Good morning!

Thank you for the suggestions.

Today I have covered:

- Boohoo (LON:BOO)

- MPAC (LON:MPAC)

- Altitude (LON:ALT)

- Beeks Financial Cloud (LON:BKS)

I did not get to cover these three, but Avation (LON:AVAP) received some intelligent commentary in the thread below, if you're interested.

- Avation (LON:AVAP)

- HSS Hire (LON:HSS)

- Vertu Motors (LON:VTU)

Boohoo (LON:BOO)

- Share price: 272.4p (+12%)

- No. of shares: 1.2 billion

- Market cap: £3,160 million

A brief but very positive H1 update from Boohoo. Performance is ahead of expectations.

Consequently, the board now anticipates that results for the current financial year will be ahead of previous guidance, with Group sales growth now expected to be between 33% and 38% (against previous guidance of 25% to 30%).

Assuming 35% sales growth, total revenues would climb to £1,155 million in the current financial year.

The company's broker thinks that only a tiny fraction of the revenue growth will come from Bohoo's recent acquisitions (MissPap, Karen Miller and Coast). So it's nearly all organic growth from Boohoo, Prettylittlething and Nasty Gal.

As far as profitability is concerned, EBITDA margin is set to stay around 10%, so the EBITDA result this year should be in the region of £115 - £120 million. The adjusted pre-tax profit forecast is now £96.7 million (previously £90.4 million)..

My view: I'm impressed, of course. Boohoo has a great track record of profitable growth and of beating expectations.

As mentioned before, one of the things which holds me back from investing is the fact that Boohoo only owns 66% of PLT. Last year, out of £47.5 million in group net income, £10 million was attributable to the minority shareholders (i.e. to the family behind Boohoo (LON:BOO) ).

Maybe this doesn't matter, if the total pie will ultimately prove big enough to justify today's market cap of around £3 billion?

Elsewhere, I note that the valuation of Marks and Spencer (LON:MKS) has dropped to sub-£4 billion. Seems to be only a matter of time before Boohoo eclipses the traditional, legacy retailer.

Tough markets

Has anybody else noticed how extreme market sentiment has become, with respect to "quality" versus "non-quality" stocks? Maybe it's just me, but it seems that the disparity has never been higher. Perhaps there could be a study on the dispersion of valuation multiples, and trends in this over time?

For example, we have Boohoo (LON:BOO) at a PER of 40x while Marks and Spencer (LON:MKS) languishes at less than 10x. One of them is online and growing, while the other is a legacy retailer and is shrinking.

As a general observation, there seem to be fewer companies these days which aren't classified either as "quality/growing" or "poor quality/shrinking". There are good companies and there are bad companies, and fewer in the middle.

I'm finding it easy to get frustrated in these markets, and I don't think I'm alone. The "value" strategy has not worked for a long time, and is still not working. I've adjusted my quality filter to be ever more selective, but it's still hard to understand why some stocks remain so cheap. Looking for value can feel like a complete waste of time, when value stocks are continuously getting cheaper.

It also feels like we've had a lot of mishaps, failures and accounting scandals on AIM over the past year. In recent months, Burford Capital (LON:BUR) has dominated the headlines. The CAKE fiasco is not so long ago, either. Think of GOAL, FLYB, ESL, STAF, etc.

This FT article (which I think I discovered via a Stocko reader) generated quite a lot of comments, not all of them favourable. It describes how AIM fundraising has "slowed to a trickle" and how the performance of the top AIM companies has been rather poor over the past 12 months.

From an index point of view, AIM has never been a great performer, and it has been a particularly tough place to be over the past two years. It has performed significantly worse than the FTSE All-Share:

The other point about AIM is that returns tend to be highly concentrated in just a few winners, while most shares achieve little for investors.

While that's true for most indexes, I'd be shocked if it didn't apply even more to AIM, where many of the companies are highly speculative and ultimately prove to be worthless, than it did to other markets.

It's also a very unequal index: the likes of Boohoo (LON:BOO) and Fevertree Drinks (LON:FEVR), with multi-billion pound valuations, move the needle in ways that the vast majority of companies are unable to, even if they succeed.

