Good morning,

Some RNS announcements I noticed today:

- Carpetright (LON:CPR) - in line with expectations trading update

- Severfield (LON:SFR) - in line with expectations trading update

- Devro (LON:DVO) - in line with expectations trading update

- Photo-Me International (LON:PHTM) - €20 million acquisition

- Thalassa Holdings (LON:THAL) - extension of offer for Local Shopping REIT (LON:LSR)

- Mincon (LON:MCON) - trading update, Q1 profit "slightly behind" last year.

- BigDish (LON:DISH) - expanding to Basingstoke, Exeter, Brighton

- Synnovia (LON:SYN) - trading update, marginally below expectations and a restatement of historic accounts.

These aren't earth-shattering announcements so I might just run through each of them with quick comments.

Elsewhere, I listened to the Tesla Q1 conference call live last night, and increased my short position in it again this morning. Lots of weird and interesting things going on there, as always!

Stop the press: Laura Ashley Holdings (LON:ALY) issued a profit warning at 10:30 am. Not great for shareholders.

Carpetright (LON:CPR)

- Share price: 20.55p (+34%)

- No. of shares: 304 million

- Market cap: £62 million

The market loves this update, helping the shares back toward the January high.

The key bit is that the "UK like-for-like sales trend improved significantly in the fourth quarter, compared to the year to date".

Does this mean that like-for-like sales were positive? To me, it doesn't, not necessarily. All we know is that they are less bad than the first three quarters of the year!

A reminder:

- Q1 LfLs: down 16.8%

- Q2 LfLs: down 8.9%

- Q3 LfLs: "remained negative, although the trend has improved from that of the first half".

So the year-to-date LfL result might be minus 10%, for example. And Q4 is much better than that.

£19 million of cash savings are on target - a very big number for a company with this market cap!

CEO comment:

"the work we have done to reposition the business is starting to deliver the benefits necessary to put Carpetright back on the path to sustainable profitability."

My view - not something I want to own or research in detail but I can accept the possibility that it could be profitable again. The "underlying EBITDA loss" in H1 was quite small and much has changed in H2. The net debt figure of £12 million at H1, after raising equity and restructuring, now seems manageable.

Severfield (LON:SFR)

- Share price: 74.8p (+1%)

- No. of shares: 304 million

- Market cap: £227 million

The is "the UK's market-leading structural steel company".

I covered it in a little bit of detail at last year's results.

The share price hasn't done much over the past year but the order book is stable and it sounds like things are proceeding for the company as it hoped they would. I'll move on!

Devro (LON:DVO)

- Share price: 195.3p (+4%)

- No. of shares: 167 million

- Market cap: £326 million

This strikes me as a decent business that might not get the attention it deserves.

It produces the collagen casings used in sausage making. Not a stock for vegetarians, then!

It has a great track record of avoiding losses, although exceptional items and cost pressures have taken a bite out of profitability in recent years.

Today it reports a slow start to the year, with momentum building through Q1 and producing an overall result in line with expecatations. It expects a H2-weighting.

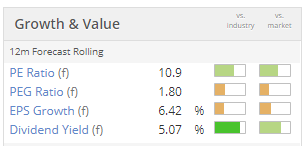

Quality metrics are a little bit average, which I guess is due to the capital intensity of the manufacturing process, but if it hits its targets this year then it could prove to be unjustifiably cheap at current levels:

Please note that it carries net debt of c. £140 million.

Photo-Me International (LON:PHTM)

- Share price: 88.6p (+3.6%)

- No. of shares: 378 million

- Market cap: £335 million

Many of you will be familiar with this operator of photo-booths and laundry equipment.

It is today branching out with the acquisition of a self-service fruit juice company, Sempa, for €20.6 million.

The enterprise value for the deal (excluding Sempa's large net cash position) is only €11.6 million, which looks like a bargain compared to PBT last year of 3.7 million. Although 3 million PHTM options are also needed to retain Sempa's CEO for three years.

