Good morning, it's Roland here kicking off today's report.

There are a lot of companies reporting today, so I'll focus on the most viewed list, reader requests, and quick summaries.

Update 11am: I'm happy to report I've now been joined by Paul, who'll be adding some further sections.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

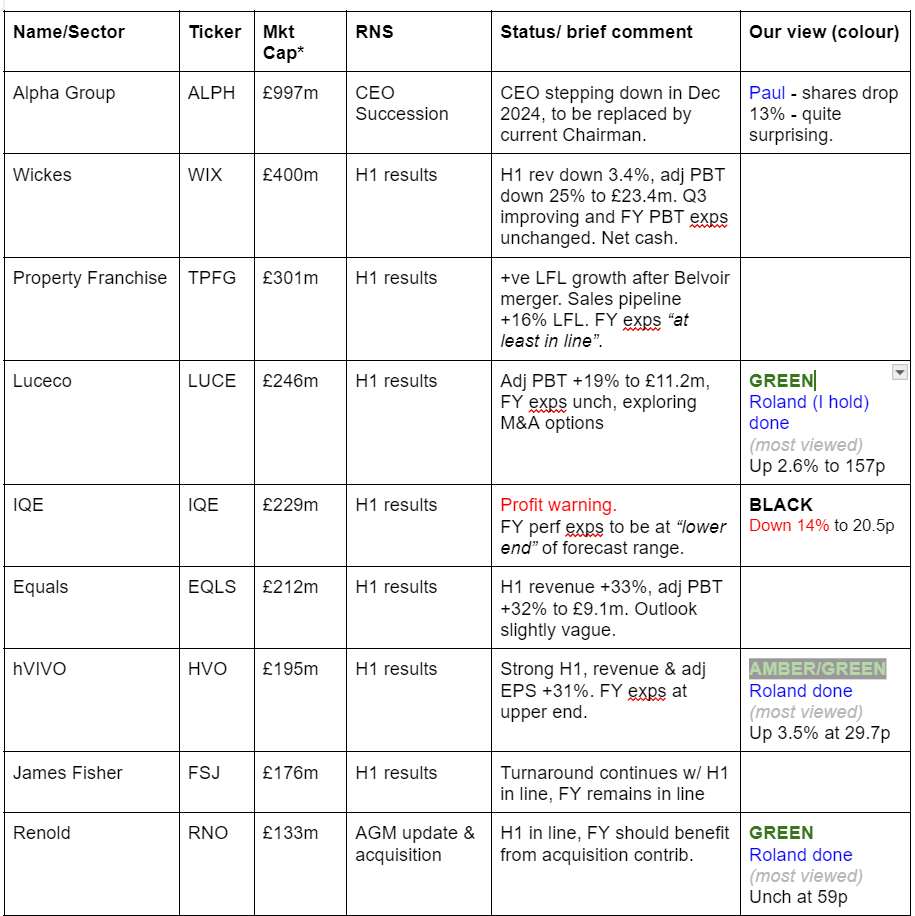

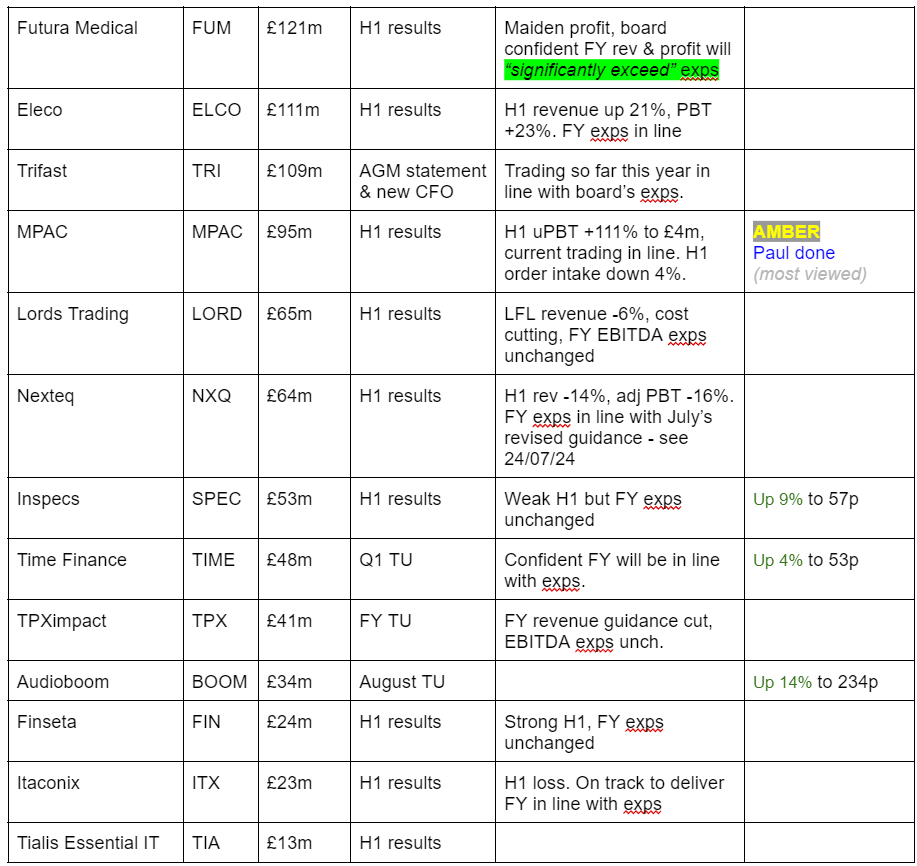

Companies reporting

*Market caps at last night's close

Summaries

Renold (LON:RNO) - Unch at 59p (£133m) - AGM TU & Acquisition of MAC Chain - Roland - GREEN

Today’s trading update confirms performance has been in line with expectations so far this year. Renold also announced an acquisition which should improve group profit margins further. My view remains positive, despite a couple of minor niggles.

hVIVO (LON:HVO) - +3.5% at 29.7p (£204m) - Interim results - Roland - AMBER/GREEN

A strong set of half-year results, although tempered (slightly) for me by expectations for a weaker H2 and a shrinking order book. I suspect this is only short-term and believe that growth prospects could remain strong. But with updated FY24 eps forecasts suggesting a flat result this year, I’ve adopted a slightly more cautious stance.

Luceco (LON:LUCE) - +2.6% at 157p (£251m) - interim results - Roland (I hold) - GREEN

A solid set of half-year results from this electrical products specialist despite market headwinds in the UK construction sector. The outlook for the next 18 months seems positive and I’m comfortable with the fundamentals and valuation here. However, I do have some longer-term concerns about the acquisition-led growth strategy.

MPAC (LON:MPAC) - unch 465p (£95m) - H1 Results - Paul - AMBER

H1 profits are nicely up against weak comparatives, and in line with expectations. Good visibility means FY 12/2024 is also tracking in line. I have issues with the excessive receivables on its balance sheet, and poor H1 cashflow. Lumpy orders, erratic historical performance, and no divis since 2016, mean that I’m struggling to get above AMBER, but the PER does look modest.

