Good evening/morning, it's Paul here.

I'll start (this bit written late Monday evening) with some catching up from stuff I was too tired to write about earlier, to get you started on Tuesday morning.

Tandem (LON:TND)

Share price: 190p (up 3% at market close)

No. shares: 5.0m

Market cap: £9.5m

(I do not currently hold this share, but have done in the past)

This group sells bicycles, mobility & leisure equipment, and toys.

The shares looked interesting earlier this year, after it reported a bumper H2 in 2018, of about £2.4m profit. Some investors thought this might be a new, higher run, rate, implying maybe £4-5m future annual profit.

That's not turned out to be the case, as H1 in 2019 reported £509k pre-exceptional profit, not the £2m+ that some imagined might be the case. Still, it's a good improvement on the -£298k loss reported in H1 of 2018.

Revenues also seem somewhat unpredictable (hence why profit goes up & down), eg.

H1 2018: £12.7m

H2 2018: £19.8m

H1 2019: £16.0m

Hence it's looking as if the bumper H2 last year might have been a bit of a one-off bumper period?

Outlook comments are quite detailed, talking about each product category. The overall picture is this;

The potential threats on the horizon that we previously alluded to remain in place. Whilst we shouldn't seek to 'blame' Brexit, we remain cautious as to the impact that it will have, should it materialise soon, with potentially uncertain future import duty rates and with regards to consumer spending which is discretionary for the type of products that we supply.

Weak sterling, and therefore a correspondingly stronger US dollar, is also likely to effect the cost of future imports.

We previously stated that the longevity and success of most licences is limited and transient. Whilst we continue to seek new, exciting and profitable properties there is no guarantee of this.

[Paul: note that Peppa Pig is mentioned, which has recently been bought out by Hasbro - how much impact could this have on Tandem?]

Despite these threats we look forward to the rest of the year with some confidence and expect to deliver a satisfactory result to our stakeholders for the full year.

Who knows what a satisfactory result would be? There doesn't seem to be any broker forecasts out there.

Tax charge - strikes me as unusually high in percentage terms. The company says;

There was a tax charge of £215,000 during the period compared to £8,000 in the prior period. This reflected the increased level of business undertaken from our Far East operations.

Investor presentation - helpfully, the company has provided this 44 page slide deck on its website today. It only took me about 10 minutes to whizz through, as most of it is pictorial, showing products.

Balance sheet - looks OK.

Net assets: £12.4m

Net tangible assets: £6.9m (after removing £5.6m of intangible assets)

Current ratio: 1.47 - looks OK

Current assets contains cash of £3.74m, up strongly from a year earlier;

Cash and cash equivalents were £3,740,000 at 30 June 2019 which compared to £957,000 at 30 June 2018. The timing of creditor payments, utilisation of invoice finance facilities and ongoing careful management of inventories helped to improve this position.

However, the narrative then refers to overall net debt, despite there apparently not being any bank debt on the balance sheet;

There was a 43% reduction in net debt from £3,508,000 at 30 June 2018 to £2,006,000 at 30 June 2019.

Therefore, I make that a £5,746k liability included within net debt. Let's try to work out what that is! Right, I've worked it out - this figure must be the total of two lines, both called "other liabilities", of £4,736k in current liabilities, plus £1,010 in non-current liabilities.

Curiosity got the better of me, so I've looked up what this debt is, in the 2018 Annual Report (note 14). It's mainly invoice discount financing, plus a mortgage on a freehold (which itself is in the books at £3.12m asset - based on a Jan 2018 external valuers report).

Investors could easily miss the debt, hence it's important to remember that the cash figure of £3.74m is only part of the picture. The company doesn't have net cash, it has net debt, of £2.0m, but I would also take into account the freehold property of £3.1m.

