Good morning, it's Paul here!

Market musings

Confidence seems to be returning to the US markets, after a wobble last week before hurricane Irma. I do wonder if anything can stop this bull market? A commentator wryly remarked yesterday that because everyone is expecting a pullback, he thinks it's unlikely to happen. So an expensive market just keeps getting more expensive.

Historically, when markets reach the euphoria stage (which is where we are now, in my view), then it always ends in tears. Absolutely always. It's just that we don't know when. Meanwhile the good times can keep rolling. This does feel similar to 1999 though, in terms of market sentiment, in my view - i.e. getting very toppy, especially for technology & other growth stocks.

The complicating factor now is ultra-low interest rates. In the past, a decent, growing company, on a PER of 20 would have seemed quite expensive. However, now that interest rates are close to zero, then a (growing) earnings yield of 5% (the reciprocal of a PER of 20) actually looks quite good. Mind you, that assumes earnings keep growing forever, which of course they won't. As we're seeing in the hospitality sector, once demand drops, then the operational gearing kicks in, and massacres earnings (more of that below, re Tasty (LON:TAST) results today).

On the bull side of things, I am mindful that once-in-a-lifetime (or maybe one off, irrespective of timescale) changes are occurring to whole sectors, due to internet disruption. So you could argue that companies like Amazon , Google , and others, are becoming so dominant that nothing seems likely to stop them, other than Government intervention to break them up. Trump has already made complaints about Amazon destroying competitor businesses which previously paid taxes. Since Amazon barely even tries to make much profit, it pays little corporation tax. Hence Government tax incomes are hit by the company's relentless march to global domination. Surely, sooner or later, these dominant (arguably monopolistic) US large companies are likely to face forced break-up? Maybe that could be the trigger to eventually end this long bull market? I don't know, but it's all fascinating.

I was looking at the valuation of Shopify Inc ( $SHOP ) yesterday. It's on a forward PER of 837.8. That might seem like insanity, but when you look at the growth & forecast growth, this is likely to become a future giant, dominating its space. So providing that growth continues, then the valuation of £9.7bn might turn out to be sensible, or even cheap, long term. If the growth slows, or stalls, then the valuation would collapse overnight.

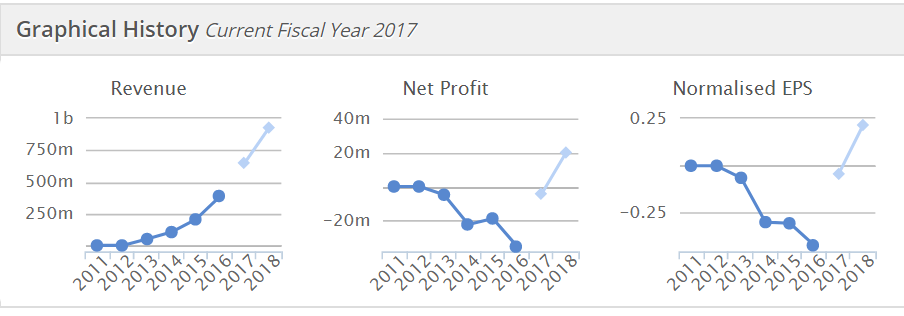

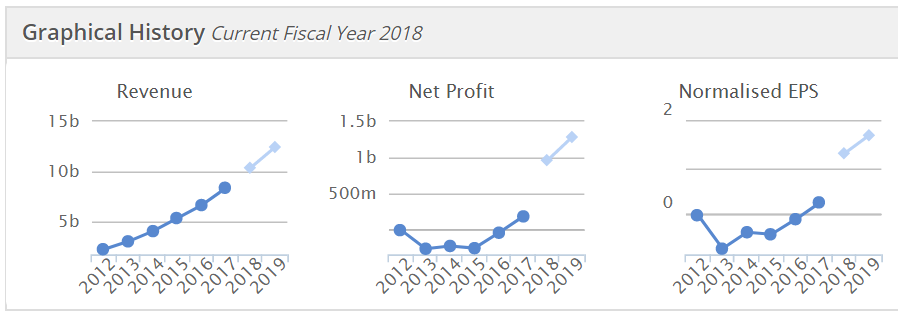

Another fascinating company is Salesforce $CRM . As you can see from the graphs below, it was actually loss-making during its growth phase, but is now becoming highly profitable. So if you tried to value it on a PER basis over the last few years, that would have made no sense.

