Good morning!

The market continues to suffer the blues, i.e. it's in the red with the FTSE down by more than 100 points this morning.

The Dow Jones lost 800 points yesterday (about 3%) and while it remains at an elevated level, those sorts of daily movements aren't good for an investor's nerves.

The two major issues in the US are

- their entire market is overvalued vs. historical norms, and

- the Fed wants interest rates to get back to a more normal range (but the President does not).

The situation in the UK is very different - in fact, it's pretty much the exact opposite. We don't have that problem of wild overvaluation, even though the Bank of England has shown no real ambition to get interest rates back to normal.

In other words, relative to interest rates, UK equities are amazingly cheap at the moment. The obvious explanation for this is Brexit uncertainty.

I've seen some of this first-hand, among friends. International investors are getting scared out of UK property and UK savings accounts by the doomsday predictions of a disorderly Brexit.

But for an economic contrarian who specialises in UK equities, it's a great time. I can buy into a market (the FTSE) that is hated by international investors at a level that has made no progress at all in 18 years.

Admittedly, its valuation was over-cooked in 2000, and that was true again in 2007. But it's much less likely to be overvalued on the third attempt, nearly twenty years later!

Don't get me wrong - I do expect turbulence around Brexit. The vote in Parliament next Tuesday could, in the words of a fellow investor, be "the point of maximum pessimism". It feels like the strange and unusual politics around Brexit have been building up to some kind of a crescendo - perhaps the final movement is about to begin.

With my customary macro intro out of the way, let take a look at some shares.

- Boohoo (LON:BOO)

- eve Sleep (LON:EVE)

- Ted Baker (LON:TED)

- Impax Asset Management (LON:IPX)

- Clipper Logistics (LON:CLG)

- PCF (LON:PCF)

Boohoo (LON:BOO)

- Share price: 180.6p (-0.8%)

- No. of shares: 1160 million

- Market cap: £2,095 million

The BBC's "Watchdog Live" found that Boohoo's countdown timers on its sales promotions were fake. When the time ran out, the timer simply started up again and the sale promotion continued.

Boohoo today says that it will take on board some guidance from the Advertising Standards Authority/Committee of Advertising Practice, and review its promotions so that they comply with regulations. No action will be taken by the ASA/CAP.

It doesn't seem to be a material news story for investors. This kind of thing is very common, all over the web. I've noticed that the poker app I use on my phone nearly always has a little hourglass in the top corner of the screen, trying to sell me something before the offer expires. It's misleading because there is always an offer and the offers are always approximately the same as each other! But the timer helps to promote the idea that the offer is scarce.

By the way, I can't help noticing that boohoo's lack of share price progress over the past 18 months has helped it to grow into its valuation to some extent:

It first reached the current level c. April 2017. Might be worth keeping an eye on this for continued weakness.

eve Sleep (LON:EVE)

- Share price: 11.35p

- No. of shares: 140 million

- Market cap: £16 million

Woodford Investment Management is doubling down on this dog, planning to put another £8 million into it and taking a 42% stake.

Can anyone point to a recent example where Woodford allowed a failed company to die or for the ownership of the company to pass on to others, rather than putting more and more of his own cash in? His 64% stake in RM2 springs to mind.

I get the impression that there is a bloody-minded refusal to admit defeat at WIM. It can't end well.

Ted Baker (LON:TED)

- Share price: 1531p (+4%)

- No. of shares: 44.6 million

- Market cap: £682 million

For the 16-week period from 11 August to 1 December, trading seems in line with expectations. Performance is described as "resilient".

- retail sales (including e-commerce) +2.3%, slower than the rate of growth of average retail square footage (+5.2%).

- E-commerce sales 30.% of total (2017: 26.3%)

- wholesale sales minus 6.5%, as expected, due to earlier timing of wholesale deliveries. Unchanged expectations for "mid to high single-digit wholesale sales growth (in constant currency) for the full year."

Separately, a law firm has been hired to conduct an independent external investigation into accusations against the Founder-CEO.

My view

This is looking super value at the moment, on a forward P/E ratio of only 10x.

It's a true international brand - c. 60% of stores and concessions are outside the UK. So you get that international diversification to mitigate macro risks.

Some readers will know that luxury is one of my favourite sectors. Within luxury, Ted Baker is clearly one of the most successful brands.

General fears around retailing should, in my view, distinguish between the everyday brands competing on price (where customers will switch to online competitors if they are cheaper) vs. the luxury brands who earn very high margins and are more about selling a lifestyle and an image.

The Ted Baker gross margin is c. 61%, not as high as Burberry (LON:BRBY) (69%) (in which I have a long position) but not far off Mulberry (LON:MUL) (63%). I think all of these shares are worth researching.

Besides slowing sales growth, a primary concern with Ted Baker now is whether the allegations against the CEO could turn into something more serious and end up poisoning the whole brand. It's hard to distinguish his fate from the fate of the company, given how central he has been to its success.

For that reason, I haven't quite had the courage to pick up some shares in this yet. It remains high on my watchlist.

Where the StockRank falls down is its Momentum - the share price is in a firm downtrend.