I feel that the company should clearly mark interest-bearing debt as being such, on the face of the balance sheet. Not just call it "other liabilities", which is not the correct description of what it actually is, and could lead to some investors missing the debt altogether. It looks as if Thomson Reuters haven't picked up on this debt, since it shows a substantially good net cash figure, which is not correct in my view. I've raised a green ticket, to have this issue looked into by the team at Stockopedia HQ & to query it with TR.

Pension deficit - also needs to be factored into valuing this share, at £2.67m.

Overall therefore, the balance sheet is not as strong as I thought it was originally, but it's perfectly adequate.

My opinion - given its tiny market cap, and balance sheet not being as strong as it initially looks, on top of profitability (with a high tax charge) that is significantly down on the last half year sequentially, I'm struggling to get excited about this.

The dividend yield is nothing to write home about either. Plus there's often a wide bid-offer spread, and the share is very illiquid. I recall it took me several attempts to sell, and had to do it piecemeal, for a smallish speculative holding that I picked up a while ago & then got bored with.

On the upside, outlook comments suggest that H2 should be OK.

In these cautious & uncertain times, I don't think it's worth getting involved again here, so I'll stay watching from the sidelines.

Altitude (LON:ALT)

Share price: 56p (up 22% at market close)

No. shares: 68.8m

Market cap: £38.5m

Altitude Group plc (AIM: ALT), the operator of a leading marketplace for personalised products, announces its unaudited results for the six months ended 30 June 2019.

This is a bit of a punter's favourite - a lot of people got clobbered by the recent profit warning.

The 5-year chart below neatly shows how the legacy business was virtually worthless, then all the excitement started in 2016 about it branching out into developing a US-based internet platform to link up end customers with promotional products companies. The idea being that there are numerous mom & pop companies in the promotional products sector, with a big gap in the market for a tech platform that enables them to easily create personalised websites for their clients.

As you can see from the chart, the jam tomorrow bubble burst recently. Although I'm taking a look today, because there's been a 22% rebound upwards today in the share price, so maybe people are starting to get interested again?

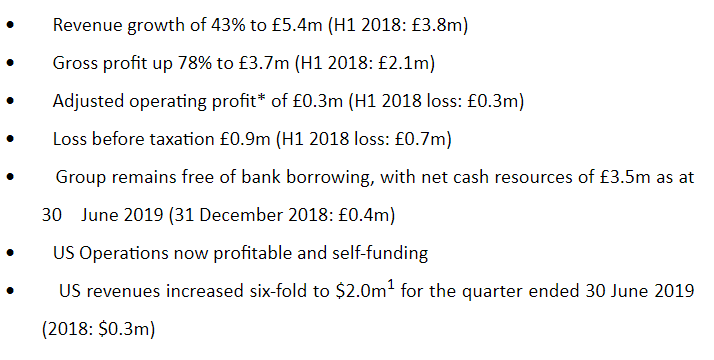

The financial highlights show some progress, although bear in mind it made an acquisition in Jan 2019, which will have fed into most of this 6 months P&L numbers;

I like the comment about being self-funding, which reduces the risk of further dilution.

High gross margin, and breaking into a small operating profit, also look reassuring.

Balance sheet - looks sound.

There's £3.5m of cash, and no debt.

Cashflow statement - it funded the acquisition of AI Mastermind LLC, and other outflows, with a £9.1m placing. This also left enough left over to boost the cash position (very sensible).

Outlook - management remains very excited about the potential, whilst admitting that growth to date hasn't been as fast as originally expected.

My opinion - I can't really take it any further than that, because the valuation rests entirely on future growth actually happening, and fast enough to get everyone excited again.

Given that, so far, results have disappointed, and broker forecasts have been wildly too optimistic, then there is a bit of a credibility problem.

On the upside, it's completely normal for rapid growth companies to over-egg the pudding early on. Growth companies nearly always take longer & cost more money, to achieve success - often years later than originally planned (look at CloudCall, for goodness sake!)

Therefore investors have to work out whether they think Altitude is a dud, or whether this year's profit warning was just a bump in a road which could still take them to sunny uplands? I've got absolutely no idea what the outcome is likely to be.