So, if we can spot the truly exceptional growth stocks, then the rewards can be spectacular. Trying to do that has been one of my key areas of focus over the last couple of years. I like value investing, but there are times, during roaring bull markets, when it's largely a waste of time - people are focusing on growth, not value, at times like this. Mind you, there are still some interesting special situations out there, where value can throw up good results too. Although a low PER usually means it's a rubbish company.

Tasty (LON:TAST)

Share price: 37p (down 11.9% today)

No. shares: 59.8m

Market cap: £22.1m

Half year report- for the 26 weeks ended 2 July 2017.

This is a chain, operating 65 restaurants, 58 of which trade as Wildwood - a pizza/pasta/grill concept. The other 7 trade as Dim T. Neither concept looks particularly interesting to me.

Things have not been going well. The company warned on profits in Mar 2017, and again on 9 Aug 2017, which I reported on here. It seems odd that the shares have fallen another 11.9% today, since the interim results today seem to be in line with the figures indicated in the RNS on 9 Aug 2017. Maybe the price was just marked down this morning at the open, by the market makers?

Very small stocks like this are often so illiquid, that the share price is quite artificial really - there are often frustrated buyers & sellers who simply cannot transact at all in size. So the market price often just reflects the balance of buyers & sellers of tiny scraps of shares. We came across this phenomenon recently with eg Solutions (LON:EGS) where the company is being sold for less than the prevailing share price. They're doing this because, essentially they're saying that the share price was wrong - small trades had pushed it too high, whilst the institutions were not able to transact at all. This is an interesting point of wider significance in small & micro caps, whose prices can often be irrational because bigger buyers & sellers can't really transact at all.

Key points from Tasty's interims today;

Revenues up 11.8%, due to new site openings

Operating profit before pre-opening costs for new sites (of £165k) fell 72% to just £544k - note how operational gearing is an absolute killer in the hospitality sector (very similar to retailing sector). Most costs are fixed, so when demand softens, then profits can collapse very quickly.

Exceptional costs - are huge, at £9.3m for impairment of property, plant & equipment - i.e. money previously spent on capex, which now turns out to have been squandered.

There seems to be a bit of an H2 weighting historically to profits, although it's difficult to tell, as that might have been caused by new site openings. So I would guess that full year profits, before exceptionals & pre-opening costs, look likely to come in maybe between £1- 1.5m? I'm possibly being too generous there, as Stockopedia shows a broker consensus of profit after tax this year of only £0.5m. It's probably best to be cautious, given that this sector is facing horrible, multiple problems (e.g. Living Wage, business rates rising, higher food prices, over-capacity, competitors discounting prices, and waning demand).

Narrative - in the brief commentary provided today, the key points not covered already above are;

4 new sites opened. (Why??? If the format isn't really working, why open more of them?!). The company does say it's slowed the pace of its roll out. They should stop the roll out, if they had any sense. It's madness to borrow more, to open restaurants that the public don't seem to like enough to generate decent profits. It sounds like they might have belatedly come to the same conclusions, as no new sites are currently planned for 2018. That is good news.

Cautious outlook;

The Board believes that the sector as a whole has been suffering due to a slowdown in consumer spending since the beginning of 2017 and this is set to continue into 2018. This is not unique to the Group or any particular area but appears to be a nationwide problem particularly evident in London and has impacted turnover and profit.

As a result of the weak trading environment the Group is facing pressure on sales and margins. The Group is taking decisive action to improve its position

The Group recognises the challenging conditions ahead and is taking action to strengthen its position. The Directors are confident that the Group's restaurants remain appealing to customers and the Group will continue its growth in the future.