My point is that when you have an index where most shares are losers, and the index itself has performed poorly, then you have a really tough investing environment. Throwing darts might work in some markets, but it probably won't on AIM.

The political risk to inheritance tax relief is another factor which could smash AIM valuations at some point - perhaps it already has, to an extent?

Anecdotally, I've noticed that lots of my investing friends had a great H1, but the last two months have been much tougher. The flow of profit warnings in popular small-cap stocks has seemed relentless (e.g. most recently Somero Enterprises Inc (LON:SOM) and Altitude (LON:ALT) ).

And when you consider that the big-cap FTSE-100 index has also been a terrible performer, it's a wonder that investors in the UK market aren't more depressed.

Meanwhile, the din of politics is impossible to ignore, with the huge distraction that it brings and the uncertainty that it spreads to financial markets.

What I'm doing

Looking forward, I plan to make the following changes, gradually, to make my investing life better from now on:

- more index trading and investing - I think I have a good sense for value in the indexes, and it suits my temperament, so I'll be doing more of this.

- more shorting - I probably find it easier to detect a bad business than a good business, so I'll keep doing this.

- more US investing - the US market has many of the best companies in the world, and I'll increase my allocation to them from now on

- less value investing - I need to be more selective in future, letting fewer companies in to my portfolio because they are "value". I need long-term holds, which means I need to be extra strict on quality, and less strict on value.

By gradually making these changes, I hope to move on from the frustration of seeing cheap shares remain cheap for extended periods of time, and use some extra tools to enhance my overall returns.

Some motivational thoughts

When the stock market has been rubbish for a while, you start to see people dropping out of it - they give up and move into cash or property instead.

I don't think we are at peak despondency yet, so there could be a lot more to come. When we get into a full-blown economic downturn and/or when politics becomes even more chaotic, that might be the point of peak depression. That's when people will walk away from the stock market and never come back (as many people did in 2008).

Continuing to invest in that environment won't be easy, but it is the point when investing is the most profitable, from the point of view of your long-term returns. That's the point when you get the most attractive bargains, if you have the courage to buy them.

In the wise words of Buffett: "the stock market is a device for transferring money from the impatient to the patient".

The Stocko community is a sophisticated bunch, and many of you will have been through more market cycles than I have, but perhaps these comments will help some of the less experienced investors to think twice before selling out of their portfolios at the worst possible time.

MPAC (LON:MPAC)

- Share price: 213.75p (+6%)

- No. of shares: 20 million

- Market cap: £43 million

This is a "global packaging and automation solutions group".

See my coverage of the trading update in July.

This stock used to be all about "can it survive its pension fund?"

It's now more about profitability and exactly how much cash will be left over for shareholders, after making payments to the pension fund.

H1 results

Some fine numbers here.

- Revenues +62% to £45.8 million (of which £5.5 million was generated by an acquired business)

- PBT £2.9 million (versus a loss last year)

- underlying PBT £4.5 million (breakeven last year)

Guidance

The company explains that its order book at the start of 2019 was much higher than at the start of 2018, and that's what helped it to generate such a big result in H1.

The order book at the end of H1 2019, however, is only "broadly comparable" to the order book at end of H1 2018.

So it sounds like many more orders will be needed to sustain the growth into H2, and this is less certain:

..there remains the potential for forecast orders to be delayed due to general economic uncertainty for the medium term, driven by macro-economic and political circumstances outside of the control of the Group. Therefore, the Board anticipates that, while the results for 2019 will be above current market expectations, primarily as a result of an increased number of repeat projects and by operational efficiencies, the medium-term economic outlook, driven by macro-economic factors, is less certain.

Pension

We already knew there was good news on the pension front, thanks to the trading update.

The actuarial deficit is £35 million as of June 2018, compared to £70 million three years earlier, and is expected to be eliminated by July 2024.

My view

I can't predict this company's order flows and there are still quite a few years until the pension issue will finally be resolved. That said, full marks to Mpac for trading through their difficulties and apparently coming out the other side. Investors are right to feel optimistic.

