Hi everyone!

Thanks for all the fantastic feedback yesterday on the subject of tablets. I wandered around a couple of department stores for a few hours, and in the end decided to wait another few months before making a bigger purchase that could also be used as a laptop. There are some amazing new hybrid devices (with both laptop and tablet functionality), and I think I'll choose the Surface Go or Surface Pro from Microsoft.

Burberry (LON:BRBY)

(Please note that I have a long position in BRBY.)

More portfolio news this morning, with a Q1 update from Burberry (LON:BRBY). This was already my second-largest holding, and the shares are up 8% as I type. The company has reported a return to like-for-like store sales growth (around 4%) thanks to a strong response to the company's new product range.

The outlook for FY 2020 is unchanged, including the previously-announced H2 weighting. But I think that investor uncertainty surrounding the new designer is evaporating. Like-for-like store sales growth, the closure of some underperforming stores, and £120 million of cost savings are all reasons for encouragement. I'm happy to continue holding for the foreseeable future.

Note also that this share has a StockRank of 87. I'm not ashamed to buy quality big-caps, sometimes!

Ok, time to check out some small-caps.

- Fulham Shore (LON:FUL) - results

- MPAC (LON:MPAC) - trading update

- A.G.Barr (LON:BAG) - trading update

- XLMedia (LON:XLM) - tender offer

Fulham Shore (LON:FUL)

- Share price: 12.4p (+8%)

- No. of shares: 571 million

- Market cap: £71 million

This restaurant has really grown on me. It started out as a research project, but I found that the sourdough pizzas at Franco Manca were so good and the meals were such good value that I was happy to keep going back.

I also tried out The Real Greek in Covent Garden this year - not such a compelling format, but still a good experience.

These are some decent results:

- Revenue growth is 17%. The total number of restaurants increased by 5%, so the like-for-like numbers must be good.

- "Headline Operating Profit" is £3.5 million (2018: £3.7 million)

- Actual operating profit £1.8 million (2018: £0.1 million)

- Net debt is £9.4 million, a reduction from last year.

The Chairman notes that "much of the capital invested in the UK restaurant sector over the past five years has not been spent wisely" - indeed!

Some of us would argue that there has been a general oversupply of restaurants, but it's probably true that the demise of the restaurant sector also has a lot to do with bad decision-making within it.

Successful restaurant businesses continue to be those that offer consistent, delicious and reasonably priced food made with quality ingredients.

I tend to agree that Franco Manca does this.

He talks about opening restaurants in unusual locations, with the view that customers will find them anyway, if they are good enough - interesting.

Growth plan - now targeting eight to ten new restaurants in the current financial year. The current financial year started with an estate of 60.

Property - Fulham Shore thinks rents must fall further, and is holding out for lower rents on its properties. I agree with that strategy, and share their optimism: we aren't in a normal cycle, but in the middle of a long-term shift where the use of property is changing.

The Chairman comments:

I believe we are due for a longer period of rental decline this time around. Commercial agents, who have historically been aligned with institutional landlords' interests, should realise the boot is now firmly on the other foot. These agents should start to truly represent successful tenants' interests as that is where the power and their interest now lies.

Dividend - no dividend, as the money is needed for the expansion. The Board will "consider a dividend policy over the current financial year".

Outlook - Confident. Franco Manca is coming to Leeds, Edinburgh and Manchester.

Financial Results

The use of Headline EBITDA is a bit problematic for me, since I view depreciation as a real cost of runnng a restaurant business.

If you're happy with the other adjustments, you could take the company's Headline EBITDA and subtract the depreciation and amortisation expense (nearly all of this is depreciation). You then have an underlying EBITA of £3.5 million, which is still a heavily adjusted number.

I'd also want to include the PPE impairments and the share-based payments, since I view them as regular costs of doing business (and you can see that they are in the accounts both this year and last year).

So personally, I would use an underlying EBITA of £3.2 million.

Conclusion

As much as I enjoy dining at Franco Manca, I'm more comfortable being a customer than a shareholder. Even using the pre-tax, pre-interest EBITA number above, you still get a hefty earnings multiple at the current market cap.

This sector terrifies me, so I'd want cheap pricing before I considered getting involved, even for a format which works really well like Franco Manca (or Real Greek).

Remember that bad weather can be disastrous:

Summer of 2018 was much stronger than the previous summer especially with a significant number of days benefiting from warm weather and sunshine.

The sun is shining right now, which bodes well for FY March 2020. And with lots of store openings in the works, the company is set to make hay. Just watch out - summer of 2020 might not be so favourable!

MPAC (LON:MPAC)

- Share price: 184p (+18%)

- No. of shares: 20 million

- Market cap: £37 million

This is what used to be known as "Molins". It's now a high speed packaging business.

Profit for FY 2019 will be significantly above current market expectations.

The current order book, year to date order intake and the volume of quotation activity provides the Board with confidence in the prospects for the remainder of the year.

Pension Predicament

As of December 2018, the company pension fund (according to accounting rules) had assets of nearly £400 million, versus liabilities of nearly £380 million, i.e. a £20 million surplus.

On the stricter actuarial basis, the fund was in deficit of £35 million as of June 2018. That's actually a big improvement compared to where it was three years previously, and the company said:

The actuarial deficit is now expected to be eliminated in July 2024, compared to August 2029 under the previous valuation.

For now, the annual deficit recovery payments to the fund from Mpac are c, £2 million p.a.

My view - there are different ways of looking at this, e.g. you could take the present value of the future deficit recovery payments (about £10 million in total over five years) and add them on to the market cap, to see what the current valuation says the underlying business is worth.