Paul's section

MPAC (LON:MPAC)

Unch 465p (£95m) - H1 Results - Paul - AMBER

MPAC (LON:MPAC) , the global packaging and automation solutions Group, today announces its unaudited financial results for the six months to 30 June 2024 (the "Period").

Positive headlines and key numbers -

“Significant revenue, margin and profit growth

Strong order intake and healthy prospects pipeline; confident in the full year and beyond”

Very good “underlying” PBT and EPS growth, albeit coming from a low base last year.

Performance has been quite erratic, with profit collapsing in 2012, but rebuilding since, which has been reflected in a roller coaster share price.

No divis paid since 2016, which is a definite question mark - this doesn’t look a very cash generative business over the long-term.

Outlook - there are some nice points in the “operational & strategic highlights” section, saying that H1 was in line with expectations. New customers won. Underlying operating margin up strongly from 4.2% to 7.5%, operational efficiencies, new products launched.

“Order book broadly unchanged from FY 2023”

Current trading also in line with the Board’s expectations.

H2 weighting, but gives reasons for why it thinks that can be achieved -

“Confident in relation to the full year end and, with continued improvement in project margins, in achieving the H2 underlying profit weighting which was announced earlier in the year”

Build up of working capital in H1 expected to unwind in H2.

Acquisitions - sounds like more are in the pipeline. Do these add value though? I’m not sure.

Balance sheet - NAV is £68.5m. That includes intangible assets of £23.3m, and a £33.0m pension asset, so both of those need to come off, and I’ll also deduct deferred tax liabilities of £8.3m and a pension deficit of £1.6m, giving NTAV the way I calculate it of £22.1m, which looks OK for the size and type of business.

