Good morning, it's Paul here.

I have to head into London late morning, so this report will be earlier, and a bit briefer than usual. The results/updates that I intend covering are in the article header.

Driver (LON:DRV)

Share price: 63.5p (pre market open)

No. shares: 53.9m

Market cap: £34.2m

Driver Group PLC (AIM: DRV), the global professional services consultancy to construction and engineering industries, is pleased to announce its results for the financial year ended 30 September 2017.

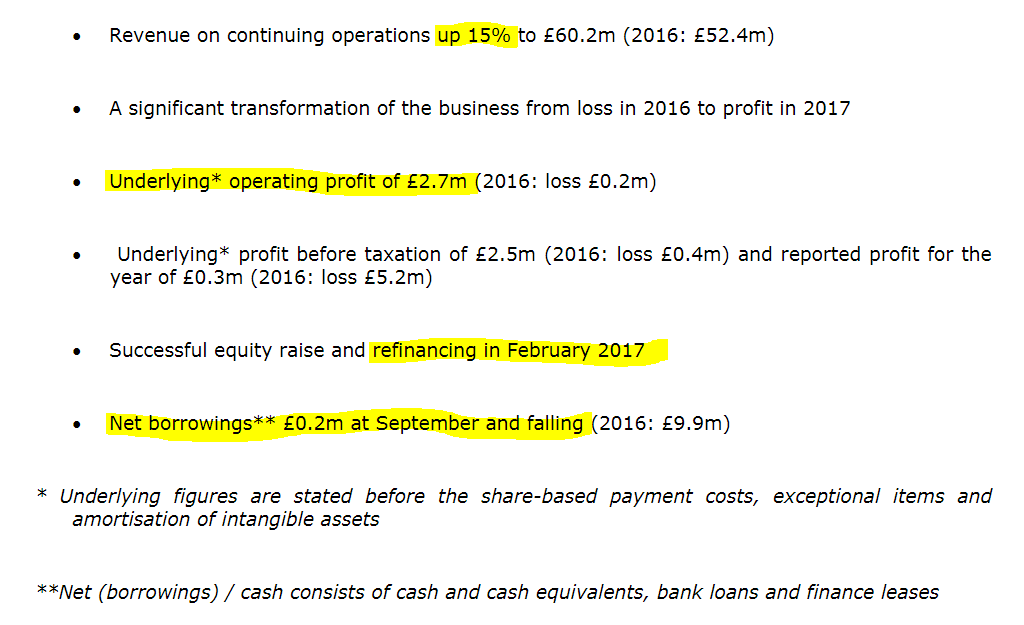

This looks like a nice turnaround situation, which has been reflected in a recovering share price (up nearly 50% from its 2017 low in the spring). The highlights look good;

That's a decent swing back into profitability.

I also like that net debt has been almost eliminated, mainly from an £8.5m equity raise in Feb 2017.

Underlying EPS for continuing operations was 5.8p (2016: loss of 1.0p). Assuming that they are calculated on the same basis, that looks well ahead of the 4.2p broker consensus shown on the StockRank.

However, an important point to note is that the share count rose considerably about half way through the year, due to the refinancing. The average number of shares in issue is used in calculating EPS. Therefore next year & beyond, earnings will be diluted to a greater extent by a full year's impact of the larger number of shares. This is why forecast EPS is set to fall next year.

One broker comments this morning that its 4.1p EPS forecast for the current financial year 09/2018 might be too cautious, so there's scope for upgrades.

Outlook comments look mostly good;

Positive start to the year and continued strong cash collection in line with management expectations.

Strong pipeline of opportunities across the Global business.

The first two months of the current financial year have shown a continuation of the positive trading and improvements that we enjoyed in the latter part of last year.

In a professional services business like ours, it is notoriously difficult to predict activity levels but your Board will continue to monitor costs and margins to ensure that the Company deals appropriately with the fluctuations in activity that are a feature of our business.

