Hi, it's Paul here.

At the suggestion of Matylda, I'll be doing a car dealerships special today. This is because Pendragon (LON:PDG) has reported its 2017 results, but there's nothing much else of interest on the RNS today. So I'll write about PDG, and compare it with 6 other listed car dealerships, being;

Vertu Motors (LON:VTU)

Cambria Automobiles (LON:CAMB)

Lookers (LON:LOOK)

Inchcape (LON:INCH)

Marshall Motor Holdings (LON:MMH)

Motorpoint (LON:MOTR)

I started quite late today, so this article will gradually take shape throughout this afternoon.

Pendragon (LON:PDG)

Share price: 24p (up 14.6% today)

No. shares: 1,424.1m

Market cap: £341.8m

(at the time of writing, I hold a long position in this share)

Full year results - for the 12 months to 31 Dec 2017

We are the UK's leading vehicle online retailer with 184 franchise points and 27 used retail points.

We represent a range of volume and premium products that we sell and service which include: Aston Martin, BMW, Citroen, Dacia, DAF, Ferrari, Ford, Harley-Davidson, Hyundai, Jaguar, Land Rover, Kia, Mercedes-Benz, MINI, Nissan, Peugeot, Porsche, Renault, SEAT, Smart and Vauxhall.

Brand names include: Stratstone, Evans Halshaw and Quicks.

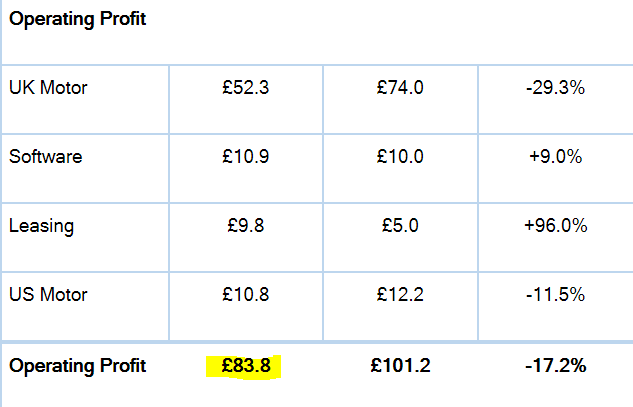

Note the emphasis on online sales. This is rather interesting, as Pendragon is not a vanilla car dealership chain. It also has a software business, which is material to group profitability - see table below;

The first column is calendar 2017. The second column is the 2016 comparative. As you can see, group operating profit fell from £101.2m to £83.8m. This was expected, since UK new car sales fell sharply in 2017. The suggested reasons for this include: Brexit-related uncertainty, higher prices due to sterling devaluation, lack of consumer confidence, and uncertainty over diesel vehicles caused by a shift in Government policy.

Other issues which might be hurting sentiment towards the sector include the likelihood of electric cars growing in popularity - and requiring less attention in garages. Also, ultimately cars could become self-driving, hence fewer people would want to buy their own car. I've also seen press reports that fewer young people are learning to drive, thus likely to reduce demand for new & secondhand cars. We also then have upward cost pressures. So the sector as a whole is facing a lot of headwinds.

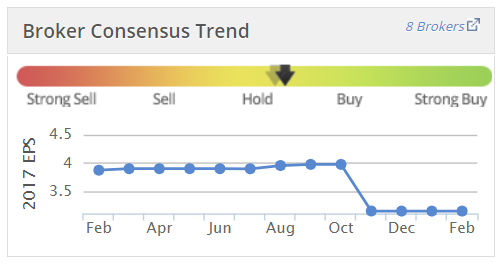

In line with expectations - there's a broker note issued today, which is available on Research Tree. I'm reading that now. It says that the 2017 results are in line with expectations set in Oct 2017 - which were reduced expectations, that triggered a sharp fall in share price at the time, from 30p to 22p.

I nipped in and bought a few shares at 22p, which was a good entry point short term. I remember that trade, as I was drinking a can of Marks & Spencer pina colada, on a train from Reading to London. I recall being a bit concerned that the pleasant, pineappley glow that the drink was giving my train journey might have impaired my judgement in buying shares in a car dealer.

The usual Stockopedia graphic shows the sharp reduction in full year 2017 EPS expectations in OCt 2017. The narrative today also mentions that the group had a tough Q3, but that Q4 improved;

Apologies all round - this article conked out earlier on.

I'll try to finish things off, when time permits, but I'm feeling exhausted & flaked out. So will try my best to finish off, but can't promise anything. Think I need a break.

Regards, Paul,.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.