One item that stands out like a sore thumb is “Trade and other receivables” of £52.6m. That’s way too high, and is almost all of H1 revenues of £60m. I think we had this issue once before, but it needs to be queried with management. Receivables should be something like £20m (a third of H1 revenues), not £53m. So there’s a problem here I think, in that MPAC seems to be accumulating work done, but not being paid for it yet. That introduces obvious risk of something going wrong. I would want to see them receiving stage payments from customers, rather than running up a large amount owed by customers - who might then dispute amounts owed possibly. It’s not right anyway, whatever the explanation we’re likely to receive telling us that it’s OK!

Cashflow statement - was poor in H1, with working capital sucking in cash, to produce an overall negative cashflow. They say this should reverse in H2, but it does worry me a bit, as this didn’t happen last year - cashflow was positive in both H1 and H2 in 2023.

The pension scheme is still cash hungry, consuming £1.2m of cash in H1.

Since there is now a large accounting surplus, that probably means the actuarial deficit might reduce in future maybe? I’ve not looked into the detail, this is just to flag that it’s an issue which you’ll need to check carefully before buying the shares.

Broker updates - both Shore and ED update us.

ED has 38.4p adj EPS for FY 12/2024, and 44.0p for next year.

At 465p per share, this is a PER of 12.1x and 10.6x, which looks pretty good value to me. There’s no net debt to worry about either, with a smallish net cash position. Hopefully they can do a better job of collecting in the mountain of receivables, and move into a much stronger net cash position in future.

Paul’s opinion - I’ve only been AMBER in the past, and my concerns over excessive receivables and lumpiness of orders (plus no order book growth) are holding me back from going up a notch to amber/green. So it’s another AMBER from me today - which is fairly good, as ambers tend to perform well overall, and only a little behind amber/greens.

I can see why bulls like the lowish PER, but how reliable are profits? Arguably the erratic historical figures deserve a lowish PER.

Roland's section

Renold (LON:RNO)

Unch. at 59p (£133m) - AGM Trading Update & Acquisition of MAC Chain - Roland - GREEN

the Group's financial performance in the first five months of the new financial year was in line with its expectations

Industrial chains and gearboxes group Renold is one of Paul’s top 20 shares for 2024. The stock has performed well so far this year, driven by a strong improvement in profitability.

Today’s update doesn’t appear to have moved the needle with investors but reads fairly positively, in my view. There’s also news of an acquisition that is expected to make a positive contribution to trading for the remainder of the year.

Checking back in our archive, Paul covered Renold’s 2023/24 results here in July. He then took a look at the company’s share buybacks for director stock options awards here.

AGM Trading update: Renold confirms that trading during the first five months of its financial year has been in line with expectations.

Group revenue for the period fell to £102.3m (FY24: £104.7m), which was a 0.9% reduction at constant exchange rates.

This extends the company’s run of flat revenue – I see that prior to today’s acquisition, analysts had expected this flat trend to continue:

Order intake has risen by 15.5% (constant rates) to £105.5m so far this year (FY24: £92.6m), although this benefited from a single large contract award with the Canadian Navy in May. Excluding this, underlying order intake was 4% higher at constant rates.

The order book was flat at £85.5m at the end of August (August 2023: £85.4m). The company describes this as “close to a record high level”.

Net debt was £24.5m (0.6x EBITDA) at the end of September, ahead of today’s acquisition. This looks comfortable to me.

Outlook: the company sounds positive about trading and the outlook for the remainder of the year:

Trading and profitability for the first half is in line with the Board's expectations, whilst the full year will now also include six months contribution from the MAC Chain acquisition.

Research Tree has an updated note from house broker Cavendish (many thanks) upgrading FY25 earnings forecasts by 5.7% to 7.5p per share.

Cavendish’s analysts have upgraded FY26 forecasts by 15.9% to 8.6p per share.

Stockopedia already had a consensus figure of 7.5p per share for the current year, so this leaves the stock on an unchanged forward P/E of 7.9 for FY25.

Acquisition: The company has also announced the acquisition of MAC Chain Company Limited today, for $31.4m in cash.

MAC Chain appears to be a Canadian company with operations in Canada and the Pacific Northwest of the USA. It’s a “manufacturer and distributor of high quality conveyor chain and ancillary products”, primarily serving forestry and broader industrial markets.

This acquisition is expected to “immediately enhance” adjusted earnings per share, but also be accretive to Renold’s group operating margin.

