Good morning, it's Paul here!

Let's hope the technical gremlins at LSE have been fixed, and that we get our 7am announcements on time today, instead of nearly 1.5 hours late yesterday. I don't understand why the market opened, given that the news feed was not working properly. They should have suspended market trading until full information had been released (and given us an hour to read the news).

Let's hope small caps continue perking up - there have been some good rebounds already in oversold small caps, which is pleasing. I'm certainly rummaging around for bargains at the moment. In a way I enjoy market sell-offs, as the good shares tend to be thrown out with the bad, thus creating some buying opportunities in stocks that I'd like to hold, but declined to pay the lofty prices being demanded late last year.

I'm wondering if some selling might have been tax year end related? After all, if a share is showing a hefty loss, then ditching it before the tax year end reduces our tax charge on other, profitable disposals during the year.

Mello Derby, 26-27 April

Not long to go now, for this terrific event - organised by investors (David Stredder & his team), for investors. There are no spivvy junior resource stocks at this event, just good quality small caps that want to meet investors. Plus, an outstanding line-up of speakers.

I can't stress enough what a great community feel that David's Mello events have. Being smaller than the London conferences, they attract serious investors, who are prepared to pay a modest entry fee. This gives excellent access to companies & management, and will also greatly broaden your social network of sensible investors, if you hang out in the bar after hours especially!

Anyway, do come along if you can, it's going to be brilliant. Graham & I will be there, and are really looking forward to meeting more readers & comments contributors from here.

D4T4

Share price: 132.5p (up 23.8% today, at 12:31)

No. shares: 38.0m

Market cap: £50.4m

Trading update & contract wins

D4t4 Solutions Plc (AIM: D4T4), the AIM-listed data solutions provider...

The company is today updating us on performance for the year ended 31 Mar 2018.

To refresh our memories, here is my review on 22 Feb 2018. The key issue then was that the company's performance in H1 was poor, hence the full year forecasts looked a very tall order. So there seemed to be a high risk of a full year profit warning. The share price fell back a considerable amount, to factor in these worries.

As you can see from the sharp rebound in share price today, the market is relieved at what sounds like a reassuring update. However, I'm not entirely happy with the wording of this key sentence, as it side-steps reporting on trading versus market expectations, which is they key information. Instead, the company says it will beat prior year comparatives, which of course is not the same as beating market expectations.

The Company is in the process of its year end close and intends to provide a more detailed update on financial performance on 23 April 2018, in advance of this, the Directors are confident that the revenue and adjusted* profit before tax will be ahead of the comparatives for the year ended 31 March 2017.

This is annoying, because it now wastes everyone's time, by forcing us to look up prior year results, and compare them with current year forecasts.

Last year's adjusted PBT was £4.22m, with adjusted EPS of 9.97p.

Stockopedia is showing broker forecast of 10.1p EPS (which is usually calculated on an adjusted basis). So, it seems to be the case that the company has likely achieved market expectations. So why didn't they just say so?

As there is limited broker information now, post MiFID II, I usually check broker forecasts to other sources. Reuters own website shows consensus of 9.6p, which is strange as Thomson Reuters provide the data to Stockopedia, hence why their figures are usually the same as the ones here.

A house broker note issued today seems to imply that the 10.1p EPS forecast has been achieved, and has a positive tone. So the very strong H2 which management promised, does seem to have been delivered. Kudos to management, as that doesn't often happen - a very toppy H2 forecast is usually followed by a profit warning, but not in this case.

Recent contract wins saved the day, in terms of the year just ended, but also sounds like they provide a good start to the new financial year;

... delighted to announce that having secured a number of high quality contracts in the last quarter of its financial year ended 31 March 2018 (further details of which are set out below) it expects to report a very strong trading performance for the second half of the year alongside a record level of bookings, which underpins the Board's confidence for financial performance in the current financial year ending 31 March 2019.

That's all great, but to my mind it also highlights the problems when investing in small software companies - they're so dependent on high margin contract wins, that financial performance is almost impossible to predict with any degree of confidence. Therefore, profit warnings, and volatile share prices, seem a higher risk. You can't really sleep easily when holding this type of share.

My opinion - given that the year just ended turned out OK, this share might be worth a closer look perhaps? The PER seems reasonable (about 12-13), the balance sheet is satisfactory, and there's a dividend too.

The inherent unpredictability about performance worries me too much to want to buy any shares in it. Also, without having done any detailed research on its product, or competitors, I don't know how to assess it. Note also that the share price hasn't really gone anywhere overall in the last 2 years;

Mission Marketing (LON:TMMG)

Share price: 48.5p (up 6.6% today, at 13:18)

No. shares: 84.1m

Market cap: £40.8m

(for the avoidance of doubt, I no longer hold any position in this share)

... the technology-embraced marketing communications and advertising group...

Acquisition - of a London-based creative agency, called Krow. The initial consideration is only £2.75m, which looks a great deal at first sight, for a business with an impressive client list, which made an underlying profit of £1.0m for y/e 31 Dec 2017.

However, there's a sting in the tail - contingent consideration, based on performance targets, of up to an additional £11.75m. That strikes me as very high, relative to the size of the group. There's a risk that could backfire, in the event that Krow performs brilliantly, triggers a big payout, then the economy goes into recession. So I think shareholders probably need to think carefully about acquisition-related potential liabilities, and whether the group might be over-stretching itself, and building up potential future problems again?

