Good morning,

We have a few new updates worth discussing today, and I'm also interested to look at yesterday's backlog if there's a chance.

- Churchill China (LON:CHH)

- GYM (LON:GYM)

- Watchstone (LON:WTG)

- Brickability Group

- Duke Royalty (LON:DUKE)

- McColl's Retail (LON:MCLS)

As a reminder, the backlog from yesterday includes Loungers (LON:LGRS), Headlam (LON:HEAD), Wey Education (LON:WEY) and Proactis Holdings (LON:PHD).

Churchill China (LON:CHH)

- Share price: 1610p (+1.6%)

- No. of shares: 11 million

- Market cap: £177 million

Churchill China plc (AIM: CHH), the manufacturer of innovative performance ceramic products serving hospitality markets worldwide, is pleased to announce its interim results for the six months ended 30 June 2019.

I have read through this entire thing and can't find anything particularly controversial in it.

This reflects well on a company which has grown over the years and hasn't really put a foot wrong. It's the good companies which also tend to be the most "boring", on a superficial level, because they just keep on pumping out solid results!

Note the strong like-for-like growth rate of 25% in operating profit, before taking into account the effects of a small acquisition.

The increased stake in Furlong Mills bumps up Churchill's growth rate to 30%.

Note also the very clean accounting: H1 PBT before exceptional items is £4.2 million, while H1 PBT after exceptional items is £4.3 million! The company made an exceptional gain of £0.1 million during its acquisition.

Last year, there were no exceptional items in H1 at all.

Strategically, the company says it has exited activities where it did not have a competitive advantage over the past five years. Despite this, revenues have grown every year. The latest H1 period continues the trend with 10% growth on an underlying basis (my own calculations, excluding the acquisition).

One thing I would bring your attention to is the higher level of cash that left the business in H1, as Churchill expanded manufacturing capacity and bought the Dudson brand. The good news is that these projects are likely to spur future growth, and the overall investment spend in H1 (£3.2 million) is affordable compared to the company's likely annual cash generation.

Outlook

Trading is in line with expectations:

We have reported a strong performance in first half year and once again this has been achieved as a result of long term investment in line with our strategic targets. We have continued to benefit from growth in export revenues and have increased our margins as a result of the sale of further added value products. Our market position remains strong and we believe we have further opportunity, both organically and from our recent acquisitions, to continue to make further progress.

Note the reference to export revenues. This company is tied to Europe and so it has made significant Brexit preparations:

In February 2019 we began to supply orders to Europe from inventory established in a third party run warehouse in Rotterdam. We now hold over £0.5m of inventory in Europe and plan to increase this in the second half of 2019.

The company says it has made "sensible plans to mitigate the effect of disruption on our business where possible".

My view

At the great risk of repeating myself, I maintain a positive view of this business and regret that I don't yet own any of it. However, the shareholder base (including the Roper family) has held firm and the stock has never really gone on sale. December 2018 was the sweet spot in terms of a recent entry point.

This remains on my watchlist, as it does for many of my peers, who would be interested to get it at lower levels.

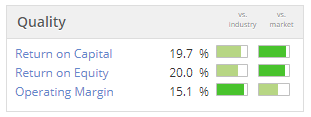

Check the high quality metrics:

GYM (LON:GYM)

- Share price: 244.5p (+2.5%)

- No. of shares: 138 million

- Market cap: £338 million

This is a rollout that I've been monitoring for some time.

We already knew that these results were going to be nice, thanks to the trading update in July.

Adjusted PBT increases to £7.1 million for the period. The adjustments include £600k of amortisation and £900k of impairments associated with shutting down an underperforming store.

Reading the small print

I've looked up last year's annual report to remind myself what is being amortised, and I think the main item is acquired customer lists, which are assumed to decay over a three-year period.

I'm relaxed about adding this back in as a £600k adjustment, but I would be a bit more cautious of the £900k impairment.

The reason is that shutting down underperforming sites might be needed from time to time, on an ongoing basis. For example, two more sites are earmarked for closure before the end of the year. Even though the company doesn't predict any more closures for the foreseeable future, I wouldn't rule them out.

This type of thing also happens with pub and restaurant shares, where in my experience the adjustments can be a lot worse! Investors are asked to focus on the profits at the good sites, while ignoring the expenses associated with shutting down the bad ones.

Anyway, the profit adjustments at GYM are nothing out of the ordinary but I would personally reduce the £7.1 million PBT figure down to £6.2 million, to include the cost of impairing the site which didn't work out.

Second-half weighting

Important to note that the roll-out is weighted toward the end of the current year. 8 new sites were opened in H1, versus full-year guidance of 15-20.

I think there is a risk the company will wind up at the lower end of its guidance, if a few of the new sites fail to open on time.

Another way of looking at it is that people are most interested to join a gym around the New Year, so the company will be strategically opening stores during the season when it is easiest to make sales!

Outlook

Trading in H2 is in line with expectations and the company confirms its view that it is on track to achieve plans for the full year.

My view

I still consider myself a fan of this company and share. It is forecast to make nearly 14p in EPS next year, followed by 15.5p in 2021.

Worthy of a place on our watchlists, in my view.

Watchstone (LON:WTG)

- Share price: 73p (+3%)

- No. of shares: 46 million

- Market cap: £34 million

Counterclaim against Slater & Gordon (UK)

The famous deal between Quindell (now called "Watchstone") and the Australian law firm S&G continues to attract controversy.

It's primarily of historical interest, so perhaps we shouldn't dwell on it. But I was short Quindell around the time of the deal, which ruined S&G and which I believe prevented Quindell from going bust. So it will be fun to see what the courts eventually make of it.

