Good morning!

There is no shortage of news today. Due to time constraints, we are covering:

- B.P. Marsh & Partners (LON:BPM) - final results

- Motorpoint (LON:MOTR) - final results

- Ted Baker (LON:TED) - trading update

- Trifast (LON:TRI) - preliminary results

- IG Design (LON:IGR) - full year results

- Carclo (LON:CAR) - strategy update

- QUIZ (LON:QUIZ) - preliminary results

B.P. Marsh & Partners (LON:BPM)

- Share price: 308p (pre-market)

- No. of shares: 37.4 million

- Market cap: £115 million

(Please note that I have a long position in BPM.)

This is a private equity vehicle specialising in the insurance industry. It has a great track record and my positive impression of management led me to make it a smallish position in my portfolio last year.

Indeed, I've added to my position this morning, using some of the proceeds from my disposal yesterday.

Key points

NAV per share has increased by 3% to 350p. It should have done better than that, but it was held back by a large placing at 252p last June. The dividend is also a headwind to NAV growth.

The June placing brought in an Australian insurance group called PSC (ASX:PSI) as a strategic investor. The relationship with PSC is said to be progressing well.

As for its investments, the underlying portfolio seems to have worked hard for BPM during the year. Pre-tax operating profit is £12.2 million, boosted by £14.1 million in unrealised gains on its portfolio.

That's a 16% improvement in unrealised gains compared to last year, if we strip out the effect of a change in valuation methodology which artificially increased 2018's results.

The method

Most of BPM's assets are valued using a multiple-of-earnings method. So when the investees become more profitable, this translates to higher valuations on BPM's balance sheet and unrealised gains on its income statement.

This is a source of significant uncertainty: the NAV is a matter of opinion, basically. Investees have to be separately valued based on BPM's view of what the appropriate earnings multiple for each of them is. Here's an excerpt from today's statement:

The multiple is derived from comparable listed companies or relevant market transaction multiples. Companies in the same industry and geography and, where possible, with a similar business model and profile are selected and then adjusted for factors including size, growth potential and relative performance.

Thankfully, the company tells us the weighted average multiple it is effectively using for its equity portfolio. The EBITDA multiple is 11.9x (up from 11.4x last year) while the P/E multiple is 13.3x (down from 15.5x).

A P/E multiple of 13.3x doesn't sound like an outrageous valuation to me, and you can see that it's actually more conservative on this basis than it was last year. We don't have the sort of granular data that would let us examine each specific valuation of its investees, but I'm comfortable with these aggregate multiples.

Share-based payments - there is a potentially dilutive bonus scheme, with 1.5 million share options. However, the terms seem very reasonable to me. After three years:

"...the employees and directors will receive on vesting the growth in value of the shares above a threshold price of £2.81 per share (market value at the date of grant) plus an annual carrying charge of 3.75% per annum (simple interest) to the market value at the date of grant. The Share Trust retains the initial market value of the jointly-owned shares plus the carrying cost."

Buy-back scheme - the company will continue to buy back its shares, in small amounts, if and when they trade at a discount of more than 15% to NAV. On the basis of the 350p NAV, this means that buybacks are possible below 297.5p.

Outlook

Encouragingly, the flow of investment enquiries is "commensurate with prior years", and discussions with possible new investees are ongoing.

There is likely to be more activity in Australia, given the presence of the new major shareholder there. This doesn't concern me: BPM is already a seasoned international investor with holdings in Australia, Singapore, the USA, South Africa and Spain.

My view

The founder, Brian Marsh OBE, appears to have developed a strong management team around him. So I'm willing to make a bet that BPM's strong performance will continue for the foreseeable future. This share has been promoted to a medium-sized holding for me (4% of portfolio).

Motorpoint (LON:MOTR)

- Share price: 214p (+1%)

- No. of shares: 95.4 million

- Market cap: £204 million

Motorpoint Group PLC, the UK's largest independent vehicle retailer, today announces its Final Results for the year ended 31 March 2019.

These results are in line with the prior trading update: underling PBT is up 10%.

Motorpoint operates car supermarkets, selling cars up to 3 years old and with low mileage, from almost any manufacturer. You can browse the catalogue here.

Let's skip ahead to the outlook:

With reference to political uncertainty, the company says:

We enter FY20 with optimism but remain cognisant of the uncertain market and political environment.

Motorpoint's operations are ideally placed to continue taking market share in FY20 and we enter the year with a healthy and competitive stock mix, and fantastic levels of team engagement.

Just below the outlook section, in the "market report", it says that its business model will be relevant "in a breadth of market conditions".

