Good morning! It's Paul & Graham with you today. Today's report is now finished.

Agenda

Last call for Mello Chiswick! This physical event is this week - tomorrow (Weds 16th) and Thurs 17th. Here's a link for a last minute special offer for tickets, when they're gone, they're gone! Both Graham and Ed will be giving talks. I've been booked in for 2 panel sessions, and will be generally floating around being affable. So I hope to see you there. We need to get these events going again, after the pandemic, as the risk is that they won't happen again if we don't, it would be such a pity to lose the social aspect of investing, if everything moves online.

Paul's Section:

Virgin Wines UK (LON:VINO) - Here's the transcript of my interview last Friday with Jay Wright, the CEO of Virgin Wines. The audio version is here.

Gear4music Holdings (LON:G4M) - no surprises in today's H1 results (to 9/2022), the numbers look exactly as disclosed in the last trading update. Current trading & outlook comments reassure, and it confirms being on track to meet expectations for FY 3/2023 (a modest PBT of £1.1m). The balance sheet has high inventories, and too much bank debt, but both are expected to fall. Overall, I think it's due a bounce, and c.100p looks a decent entry price to me, but I can also see why other people might see things more negatively.

Wincanton (LON:WIN) - I review its interim results in some detail, and am satisfied with everything, including the balance sheet (weak, but OK), and the pension scheme (still a worry, but seems close to being fully funded). It's bounced strongly in recent weeks, but still looks modestly valued, so a thumbs up from me.

Graham's Section:

Redcentric (LON:RCN) (£185m) - today’s update brings news of a higher-than-expected H1 net debt figure at this managed IT services company, due to a range of acquisition-related issues. Offsetting this, however, many of the issues are expected to reverse over the next six to eighteen months. Sales are strong and with cost reductions expected next year (FY March 2024), the company’s profit expectations for that year are now anticipated to be ahead of prior expectations. While personally I prefer to invest in companies with an organic growth strategy, I can understand why a company in this sector would go for growth by acquisition. Fortunately, the net debt level does not look uncomfortable at this point. That could change, depending on how quickly they use up their £100m facility.

DX (Group) (LON:DX.) (£155m) - the corporate governance inquiry here turned out to have very little impact on trading or indeed on shareholders, although it did result in some attrition in management. There were allegations of bribery by some employees; hopefully the matter has been dealt with now. DX has produced excellent numbers for FY June 2022 and Q1 for the new financial year is in line with expectations. I’m enthused by the organic growth strategy and the cash conversion. Thanks to a large net cash position (excluding lease liabilities), the company can afford to fund internal investment and also expects to pay a dividend next year for the first time since 2016. A cheap earnings multiple attached to these shares is justified by the risky sector in which it operates. This is priced to do well if its hits estimates over the next few years.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

Gear4music Holdings (LON:G4M)

96p (pre market open)

Market cap £20m

The share price for this eCommerce seller of musical instruments has plunged to new all time lows this year. The market has totally fallen out of love with eCommerce businesses generally, so this is largely a sector move. However, also plenty of justification for it, if you see how earnings expectations for this year & next year have collapsed -

This is what the share price (below) has done since listing in June 2015 - plenty of opportunities to make big money, but only if you sold near the two tops. Which again calls into question the concept of holding long-term for small caps. I’m coming round to the view that it’s better to trade in & out, if you can time your entry & exit points well, which is easier said than done -

.

What’s the latest? Today we have this -

Gear4music (Holdings) plc, ("Gear4music" or "the Group") (LSE: G4M), the largest UK based online retailer of musical instruments and music equipment, today announces its unaudited financial results for the six months ended 30 September 2022 ("the Period").

These numbers look exactly as guided in an H1 trading update which I covered here on 20 Oct 2022.

H1 was a small loss of £(1.1)m on revenues of £66.3m, although it’s the seasonally quieter half, and I think it’s a reasonable explanation that the hot summer suppressed demand.