Having said that, I'd be much happier taking a punt on this at the current c.£40m valuation, than when it was approaching £100m market cap not long ago (which on reflection was crazy, given that it had only just started to generate revenues from the new activity).

I wouldn't rule this out as something I'd be prepared to take a punt on, now that the share price has come down to a more realistic level, given the early stage nature of what it's trying to do.

H & T (LON:HAT)

See the comments section below (no.2) for my thoughts on the positive RNS from this pawnbroker (increasingly looking like the last man standing) re current trading, and acquiring pledge books from a bust competitor.

Good, that's Monday's backlog sorted out.

Tuesday is set to be dominated by results/outlook from Revolution Bars (LON:RBG) (in which I have a personal holding), and a meeting with management in the afternoon. So I need to be really well prepared for that, so apologies in advance if it pushes other things onto the back-burner. I'm writing all of this week's reports, so I can always catch up on other stuff later in the week, and in the evenings, etc.

Revolution Bars (LON:RBG)

Share price: 67.4p (down c. 3% today, at 13:13)

No. shares: 50.0m

Market cap: £33.7m

(at the time of writing, I hold a long position in this share)

Revolution Bars Group plc ("the Group"), a leading UK operator of 77 premium bars, trading under the Revolution and Revolución de Cuba brands, today announces its results for the 52 weeks ended 29 June 2019.

I read the RNS first thing, between 7-8 am, and thought it looks encouraging. We already knew that the results for FY 06/2019 would be in line with market expectations, because the company would have had to put out a profit warning if that had not been the case (as it did in June 2017).

Therefore, the key issue to affect the share price, is the current trading & outlook sections.

I had a range of scenarios in my mind;

- Upside case - LFL sales turning significantly positive in current trading

- Middle case - continuation of last year's slightly negative LFL sales

- Downside case - a further deterioration in LFL sales

As things turned out, we're somewhere between the upside & the middle case, which I find moderately encouraging, for a turnaround situation, on a completely bombed out share price. The actions being taken by management are working, but not yet enough to put out any bunting.

Here are the main points the way I see things;

