Good morning!

A couple of companies in my portfolio reported today, and we have plenty of other stories to discuss.

Today's list:

- H & T (LON:HAT)

- 888 (LON:888)

- French Connection (LON:FCCN)

- Staffline (LON:STAF) (restoration of trading)

- Mothercare (LON:MTC)

Trade update - I now own some long-term, deep out-of-the-money put options in Tesla. The effect of this trade is that I am betting Tesla's equity turns out to be worth nothing by 2021.

This probably won't happen, and the options will probably expire worthless, so I will lose all of the money I've invested in them. Just have to put my feet up and wait until 2021 to find out!

H & T (LON:HAT)

- Share price: 294.9p (+3.5%)

- No. of shares: 37.7 million

- Market cap: £111 million

(At the time of publication, I have a long position in HAT).

This share has been in my portfolio since 2013. At this stage, perhaps it's fair to say that I'm a veteran H&T shareholder?

More good results for 2018:

- pledge book up by 9.5% to £52 million, a fresh high

- personal loan book up by 38% to £20.5 million

- personal loan revenue after impairments up 80% to £7 million

The personal loan segment has been the biggest driver of growth, but nearly all operating segments showed encouraging progress. For example, revenue from foreign currency services grew by 24% (from a low base).

The company remains wonderfully disciplined as the number of stores increased by only one during the year, to 182.

H&T has resisted the urge to expand unprofitably, instead fine-tuning the profibability of its existing estate. Indeed, it has a slightly bigger store portfolio (c. 190) if we scroll back to 2015.

It says that it now has access to a "broader customer base", after improving its online channels with respect to both jewellery retailing and pawnbroking.

Traditionally, a pawnbroking customer was an older woman with dependants who had family jewellery items she could pawn to get through a temporary cash flow difficulty.

As the business has moved online, it's easy to imagine a younger audience that is more balanced between men and women might now access the service.

Dividend - the full-year dividend is increased by 5% to 11p, with 6.6p getting paid in May.

Diluted EPS is much higher at 29.2p, so we have a well-covered dividend.

Note however that this does not mean that the company's cash balances are growing.

Since H&T is increasing the amounts extended to customers on credit, this means that cash is leaving the company (going to customers), with the hope and expectation that profits will increase in the future.

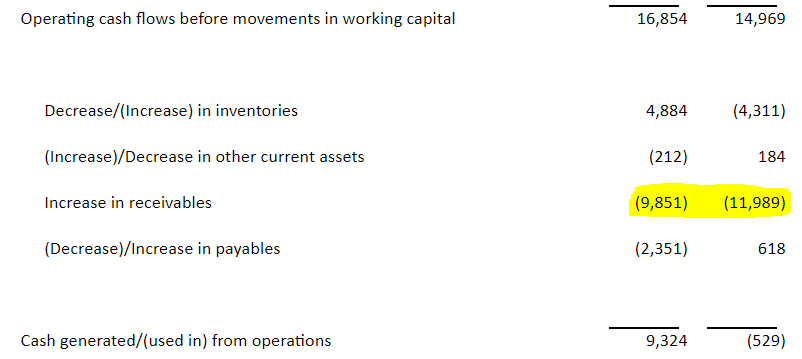

Receivables have grown by a massive £21 million over the past two years:

This £21 million drag has helped to reduce cash generated from operations from £32 million to £9 million, if we combine the results of the past two years (making no other adjustments).

Borrowings have had to increase by £10 million to £25 million, so the company is using most of its £35 million facility.

Am I uncomfortable with any of this? Not in the slightest. It does increase the overall risk profile of the company, compared to choosing not to grow, but so long as it is prudent in terms of the amount lent to customers then I don't see it as a problem.

The "risk-adjusted margin" in pawnbroking has fallen by 2%, but the company says this is due to lower interest rates being charged on higher-value loans, rather than a rise in impairments.

In personal loans, 59% of the loan book falls outside the FCA's definition of High Cost Short Term Credit (HCSTC), which in my opinion reduces the regulatory risk in this category. This percentage is a big increase on the 50% reported for December 2017.

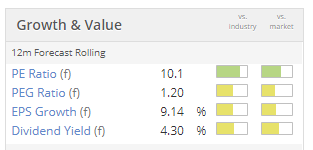

Some people have been wondering out loud why H&T shares are so "cheap". For example, the ValueRank comes in at 80.

My own theory is that the apparently cheap valuation may be due to the regulatory risk in this sector. But with most of its personal loans now falling outside the scope of HCSTC, is this such a big risk? Personally, I suspect that these fears are overblown.

Even when we consider those of its loans which do fall within the scope of HCSTC, I think it must be more likely than not that the authorities have finished adding restrictions to this sector for the foreseeable future.

It's also worth bearing in mind that regulation can have dampening effects on competition. As the largest pawnbroker and a highly visible provider of personal loans on the High Street, H&T may find that its competitive position improves in the event of any further regalatory tightening.