Nonetheless, your Board is confident that we can continue to build on the exceptional progress we have made so far. There is no question that in every significant respect the Company is in a far better state than it was a year ago.

I admire the honesty of the Chairman in saying that activity levels are notoriously difficult to predict. However, that does rather put me off investing in this share. I prefer predictable revenue streams, which lowers the risk of profit warnings.

Balance sheet - looks strong. The working capital position looks excellent, with a current ratio of 2.86. Although as always with this type of business, collecting in the trade receivables is not always easy.

My opinion - the company's fortunes have dramatically improved, after poor performance in 2015 & 2016. That has been reflected in a good share price recovery since the refinancing in Feb 2017.

I don't know how much more upside there is to be had here - maybe up to another 20%? I could see it going a bit higher, but probably not enough to interest me. Also the sector doesn't really interest me either, partly due to the lack of earnings visibility.

It's good to see a previously struggling company pull through with a nice turnaround. Also note that exceptional items are quite large in the last 2 years, so I would want to see some strong, genuine profits, not just adjusted profits, in the future.

Servoca (LON:SVCA)

Share price: 23p (down 2.1% today at 08:21)

No. shares: 122.9m

Market cap: £28.3m

Preliminary results - for the year ended 30 Sep 2017.

This is a recruitment & staffing company.

Results look pretty good - adjusted profits up 11.4% to £3.9m. That's not bad when some similar companies have been struggling to maintain earnings this year. Servoca seems to be benefiting from staff shortages in the UK public sector. I feel that the Government's public sector pay freeze may have been counter-productive, and gone on too long, hence perhaps costing the taxpayer more in the long run, as gaps are filled with more expensive agency staff. Still, that staffing problem in the NHS & schools is Servoca's profit opportunity.

Adjusted basic EPS is up 13.8% to 2.56p - giving a PER of 9.0, which is fairly typical for small staffing companies - this is not a sector that commands high valuations.

CEO comments;

These results represent another very positive year of progress and build on our consistent improvement over recent years. All five of the business areas through which we manage the Group saw an increase in revenues and our Outsourcing operations enjoyed a significant improvement in operating profits.

The performance of the Group continues to benefit from its diversified business mix. We are again pleased to be able to declare an increased dividend payment for the year-end, which our strong financial performance enables us to do. Our performance over the last year means we continue to face the future with confidence.

Balance sheet - looks adequate, with about £5m in NTAV.

Working capital looks fine to me, so no issues here that I can see.

Dividends - are rather small. Note that there seems to have been a gap when the company stopped paying divis between 2002 and 2016. The 0.4p divi just announced is a yield of only 1.7%. There are much better yields available from other small recruitment companies.

The low yield makes share buybacks seem a rather odd thing to do. Maybe there is an overhang of institutional shares that they want to clear out?;

The Board also intends to continue the current policy of buying back the Group's shares, in particular at recent price levels, which the Board thinks fail to fairly represent the value of the company. Our strong balance sheet and operating cash flow enable us to continue to do so for the foreseeable future.

It's difficult to argue with doing share buybacks when the shares are only rated at a PER of 9. On the other hand, Servoca does not have surplus cash, it had net debt of £2.3m at 30 Sep 2017. I'm not entirely comfortable with share buybacks at small companies that have debt. The problem is that smaller companies can see debt facilities withdrawn in recessions.

My opinion - Servoca seems to be concentrating on niches where there is plenty of demand for staff. The rating looks undemanding. So it might be worth a closer look maybe.

Due to time constraints today, I'll have to cut some corners from now on;

Begbies Traynor (LON:BEG)

Share price: 68.4p (up 1.5% today)

No. shares: 107.6m

Market cap: £73.6m

(at the time of writing, I hold a long position in this share)

This is an insolvency practitioner & property services group.

Good interim results are out today - which the company says are in line with expectations. Adjusted basic EPS is 2.0p in H1, up from 1.8p in H1 last year. Note that a £0.8m contingent success fee boosted these results.