Outlook & current trading are more encouraging, and are the same as disclosed on 20 Oct - but with added comfort that current trading into November has continued the improving trend -

Trading Outlook:

· Improved trading momentum during FY23 H2 has continued into November, maintaining the Board's expectation of a return to pre-Covid, H2 weighted trading seasonality*

· Net debt and on-hand inventory expected to reduce by 31 March 2023

· Full-year outlook in-line with consensus market expectations**

I am pleased to report that we have seen a consistent improvement in trading momentum during the last two months, despite continuing macro volatility. We are also well prepared for our peak seasonal trading period. The board therefore remains confident that results for the full financial year will be in-line with current consensus market expectations**

* H1 sales as % of full-year sales were 44% in FY22, 45% in FY21, 41% in FY20, 36% in FY19 and 39% in FY18.

** Gear4music believes that current consensus market expectations for the year ending 31 March 2023 are revenue of £155.1 million, EBITDA of £8.9 million and profit before tax of £1.1 million.

What we have then, is a business eking out a tiny net profit margin. There’s not really any evidence that the acquisitions have made much difference, although that could be covering up a deterioration in the core business possibly?

The pandemic distorted things so much, with a lot of demand pulled forward, that it’s difficult to know what level trading is likely to settle at. Although I do find the current trading & outlook comments reassuring.

Balance sheet - the commentary says that mgt deliberately over-stocked, to ensure product availability (a very big range), which is planned to reduce gradually. This should help reduce net debt, which is currently too high for my taste, at £21.8m (although that has come down from £24.2m six months earlier), and forecast to reduce further.

NAV is £37.0m, less intangibles of £21.2m, and I’ll also eliminate the £(2.3)m deferred tax line, which gives NTAV of £18.1m. This includes some freehold property, a strong positive, so overall it’s OK I think.

Inventories of £43.4m is too high, but we know the reasons why, and the commentary talks about getting stock levels down, which is good I think. Inventories don't perish, or suffer from fashion risk, so these are good assets.

Bank debt is too high as a result, but this should also come down once peak trading is out of the way, and excess inventories have reduced. The good thing is that there’s no operational cash burn, since the forecast is for a modest profit this year, and that looks a credible forecast. Plus the bank will have security over the freeholds and the inventories, I would imagine. Still, £29m of gross bank debt is too high. That’s partly offset by £7.2m cash, hence the £21.8m net debt figure mentioned above. I’d like to see net debt come down to no more than say £15m, which looks do-able if inventories are slimmed down.

My opinion - given the collapsed share price, I think risk:reward looks quite good at £20m market cap. At some point, sentiment could change positively for bombed out eCommerce stocks, and several have already bounced strongly.

I think G4M is too dependent on bank funding currently, and I’d need to check what the covenants are before committing any funds to this share. There is a clean going concern note in today’s accounts, which reassures.

There’s nothing alarming, or unexpected in today’s update, so the share price probably should stabilise, or even have a bit of a bounce at some point. Longer-term, G4M is gaining market share, in a very competitive market, and could end up a much bigger business, possibly with economies of scale? Potentially interesting, but not for the faint-hearted.

.

Wincanton (LON:WIN)

375p (up 2% at 09:24)

Market cap £468m

I last reported on this impressive logistics company here on 7 Oct 2022, commenting that 304p looked an excellent entry point. It’s risen 23% in just over a month, so not quite so attractively priced now, for value hunters. Although the fwd PER is still cheap, at 8.9, and a decent yield of 3.8%.

Legacy problems, mainly the pension scheme looks close to being fully funded, and net debt has largely gone now.

Open book contracts allow cost increases to be passed on to most customers, and this type of distribution business should be relatively insulated from any recession.

So that’s a summary of why I like this share, and have been bullish for a while.

Interim Results

Wincanton plc ("Wincanton" or "the Group"), a leading supply chain partner for UK business, today announces its half year results for the six months ended 30 September 2022.

Diversified customer portfolio delivers sustained growth in a challenging external environment

The highlights table looks solid to me, given tough macro conditions -

.

Statutory numbers are slightly lower (basic EPS of 17.4p, compared with underlying basic EPS of 18.8p), so the adjustments add 8% to profit, not enough to make me want to investigate.