The information provided in the RNS tells us that MAC generated sales of $25.8m for the year ended June 2024, with a pre-tax profit of $3.5m. This implies a pre-tax margin of 13.6%, which is indeed ahead of Renold’s FY24 operating margin of 12.6%.

Cost savings are expected to reduce the purchase multiple to 6.9x EBITDA and Renold’s management expects leverage to peak at 1.2x EBITDA following the deal.

Roland’s view

Although Renold’s appears to have struggled to deliver much top-line growth in recent years, the group’s profitability has improved significantly:

Today’s acquisition looks fairly priced to me and I’m pleased that it should improve the quality of the business, if we view this in terms of profitability.

Given the group’s improving margins and double-digit returns on capital employed, Renold shares don’t look expensive to me.

I’d like to understand a little more about the group’s recent lack of revenue growth. Is this cyclical, or structural?

Personally, I would also prefer to see Renold pay a slightly more generous dividend.

However, these are only minor niggles for me, at this valuation. The outlook still seems positive and I would guess there could also be some cyclical upside potential (e.g. in mining).

I am quite happy to maintain Paul’s previous GREEN view on this stock.

hVIVO (LON:HVO)

+3.5% at 29.7p (£204m) - Interim results - Roland - AMBER-GREEN

hVIVO describes itself as a “specialist contract research organisation and world leader in testing infectious and respiratory disease products”. From what I understand, this company is well-known for its ability to run human challenge trials, where volunteers are infected with a mild dose of a disease so researchers can study how it progresses and consider possible treatments.

I don’t look at healthcare stocks very often and I must admit hVIVO is a new company to me.

Checking back in our notes I see Paul covered the firm’s H1 trading update positively in July.

Share price performance has certainly been strong over the last year, with the shares up c.50% over the last 12 months.

Today’s half-year results appear to reiterate the positive guidance issued in July:

"We are pleased to reaffirm our full-year revenue guidance of £62 million and expect EBITDA margins to be at the upper end of market expectations”

hVIVO helpfully informs us that consensus market expectations for FY24 EBITDA margins are 22.7%, within a range of 22-24%. Given this, I’d expect this year’s EBITDA margin to be 23%-24%.

H1 results summary: today’s figures cover the six months to 30 June 2024 and show strong half-year earnings growth and improved profitability for this business.

Here’s a summary of the main figures:

Revenue up 30.6% to £35.6m

EBITDA +67.6% to £8.7m

EBITDA margin of 24.5% (H1 23: 19.1%)

Adjusted earnings up 30.6% to 0.81p per share

Cash of £37.1m (H1 23: £31.3m)

Order book of £71m at 30 June 2024 (H1 23: £78m)

The company flags various operational highlights including the opening of its new facility at Canary Wharf and “a record number of volunteers inoculated” across various trial programmes.

Performance seems to have been improved by “expedited delivery of projects”. This is apparently the reason why the order book at the end of June was lower than one year ago – hVIVO is completing contracts more quickly than it was previously.

Among the contracts signed in H1 were a £6.3m Human Rhinovirus (HRV, or common cold) trial and a £2.5m Omicron (Covid-19) “characterisation study” with a mid-sized pharmaceutical company.

The company also reported progress manufacturing various “challenge agents”. I believe these are required to infect the human volunteers participating in trials.

Outlook: the company has reiterated its full-year revenue guidance of £62m and says that 100% of this guidance is now fully contracted.

This highlights the expected H1 weighting this year – H1 revenue of £35.6m represents 57% of the expected FY figure, so H2 is expected to deliver just £26.4m of revenue.

Assuming a full-year EBITDA margin of 23.5% (upper end of 22%-24% range) gives an EBITDA figure of £14.6m.

Today’s results show adj EBITDA of £8.7m converting into £5.3m of after-tax profit.

Assuming a similar conversion for the full year suggests hVIVO could generate £8.8m of profit this year. With the market cap at c.£200m after this morning’s rise, that prices the shares on c.23 times FY24 forecast earnings.

My estimate is broadly in line with updated guidance from Cavendish today. After upgrading its forecasts in July, Cavendish analysts have now trimmed FY24 earnings estimates to 1.3p per share (previously 1.4p) due to expected higher lease costs.

Forecast earnings of 1.3p price the shares on a P/E of 23.

Roland’s view

I don’t know much about the medical and operational side of hVIVO’s business. But the company’s accounts do tell a positive story, in my opinion.