Finally, I would note that performance within the loans book improved a lot during this year of growth: impairments as a percentage of revenue fell to 69% from 75%. This segment has risen rapidly from a small base and now makes a material contribution to overall profitability.

Outlook for 2019 - demand for the company's products remains strong and it is confident that it will be able to navigate Brexit. It enjoys counter-cyclical properties in that it benefits from Sterling weakness (so long as this is accompanied by an increase in the Sterling price of gold) and also, in my view, could benefit from increased product demand in a recession.

Probably the main risk for H&T in the short-term, from my perspective, is that Sterling strength could accelerate, which could depress its profits in Gold purchasing.

As a long-term supporter of the company, I'm happy to ride out these macroeconomic waves. H&T remains a core holding.

888 (LON:888)

- Share price: 165.7p (+2%)

- No. of shares: 364 million

- Market cap: £603 mllion

(At the time of publication, I have a long position in 888.)

This is a holding I topped up recently, after strengthening my view that it's the best Israeli stock listed in London and a great company in its own right.

It's a member of the FTSE-250 index, which is an index I'm very happy investing in (although Plus500 (LON:PLUS) is a member of this index, too).

Today's results are quite good.

- 2% reduction in revenue

- adjusted EBITDA up 6% as every category of cost and expense was reduced

Let's consider revenue growth by operating segment:

- Casino (by far the biggest segment) up 8%

- Sport, the second biggest segment, up 6%

- Poker collapses by 37% - much worse than I would have expected. Losing competitiveness in this area, although it continues to invest and will try to recover.

- Bingo down 17%, due to UK regulations.

Outlook: confident.

...underpinned by the Group's diversification across products and markets as well as its technology leadership and first-class team, 888 is very well positioned to continue to generate value for its stakeholders

There is likely to be a short-term hit to profitability, as 888 invests in the US market.

The efforts in the US are definitely a bit speculative, seeing as the US Department of Justice is currently in a battle to prevent all forms of online gambling. 888's new investments in the US could potentially turn out to be worthless, in a worst-case scenario.

The possible upside however, is tantalising, and I am fine with 888 making a run for the US.

Closer to home, I've been impressed by 888's ambition, particularly with 888sport which has a long-running sponsorship deal with Birmingham City.

Dividend - there is a reduction in full-year dividend to 12.2 cents (9.3p) from 15.5c (11.8p), as the company preserves cash for bolt-on acquisitions and organic investment opportunities.

That still makes for a trailing yield of 5.6%, with scope for a bounce back in the dividend for FY 2019.

And I think it's good that the company plans to keep investing and growing, rather than paying out everything in dividends. It has earned the right to do so, in my view, by earning terrific returns for investors.

The company has no borrowings and $76 million in net cash as of December 2018 (after amounts owed to customers). It paid out $57 million in dividends during 2018.

It also has a borrowing facility, in case it needs extra cash for acquisitions. While I would be terrified if I saw a "transformational" deal, recent acquisitions have been more of the "bolt-on" variety, which I am comfortable with.

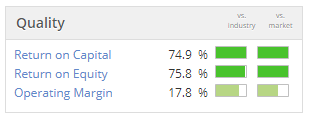

My view - in case it's not already clear, I'm a fan of this business! Cash-rich, earning big returns on capital, with a distinctive brand, and clear growth opportunities.

Granted that it's a tough sector, and I have no immediate plans to increase my stake any further. But prospects from the current level seem quite good, in my opinion.

French Connection (LON:FCCN)

- Share price: 43.3p (+2%)

- No. of shares: 97 million

- Market cap: £42 million

Preliminary results for the year ended 31.01.19

An old SCVR favourite, French Connection has finally returned a pre-tax profit before adjusting items of £0.1 million. It has been a long wait for this day.

The adjusting items are unfortunately rather large: £9.4 million, compared to £3.8 million last year.

At the risk of stating the bleeding obvious, those adjustments are pretty large compared to the market cap of the entire business! They include:

- £2.8 million provision for bad debts, with £2 million unpaid from FCCN's Indian licensing partner and £0.8 million written off from a UK concession partner (House of Fraser).

- £6.6 million related to stores. £0.7 million expensed for store closure costs, and £5.9 million for onerous lease provisions.

Onerous lease provisions are a way of recognising future losses up front, on stores where the agreed rents are simply too big.

It's a "non-cash" loss on day one when the onerous lease provisions are recorded.

Then, in future years, it's not recorded as a loss at all, but there is cash outflow as high rent payments are devoted to extinguishing the onerous lease provision.

Checking the balance sheet, the £5.9 million of OLPs are visible with £2.4 million recorded as "current" (to be extinguished by January 2021). That's sort of encouraging to me - perhaps the company is finally close to escaping the bulk of its onerous leases, i.e. within the next two years, maybe?

10 stores were closed in FY 2019. One new store was opened (why?!), leaving the total number of operated stores at 96.

The number of franchised, licensed and joint venture stores and concessions falls by a similar percentage to 195.

The pace of store closure still looks rather pedestrian to me. An 8% reduction p.a. doesn't strike me as urgent enough.