My view - It's hard to get overly excited about a company that operates vending machines.

On the other hand, I also don't understand why Photo-Me's share price is so low at present. Admittedly, it has a had a difficult few years. The core photo-booth business is not growing and its longevity is arguably questionable. But earlier this month, the group guided for at least £42 million in PBT for the financial year which ends this month (subject to a little bit of adjustment).

It is active in many EU-27 countries, so perhaps there are also some Brexit-related concerns. The company has itself blamed Brexit-related issues for consumer uncertainty and delays in B2B orders.

Despite these problems, the StockRanks see a lot of value here (ValueRank of 86) and so do I. This could be worth researching in greater detail.

Thalassa Holdings (LON:THAL)

- Share price: 81p (unch.)

- No. of shares: 17.5 million

- Market cap: £14 million

Thalassa's Chairman repeats his arguments yet again with another set of overtures to the shareholders of Local Shopping REIT (LON:LSR). Sensibly, fewer than 1 in 7 LSR shareholders have accepted his offer so far.

Assuming that his offer fails, there will be a stalemate situation, and the LSR board will seek to break the deadlock through a special legal procedure. Good luck to them!

Mincon (LON:MCON)

- Share price: 99p (-2%)

- No. of shares: 210.5 million

- Market cap: £208 million

This is an Irish engineering group which makes rock drilling tools.

Its overall performance in recent years has been terrific, but today it reports Q1 2019 organic sales growth of just 4% for the products it manufactures (as opposed to 3rd-party product sales).

Last year in Q1, it reported that its own products enjoyed sales growth of 19%, which I believe represented organic growth at that time.

So there is a definite slowdown as far as that goes.

Total revenue growth, including the effect of acquisitions, is up 24% overall after the acquisition of a distributor, but profitability is "slightly behind" last year's result.

Group review

It's a detailed update, and this bit seems particularly important.

Having developed "a complex business model", it is reorganising:

We have decided to overhaul the Group, reduce the overhead by a targeted €3 million a year, and reorganize on a regional basis into three zones

Strategically, the company is "getting much deeper into the service element", helping customers to begin their construction or mining processes.

My view

I felt like I was priced out of this share at 150p, but at 99p it's much more palatable! So this is another one which I would say is potentially interesting.

BigDish (LON:DISH)

- Share price: 2.2p (+5%)

- No. of shares: 286 million

- Market cap: £6 million

This is a new company (listed in August 2018) that offers yield management for restaurants. You go onto the website or download the app, and get tasty last-minute discounts on restaurant seats. It allows for very efficient restaurant pricing, a bit like airplane seats.

I don't know if it will be commercially successful but the CEO is "extremely happy with the speed of the progress" as it geographically expands.

Synnovia (LON:SYN)

- Share price: 86.5p (-7%)

- No. of shares: 39 million

- Market cap: £34 million

Trading update and restatement of accounts

This was knowns as "Plastics Capital" (PLA) until December 2018. Paul and I never liked it very much - see the archives.

Today we learn that FY March 2019 results, although still better than the prior year, will be below market expectations.

There was also a minor error in the accounts. Doesn't sound like a big deal - just something to do with inter-company sales.

This company doesn't interest me at all, I'm afraid.

Laura Ashley Holdings (LON:ALY)

- Share price: 2.465p (-12%)

- No. of shares: 728 million

- Market cap: £18 million

Notice of results and trading update

A surprisingly muted response to an unquantified but serious profit warning that was released during market trading hours.

Trading conditions have been very demanding over the third quarter. The Board of the Company have reviewed the revised full year forecasts for the year ending 30 June 2019 and expect the results to be significantly below market expectations.

That's it. How unhelpful!

With a statement like that, what the company is really saying is that it doesn't care about its small shareholders, and isn't bothered informing them about what is going on.

Bargepole material.

Nothing to look at it in detail today, but as you can see we only had trading updates to work with.

Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.