Good morning!

The World Cup dream is over for another four years as far as England is concerned. No shame in getting to the Semis, though.

Some stock market news on the radar today:

- ASOS (LON:ASC) - trading statement

- Portmeirion (LON:PMP) - trading update

- Indivior (LON:INDV) - guidance below expectations

- Dart (LON:DTG) - final results

- Polar Capital Holdings (LON:POLR) - AuM update

ASOS (LON:ASC)

- Share price: 6055p (-7%)

- No. of shares: 83.6 million

- Market cap: £5,062 million

ASOS is far too big for this report. It has knock-on effects across fashion retail in general, so I keep half an eye on it.

It has a year-end in August. This update completes the picture to June.

Good:

- Gross margin up 130bps, ahead of plan

- Market share growth continuing

Bad:

- FY 2018 sales set for the lower range of guidance (+25% to +30% growth)

Neutral:

- FY 2018 PBT to be in line with consensus

- Medium term guidance unchanged for +20% to +25% sales growth p.a., 4% EBIT margin.

It's a very low EBIT margin, whatever way you look at it.

That doesn't necessarily mean poor returns for shareholders. ASOS's return on capital has been very good:

So I don't automatically rule out a company with a weak operating margin. If it generates lots of sales relative to its asset base, it can still generate fine returns (the metric you need to check for this is asset turnover - it's on the StockReport).

The ASOS valuation remains at the adventurous end of the scale, however, and the share price is highly sensitive to changes in sentiment.

I can see forecasts for net income of £81 million in FY 2018, followed by £100 million in FY 2019 and £125 million in FY 2020.

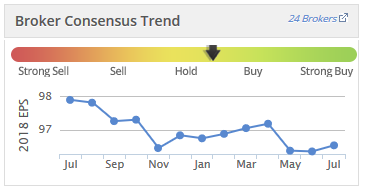

I suspect that these forecasts require a strong showing relative to the planned 20%-25% p.a. sales growth. So if forced to choose either way, I would bet that the negative drift in EPS forecasts will continue through FY 2019 and FY 2020:

It's continued growth in market share looks inevitable, though.

Whereas before I might have shorted ASOS (I did short it, once or twice), these days I think in terms of what price would I be interested to buy into it.

Perhaps if the PEG ratio (P/E to earnings growth) was below 1.5x, that's the sort of range where it would look very attractive?

It may seem greedy to want to hold out for such a cheap price (the PEG was 3x as of yesterday), but it has weak momentum at present and is categorised as a Falling Star by the Stocko algorithms. If we are patient, we might get that buying opportunity some day!

Portmeirion (LON:PMP)

- Share price: 1220p (+2%)

- No. of shares: 11 million

- Market cap: £133 million

Portmeirion, the manufacturer and worldwide distributor of high quality homewares under the Portmeirion, Spode, Wax Lyrical, Royal Worcester and Pimpernel brands, updates on trading for the first half of the current year.

This company is in the same sort of business as Churchill China (LON:CHH), providing tabletop wares.

H1 sales are up 11%, or 15% at constant currency - very good. The outlook for the full year is in line with expectations.

I haven't got much to say about this stock that hasn't already been said by Paul in previous renditions of this report. See the archives.

Today's update possibly suggests that an eventual earnings beat is more likely than an earnings miss for the full year. There is some seasonality in the business. Nevertheless:

We are delighted with the positive start to the year with strong progress in both our ceramic and home fragrance divisions.

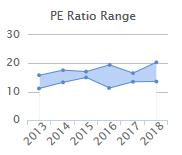

Valuation has been trending upwards. Given that trading is currently strong and the company has such a fine track record, this is understandable.

I would like to have a position in this or in Churchill China (LON:CHH) some day, when I can find a space for one of them in my portfolio. I better not wait too long, or they will probably end up getting taken over!

As is often the case, I am waiting for a bit more value before I take the plunge:

Indivior (LON:INDV)

- Share price: 270.5p (+1.5%)

- No. of shares: 728 million

- Market cap: £1,969 million

Indivior Sees FY18 Guidance Below Expectations

Indivior is a specialty pharmaceuticals business that was spun off from Reckitt Benckiser (LON:RB.) back in 2014. I remember, because the fund I was working for at the time ended up holding some Indivior shares.

Knowing as much about pharma back then as I do now (i.e. nothing) my instinct at the time was to sell. I think that's what we did.

I then remember the sinking feeling as Indivior shares proceeded to rally strongly in the months following spin-off.

As explained in You too can be a stock market genius (one of my top 3 favourite investment books of all time, though I'm not sure if I had read it by 2014), spin-offs can make for fine investment opportunities.

The whole point of a spin-off (in general) is to enable investors to correctly value a particular segment of a group PLC. It gets rid of the "conglomerate discount", the discount in valuation suffered when different businesses get put together and investors don't have the expertise to value all of them.

Anyway, I am digressing. Indivior shares have performed very well over the years, and breached 500p last month.The entire share price fall since then has been huge, even taking into account a 7.3p dividend. Commiserations to anyone holding this through the fall.

The cause has been the release of a generic alternative to Indivior's SUBOXONE medicine (a treatment for opioid dependence) by Dr Reddys Laboratories ($RDY).

A legal battle over Indivior's patents is underway. In the meanwhile, Indivior has suspended its guidance for FY 2018:

At this time, Indivior cannot reliably provide updated FY 2018 net revenue and adjusted net income guidance until the impact of DRL's launch is better understood. The Company expects that this will be no later than its third quarter results announcement, currently scheduled for November 1st.