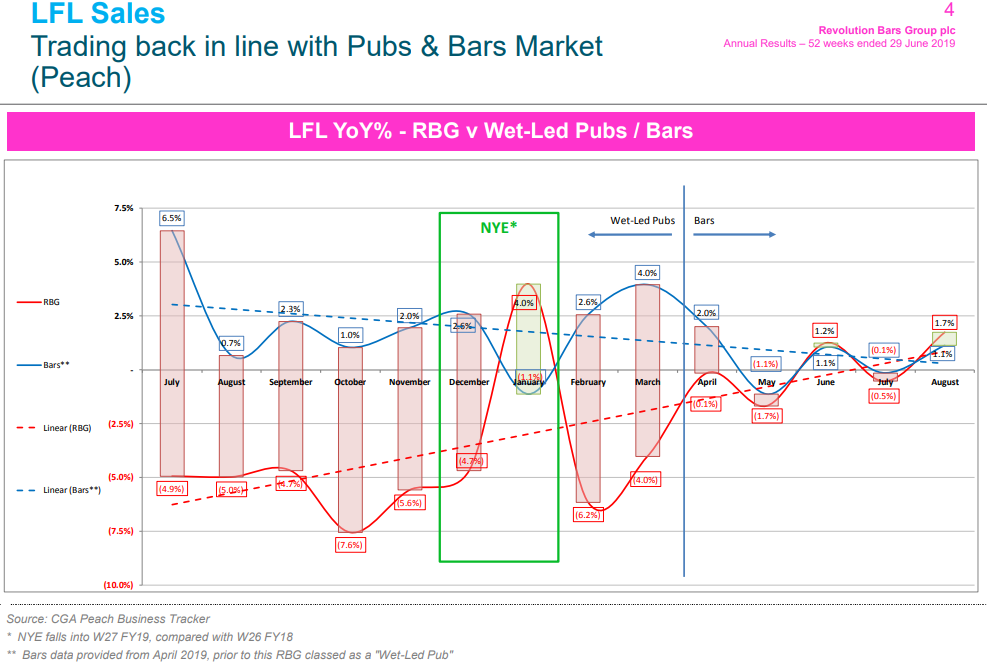

Improving sales trend - absolutely key. LFLs have improved from -4.0% in H1, to -1.8% by Q4, and now in the new year, Q1 was positive, at +1.2% (the most relevant figure, which strips out the impact of days when refurbishments were being carried out). This should have triggered a bounce in the share price, but so far it hasn't, as so few shares have actually traded (only 110k today so far, at the time of writing).

What went wrong? The main reasons for RBG's under-performance last year are these below, and I've added in brackets what management is doing to fix things;

- Older sites had become tired, and were suffering because they looked tatty. Previous management had concentrated on new site openings, neglecting to keep older sites up to standard, causing them to see sales declines & staff departures for smarter competitors. [Remedy - sites are now being rapidly refurbished, which costs c.£200k per site. New site openings have stopped for now, to allow a focus on improving performance of existing sites]

- Brain drain - key staff (e.g. area managers, accounts, and some top site managers) were poached by competitors, causing a deterioration in trading in some sites. [Remedy - recruiting, training & retaining good staff]

- Takeover activity - dragged on for a long time, resulting in a recommended cash bid at 203p (which with hindsight shareholders should have accepted), thus putting further strain on the previous management, affecting day-to-day operations. [The Stonegate bid fell through, so new management has been able to focus on running the business]

- Own goals with the food menu - a (since departed) Food Director made a complete hash of things, ditching best sellers for a fancy new menu that flopped. [New menu brought back the old best sellers]

I won't regurgitate all the detail from the commentary in today's RNS, but it strikes me that management is making reasonable progress, and doing the right things to fix the business. An example;

Refurbishments - this is the number one priority, and a virtually guaranteed way to improve performance of struggling, tired, sites. They cost an average of about £200k, which is a lot cheaper than initial fit outs for new sites, which are c.£1m.

Therefore with no new sites opening in this financial year, just refurbs, we should see the capex figure drop significantly. Hence free cashflow should improve considerably in FY 06/2020, enabling debt reduction (which is not high anyway).

Net debt at period end was £14.9 million (2018: £11.5 million) after capital investments of £11.6 million

Adjusted EBITDA was in line with expectations, at £11.1m. Therefore net debt/adj EBITDA is only 1.3 - this is not a problem level at all. Banks are usually happy up to about 2.5 to 3 times, sometimes more.

The going concern note 1(b) just looks like a formality, and is not a worry to me - it outlines the bank facility, concluding that there is ample headroom. We often see such going concern notes - it's only a problem if there is something worrying in there, which there is not here. Such a strongly cash generative business should have no problem at all renewing its bank facilities in due course, at a lower level. It also confirms actual & expected compliance with bank covenants.

... The Group continues to be very cash generative pre expansionary capital expenditure, has ample headroom on its facility to cover working capital and seasonal cash flow needs and can potentially cover a significant reduction in trading performance relative to the current sales trend.

The Directors have reviewed the Group's trading forecast, which demonstrate that the Group has adequate financial resources to continue in operational existence for at least 12 months from the date of approval of the financial statements and to remain compliant with the terms of the revolving credit facility and the financial covenants (tested quarterly) attached to it. For this reason, the Directors continue to adopt the going concern basis in preparing the consolidated financial information.