Today, Watchstone announces that it wants £63 million from S&G's UK business to remedy "breach of confidence, inducing breach of contract, and unlawful means conspiracy".

Watchstone claims that S&G's investment bank obtained confidential information from PwC, enabling it to pay less for Quindell's assets than it would otherwise have had to.

The context for this is a £637 million claim by S&G, against Watchstone, for breach of warranty and/or fraudulent misrepresentation.

My view - I don't know if this case has any merit, so there is no point in speculating. I have little sympathy for either party: Watchstone should have gone bust, and S&G should not have paid hundreds of millions of pounds for businesses that were virtually worthless, and which many observers from the outside could see were probably worthless!

As for the value of Watchstone (LON:WTG) today, I doubt that it is worth much more than the current market cap.

The residual operating businesses look like junk (heavy losses at an underlying EBITDA level last year), so the only attractions are the £50 million cash balance and the lawsuit against Rob Terry.

I'd only be interested in this one at a huge discount to the cash balance.

Brickability Group (BRCK)

The City isn't happy right now about the lack of IPO activity. Brokers and advisors are competing for very limited amounts of new business.

Here is something new: Brickability Group.

Its specialities are:

- Bricks & Building Materials

- Roofing

- Heating, Plumbing & Joinery

Company description:

The Brickability Group plc consists of 19 companies, all of which are able to bring together specialist products and services to meet the needs of the greatbuilding and construction market. ...by coming together they will be able to grow sales in new areas and winning new customers by utilising the wonderful contacts earned by the group over the years.

The market cap is £150 million at the Placing Price, putting it firmly in small-cap territory.

Cenkos Securities (LON:CNKS) is the Nomad/Broker - maybe this deal will give it a boost?

My view

This is a medium-sized business, with 25 sites and 225 employees, according to the Admission Document.

Operating profit came in at £14 million in FY March 2019. Leverage looks a bit high on the historic balance sheets, but the company says the £54 million in IPO proceeds will be used to deleverage - sounds good.

This might be worth investigating further.

Duke Royalty (LON:DUKE)

- Share price: 47.45p (-0.3%)

- No. of shares: 200 million

- Market cap: £95 million

Follow-on contribution and restructuring

(Please note that I do not have a position in DUKE.)

This RNS concerns one of Duke's smaller investments.

You might think, therefore, that it should not have triggered me to exit this company. Yet it has.

Last time I covered DUKE, I summarised my thoughts as follows:

"An adventurous financial stock carrying significant risks, but I'm optimistic about this one."

Unfortunately, it has now strayed too far into risky territory for my liking. Even if the size of this deal is small relative to the size of the entire portfolio, the sum total of the risks is now too great for me.

It's difficult to put my calculations into words. Let me put it this way.

1. Duke has restructured a deal from its Capital Step acquisition, suggesting that the initial structure of the deal was not secure enough.

The Capital Step deals did look a bit riskier, compared to Duke's model. While I can see the rationale for the Capital Step deal, to accelerate diversification, I am always biased in favour of organic development rather than "buy-and-fix"-type acquisitions.

2. The investee mentioned today is going to use the follow-on investment from Duke to build a restaurant and entertainment venue in Dublin. While I love going to restaurants in Dublin, lending to them is not an activity which I want to be involved in.

3. The investee mentioned today has recently restructured its debt. While I don't doubt that the investee is currently on a sound financial footing, I am not convinced about its financial track record.

4. A transaction some years ago valued the main operating business mentioned today at £5.1 million. The size of Duke's investment in its parent is €2.75 million. How much equity value can be left?

5. The cash yield for this deal is 18%. As with other deals, the high yield makes me question how much the equity can be worth.

6. Some other investees since mid-2018 make me uneasy, e.g. an Irish recruitment company. The original investees looked risky too, e.g. a Dutch river cruise operator.

7. As mentioned previously, I have been uneasy about the recent development which saw Duke taking equity stakes in its investees, even if Duke considers them to be a "sweetener" that aren't explicitly paid for by Duke.

Putting it all together, there are two main reasons for me to exit my position in this company.

Firstly, the likely risks associated with Duke's deals and the quality of the investees haven't matched up with my original expectations. I could be proven totally wrong on this front - no investee has defaulted yet.

Secondly (and this is not Duke's fault), due to my tax situation, I have no tax relief on dividends. Therefore, rather than paying high marginal rates on Duke's 7% yield, I am better off owning something which doesn't pay a dividend.

There has always been a conflict between my tax situation and Duke's policy of paying large dividends (in accordance with the wishes of its institutional shareholder base). Rather than sticking around in a situation which is less-than-ideal, I prefer to make a clean exit.

McColl's Retail (LON:MCLS)

- Share price: 45.75p (-5.5%)

- No. of shares: 115 million

- Market cap: £53 million

A poor update from this chain of convenience stores, with like-for-like sales down 2.2% and total revenue down 3.6%.

I was discussing this with an investor friend today, who sees a lot of value in the shares. He sees scope for the company's operating margin to improve (from the current 1%) which would make these shares very cheap at current levels.

However, I think these shares are cheap for the right reason. The risks are clear - it's a highly leveraged, low-margin retailer that is currently in reverse gear. It could work out, but it's obviously in a high-risk category of business. Suitable only for brave value hunters and those who think the brand has some value.

Stocko rates it as a Value Trap, which sounds about right.

Apologies for the slow production of today's report - many other tasks getting in the way. Will try harder tomorrow to stay on track!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.