Impax Asset Management (LON:IPX)

- Share price: 213.5p (-2%)

- No. of shares: 130 million

- Market cap: £278 million

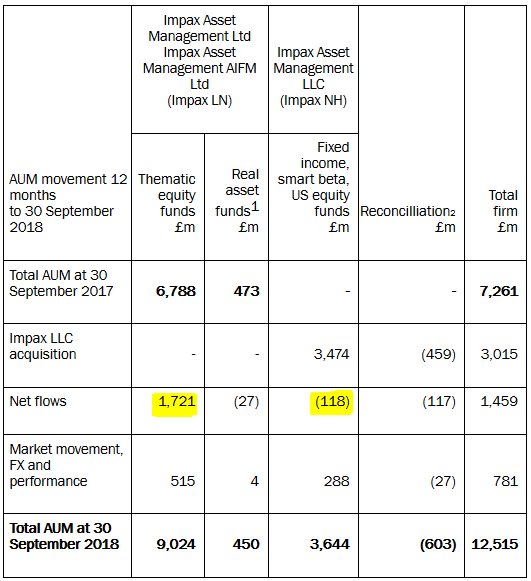

The "business highlights" and "financial highlights" from Impax are heavily influenced by its acquisition of Pax in January, so most of the numbers are unhelpful in terms of figuring out the group's underlying or organic performance.

Thankfully, the integration of Pax appears to have gone well.

Underlying performance is also quite good. You can see from this chart below that the core business in London saw good inflows during the financial year ("Impax LN").

The acquired business in New Hampshire ("Impax NH") saw small net outflows.

The flow numbers are the ones which matter to me, since they represent customer decisions and customer demand.

The market movements/FX and performance, on the other hand, are to a large extent beyond anyone's control!

If I held these shares, I'd have some concern about the outflow from Impax NH. Though it is understandable in the sense that some clients might have had concerns over the change of ownership, and active fund flows in general have been very weak in the US.

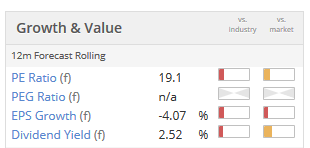

Congrats to anyone who has held on to this company since we started covering it in this report. For what it's worth though, I do think it is fully valued at present. There are other good asset managers at significantly cheaper ratings. So unless you have a lot of conviction in the trend for environmental investing, I don't see why you'd be in a rush to buy these shares at the current level.

Clipper Logistics (LON:CLG)

- Share price: 283.5p (-2%)

- No. of shares: 101.5 million

- Market cap: £288 million

Key points:

- revenue +14% to £228 million

- EBIT +16% to £10.7 million

- e-fulfillment and returns management particularly strong

- PBT +17% to £9.3 million

Many private investors will know this as the logistics supplier for Sosandar (LON:SOS), where coincidentally it provides e-fulfillment and returns management. Clipper is an indirect beneficiary of Sosandar's growth! It also works for ASOS (LON:ASC) and Boohoo (LON:BOO) (Pretty Little Thing).

Exec Chairman comment:

"The Group continues to be exceptionally well-placed to benefit from the continuing migration to online retailing and the increasing propensity for consumers to choose click-and-collect services when placing orders online."

Outlook: Clipper is "performing well" so far in H1.Lots of detail provided. Overall, seems fine.

My view: I avoid investing in the logistics sector as I find it too difficult and unpredictable. Got to hand it to Clipper, though - it has a terrific track record:

The share price has been weak since it missed expectations earlier this year. It's still not as cheap as I would like, but others might like to research it further.

Property-related services?

As has been pointed out in the comments, Clipper has a contribution to EBIT from "property-related advisory services", and it's not obvious what these services actually are.

I've checked out the most recent annual report, in which it says that these services are "linked to optimising the Group’s warehousing arrangements".

The report also says in relation to these services:

Management assesses the fees that are applicable to each specific transaction and recognises revenue in the income statement at the time of the underlying transaction. In forming the judgment, the Group considers whether the leases it has entered into are operating leases, whether the future rentals are at market value and accordingly whether the fees can be attributed to delivered property services.

What does this mean? Is space being rented out below market value?

I think there is possibly only one customer for these services: Hamsard 3476 Limited, a company controlled by Steve Parkin (Executive Chairman), which according to Companies House also has Clipper's CFO on its Board.

At year-end 2018, Hamsard owed Clipper £4.2 million (the entire amount of revenue it generated for Clipper). For the most recent H1 statement, Hamsard owes Clipper £2.8 million (again, the entire amount of revenue it generated for the period).

Related party transactions are usually worth investigating. Clarity on these transactions would be welcome.

PCF (LON:PCF)

- Share price: 36p (-3%)

- No. of shares: 214 million

- Market cap: £77 million

(Please note that I currently hold PCF shares.)

These results came out yesterday.

I attended PCF's recent presentation at Mello. Scott Maybury left everyone with a very positive impression of progress.

We have confirmation from this statement that the company is a year ahead of schedule to meet its £350 million portfolio target (though this includes an acquisition - the original target was based purely on organic growth).

The savings product has proven to be a hit among retail customers, picking up a couple of awards and letting people open an account in minutes.

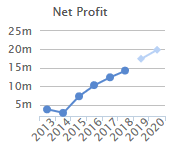

Increased size has enabled ROE to pick up to 10.3%, but I hope that this is only the beginning of ROE increases. The platform should be capable of reaching 12.5% soon, and then reaching higher after that with further bolt-on acquisitions.

Impairments remain very low at 0.5%. The company admits that this figure is being boosted in an artificial way by the recovery of old debts from the financial crisis, so that the actual rate is "slightly higher" than the headline rate.

I'm fine with that. PCF is moving more and more into the "prime" customer segment with its core business, so overall credit risk levels are falling.

The chief risk/opportunity looking out to 2022 is in the diversification and acquisition initiatives. PCF has already made an acquisition in lending to the media/broadcast industry, and is now looking at moving into the property bridging sector.

I'm sufficiently comfortable with management and with the overall story to see an opportunity for continued growth in ROE to 12.5% and beyond. Anything higher than 12.5% would be satisfactory for me over the long-run.

Net assets are £42.6 million, putting the price to book value ratio at 1.8x at today's share price. Anything much higher than that would probably be too adventurous, given the stage it is at. But as a long-term hold, I'm very comfortable with this share.

All done, thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.