Stocko aptly rates it as a Turnaround:

Altitude (LON:ALT)

- Share price: 57.2p (-38%)

- No. of shares: 69 million

- Market cap: £39 million

Trading update and notice of interim results

Commiserations to those who held this overnight and have seen a very large drop overnight. This is another stock that is frequently mentioned among private investors.

While the growth numbers given for H1, objectively speaking, aren't terrible, they have resulted in a significant cut to forecasts.

In the words of the broker (via Research Tree): "forecasts are pushed back a year".

The FY December 2019 forecasts are changed as follows:

- Turnover £11.9 million (from £18.5 million)

- EBITDA £1 million (from £6.5 million)

- PBT £0.2 million (from £5.9 million)

These come out as huge percentage reductions because Altitude was supposed to be on the cusp of breaking into strong profitability. However, that "cusp" is now 12 months longer than previously thought.

Altitude runs a US-based promotional products platform, and investors believe that it could benefit from network effects as the suppliers and buyers of these products use the Altitude platform to transact.

From a balance sheet point of view, Altitude reports £3 million in cash (with no borrowings) and says that its US business is now self-funding.

It also says that "the business model is working, is scalable and is commercially attractive to both sides of the marketplace".

I'm inclined to think this is worth looking into. Official forecasts have been put back by a year, but if they are achieved then the company will generate adjusted PBT of £5.7 million next year (FY 2020). As a marketplace, it could have very attractive economic characteristics for investors.

The company recently announced a change of accounting reference date, from December to March, and this will create the mess in the accounts that it always does. As is often the case, the company put forward a convincing-sounding rationale for this change.

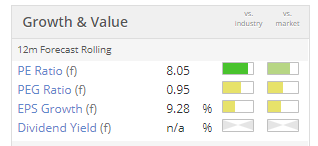

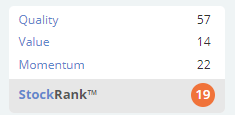

Beeks Financial Cloud (LON:BKS)

- Share price: 81.7p (+3%)

- No. of shares: 51 million

- Market cap: £42 million

Beeks Financial Cloud Group plc (AIM: BKS), a cloud computing and connectivity provider for financial markets, is pleased to announce its final results for the year ended 30 June 2019.

Beeks provides financial institutions with access to servers near financial exchanges.

Because it charges customers on a monthly basis, it calls itself an "Infrastructure-as-a-Service (IaaS) provider". Any company that charges customers more than once now calls itself "as-a-Service".

Results

These are solid results, with revenues up 32%, though underlying PBT only increases by 11% in response.

The "annualised monthly committed recurring revenue" (what a mouthful!) is now £9.1 million, which I will simply call the run-rate of revenue.

Gross margin has declined by a few percentage points to 49.6%, which Beeks says was anticipated as two new data centres have not yet reached breakeven. The depreciation charge has increased, as capex growth has outpaced sales growth.

Pre-tax profits remain small relative to the market cap but are forecast to more than double in the current financial year to £2.2 million, before rising to £2.9 million in FY 2021.

Outlook statement is confident:

Overall, the business is delivering on its early promise, using the enhanced profile and strengthened balance sheet resulting from the IPO in 2017 to capitalise on the growth in demand for Infrastructure as a Service offerings within financial markets. We are confident the quality of our service will see our client list continue to grow in the year ahead, and we look to the future with confidence.

My view - this looks and sounds like a decent outfit. I don't understand why someone else couldn't build a similar company if they were willing to spend the money on servers in good locations, but see for yourself what you think of the company's analysis of its competitive positioning:

We have... a strong competitive advantage through the breadth of our connectivity to trading venues, the sophistication of our self-service web portal, and the breadth of our services. We now have a foot-hold in all asset classes of note, meaning we can enter into contract discussions with any financial institution within the trading ecosystem. We believe we are now one of only very few businesses with this breadth globally and are unique in delivering these services via the cloud.

Stocko is cautious, classifying it as a Falling Star:

Out of time for today, thank you for your comments and feedback as always.

Paul is back tomorrow.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.