However, it's important to remember that 33% of underlying profit between £5.5 million and £10 million will have to be paid to the pension fund each year until 2024.

So between deficit recovery payments and these bonuses, the pension fund is set to gobble up a lot of cash over the next five years. The more successful that Mpac is, the more cash the pension fund will gobble up.

And even though the pension fund has been managed successfully so far, there is still some risk associated with interest rates and the other ingredients which make up a pension liability, which shouldn't be forgotten.

Equity Development are looking for Mpac to generate adjusted PBT of £5.5 million this year, on the back of a huge revenue increase (including the effect of an acquisition).

That will be a fine result, and the signs are strong that it will be achieved. On the basis of positive trading, we can now say with some confidence that Mpac is likely to outlive its pension fund.

As a result, the debate has moved on to the more bullish question of just how much cash is going to be left over for shareholders between now and 2024. There's probably no good way of analysing this without getting your spreadsheets out and doing the sums.

But away from the financials, we also need to bear in mind that this is a lumpy business. Predicting the demand for Mpac's assembly and packaging machinery is not exactly straightforward. It's too difficult for me.

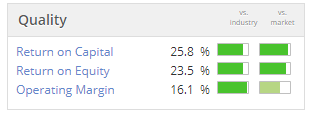

Stocko likes it, calling it a Turnaround stock - how clever! High value and high momentum, but low quality:

A.G.Barr (LON:BAG)

- Share price: 654p (-25%)

- No. of shares: 114 million

- Market cap: £744 million

Again this is not a small-cap, by our definition, but let's say a few words on it.

I entered the soft drinks sector in late 2018, adding Britvic (LON:BVIC) to my portfolio. Barr and Britvic were both interesting to me, but I like Britvic's portfolio and thought that it was priced much more reasonably, even taking its debt into consideration.

But could an attractive buying opportunity at Barr have finally arrived today?

What happened

Barr increased its pricing again, after it had previously cut prices to deal with last year's challenges.

This has not worked out well, and trading has been below expectations.

This has been exacerbated by some specific brand challenges, particularly in Rockstar energy and Rubicon juice drinks, as well as disappointing spring and early summer weather, most notably in Scotland and the north of England, and compounded further as we approach the half year when the prior year comparative weather was at its peak.

So we have another weather-related story. This time, poor weather in Scotland and the North of England (relative to last year) is making it impossible to meet the prior-year comparatives.

On the brand-related issues, the benefits of remedial action will not be felt until later in H2 (the company's financial year ends in January).

Outlook

- H1 revenue down 10% to £123 million

- Not expecting volumes to recover in H2

- Full-year profit expected down by up to 20%

- Exceptional costs will be incurred to regain momentum

My view

Let's figure out the latest PER, first of all.

Adjusted PBT last year was £45.2 million (the adjustments are minor).

Taking this down by 20% gives us £36 million, which is supposed to be the bear case scenario.

Applying tax, we get net income of £29 million.

So by my quick calculations, the current-year P/E is now 25.5x (worst-case scenario) at the current share price.

The portfolio - the staying power of its main brand IRN-BRU is well-understood, and I can also see a lot of value in Snapple.

Other brands, however, don't stand out to me - I'm unfamiliar with many of them. Indeed, today's profit warning has been partially caused by problems with the Rockstar range of energy drinks and with the recipe for Rubicon juice drinks. I'm not familiar with these brands.

So while I'd be willing to pay up for IRN-BRU and Snapple, I have limited interest in many other elements of the portfolio.

For these reasons, I am inclined to stay on the sidelines for now. I'd like to see if Britvic and other peers report sharply declining volumes. I want to know if the pricing strategy has caused any permanent damage to the core brands. And I'd also like to get a sub-20x P/E multiple for an entry point! Perhaps that's too greedy, but it seems fair.

Conclusion - Barr is staying on my watchlist, as I wait for a juicy buying opportunity. Existing, long-term holders might feel inclined to carry on holding, which I would not argue with.

XLMedia (LON:XLM)

- Share price: 78p (+7%)

- No. of shares: 207 million

- Market cap: £161 million

Tender Offer, Notice of GM and Trading Update

Good news. XLMedia proposes to accelerate its buyback efforts with a 20 million-share purchase at 80p. It replaces the existing $10 million buyback programme.

Trading update - business is stable in and in line with expectations. Personal finance publishing is going well in North America, but gambling legislation is hurting revenues in Sweden.

It reiterates that the cash is all real, and continues to flow:

The Company has a positive material cash balance and generates strong cash flows from operations. The Company's current cash balance will support the proposed Tender Offer, ongoing organic investment initiatives and current working capital commitments. XLMedia remains a highly cash generative business and as such will continue to maintain a progressive dividend policy, distributing at least 50 per cent. of retained earnings.

My view - If I was forced to invest in one more Israeli company (in addition to 888), it would be either this or Plus500 (LON:PLUS) (at current levels). There is plenty of evidence that the cash at XLM is real and the new publishing strategy is simple and easy to understand.

I have no idea what it might do over the long run but for now I do think that shareholders could potentially get showered in cash.

Elsewhere:

- the law firm Gateley Holdings (LON:GTLY) has released results and the outlook sounds in line with expectations.

- the premium cinema chain Everyman Media (LON:EMAN) has released a trading update which is in line with expectations, too.

- Cloudcall (LON:CALL) shares are down 10% as it reports a "lag" in revenue from larger customers. There doesn't seem to be any point in commenting on this, as Paul has studied it in a lot of depth.

That will do for today - thanks everyone.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.