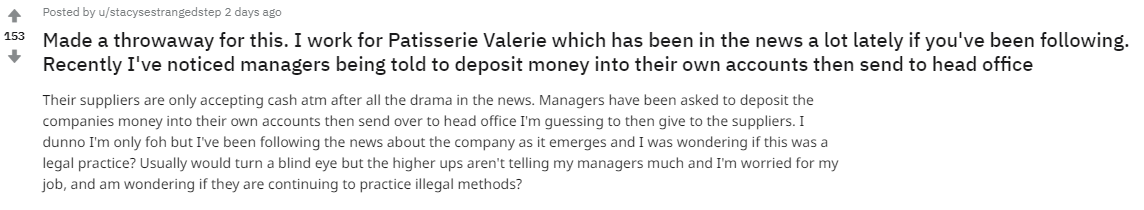

On that thread, an anonymous user has asked the following question:

It could be a fake story, who knows? But if it's true, I think it's safe to say that strange financial behaviour like this would be a red flag of huge proportions.

The user says it was explained to their manager over the phone.

If it's true, what could be the explanation for this?

Victoria (LON:VCP)

- Share price: 388.5p (+2%)

- No. of shares: 125 million

- Market cap: £487 million

Following on from our coverage yesterday, today we have confirmation that Victoria has achieved a credit rating from S&P for its new senior secured notes. The rating is BB-.

Netflix is another example of a company with a BB- credit rating. And here are the countries with BB- sovereign credit ratings (from Wiki):

You can hopefully see that it's not exactly the Premier League of credit ratings, but it's not the Southern League Division One West either. There are much weaker companies and countries than these.

Well done to VCP for getting these credit ratings from S&P and Fitch.

In case there is any doubt, I would not consider the equity to be of any interest whatsoever.

Zotefoams (LON:ZTF)

- Share price: 561p (+4%)

- No. of shares: 48 million

- Market cap: £271 million

Zotefoams, a world leader in cellular materials technology, today provides a trading update for the third quarter ended 30 September 2018.

We don't cover this one very often. The financials say that it is a growing and profitable business, so I thought I would let it have a mention.

Key points from this update:

- new all-time high for Q3 sales

- full-year revenues and PBT expected to be slightly ahead of market expectations (though there is sensitivity to exchange rates)

- Year-to-date revenues +16%, even with a currency headwind

- the main foam product with broad applications is up 7%, but the high-performance products for specialised applications are up 97%. These are used in footwear and aviation and for insulation.

- capacity expansion programmes going well in the UK and USA.

My view: it's an impressive update and makes me think that this unusual company is worth researching in greater detail.

Be prepared to pay up for it, though:

Elektron Technology (LON:EKT)

- Share price: 42p (+17%)

- No. of shares: 186 million

- Market cap: £78 million

Elektron Technology plc (AIM: EKT), the global technology group, is pleased to provide an update on trading for the third quarter ended 31 October 2018.

The last time I covered this, it issued a trading update for H1 that was ahead of expectations.

Now we get a Q3 update that is ahead of expectations. Very nice!

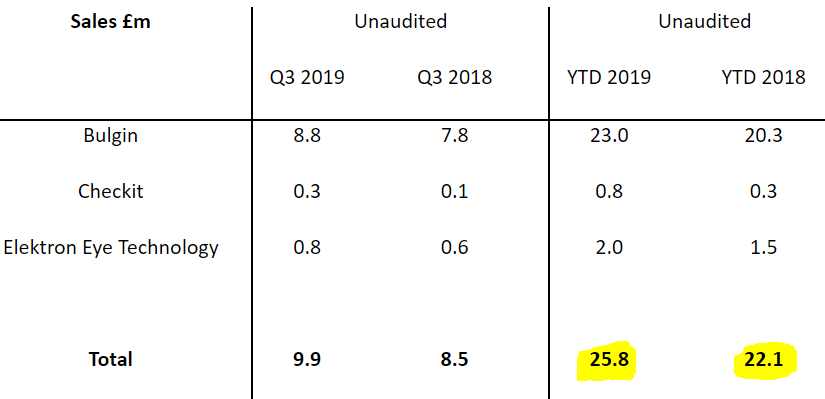

This table breaks down sales performance by subsidiary. I've highlighted the total year-to-date sales, which are up by almost 17%.

Sales at Bulgin (which designs and manufactures sealed connectors and components for harsh environments) are now expected to be significantly ahead of management's expectations (these expectations having already been upgraded earlier this year).

The other much smaller subsidiaries are also doing very well.

The RNS does not say what the new or old expectations are. There is a note from Equity Development with the following changes to forecasts:

- FY 2019 reveune forecast £33.5 million (raised from £31.9 milion)

- FY 2019 EBIT forecast £4.6 million (raised from £2.7 million)

- FY 2019 cash forecast £9.7 million (raised from £8.3 million).

My view - it looks like there is an impressive outperformance coming up, so well done to the company for that.

The Equity Development note has an 83p share price target on the basis that its peers are trading at EV/EBIT multiples of 14.9x (Bulgin) or EV/sales multiples of between 4.5x-8.1x (Checkit and EET). The obvious objection to that sort of analysis is that its peers might also be overvalued.

At the end of the day, I don't feel like I have any special insights into Elektron's products and markets. So I will leave this one to others to research in greater detail.

PCF (LON:PCF)

- Share price: 36p (-1%)

- No. of shares: 214 million

- Market cap: £77 million

Completion of Acquisition and Issue of Equity

(Please note that I currently hold PCF shares.)

This is worth mentioning in passing, because I omitted it from recent coverage of this share.

PCF has now completed its first acquisition. It has bought Azule Limited, which provides funding and leasing services to the broadcast and media industry.

Typical use cases shown on Azule's website are as follows:

Perhaps you’re a self-employed owner-operator buying your first (or next) camcorder? Maybe you’re a financial director tasked with finding the money to upgrade your edit suites? Or could you possibly be a hire company boss looking to overhaul your touring lighting rig? Whatever your circumstances, at Azule we have the tools, experience and contacts to help you to get the most appropriate asset finance deal possible.

The amount paid is £4.1 million plus up to £1.5 million over the next two years, i.e. max total is £5.6 million.

Azule recently generated annual PBT of £0.8 million. So the trailing P/E multiple on the purchase is perhaps 8x or 9x?

The recent ROE at Azule was 27% - excellent.

I'm going to guess that Azule's book value is now somewhere between £2.5 and £3 million, if PBT of £0.8 million represented ROE of 27%. So the purchase price is a considerable premium to book, but is justified by the high returns.

My view - I find it a surprising asset class, but it fits with PCF's diversification and acquisition strategy as it looks to reach its £750 million lending portfolio target by September 2022.

Regular readers know that I generally try to avoid buying shares in acquisitive PLCs.

But I view PCF as a special situation: its new banking license has enabled it to achieve excellent organic growth and should also make it possible to significantly improve the performance of companies it acquires.

Azure will now have access to a much cheaper funding source (PCF's retail deposits) than it previously had access to, which should make a big difference to its future profitability.

While I still value PCF's organic growth more than I value its growth by acquisition, I believe that the acquisition strategy has a lot of potential to succeed. I watch with interest.

That's about it for today's RNS feed as far as I'm concerned.

Have a great evening,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.