Morning folks,

Quite a few announcements today.

I'm going to skip the trading statements that are "in line with expectations" - they aren't really news.

A few updates which did catch my eye, for one reason or another:

- Koovs (LON:KOOV) - "Customers love Koovs"!

- Tandem (LON:TND) - AGM statement

- Aukett Swanke (LON:AUK) - interim results

- Gordon Dadds (LON:GOR) - final results

- XPS Pensions (LON:XPS) - final results

- Sprue Aegis (LON:SPRP) -AGM statement

Koovs (LON:KOOV)

- Share price: 19.75p (+13%)

- No. of shares: 175 million

- Market cap: £35 million

This isn't a proper news announcement, either, but I just thought it was interesting!

Koovs, the online fashion retailer, has achieved a big net promoter score (NPS) among customers in a survey conducted by an "independent industry research company".

I'm not familiar with this research group - it is supposedly rather large in the Indian market.

Figures for Q1 2018 show Koovs with an NPS of 61%, 16 points ahead of its nearest rival and performing top in all six customer categories of Price, Product Variety, Product Quality, Ease of Navigation, Delivery and Post Delivery Experience.

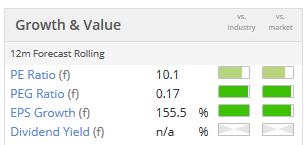

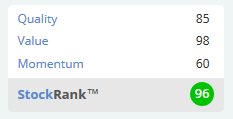

I've just pulled out the interim results to confirm my suspicion the Koovs still had a negative gross margin, as of the most recent figures:

The company is moving in the right direction, certainly.

Sosandar (LON:SOS), another small online fashion play, should also see margin improve as it scales up, thanks to increased buying power.

But a negative gross margin is a major red flag in my book. It means the company is selling a dollar for 90 cents (or one rupee for 50 paise). No wonder customers love it so much!

It's easy to have very happy customers when you are selling things at a loss. What's more difficult is to keep your customers happy and make a profit at the same time.

The metrics have definitely been moving the right way for Koovs, but for me it still needs to get across that threshold of profitability at the gross margin level.

It had a much improved "Trading Margin" of 18% at the interims.

The definition of this is:

implied retail gross margin that would be reported in the companies accounts if Koovs India were able to ship products directly to the end consumer.

The trading margin excludes delivery, warehousing and customer care costs - these are important costs that nearly all of Koovs' competitors will have to bear, too. If they are all providing a more basic service to customers and/or at a much higher price (because they want to make money), then it's no surprise that Koovs would have the best NPS scores in the industry!

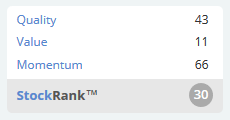

Koovs has a StockRank of 3 and is classified as a Sucker Stock, so the warnings are pretty clear. It could still succeed, but the odds don't look terribly favourable.

Tandem (LON:TND)

- Share price: 120p (-17%)

- No. of shares: 5 million

- Market cap: £6 million

Tandem is too small for us to typically cover in this report, but I feel compelled to mention it in light of this AGM statement. It is a bike and toy designer, owning and licensing some decent brands.

Sadly, this stock has been very costly to me. I may not be able to remain objective in my coverage of it!

Back in 2015, I was convinced that it was going to do very well for investors. I "backed up the truck" and made it my biggest position.

The profits that I imagined did not materialise. 2015 and 2016 results were uninspiring.

Bear in mind that this is a very old company. The share price chart goes back to 1994 and I can see RNS statements stretching back to 1999. Some of its bicycle brands are over 100 years old.

The most disappointing aspect of the performance, from my view, is the sense of wastefulness.

2014 had been a particularly good year for the company. Instead of increasing its dividend to an attractive level or creating some value within the existing business, it went on the acquisition trail. Over £4 million was ploughed into buying up other small businesses. That's more than half of the current market cap!

Directors paid themselves almost £800k last year, while distributing less than £200k in dividends to shareholders. I think that's sufficient to show where priorities lie. There are times when low dividends are appropriate, but that does not include mature (very old) companies, with limited growth prospects.