Problem sites - are either being disposed of, on the market, or undergoing turnaround attempts. It can be very difficult, or even impossible, to exit from over-rented, loss-making sites. So this could be a serious problem. The biggest danger for any struggling retailer/hospitality company, is that expensive leases drag the whole company under. For that reason, it's a mistake to assume that these problems can be solved. They could be terminal.

Menu - a "major review" has taken place of product. Sounds sensible, since customers are voting with their feet & not buying it as much as before. This is such a competitive sector - anyone who stands still just gets left behind, by newer, better restaurant operators.

Bank debt - given that profitability seems to be heading down to zero (and possibly below), I wouldn't want to see any net debt. Tasty actually had £5.4m net debt at 2 Jul 2017, which is down from £7.4m a year earlier. The company says it intends to reduce net debt further by the year end. That sounds sensible to me. They need to clear that debt asap, so that the bank manager doesn't end up calling the shots, if the company does move into losses in future.

My opinion - I don't like this at all. The whole sector is very difficult right now, and likely to remain so. All 5 listed restaurant operators have warned on profits this year. The reasons underlying that look only set to increase.

Sector specialist, Langton Capital, in its outstanding hospitality sector email (free, here - very highly recommended, it's essential daily reading for me), recently flagged up another issue - that we're still taking our overseas holidays, but end up spending far more than we intended whilst abroad, due to weak sterling. Therefore, once people come back from their holidays, they're skint. So trips to the pub, and meals out, are the obvious candidates for belt-tightening.

I'm not planning on buying back into Tasty. If there are future signs of a turnaround, then I'd consider it. However, in my view, it would probably be a mistake to try to bottom fish now. The fixed assets are worthless, if the company moves into trading losses. So there's not really any downside protection from the balance sheet. Meanwhile, over-rented sites on leases which cannot be exited, are the Achilles Heel for any type of struggling multi-site operator. Therefore, I would need to find out how long its leases are, and how profitable/(loss-making) each site is. We're not given that information, so in a way this company is almost impossible to value right now.

Without the information I need to value it, it's not possible to come to a sensible conclusion, so for that reason I'll just avoid it altogether for the foreseeable future. I certainly don't want to be buying into a struggling restaurant chain, with a dubious format, when its profits have collapsed.

For me, the only decent sector pick is Fulham Shore (LON:FUL) - however at 14.1p that's not cheap enough to tempt me yet. I think sub-10p is the sort of level where risk:reward might look interesting there.

It's a hideous sector, so why get involved?

Looking at the 2-year chart below, it's tempting to wonder if there's any merit in bottom-fishing. I think it's important not to anchor to the previous share price, when the fundamentals have dramatically deteriorated, as they have with Tasty. I remain unconvinced. Although clearly, if management does manage to execute a convincing turnaround, then there might be good upside. In the current environment, my feeling is that a strong turnaround looks extremely unlikely.

Van Elle Holdings (LON:VANL)

Share price: 98.4p (down 4.5% today)

No. shares: 80.0m

Market cap: £78.7m

AGM Trading Update - this company floated in Oct 2016. It's a "geotechnical engineering contracting company" - e.g. piling, foundations, and other ground engineering works for the construction industry. It has a 30 April year end. So today it seems to be reporting on Q1, so that's May - Jul 2017.

Today's announcement says;

... trading in the first quarter of the financial year has been encouraging, with good levels of activity across the Group, particularly within the General Piling division and the recently established Scottish operation.

Market and operating conditions in the Group's rail business remain more challenging but the Board continues to see this as an area of opportunity for Van Elle over the medium term.

The Board will continue to monitor conditions in its markets closely and, whilst acknowledging the normal seasonality of the business, remains confident in its expectations for the current financial year as well as the long-term potential of the Group.

On the face of it, that sounds reasonable. Although the tone is perhaps a little tentative? So I wonder if this could be perceived as making a profit warning possible later in the year? I think that could be why the share price has slipped a little today.

