Good morning!

I'm back to look after the SCVR for a few days.

After some musings on the FTSE, I will look at:

- Carpetright (LON:CPR)

- Clipper Logistics (LON:CLG)

- Hipgnosis Songs Fund (LON:SONG)

- Cambridge Cognition Holdings (LON:COG)

FTSE Index - Contrarian Trading

It may not be the most exciting financial instrument in the world, but the FTSE remains an object of fascination for me.

This instrument was trading above 6700 in mid-2007. It previously broke that level in 1999 and 2000.

Twenty years later, anyone who was waiting for some decent capital appreciation has been disappointed. Despite reaching 7900 last year and 7700 this year, it is now threatening to return back to the 7000 level. Over a very long period of time, it has made very little progress.

Now it is true that the dividends have been strong, and if you reinvested them, then your portfolio has done ok. But the capital value of the index hasn't gone anywhere.

There are several possible explanations for this, and I think "the truth" lies somewhere in the middle:

1) FTSE-100 is a poor-quality index whose companies are structurally unable to generate compound returns.

2) The FTSE-100 is currently exposed to severe macro-economic risks (e.g. Brexit, recession), which require the index to carry a large discount.

3) (related to 2) The pound sterling is temporarily undervalued. When it strengthens, the value of foreign earnings will decline in GBP terms. The FTSE needs to be discounted to prepare for this.

4) The FTSE-100 is undervalued.

Personally, I am leaning toward 4) as the primary explanation for the FTSE's current level, with a little bit of 1) and 2) and 3) as well.

Indeed, I have added to my leveraged long position in the FTSE this morning, via put options.

While I have mostly avoided leverage in the past, and remain very cautious about using it, I can't resist taking a big position in the UK index at this time.

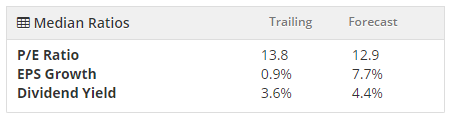

Even allowing for the fact that it's a low-growth index, the P/E ratios which it offers make little sense to me:

I don't currently expect interest rates to rise. And especially if they don't rise, then the dividend yield offered by the FTSE is really good value right now, in my opinion.

If UK price inflation picks up, that would still favour the FTSE, in my view, as many of the companies would be able to increase their sale prices simultaneously (e.g. the commodity sector, consumer goods).

Sector Concerns

Financials make up around 20% of the value of the FTSE. If we had another banking crisis, then of course that would be a big blow.

But if you look at the share prices of the big banks, they are already looking quite beaten up.

Barclays (LON:BARC), for example, sports a P/E ratio of 6x and a forward dividend yield of 6.5%. Its price to tangible book value is .4x (all numbers according to Stocko).

In a similar way, Lloyds Banking (LON:LLOY) has a P/E ratio of 6.5x, a dividend yield of 7% and a price to tangible book value of 0.9x. The yield at HSBC Holdings (LON:HSBA) is also 7%.

While I wouldn't be interested to own these shares individually, buying them as a sector group within an index at current levels doesn't scare me. One or two of them could have a problem, sure, but the basket as a whole might still offer decent value (assuming that we don't have another global financial crisis and bank crisis!)

The big-cap energy sector is another area where buying individual stocks isn't something I normally do, but where I think the group as a whole may offer value within the index.

Royal Dutch Shell (LON:RDSB) currently offers a 6% dividend yield and a PER of 10x. Glencore (LON:GLEN) trades around book value and offers a dividend yield of more than 6%. The yield at BP (LON:BP.) is nearly 7%. This is a basket of shares where I'm happy to be long at current levels.

Summary

When trading the index, I don't get to enjoy this yield directly, but I do get to enjoy any change in the market's perception of what this yield is worth.

The FTSE is in a perfect storm right now of Brexit concens and recession fears. International investors don't want to know about it, and British investors are unable to take up the slack, riddled with fear of Brexit and another recession. And for the average investor, the fiasco at Woodford may have knocked confidence in the funds industry.

I think it's exactly at times like this that someone with a bit of additional risk tolerance and a longer time horizon, can potentially get some great bargains, both at an individual stock level and also from the point of the index. Let's see if the FTSE turns out to be a bargain at current levels.

Disclosure: the breakeven levels for my FTSE trades are around 6400-6500.