I held the stock for as long as I could, hoping for a rebound. Eventually, when I was trying to make a property purchase last year, I sold out and crystallised significant losses. But I still thought that the outlook for shareholders was quite good.

The 2017 results turned out to be amazingly positive. Revenue was down as the bicycles division was restructured to cut costs. As a consequence, net income rebounded to an all-time high of £1.7 million.

To give credit where credit is due, the company has almost never made a loss.

Additionally, the accumulated profits over the 2015-2017 period have left the balance sheet in decent shape.

The company has net debt of £1 million but net tangible assets are £5.5 million of which £3.5 million is freehold property.

I can't help thinking that if it hadn't been for its 2015-2016 acquisition spree, the balance sheet and shareholders would be so much richer again.

I strongly considered buying back in again, after the 2017 results announcement.

The following factors held me back:

- the bid-ask spread

- I had already got it wrong once before, so how confident could I be that I was going to get it right the second time? Was I acting on emotions, trying to recover prior losses, rather than thinking rationally?

- and the main reason: what was going to stop the entrenched management/directors from going on another acquisition spree or otherwise wasting their net income this time around?

Despite the above factors, it remained a tantalising proposition.

For a value hunter like me, a mid-single-digit P/E is hard to ignore.

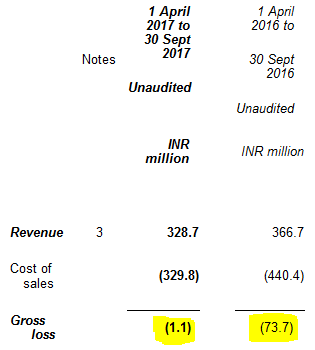

And how often do you see a StockRank like this:

Anyway, let's take a look at today's AGM statement:

Trading in the first part of the year has been difficult, with revenue for the 25 week period to 24 June approximately 30% behind the prior year period for a number of reasons

Amazing, isn't it?

Just like after the 2014 results, Tandem has swung from a great performance to suddenly facing severe difficulties.

Toys and outdoor products have been overstocked. Again, to be fair to the company and management, there has been a well-documented bloodbath in the toys sector:

The well documented issues in a number of national retailers, most significantly Toys R Us who were one of our top five customers and an outdoor specialist, have also impacted on the sector.

It wouldn't be a proper profit warning without blaming the weather and consumer confidence, too:

Lengthy spells of cold weather and periods of heavy rain coupled with cautious national retailer buying and a lack of confidence in consumer spending was acutely reflected in toy industry data with a significant year to date decline in sales reported.

Bicycle sales have also been disappointing. No specific reason for this is given.

There is some good news on the horizon:

We are delighted to announce that we have reached agreement, subject to contract, with The Walt Disney Company to significantly expand our portfolio of licenses for 2019 and 2020 to incorporate their major properties, including Disney, Marvel and Lucasfilm.

So it's another mixed and mostly negative statement from Tandem.

I'm probably never going to buy shares in it again, since having been burnt by it once, and feeling sore about that, I don't want to revisit it.

But do I think the shares are too cheap? Yes, I do still think so. The brands owned by the company, its long-standing profitability, and its ability to win licenses from the likes of Disney deserve a bigger market cap, I think.

The problem is that £800k of remuneration for directors is so high, relative to the size of the business. And although they have by no means done a terrible job of managing the business, they have failed to take actions which would either a) generate strong compound returns for shareholders, through the effective reinvestment of profits, or b) produce a reasonable return for shareholders, relative to the riskiness of the stock, by offering buy-backs or dividends of an appropriate size.

If the directors could be motivated to improve shareholder returns, or replaced, I'm confident the value of the company could be significantly increased.

So perhaps in the absence of a shareholder campaign, and given that trading has deteriorated so much in the first half of the year, the prospects remain dim. At the end of the day, I'm just going to have to put this in the "too difficult" category.