My opinion - for me, contractor businesses like this hold absolutely zero appeal. Something nearly always goes wrong, sooner or later, with a big contract, with the inevitable profit warning. I just don't think companies like this should be listed at all on the stock market. In this case though, the valuation appears undemanding, and the divis aren't bad, at 3.8%.

13:24 - Right, I have to down tools for a couple of hours, as my mother is unwell, so I'm popping round to make her some lunch & have a discussion about how everything is being dumbed down, and how awful all the politicians are, over several cups of tea!

After that, I've got nothing else on for the rest of the day, so will definitely be adding some more sections later.

Best wishes, Paul.

20:50 - Good, all is well, so time to do some more work!

Midwich (LON:MIDW)

Share price: 430p (up 9.1% today)

No. shares: 79.4m

Market cap: £341.4m

Interim results - for the 6 months ended 30 Jun 2017.

This company floated on AIM in May 2016, and describes itself as;

a specialist audio visual and document solutions distributor to the trade market

I've had a look at its website, and there is a wide range of products distributed to trade customers (who then sell on the product to end customers), e.g. TVs, headphones, CCTV cameras, commercial displays, digital projectors, printers, scanners, video conferencing equipment, etc.

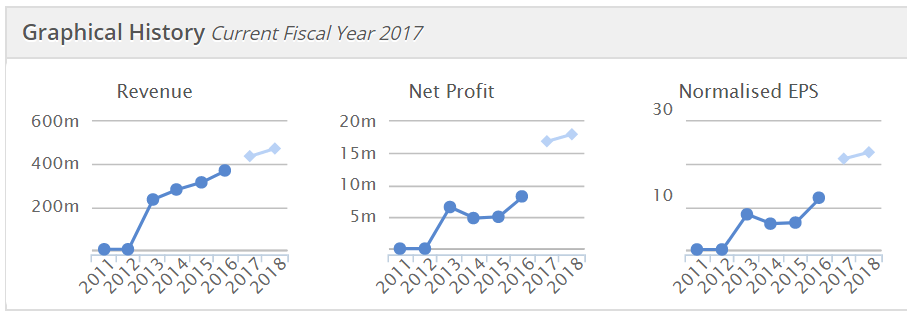

When looking at a new share, one of the first things I do is to check the Stockopedia graphical history. In this case, there is a good progression in revenues from 2013 onwards. However, net profit seems to have made a step change in the (forecast) figure for 2017, which makes me wonder what has driven such a jump in profitability, and is it sustainable?

I'm not familiar with this company. Checking the archive, Graham wrote a short, positive piece about it at 261p on 18 Jan 2017. He mentioned it positively again on 21 Jul 2017, at 388p, so readers who were paying attention could have made a nice profit on this share. Sadly I wasn't paying attention, so missed it! It seems that there has been good growth at the company, enhanced by sterling weakness, which looks to have boosted the profits of its overseas operations, when translated into sterling.

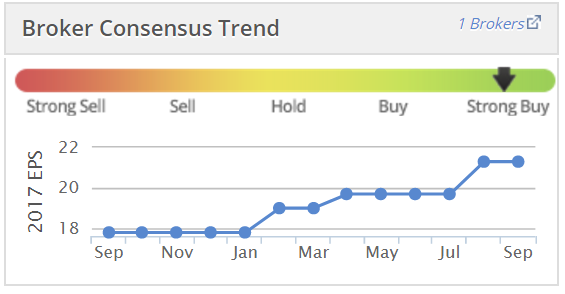

The broker consensus EPS forecast graph has shown a positive trend over the last year too, which is a key thing to look out for;

Remember that brokers are often behind the curve with their forecasts, so it often pays to find companies where the brokers are being too cautious & tardy in raising their forecasts. Also, broker forecasts can often be wildly incorrect, as lots of things change in a year. So I try to reasonableness-check broker forecasts, and home in on situations where the forecasts look far too cautious to me. IQE (LON:IQE) (in which I hold a long position) is a particularly extreme example of that right now - where brokers (and the company) have stated that there is potentially massive upside on the existing forecast for 2018-2020, due to new product launches. That is a very exciting situation, in my view, if the upside case does pan out.