Balance sheet - not great, with only marginal NTAV. The large debtor book is financed with an unsecured bank facility, which hasn't been a problem historically. Net debt has reduced considerably, from £12.2m a year ago, to £6.9m at 30 Sep 2017.

Dividends - the company has paid a constant 2.2p p.a. divi for the last 6 years - implying that it was struggling to maintain that level. So an increase in the interim divi from 0.6p to 0.7p looks encouraging.

Outlook -

Well placed to deliver upon current market expectations for the full year ...

"The group is in its strongest position for many years, which enables us to execute our strategy and continue to invest in the growth of the business."

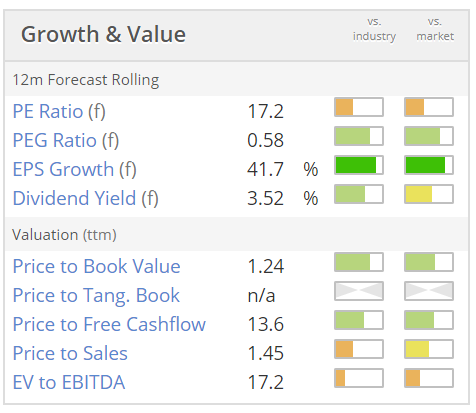

Valuation - the PER used to be typically in the 10-13 range, with a divi yield of about 5%, but these worsened recently due to a strong surge in share price since Jul 2017;

My opinion - this share is no longer in the bargain basement. However, the reason for that is that insolvencies are increasing. With the outlook for many small businesses looking tricky at the moment, it seems that, sadly Begbies are likely to be entering a period of more insolvency work. For that reason I'm hanging on to my shares, even though they don't look cheap any more. The counter-cyclical nature of insolvency work means that this share is quite a nice hedge in a portfolio, protecting against an economic downturn.

Pressure Technologies (LON:PRES)

Share price: 140.5p (up 6.0% today)

No. shares: 18.6m

Market cap: £26.1m

Pressure Technologies (AIM: PRES), the specialist engineering group, announces its full year results for the year ended 30 September 2017.

This looks to be another turnaround situation, I quite like the look of this.

The company has managed to eke out an adjusted profit of £1.1m, although after all costs the operating loss was £1.6m.

Net debt still looks too high to me, even after taking into account the £4.8m net proceeds of a share placing, post year end.

Outlook comments are the most interesting part of today's announcement.

The level of optimism within the oil and gas market is increasing by the month. Major oil companies reported healthy profits for quarter-three 2017, which is a sure sign that their attentions will start to move towards investment and growth.

Recent assurances by OPEC that production cuts will be sustained until supply-demand has been rebalanced is encouraging. Even the top three US-based shale producers have issued a cautionary note on the speed and level of investment that is prudent in order to sustain a profitable oil price.

Positive noises are also made about the group's other markets - renewable energy, and industrial cylinders - where UK MoD work for nuclear submarines provides, "a visible order pipeline for some years ahead".

Given a more positive outlook in our core markets and the recent fundraise that has bolstered our financial resources, supported by steps we've taken to ready our businesses for growth, the Board is optimistic that the Group is well prepared to capitalise on opportunities as they arise.

My opinion - this looks an interesting turnaround. This group has been highly profitable in the past, when its markets were more buoyant. The CEO today says;

The reorganisation in recent years means that there are significant operational gearing gains to be made as volumes increase. The recent share issue improves the Group's ability to support large scale organic growth, and with no immediate major capital expenditure required the Group is in good shape.

Personally I'm not really looking to open any new long positions at the moment. However, if I were, then I would give this company serious consideration. There could be more upside on the share price, as the market factors in anticipated profits growth.

Joules (LON:JOUL)

Share price: 266p (up 1.1% today)

No. shares: 87.5m

Market cap: £232.8m

Trading update - this covers H1 of y/e 05/2018.

This is a lifestyle brand, of clothing & accessories, selling from shops, online, and wholesale.

Today's update focuses mainly on revenue growth. That's not very helpful, as I'm more interested in profitability. 10 new stores have been opened in H1, so of course revenues have gone up.