These metrics are really fascinating, all the same:

Aukett Swanke (LON:AUK)

- Share price: 2.1p (-20%)

- No. of shares: 165 million

- Market cap: £3.5 million

Another tiddler of a company which I would normally never cover in this report, but it's another one that I have costly experience of, so it's close to my heart.

It's also a useful lesson in shareholder value destruction.

I made damaging losses here after I was hypnotised by a temporarily cheap P/E multiple.

The reasons to not invest were obvious enough.

An architectural practice has some of the most unattractive characteristics from an investment point of view:

- It's the perfect example of a "people business". No scalability. Always 100% dependent on employees.

- Large, lumpy, unpredictable transactions.

- Extreme cyclicality. Business dries up every few years.

Going back a couple of years ago, I was still willing to bet on a company like this, if it was cheap enough. A bit like my Tandem bet, I thought "it can't get any cheaper than this, surely?"

Having been burned, I am no longer willing to take that chance.

Aukett has another similarity with Tandem. After a couple of good years, from 2013-2015, it ploughed the best part of £2 million into acquisitions, including a poorly-timed Middle East purchase. Again, the amount spent on acquisitions now turns out to be roughly half of the current market cap.

If it had held on to that cash for a rainy day, or bought back its own shares or distributed the money as dividends, investors would now be in a better position.

Interim results today are as follows:

- Revenues down 18% at £7.41m

- Loss before tax of £1.22m (2017: £358k loss)

- Cash (net of overdraft) of £317k with net borrowings of £311k; representing 0.6% net gearing

That gearing ratio is not so bad, but the company is set for losses for at least another six months, and perhaps the base case assumption should be for at least another 18 months of losses.

The company does state that there were some "temporarily overdue" debts, and that it would have had a net funds position, if they had been paid on time.

That's another uncomfortable feature of the balance sheet: a very large receivables balance. Receivables were sitting at over £7 million at period-end, almost matching the revenue for the six months. Indeed, that receivables balance is twice the current market cap!

With revenues falling and losses ongoing, is there any hope for shareholders?

Its fortunes will be determined by the macro-economic winds:

Changes in the political climate and the subsequent timing of their impact on our markets is the key feature to the Group's recovery from the current losses. Whilst the focus on controlling costs will continue, this by itself will not resolve market issues and the Group's performance.

And this sounds worrying:

Progress has been slow on the recovery of our older debtors which has historically allowed the Group to operate within its own working capital and avoid further borrowing.

There are other investors who might be able to spot a company like this when it is coming out of a trough and is undervalued, but that's not something I've been able to do yet. I now appreciate how difficult that is.

Besides the difficulty of getting the timing right, there are also quality considerations. I now apply a filter to my stock selection which enables me to simply avoid companies like this. There are plenty of companies out there which are scalable, have more predictable sales, and aren't so cyclical. Perhaps it's a little bit more boring, but I think I prefer the stress-free life!

As for these shares, it's still possible that they are undervalued and could recover from the current level (assuming that the company can survive back to profitability and avoid massive dilution, of course). But they are going in my "too difficult"basket.

Stocko algorithms see it as having some value, with a ValueRank of 81.

Quality and Momentum, as you might expect, do not rate quite so highly.

Gordon Dadds (LON:GOR)

- Share price: 172.5p (+6%)

- No. of shares: 29 million

- Market cap: £50 million

Gordon Dadds Group PLC (AIM: GOR), the acquisitive London-based international legal and professional services group, is pleased to announce its audited results for the year ended 31 March 2018.

I don't want to make too many specific comments on this company. I really just want to point out the proliferation of professional services companies who are choosing to list. This one listed a year ago.

Strategy is as follows:

The board's overall objective is profitably and rapidly to grow the business in professional services by acquiring additional revenue which can be efficiently processed through the group's bespoke administrative systems. As the traditional partnership model for solicitors breaks down the Group is ideally placed for growth in the legal services sector.

It's pretty much exactly the type of stock I am currently trying to avoid: professional services, and with an acquisitive strategy to boot.

Its idea is to have a unified, high-tech back office platform, allowing for the efficient integration of new revenue streams.