Anyway, looking at today's H1 2017 results from Midwich, the headline figures look really good;

Revenue up 34% to £211.6m (partly driven by acquisitions) - growth was +28% on a constant currency basis.

Gross margin is very low indeed, which is par for the course for a distributor - it's only 15.3% (down from 15.6% in H1 2016)

Adjusted profit before tax is up a similar percentage to revenues, as you would expect - at £10.3m (up 36%). The adjustments are shown in note 12 to today's RNS, and look fine to me. The main adjustment is to strip out amortisation, which is not an issue.

Distributors are a good example of a business with low operational gearing. So usually a rise of fall in revenues of x% will produce a change in profit of broadly x%, or x% plus a small additional amount. Compare that with Tasty (LON:TAST) above, which is an example of a business with very high operational gearing. Which is better? When demand is falling, then low operational gearing is best. When demand is rising, then high operational gearing is best - as it turbocharges profit growth.

The big opportunity for distributors is if they can increase their gross margin, by e.g. negotiating better prices from suppliers, or by selling higher margin additional services (e.g. training) to customers. Although that then leaves them vulnerable to competitors popping up & undercutting them. Or suppliers taking action to claw back margin for themselves. For these reasons, I wouldn't normally touch any share in a distributor. The other big risk, is if suppliers decide to start selling direct to customers, cutting out the distributor altogether. That has to be more of a risk, with internet disruption being what it is. The end customer might eventually decide to just buy direct from the manufacturer in future, which would dis-intermediate both the retailer and the distributor that supplies them.

Outlook - is reassuring, in line with full year expectations;

"The strong performance reported in the first half year coupled with indications of positive sales momentum and strong contributions from recent acquisitions gives the Board confidence in reporting results for the full year in line with our expectations, which were upgraded at the time of the Group's trading statement on 21 July 2017."

Valuation - Stockopedia shows consensus EPS forecast for 2017 at 21.3p. So a share price currently of 430p gives a current year PER of 20.2. That seems very expensive for a distribution business.

Balance sheet - distributors tend to be used as a bank by their customers, so the first thing to check is how well controlled inventories & debtors are. In this case, they look fine to me - not excessive at all.

NAV is £47.4m, reducing to NTAV of £22.1m, which strikes me as being adequate, but not strong. Note that there's a fairly chunky gross borrowings creditor of £43.4m within current liabilities - I suspect that might be an invoice discounting facility, but am not sure. Although this is partially offset with cash of £20.6m. Period end cash is usually window-dressed, so overall this company relies on its borrowing facilities by the looks of it.