Carpetright (LON:CPR)

- Share price: 14.75p (+9%)

- No. of shares: 304 million

- Market cap: £45 million

Long-term shareholders have been devasted by this company's decline but more recent buyers have something to think about today, which might be positive. A major shareholder has bought up the company's credit facility from its banks. It's a £40.7 million facility.

In addition, the major shareholder is going to fully support the banks in their provision of Carpetright's £6.5 million of overdrafts. It's a quirky structure but it effectively means that the shareholder is replacing the banks in both the RCF and the overdrafts.

The shareholder is a hedge fund which owns almost 30% of the shares, just below the level which triggers a mandatory takeover bid.

Some important comments by the company:

In connection with the arrangements Meditor did not seek any assurances from the Company, did not propose board representation and did not request structural changes in the business. Meditor has confirmed it now intends to engage with the Company with a view to providing a more stable and longer-term funding platform.

My view

I've heard some of the comments from sell-side analysts on this stock today, and I share their caution.

While this might be good news, that depends on Meditor's plans and on future negotiations.

Meditor might want to protect the value of its existing equity investment by providing a more generous lending platform to Carpetright. But for all I know, it might instead plan to take control of more of the equity. As the new principal lender, I'm guessing it has the whip hand.

Carptetright's most recent annual results (FY April 2019) disclosed a material uncertainty about its ability to continue as a going concern, depending on future trading and whether it could renegotiate its lending covenants. If it does seek to renegotiate covenants in future, it will be renegotiating with Meditor.

This share remains far beyond my risk tolerance. Just goes to show that even after a CVA and a rescue fundraise, a company can continue to struggle. This share is for traders and insiders only, in my view.

The StockRanks rate it as a Value Trap, which sounds about right.

Clipper Logistics (LON:CLG)

- Share price: 224.5p (-0.2%)

- No. of shares: 102 million

- Market cap: £228 million

Trading update and notice of full-year results

Readers may know this as the outsourced logistics supplier to Sosandar (LON:SOS). It's "a leading provider of value-added logistics solutions and e-fulfilment to the retail sector".

Today's update confirms that the company is trading well and revenue for FY April 2019 will be "slightly ahead of current market expectations".

However, due to some timing issues on the recognition of contracts, EBIT for FY 2019 will be £20.2 million, "moderately below expectations". For what it's worth, I can see an FY 2019 EBIT forecast of £23.5 million.

But the company says that there will be an uplift for FY 2020, as the lost profit is recognised the following year, instead.

My view - I tend to steer clear of this sector, but have a positive view of this company. If the market as a whole wasn't so weak, I would be shocked that its share price had been hammered so hard in recent months (it was >300p in May). Last year, it approached 500p at the peak.

Current pricing seems very reasonable: PER around 11.5x, and a single-digit EV/EBITDA multiple. For fans of this company who have researched it properly, I imagine that now could be a decent entry point.

It was previously rated as a growth share, and is now being rated as a more run-of-the-mill support services company:

Risks might include weakness among its clients in the online retail sector (the likes of Sosandar (LON:SOS) and £BOO). On the other hand, as a "picks-and-shovels" type of service provider, maybe it will enjoy some insulation if that sector retrenches?

It's too tricky for me, so I'm on the sidelines.

Hipgnosis Songs Fund (LON:SONG)

- Share price: 105p (unch.)

- No. of shares: 341 million (pre-Placing)

- Market cap: £358 million

Proposed placing of ordinary shares

This unusual fund, which buys music catalogues, is raising an extra £72 million.

It last raised money at 102p, and previously raised money at 100p. It is now raising at 105.5p.

While that's not conclusive evidence of anything, it does at least suggest that the company is creating value and that its incremental value is being recognised in subsequent fundraising rounds.

Its most recent two quarterly dividends have been 1.25p each. For yield hunters, this could be worth a look.

Cambridge Cognition Holdings (LON:COG)

- Share price: 32p (-49%)

- No. of shares: 24 million

- Market cap: £8 million

Commiserations to anyone who was holding this last night.

This company has had a few issues around revenue recognition in the past (like so many others lately), but today's update can't be blamed on accounting problems.

H1 revenues are down from £2.75 million to £2.17 million, and losses are increasing. It is hoping to work its way back to breakeven by Q4 2020.

My view - too speculative for me, I'm out (dropping coverage).

That will do for today, thanks everyone.

Cheers,

Graham

PS: I hope you find my new picture slightly less offputting - "no more squinting", as a reader put it!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.