Back office is a cost centre and not a hugely important one to my mind. So I'm not sure how excited investors should be about this strategy.

Is there is a proper rationale for these legal/professional services to list on the public markets, or does it reflect an element of credulity by stock market investors, at the end of a long bull market?

What's next - a public listing for KPMG or Deloitte? Is Clifford Chance going to have an IPO?

There are important reasons why these companies have traditionally kept the partnership structure. And if that structure is good enough for the biggest and best professional services and legal firms, it should be good enough for the smaller ones as well, surely?

Let's see if my scepticism is justified.

XPS Pensions (LON:XPS)

- Share price: 183.25p (-5%)

- No. of shares: 204 million

- Market cap: £374 million

This previously traded as "Xafinity" (XAF).

I covered it ahead of its Punter Southall acquisition last December (link).

Revenues increase to £64 million and PBT increases to £4.2 million, with the following proviso:

This includes the operating results arising from the business acquired from the Punter Southall Group for the period 11 January 2018 to 31 March 2018 and amounts to revenue of £12.9m, and profit before tax of £3.4m as well as the operating results (Revenue of £2.0m and profit before tax of £0.8m) for the HR Trustees business up to 11 January 2018 when it was sold to the Punter Southall Group

I'm not entirely clear about this - does it mean that PS generated PBT of £3.4 in less than three months of ownership, while the rest of the business generated PBT of only £0.8 million?

The combined entity is now "the largest 'purely pensions' consulting and administration firm in the UK". It has 900 employees in 15 offices around the UK. It still trails the "Big 3" pensions consultancies (Willis Towers Watson, Mercer and Aon Hewitt).

Performance since year-end is in line with expectations.

Balance sheet shows equity of £154 million, eclipsed by £216 million of intangibles. The net tangible asset value has significantly deteriorated, compared to the last time I looked at it (prior to the PS acquisition).

Loans and borrowings are now £55 million, as some debt was needed, in additional to fresh equity, to fund the acquisition.

My opinion

There is precedent for companies in this space to list: see the US tickers $WLTW (Willis Towers Watson) and $AON (Aon).

I wish the company well, but I'm not personally going to get involved in terms of buying these shares. This is primarily due to the sector its in. I also think the balance sheet should weigh on the valuation.

Stocko algorithms aren't seeing much value here yet, either:

Sprue Aegis (LON:SPRP)

- Share price: 77p (-1%)

- No. of shares: 46 million

- Market cap: £35 million

This accident-prone fire and smoke alarm company has changed its name.

Putting the past behind it, it will now be called:

FireAngel Safety Technology Group plc

and will have the ticker "FA."

Operationally, the company has a new outsourced manufacturing partner in Poland ("Flex").

The Chairman states:

As highlighted in our 2017 report and accounts, we anticipated that there would be some short term impact as a result of the final agreed settlement with BRK referred to above and the transition of manufacturing to Flex. However, I do expect the Company's operating results to improve significantly in 2019 and beyond, driven by greater efficiencies and margin control, alongside our ambition to expand our geographic footprint and broaden our product base.It's a strong statement. He is calling the bottom as far as the company's financial results are concerned.

I also quite like the way the company has unified its products under the "FireAngel" name - it's a memorable name, and it makes sense to develop a single, trusted brand for customers.

The statement continues with even more confidence:

We firmly believe that the Company is well-placed to capitalise on a number of exciting operational and strategic opportunities. We are now in full control of our manufacturing processes and see a strong pipeline of new business opportunities with our existing product set, along with increased interest and demand for connected home solutions.My view

This could make for an interesting turnaround stock.

There are probably a lot of stale bulls holding it, and the share price drifts around five-year lows. And it will take some time for any recovery to be fully reflected in the results.

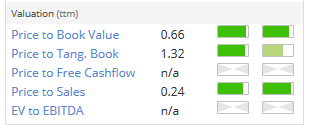

The StockRank is poor, with particularly poor momentum. It may be dipping into value territory, however:

That's it for today!

Enjoy the England vs Belgium match this evening.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.