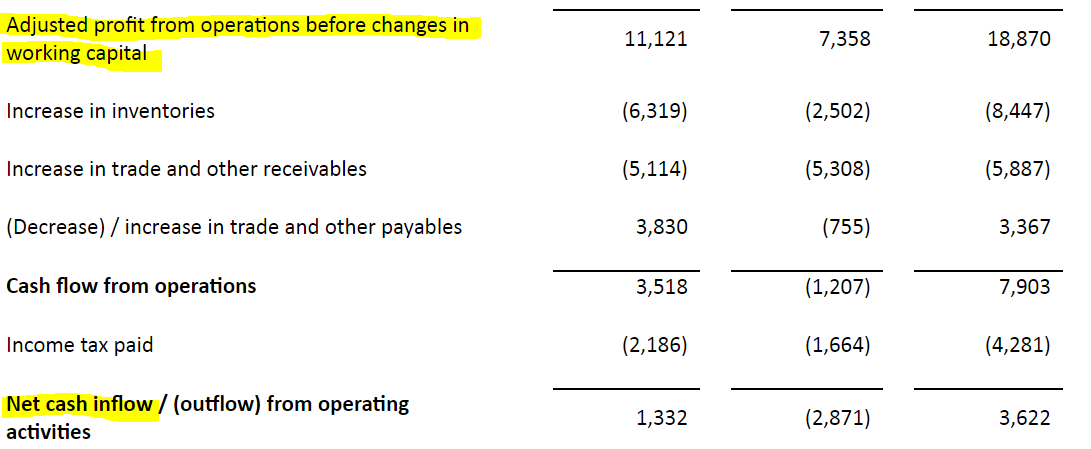

Cashflow - not great. Note that as it expands, the company is sucking in cashflow into working capital. This is the problem when a business like this grows - 2 debit balance sheet items have to rise (inventories and debtors), whilst only one credit item rises (trade creditors). Therefore this is negative for cashflow.

I recall this being a problem years ago at IT distributor, Fayrewood, which I got a bit obsessed about. The business expanded well, and made good profits, but generated little cash - which is why they eventually dissolved the group in the end & paid back shareholders, deciding that the business was an inefficient use of capital.

Note from Midwich's cashflow statement (below) how little of the operating profit actually turns into cash inflow. Note that it's mostly sucked into working capital. The columns below are H1 2017, H1 2016, and FY 2016, respectively;

My opinion - overall, this share looks over-valued to me.

I don't like the cashflow characteristics at all - it's generating very little cashflow, and the divis don't seem to be covered by cashflow. In my view, distribution businesses should only command a PER of about 10-12. So valuing this on a PER of 20 seems very rich.

Goals Soccer Centres (LON:GOAL)

Share price: 94.5p (down 9.1% today)

No. shares: 75.2m

Market cap: £71.1m

Interims to 30 Jun 2017 don't look good.

- LFL sales grew +1.6%, however

- Underlying profit before tax fell 25.8% to £2.8m

- In my view this is a horrible business model - requiring massive capex to build & maintain soccer centres. The return generated from the sites seems to often get sucked back in, on maintenance capex. So a rather poor use of capital, arguably. Therefore historically, shareholder returns have been poor, with dividends stopping in 2015.

- Of more interest that the UK estate, is expansion in America.

- No interim divi.

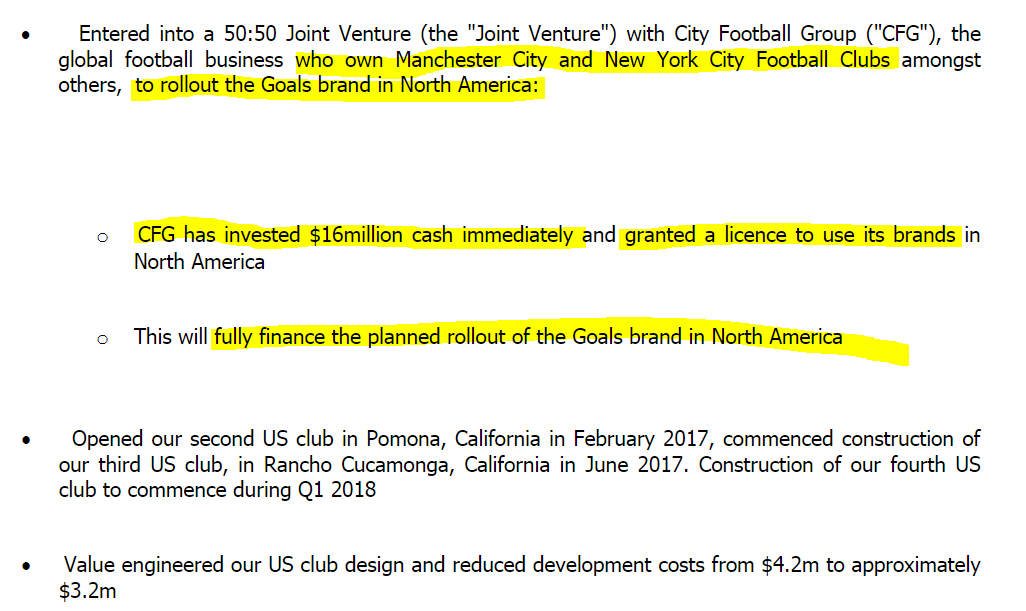

This bit sounds potentially very interesting;

Outlook - sounds cautious in the short term, hence today's 9.1% share price fall, to 94.5p.