Audited results - for the year ended 31 Dec 2017.

The headlines look good. Although it's not clear how much growth is organic, and how much from acquisitions? Actually, scrub that, I've just found the figures buried in the narrative;

Within our primary activity of Advertising & Digital Marketing, revenue growth was 8%, representing like-for-like growth of 5.4% and a first contribution from RJW.

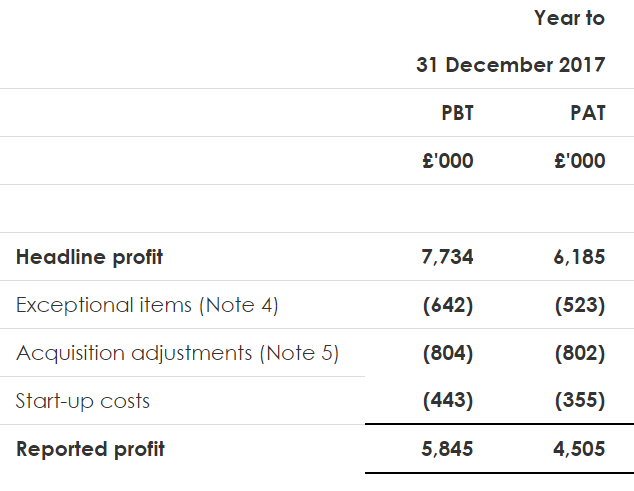

Also note that the adjustments make quite a big difference to headline, and reported profits - you always get this type of thing with PR companies - they seemingly can't resist the temptation to buff up their own results, as well as their clients'!

I'm not convinced that the £642k exceptional items really are exceptional. This type of group is always restructuring in some way, so this type of cost seems to recur every year;

Exceptional costs in 2017 comprised settlement costs to former Director Chris Goodwin and also amounts payable for loss of office and other costs incurred relating to the restructuring of certain operations in order to streamline activities and underpin the Board's growth expectations.

The £804k acquisition adjustments shown above relate mainly to amortisation, so I'm happy with the group's treatment of that.

Client retention - this stands out as impressive;

... almost 20% of our revenue again being generated from Clients that have been with us for 20 years or more. As we have mentioned before, the Board believes this Client retention statistic is second to none in the marketing services sector.

PR is notorious for having high customer churn, so it looks as if TMMG is doing something right, to retain some clients for that long.

Outlook - sounds good;

Trading in the first quarter of 2018 was ahead of last year and current indications are that prospects for organic growth are good despite the backdrop of economic uncertainty.

Added to that, we will benefit from the contribution of newly-acquired Krow Communications, announced today, and we also expect to see an improvement in margins as our various initiatives kick in.

All in all, we expect 2018 to be a year of strong growth.

Valuation - it looks cheap on a PER basis, but always has done - this seems a permanently lowly rated share. I'm not entirely sure why, but there we are.

Headline diluted EPS was 7.12p, which came in ahead of broker consensus shown on Stockopedia of 7.0p, and equates to a PER of 6.8.

Dividends - up 13% to 1.7p for the full year, a yield of 3.5%.

Balance sheet - here are my usual quick checks;

NAV: £80.15m - the balance sheet is extremely top-heavy, with acquisition-related intangibles of £87.95m.

NTAV: negative, at -£7.8m - I don't usually invest in companies with negative NTAV.

Cash of £5.9m , less bank debt of £13.1m, gives net debt of £7.2m. We should also include another £7.2m of acquisition-related obligations within debt, which would take the total net debt to £14.4m. That's a bit too high for comfort, in my view. There will also be potentially considerably more acquisition earn-outs, if Krow performs well.

Overall then, to my mind, this balance sheet is looking stretched. That may not matter when trading is going well. However, marketing budgets are the first thing to be slashed in an economic downturn. So the risk is that, when the next recession kicks in, this group could end up in a precarious position, with reduced earnings, and rather too much debt.

My opinion - the sun is shining, in terms of current trading, so everything looks fine, and the shares look cheap on a PER basis.

However, if I were the Chairman here (unlikely, we can all agree!), I'd be telling management to cool it on the acquisitions, and let the balance sheet strengthen into a positive net tangible asset position, so that the group is in a stronger position to weather the next economic downturn, whenever that comes along.

PR/marketing companies can be horribly cyclical, hence balance sheet protection is probably more important here than in other sectors. Hence, on balance, I'd say that the modest PER here is probably a sensible assessment of the risks by the stock market.

Another aspect to consider, is that, like many small caps, this is a very illiquid share. Therefore, whenever there is any buying interest from new investors, it tends to be readily supplied by existing investors who are high & dry. This leads to repeated snuffing-out of share price rises by sellers, as you can see from the chart.

It was this frustration which led me to recently sell my TMMG shares, with rather poor timing, before today's nice rise. The big question though, is whether today's share price rise will hold, or whether sellers will once again erode the gains in the coming weeks?

Arguably, a takeover bid can often be the only chance of a decent capital gain, with this type of share. Otherwise it might just remain in the perpetually cheap section of the market, with a revolving door for shareholders.

I'll add sections on Belvoir Lettings (LON:BLV) and Card Factory (LON:CARD) to tomorrow's report.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.