Free cash flow now appears to have turned positive and the group’s net cash of £37m suggests to me that hVIVO’s financial position is now fairly secure, barring unforeseen developments.

Revenue growth also appears to be delivering positive operating leverage – in other words, profits are rising faster than revenue, as fixed costs are more thinly across increased activity.

The group’s operating margin rose to 18% last year and I calculate this improved to 20.7% over the 12-months to 30 June 2024. Those are decent figures, in my view.

The stock's forecast P/E of 23 seems reasonable to me for a high-margin growth stock, but one possible caveat to this is that hVIVO’s earnings are now expected to be flat this year.

FY23 adjusted earnings were 1.3p per share, while today’s updated forecast from Cavendish is also for a 2024 result of 1.3p per share.

Admittedly, consensus estimates suggest profits could rise by a further 20% in 2025:

Even so, I’d like to see evidence of order intake improving again to help justify the stock’s current valuation.

On balance I think there’s still a lot to like here and I believe the business could have further growth potential. But I’m inclined to take an AMBER-GREEN view at this stage, to reflect the weaker H2 and shrinking order backlog.

Luceco (LON:LUCE)

+2.6% at 157p (£251m) - interim results - Roland (I hold) - GREEN

This is a supplier of wiring accessories, EV chargers and other electrical products, with a focus on the residential and RMI (repair, maintenance and improvement) markets.

I hold the shares personally as Luceco is currently a constituent of my rules-based Stock in Focus model portfolio.

Checking back in our notes, we last looked at Luceco in July, when I reviewed the company’s half-year trading update and said “I remain positive ahead of the half-year results”.

Has anything changed since then? Let’s take a look.

H1 results summary: today’s accounts show revenue up by 8.4% to £109.6m during the first half of the year. Of this, 3.6% is said to be organic, with the remainder from acquisitions.

The company says it’s encouraged by sales growth of nearly 10% in its Residential RMI divisions, which make up nearly two-thirds of group sales.

However, revenue from infrastructure customers has fallen 13%, offsetting these gains somewhat.

The overall impact on profit appears to be positive, whichever measure you prefer to use:

Adjusted pre-tax profit up 19.1% to £11.2m

Statutory pre-tax profit up 40.3% to £8.7m

Adjusted operating margin 11.5% (H1 23: 10.7%)

Net debt rose modestly to £39.4m (H1 23: £37.6m), representing leverage of 1.1x EBITDA.

This increase in borrowing is due to the acquisition of cable management specialist D-Line for up to £12.4m in February. This seems fine to me, assuming D-Line delivers as hoped.

Looking across the business, two of Luceco’s three reporting segments achieved sales growth during the half year.

Wiring accessories: revenue up 19% to £48.9m, op profit +32.4% to £9.4m

LED Lighting: revenue down 4% to £36.3m, op profit down 63.2% to £0.7m

Portable Power: revenue up 9.9% to £24.4m, op profit up 38.9% to £2.5m

This doesn’t seem a bad result to me, given the headwinds facing the UK construction sector at the moment.

However, the LED Lighting division has clearly performed poorly. Management says this is due to a drop-off in sales in infrastructure markets, which is expected to be temporary.

Outlook: trading is said to be in line with full-year expectations. Updated broker estimates today from Longspur and Panmure Liberum (with thanks) appear largely unchanged, with Longspur forecasting FY24 earnings of 11.8p and Panmure estimating 11.4p per share.

Those figures are broadly in line with the Stockopedia consensus figure of 11.8p per share, pricing the stock on 13 times earnings. There’s also a useful 3.1% dividend yield.

Roland’s view

My general view on this business is that the core wiring accessories business is probably the highest quality part of the business, with the strongest competitive advantages.

These results don’t change that view – wiring accessories generated a 19% operating margin, versus 1.9% in LED lighting and 10.2% in portable power.

On a long-term view, my main concern is whether the group’s pursuit of acquisitive growth is diluting the overall returns on capital that might be generated by the wiring accessories division alone.

Luceco shares have performed risen by 80% over the last couple of years, but remain more than 65% below their pandemic peak:

It’s not clear to me whether Luceco has the quality and scalability needed to regain those former highs.

However, as things stand today, I think this is a reasonably good business at a reasonable price.

Given the prospect of improving market conditions next year and expectations of stronger earnings, I think I can justify maintaining the GREEN view I took in July.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.