The last year or two have certainly been solid for Motorpoint, despite the car market generally facing some headwinds.

I also give the company credit for reporting zero exceptional items this year, versus £0.8 million last year. It's always great to see a set of clean accounts.

I also note that the FY 2017 Performance Share Plan hasn't vested for the majority of senior managers, as the EPS targets weren't achieved. Well done to Motorpoint for setting difficult bonus targets!

My view - I like this business, as it seems to be run in a careful way for the benefit of shareholders (via dividends and buybacks). Return on capital comes in at a whopping 89%(Stocko metrics).

I don't buy shares in car dealerships but if I had to choose just one of them, it would probably be this one.

Ted Baker (LON:TED)

- Share price: 989.5p (-26.5%)

- No. of shares: 44.6 million

- Market cap: £441 million

A nasty fall at Ted Baker. Commiserations to anyone holding this.

The first 19 weeks of the year have seen "extremely difficult trading conditions", and "some of these factors" are expected to continue.

Underlying PBT is now forecast to land in a wide range of £50 million to £60 million.

For context, Ted Baker generated underlying PBT of £63 million last year and £73.5 million in FY 2018.

Unseasonable weather in North America is mentioned as a factor. Perhaps this is the same heavy rain which triggered a profit warning at £SOM?

Total revenue - including wholesale - is up, but retail sales are down 2.6% on a comparable basis despite a 5% increase in retail square footage.

Management speak

As a team, we are proactively addressing the challenges we face as an industry. Several of our new product initiatives will commence imminently and we are confident in our collections for the coming season. We are relentlessly focused on achieving cost efficiencies as well as further cost savings throughout the business.

My view

It's only through luck rather than skill that I have managed to avoid buying into this share yet. Ted Baker (LON:TED) was a share that I viewed from afar, hoping to get a nice buying opportunity some day.

Is now the time to take the plunge?

Well, it is tempting.

From a PR point of view, I suppose there is the risk of more publicity related to founder and former CEO, Ray Kelvin.

From a financial point of view, the £50 million lower bound of the PBT forecast makes the current market cap look rather cheap, but against that we have to consider:

- possible damage to the brand caused by the Ray Kelvin situation, which could affect results for years to come, maybe?

- online sales making up a relatively small percentage (26%) of total retail sales, and not growing very fast.

- the possibility of significant exceptional costs to restructure the store portfolio, if current trends continue.

I haven't made up my mind on this one.

Trifast (LON:TRI)

- Share price: 226.5p (-4%)

- No. of shares: 122 million

- Market cap: £276 million

This has an LSE premium listing. Not your standard AIM fare, then.

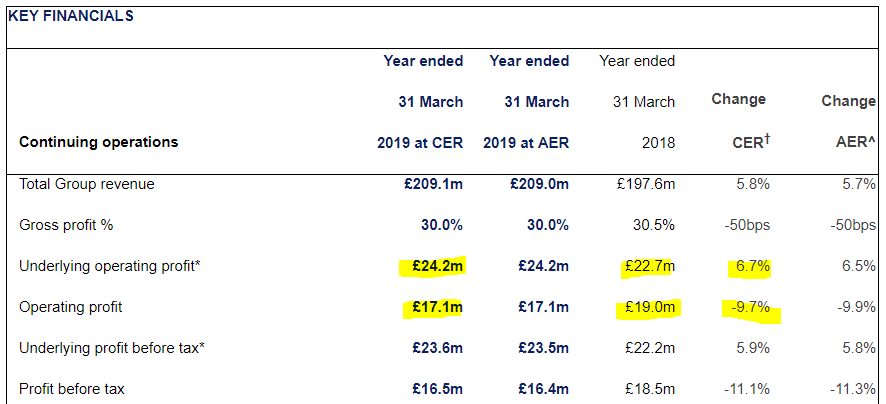

The table given to us at the top is quite complicated but it's good to see the constant FX result laid out very clearly. 70% of revenues come from outside the UK.

The most important numbers (to me) are in yellow:

Underlying operating profit is up, but the statutory result is down.

The company reports underlying ROCE at 18.8%, down from 20.1% last year, with the reason being the upfront investments in an internal project and an acquisition. Stockopedia calculates Return on Capital somewhat lower, at 14%, as you would expect. It's good to see the company using this as a metric.

Outlook - expectations unchanged.

My view - I'm not convinced by the adjustments and would be inclined to focus more on the reported numbers.

Overall, looks like a decent business. Difficult to get excited about it.