We anticipate growing like-for-like sales in the second half, albeit at a slower rate than originally expected. This is principally due to some clubs underperforming which have not received the required level of arena investment. We are also highly cautious about the pressure on consumer spending.

With our exciting developments in the US and clear signs of growth from the investments we have made, we are confident that we can deliver improved returns, over time, for Goals shareholders.

The above reinforces the problem with this business - its fixed assets wear out, due to heavy use, so require never-ending maintenance capex, just to stand still. Not a good business model really.

Balance sheet - huge fixed assets, and some debt. The debt doesn't look excessive, relative to the book value of the fixed assets.

My opinion - the UK operations don't interest me. However, the US expansion, with a JV partner, looks a clever deal. So I'm tempted to have a little punt on this share, on the basis that the US expansion could deliver better returns, over time, and trigger a re-rating possibly?

Finally, some additional comments from yesterday's results, which I jotted down on my pad.

XLMedia (LON:XLM) - Graham has already covered this in yesterday's report. However, just to add my comments that this does indeed look an impressive set of numbers. Good results. Current trading strong. Confident outlook. $4.02c divi. It's not for me, as It's overseas + AIM, but the figures certainly look impressive.

Stockopedia likes it - StockRank of 98. The fwd PER of 13.1 probably reflects the market's suspicion of overseas AIM companies, many of which go wrong. Good divi yield of 4.3%. There's no doubt cashflows are real, but are they sustainable? So far anyway, yes. It's not for me, but I can see why people like it.

Seeing Machines (LON:SEE) - poor results. Running out of cash. I think this is a stale story, which hasn't as yet delivered profitability. This is a good example of how long it takes to develop & sell an innovative product. Even if the product is good, it takes years for customers to adopt new technology, due to lengthy product development cycles for vehicles. I'm not inclined to buy back into this one.

Pennant International (LON:PEN) - quite good interims, 6m to 30 Jun 2017. Revenues shot up from £6.6m in H1 2016, to £9.6m in H1 2017. PBT shot up from £10k in H1 2016, to £933k. Note that FY 2016 was good, as it had an excellent H2, delivering £1.9m PBT for FY 2016.

Debtors of £10.7m extremely high. That needs explaining. Balance sheet is strong IF that huge debtors figure turns into cash. If there's an impairment against it, then things would look less rosy.

Outlook - revenues for 2017 will be below expectations, but that's just a timing issue, the company says. Good order book. Profit for FY 2017 should be broadly in line with expectations.

I quite like this company, but its performance can be erratic, and it's very illiquid. For that reason, the valuation of a fwd PER of 10.8 is probably about right, or maybe slightly generous?

Cloudcall (LON:CALL) (in which I hold a long position) - at long last, I think this company has reached a tipping point, where it's likely to become commercially viable in the next year. It's now demonstrating strong similarities to an early dotDigital (LON:DOTD) (former CEO of DOTD is now CALL's Chairman), or an early LoopUp (LON:LOOP) . LOOP is valued at 5 times CALL. So there's clear potential upside I think.

Very high gross margins, combined with strong sales growth, is a powerful mixture. Note that reduced losses mainly created by newly capitalising development spend of £328k (nil, prior year H1). £200k pm, cash burn, and reducing. £3m available cash (including debt), so should reach breakeven with no further dilution (yes I know they've said that before, several times, but this time it actually looks real!)

Good webcast on the company's website - great strides have been made with the product, and there are exciting customer growth opportunities in the pipeline.

I like this a lot, and have re-bought for BMUS . I think the stock could re-rate onto a growth company rating similar to LOOP, once stale bulls realise that it's probably now turned a corner. Maybe?!

All done, see you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.