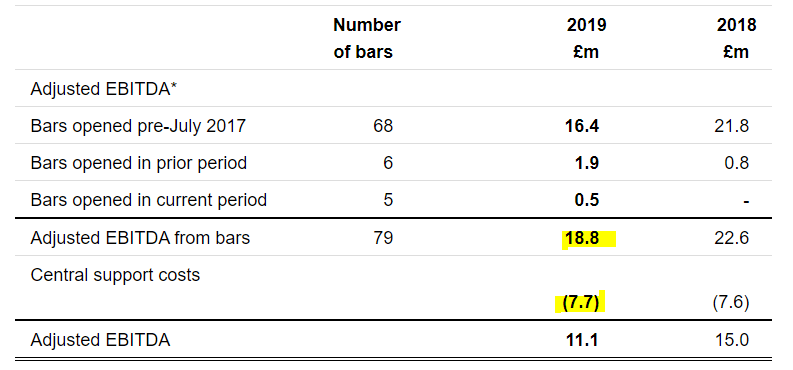

Site EBITDA - this is a very revealing table;

These are the figures that an acquirer would focus on, when putting together a bid. The bars are generating positive EBITDA of £18.8m - this is a remarkable figure, for a business valued at only £33.7m - in other words, the stock market is only valuing RBG at 1.8 times the annual cash profit made by its bars.

We need to adjust for maintenance capex, but even then the multiple would still be less than 3 times. That's astonishingly cheap, and I think it only a matter of time before RBG once again attracts bid interest.

Look at it another way - how long, and how much money would it cost, to build a similar business from scratch? Typical capex per site is £1m, hence for 79 bars, you would be talking several years to do it, at a cost of about £79m or 158p per share.

Sites make an average of £238k p.a. positive EBITDA - and bear in mind that figure will be suppressed by the problem sites - there seem to be 11 of them, looking at note 3 on onerous leases.

Central costs look far too high, at £7.7m - an acquirer would look to strip out a lot of that, hence why site EBITDA is the key number to a potential acquirer of RBG.

IFRS 16 - this new accounting standard is playing havoc with accounts, and I find it extremely unhelpful. It adds nothing to my understanding of accounts, just confuses things. The core issue is that if a site is trading profitably, then the lease commitments don't matter! It's only loss making sites which are a problem. Indeed, I would prefer RBG to have longer lease terms on its most profitable sites, which bizarrely would lead to larger liabilities on the balance sheet.

As noted in the narrative today, IFRS 16 is expected to have a big impact on the balance sheet. This has no operational effect at all, of course, so I suspect investors are just likely to ignore it, pending IFRS 16 hopefully being repealed in the not too distant future, for the nonsense that it is;

For the lease commitments, the Group expects to recognise right-of-use assets of approximately £85.5 million on 30 June 2019, and lease liabilities of £122.7 million (after adjustments for prepayments and accrued lease payments recognised as at 29 June 2019). Overall, the net assets will be approximately £23.5 million lower, and net current assets will be approximately £7.3 million lower due to the presentation of a portion of the liability as a current liability.

My opinion - I'm encouraged by this update. Signs of the turnaround beginning to work are clear, in improved LFL sales in Q1 of +1.2%. Once more sites are refurbished, that figure should rise. Forward bookings for Xmas are strong, and the outlook comments are good.

I'm not saying this is the best business on the market. What I'm specifically saying, is that the shares are obviously under-priced. Therefore it's the type of investment where I'll happily hold, as the turnaround is now visibly working. Sooner or later that is likely to either attract another takeover bid, or a re-rating of the shares. It's just a question of being patient.

I'm meeting RBG management at 4pm today, so have to prepare some intelligent questions for that meeting now. So I'll sign off here for now, and will put any further thoughts into tomorrow's placeholder, and will catch up on other company announcements tonight/tomorrow.

Here is the slide deck from RBG's website that mgt will be presenting to me & another investor today, plus of course no doubt they have lots of other meetings lined up with institutions.

Slide 4 is particularly revealing, showing a very good improvement in monthly LFL sales performance, versus wet-led pubs sector;

It's not the easiest chart to understand, but it's worth taking a little while to work it out.

Also, slides 18 & 19 look very good - giving detailed information on the refurb programme, and operational improvements.

I have to stop here for today, to get into the City for my RBG meeting.

I'll put further thoughts into tomorrow's placeholder article this evening.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.