Gross margins are said to be in line with H1 last year.

Nothing is said about overall profitability, other than CEO comments;

"The Joules brand has performed well in the first half of FY18, delivering further expansion across markets, channels and product categories. The Group's performance reflects the growing appeal of the Joules brand amongst both new and existing customers across our target markets.

So can we deduce from "performed well" that the company is trading in line with expectations? I presume so, but it would have been so much better if this announcement actually told us.

By omitting the vital point of performance compared with market expectations, this announcement introduces doubt, hence is unhelpful. Rather than all the waffle in today's announcement, I would have preferred a single line, saying that we're trading in line with full year expectations, with an asterisk and a footnote stating what the company believes market expectations are. Really, this is not rocket science, so why can't companies & their advisers provide the information that investors actually need?

Outlook - there are mixed messages here;

We look forward with confidence to the second half of the financial year, underpinned by the strength of the Joules brand and our collections. Whilst trading conditions will remain challenging, we have seen good growth in our wholesale order book for Spring/Summer 18 and are well positioned for the Christmas trading period."

My opinion - this is a frustrating announcement to decipher. There are mixed messages about good growth, but challenging market conditions. Also, they duck the question of performance against market expectations, which is all investors really want to know.

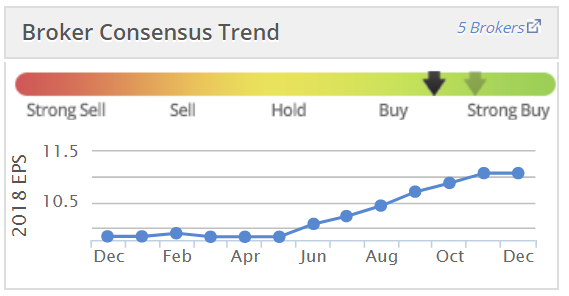

So on the basis that this announcement introduces doubt into my mind, I can't buy any shares in it. Which is a pity, because broker forecasts have been steadily rising, which suggests things are going well;

The share price has come down a fair bit from its peak in the summer, which seems to me a general market move - loads of growth companies are exhibiting similar pullbacks at the moment - BOO, FEVR, and loads of others, are off by a quarter to a third in price from their summer peaks. Somewhere amongst that lot, there will be some good buying opportunities.

JOUL is starting to look moderately attractive in valuation terms, on a forward PER of just over 20. My only other doubt about this company, is that it has a highly distinctive fashion look, which could rotate out of favour at some stage, possibly? So I think there's more fashion risk with this company than many of its peers.

Overall though, I am quite tempted to pick up a few of these. If today's RNS had been clearer, then I probably would have done so. The company & its advisers need to re-think how they communicate with investors, as it's not very good at the moment.

Note also that a lot of investors seem to be using trend following, momentum techniques at the moment. Hence the break of the 200-day moving average (red line on chart below) could trigger some continued selling perhaps?

Zytronic (LON:ZYT)

Share price: 500p (down 3.4% today)

No. shares: 16.0m

Market cap: £80.0m

Zytronic plc, a leading specialist manufacturer of touch sensors, announces its preliminary results for the year ended 30 September 2017.

These results look good to me.

Basic EPS was 29.0p, which looks to be a beat against broker consensus of 28.6p. It's up 9.0% against prior year.

Divis - a big increase here, with the final divi up 39% to 15.2p. Total divis for the year are 19.0p, for a 3.8% yield - pretty good.

Outlook - this implies no increase in new year profitability, which probably explains today's share price fall;

"The current year has started with orders, revenues and trading along similar levels to that of the prior year which together with our strong balance sheet and cash generation provides a sound base for further growth in dividends and shareholder value."

I don't think that's good enough to push the share price any higher.

Balance sheet - is groaning with cash. Surely management need to do something with it? Either give it to shareholders, or make a decent acquisition.

My opinion - nice company, probably priced about right.

That's it for today, got to dash now for an investor lunch in London.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.