Retail like-for-likes are minus 6.8%, from a poor starting point. Getting out of stores should be much more urgent, in my view, but I've been saying that for a long time.

The Chairman acknowledges that more stores could have closed, but he chose to keep them open, as rent reductions were available (rent reductions were available because few other companies want to lose money doing what French Connection is doing, I would suggest!).

We have continued with store closures during the second half of the year. Given the current environment the renegotiation of leases is now becoming more favourable to tenants and better deals are available certainly in the short term. This has resulted in a number of stores that were expected to be closed continuing to trade for the time being.

Net cash is good at £16.2 million, though I'm guessing this is a seasonal high, and it follows a disposal which boosted the cash pile. And £5.9 million has just been earmarked to pay off those onerous lease provisions.

Operating segments - the standout performer is wholesale. Licence income was a bit harder to come by, and retail was predictably bad, and worse than last year:

(LHS: FY 2019. RHS: FY 2018)

As you can see from the above table, the bull hypothesis still rests on the Retail segment gradually going away and the other segments continuing to shine.

The group remains for sale and the formal sale price is expected to conclude during the first half of 2019. "Discussions are ongoing with a number of parties".

My view

I've been watching this, like many of you, for a long time, and I agree with the bulls that it could work out very well for shareholders. Stores will eventually shut down (before the company runs out of money, presumably), or we could have a trade sale in the short-term at a higher share price.

The Chairman is 73 and owns 42% of the shares. The outcome rests, as it always has done, on his intentions and ability.

Downside risk? Well, if nobody wants to buy it at a price the Chairman is happy with, then it could trundle along and continue to frustrate shareholders. Loss-making stores that could be closed could be kept open, for no good reason.

If I had to bet, I would say that the Chairman will probably sell and go enjoy his retirement, and all shareholders will get a decent price for their shares. But I have no real conviction in this, so I'll remain on the sidelines.

Staffline (LON:STAF)

- Share price: 848p (+27%)

- No. of shares: 28 million

- Market cap: £237 million

Group update and restoration of trading

Pleasant news for shareholders of this predominantly blue-collar recruiter. The recent investigation is resolved with only an additional £3.5 million of exceptional costs for 2018 (relating to historic underpayments to workers versus minimum wage rules).

This brings total exceptionals for 2018 to £23.5million.

More good news items:

- underlying trading performance for 2018 still expected in line with expectations

- no change to forecasts for 2019

- working capital improvement of £10 million since year-end, which should benefit the debt position (£63 million at year-end).

Foul play? - a note published on Research Tree says that the false accusations brought to the Board's attention via email may have been timed on the eve of results "to cause maximum disruption to the company". Would a competitor do that or a disgruntled former employee? Intriguing.

Outlook - brokers leave their forecasts unchanged for 122.4p of adjusted, fully diluted EPS in FY 2019.

My view - I'm leaning towards the idea that Staffline is worth pretty much the same as before the suspension, i.e. around £13 per share.

Whenever there are governance and accounting issues of any kind, it can hammer confidence. Things are usually much worse than they initially appear, as more elements of the fraud are discovered over time.

In the case of Staffline, we don't have a smoking gun of any fraud and indeed, it may simply be the victim of a malicious attack.

If I was interested to trade short-term movements, I'd probably hold this on the basis that the share price can recover to its previous levels.

Mothercare (LON:MTC)

- Share price: 18.05p (+7%)

- No. of shares: 342 million

- Market cap: £62 million

Update on transformation and disposal of ELC

Radical news from Mothercare today.

Firstly, the transformation plan is going well:

- total number of stores will be 80 by the end of this month, down from 137 in May 2018.

- outsourced product to improve margins from Autumn/Winter 2019

- leaner structure and cost savings of £19 million p.a. to be delivered

On top of this, the company is selling the Early Learning Centre, both the brand and the business, for £13.5 million including a delayed earn-out payment. The buyer is The Entertainer Group (thetoyshop.com).

After selling down left-over inventory, the deal should reduce bank debt by c. £17.5 million this year.

The rationale strikes me as honest and realistic: besides the need to reduce debt, Mothercare also feels that it didn't have the resources to develop ELC's brand and product range properly.

My view - didn't think I would say this, but I'm really impressed by the progress at Mothercare.

The company has already received £14.5 million from the sale and leaseback of its Head Office. Combined with the movement arising from the ELC sale, maybe we can assume that it will achieve its target of being "bank debt free" by the end of 2019? Net debt was £21 million at October 2018.

After a CVA, lots of store closures, and a big equity raise, it looks to me like Mothercare might be on the verge of pulling through.

I'm not looking to add any retailer to my portfolio, but at least the insolvency concerns could soon be behind this one, at least in the medium-term. It will then need to go ahead and produce some profits in 2020!

I have run out of time and brain cells for today, but will revisit these tomorrow if there is any time in the morning:

- Midwich (LON:MIDW)

- Water Intelligence (LON:WATR)

- Pendragon (LON:PDG)

- eve Sleep (LON:EVE)

Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.