The next three sections are by Paul Scott:

IG Design (LON:IGR)

- Share price: 600p (down 0.7% today, at 11:58)

- No. shares: 78.3m

- Market cap: £469.8m

IG Design Group plc, one of the world's leading designers, innovators and manufacturers of Gift Packaging, Celebrations, Stationery and Creative Play products, Giftware and related product categories announces its results for the year ended 31 March 2019.

Sparkling results today from this group. I'm surprised the share price hasn't really moved.

Adjusted EPS is up 33% to 29.3p - giving a PER of 20.5 - not cheap, but surely justified given the strong profit growth.

I can't find any new broker forecasts unfortunately. Looking on Research Tree, there's a note from Progressive Equity Research from 15 Apr 2019 estimating 27.0 adj. EPS. Stockopedia shows 26.9p EPS forecast, almost the same. So the actual of 29.3p looks a comfortable beat against expectations.

Dividends - final divi up 50% to 6p. With the 2.5p interim divi, that gives a yield of 1.4% - not very exciting, but rising quite rapidly.

Outlook - key bits say;

...we are greatly encouraged with prospects for this trend to continue in 2020 and beyond...

We are excited by the positive start to the new financial year and the potential to drive the business forward through compelling M&A opportunities.

Exceptional items - large this year, at £8.4m - mainly restructuring charges

Balance sheet - looks better, since an equity fundraising was done during the year.

Cashflow statement - looks fine. A genuinely cash generative business, which is making acquisitions.

My opinion

Looks a very nice business, that has performed extremely well in recent years.

The valuation reflects this, and looks about right to me.

Carclo (LON:CAR)

- Share price: 20.2p (down 8% today, at 11:39)

- No. shares: 73.4m

- Market cap: £14.8m

Carclo plc ("Carclo" or the "Group"), a global manufacturer of fine tolerance injection moulded plastic parts mainly for the medical, automotive lighting and optics markets, issues this strategy update ahead of the Group announcing its results, for the year-ended 31 March 2019, on 23 July.

I'm very concerned about the way things are going here, and think this share is extremely high risk, as explained here on 3 Jun 2019.

Today's update says;

- Recent trading and net debt levels have been "broadly as anticipated"

- Technical plastics & Aerospace divisions performing strongly, but...

- Wipac business - losses have worsened

- Wipac costs are increasing to meet growing customer demand

Wipac - trying to exit new market (lighting for mid-volume vehicles), as doesn't have the working capital to support this growth (and by implication the bank isn't prepared to finance this growth)

"Once implemented, the revised strategy is likely to have the effect of reducing Wipac's future sales revenue but would also, consequently, significantly reduce the Group's cash requirements for working capital and capital expenditure."

Bank financing - sounds precarious;

"In the meantime, and as previously announced, discussions remain on going with the bank and other stakeholders in relation to the refinancing of the Group's borrowing facilities due to mature in March 2020. An interim Chief Restructuring Officer has been appointed to assist with these discussions."

My opinion - I don't like the sound of this at all. Things sound like they could be on a knife edge. Possible outcomes might include heavy dilution from an emergency equity fundraising, and possible withdrawal of bank funding (although that's very unusual for listed companies these days). There could also be a forced disposal of some (or all) subsidiaries.

Therefore in any of the above outcomes, equity could end up worth nothing. I wouldn't go near this one, as the risk of a 100% loss looks quite high.

QUIZ (LON:QUIZ)

- Share price: 22p (down c.20% today, at 13:14)

- No. shares: 124.2m

- Market cap: £27.3m

QUIZ, the omni-channel fast fashion brand, is pleased to announce its unaudited preliminary results for the year ended 31 March 2019 ("FY 2019").

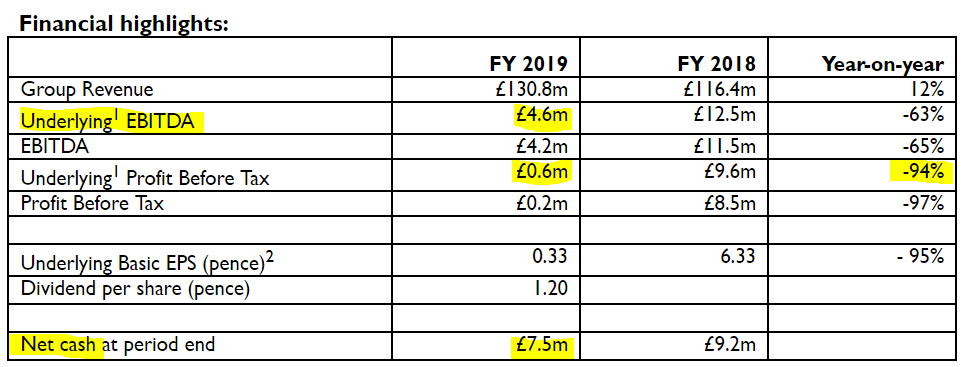

We already knew that this low-end fashion retailer (which focuses mainly on women's special occasion wear) was having quite big problems, with a series of profit warnings.