I have no ability to value this stock, but it was brought to my attention that some readers may be holding it. If anyone can shed any light or offer some perspective in the comments, that would be great.

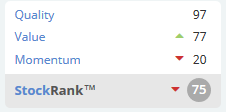

The StockRank style is currently considered to be Contrarian, due to the loss of momentum.

Dart (LON:DTG)

- Share price: 999p (+35%)

- No. of shares: 149 million

- Market cap: £1,484 million

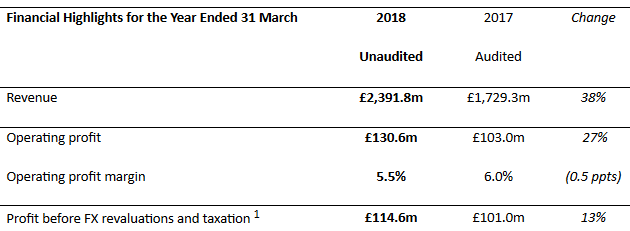

Dart Group PLC, the Leisure Travel and Distribution & Logistics group ("the Group"), announces its preliminary results for the year ended 31 March 2018.

Continuing the big-cap/mid-cap theme of today's report.

Dart's share price has almost doubled since I covered it a year ago. It's always very interesting to go back and read what I said at the time - the company was performing reasonably well, was investing in new Jet2 operating bases at Birmingham and Stansted, and was plagued with macro uncertainty over Brexit.

These are some glittering results, particularly if you focus on PBT and EPS (up 44% and 49%, respectively).

If you look at the company's more conservative "profit before FX and taxation" measure, it is a bit calmer. You can see 13% growth at the bottom right of this table:

The investments in Birmingham and Stansted worked out well:

Encouragingly, 58% of the total year-on-year passenger growth of 3.28m resulted from our two new operating bases at Birmingham and London Stansted which are already proving popular

So if you read the statement last year, saw that results had been held back in the short-term by investment for growth, and backed the company, you would have been very richly rewarded.

Passenger load factor improved to 92.2%. Still not at the levels I would have traditionally associated with the most efficient airline (£RYA), but I guess it's acceptable.

Financial results for distribution stood still, contributing £4.4 million of PBT or £7.1 million of EBITDA.

Outlook is fantastic for the current financial year, thanks to the leisure travel side of the business (Jet2.com and Jet2holidays). Thanks to strong demand and forward booking, PBT (before FX and tax) will substantially exceed current market expectations. That explains the huge share price increase today.

The company is more cautious for subsequent periods:

Looking further ahead, emerging cost pressures coupled with the overall uncertain UK economic outlook, particularly related to Brexit and how it may impact on consumer spending, means we remain unclear how demand will develop in the medium term.

It's fair enough that the company warns investors not to get carried away with bullishness.

Dart's earnings trajectory has been anything but a straight line over the years. You have to suspect that the company would suffer again in another consumer recession, or in a period of strained relationships with continental Europe, and that the demand for package holidays could be seriously affected. Hopefully, any Brexit-related travel difficulties will not prove permanent.

At the end of the day, long-term holders have been greatly enriched by this company. If I was going to buy shares in it, I would try to do so on the basis that I was going to take the rough with the smooth, and ride out the entire economic cycle with it.

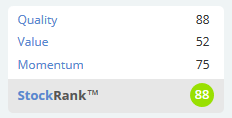

The StockRank remains excellent. This is a Super Stock.

Polar Capital Holdings (LON:POLR)

- Share price: 675p (-2.5%)

- No. of shares: 93.5 million

- Market cap: £631 million

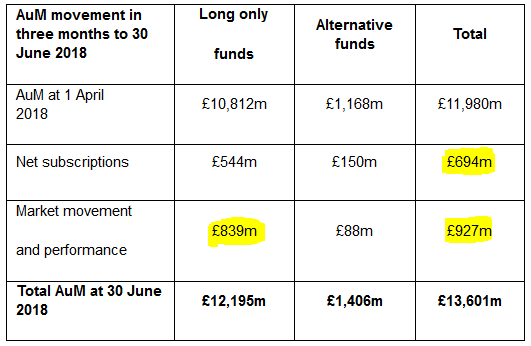

Polar Capital Holdings plc ("Polar Capital" or the "Group"), the specialist active asset management group, today provides its quarterly update of its unaudited statement of its Assets under Management ("AuM").

Following on from my recent coverage of other fund managers (PAM, MGR, IPX) and prompted by a comment, I thought I would briefly mention this AuM update.

Polar has seen good inflows during the quarter (5.8% of the starting amount) and an even stronger contribution from market movements. so that AuM makes a startling 13.5% increase in 3 months.

I agree with the CEO comment:

"While we are aware that a more challenging environment for equities will arise at some point given the advanced stage of the long recovery cycle post the financial crisis, we remain confident that our active fundamental fund strategies will continue to deliver above average returns for our clients."

This is why I haven't got any equity fund management companies in my portfolio yet, even though I really like the space and I don't think that their valuations are particularly demanding.

The best time to buy them, I think, will be when equities are unloved and their funds are also unloved and experiencing lots of client outflows. At that point, I would like to try to pick up one or two of them on the cheap.

I could be waiting a while, of course. And in the meantime, they will carry on generating fees and paying out dividends to shareholders. Polar has paid out 28p in the last 12 months, and is set to carry on increasing the payout.

Stocko really likes this one. Putting it in the bottom drawer does not seem crazy to me:

That's all for now. Thanks for dropping by, and for your suggestions! They really do help me.

Best,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.