As you can see above, profitability has collapsed, down 94% to not much above breakeven. This looks to be slightly below consensus forecast, but not enough to make that much difference.

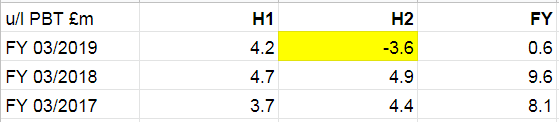

My main concern is the run rate of half year profit/losses, here's a simple table I've collated;

As you can see, in the previous 2 years, Quiz was actuallymore profitable in H2 than H1 (as I would expect, since H2 includes the autumn & Xmas party season). Yet in the most recent year, reported today, it swing to a heavy loss in H2.

Therefore, if we assume that H1 & H2 revert to being similar, in terms of profitability, then this suggests the business could be loss-making going forwards.

What's gone wrong? We don't really know, this is the problem. The narrative today mainly talks about soft market conditions, low consumer confidence, low footfall, etc. . However, it also tacitly admits there were problems with product design too, by saying;

"Re-aligning the product offering to our core customer demographic"

All the measures being taken are sensible, and quite basic, to put things right, e.g.

- Cost-cutting of £2-3m (is that enough?)

- Gross margin - fell from 63.0% last year, to 60.7% this year - which is still a very good gross margin - the business really should be able to make a decent profit on a 60.7% margin, but isn't. Why not?

International growth is continuing. Why? Surely this is a distraction for management? I'd be pushing for the business to go online only, and close all the shops.

Online has growth 34% y-on-y to 31.4% of total group sales. Growth through Quiz's own websites was excellent, at 54% y-on-y

Dividends - suspended, which makes sense in the circumstances. This is a turnaround recovery share now, not an income share.

Dept Store concessions - are being reduced, which is sensible.

No mention of store LFL sales performance, but crudely, space was up 9%, and sales up 4%, so LFL probably somewhere in the ballpark of -5%, on a lower gross margin, and with higher operating costs (wage increases in particular, affecting all retailers)

Balance sheet - still strong, with £7.5m net cash. I don't believe there is any insolvency risk at present. Although we saw with Bonmarche how a strong balance sheet can quickly be overwhelmed by a disastrous downturn in trading. Note that £1.2m of website development costs were capitalised.

There's masses of useful commentary in today's RNS. I've read all of it, but would take too long to write it all up here. Generally I agree that everything they are doing to turnaround the business looks sensible. So I think there's a reasonable chance that Quiz could indeed be turned around, getting back into perhaps modest profitability. Upside case might be that it recovers to say £4-5m profit. Not madly exciting.

To my mind, Quiz just isn't a very good brand. A lot of its product looks tacky, and I think the tie-up with TOWIE was a big mistake. At the trashy end of the market, it's difficult to see how Quiz could compete with BooHoo or PrettyLittleThing, and their ultra-low prices.

Founder family - still have a controlling stake, so will want to turn Quiz around. Experienced rag traders. Previously went bust, so they're now paranoid about long or onerous leases which is good. Deep pockets from IPO proceeds (£90m-ish), so could buy it back on the cheap.

My opinion - at such a low market cap, it's tempting to pick up a few here.

The problem is, what are we actually buying? A business that is now almost certainly trading at a loss, on an annualised basis, and needs a lot of sorting out.

I can't really analyse the business properly, because they don't split out the profitability by division. We don't know if online is making a profit now. It's growing fast on Quiz's own websites, so there might be an opportunity to close the shops & concessions, and just run it as online only? We're not give the figures though.

Stores - have short leases, so it will be able to exit the problem stores fairly soon.

Insolvency risk is currently very low, with net cash of £7.5m, but if they have another couple of disastrous seasons, then that could emerge as a future risk.

On balance, I can't make my mind up. It's tempting to pick up a few, given how low the market cap is.

Bull case - cheap, and well-funded. Experienced management could deliver improved trading later in 2019, giving maybe 100% upside from the current price.

Bear case - confidence in management must be shattered with people who bought in at the IPO. Current run-rate of trading could product a substantial loss in FY 03/2020. Tacky products & imagery on website = weak brand. Maybe Quiz isn't up to the challenge of competing with BooHoo, Asos, etc.?

Graham here. Thanks to Paul for his contributions and see you again tomorrow!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.