The profit margin is only 3.7% of revenues, so not the best sector to invest in, which tends to be low margin, due to competitive pressure.

Outlook - in line, reassuring -

We are mindful of the expected continuation of macro-economic uncertainty, and we will continue to work closely with our customers to manage inflationary pressures and labour market challenges across our markets. Our open book contracts and the contractual positions in our closed book contracts protect our operating cash flows and ability to deliver sustained growth. The Board remains confident in the Group's strategy and expects to deliver revenue and profit in line with market expectations for FY23, underlining our excellent customer relationships and resilience to challenging external conditions.

Cashflow - I like this table, which shows how the pension scheme is still a big drag on cashflow, at £20m annualised, which limits cash available for divis as you can see. However, once the pension scheme is fully funded, that should provide scope for a big increase in payments to shareholders - that’s potential trigger for a re-rating at some point, I believe, just not sure when.

.

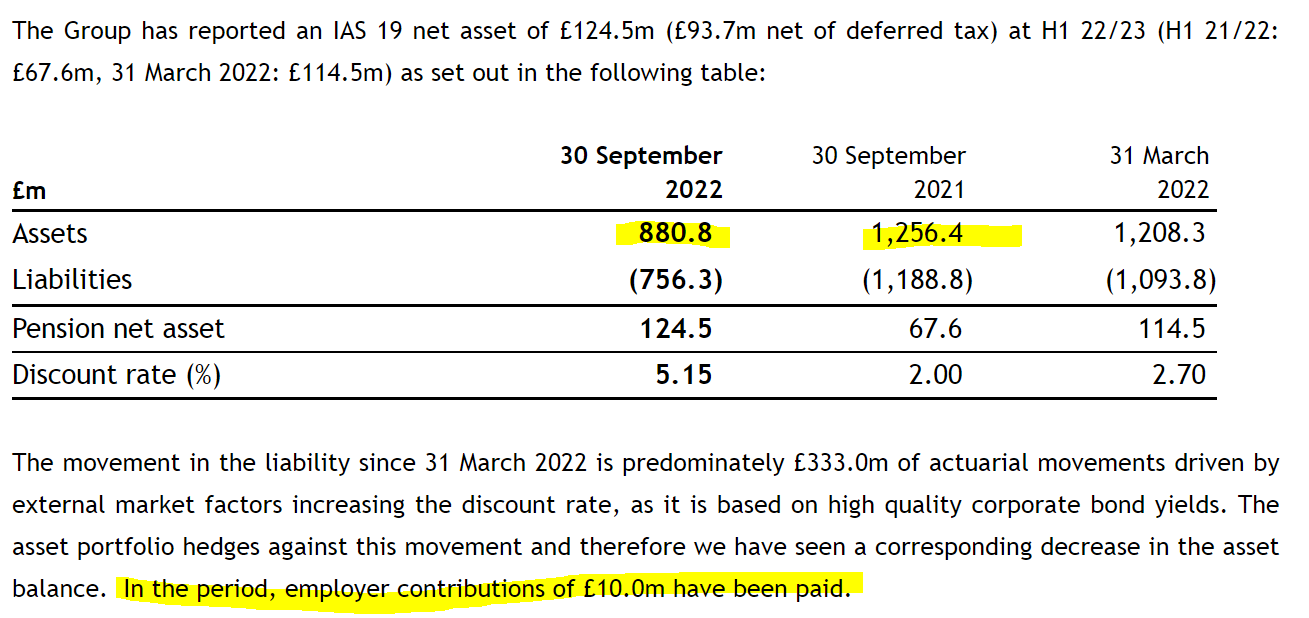

Pension scheme - these are the latest figures on an accounting basis. Look how both assets and liabilities have plummeted, due to higher bond yields.

.

This worries me though, because the liabilities (pensions to be paid) haven’t actually fallen in the real world. It’s just that the method of discounting those future liabilities has resulted in them technically having shrunk a lot.

To my mind, the actual liabilities have gone up, because of higher inflation. Whilst the asset value has plunged 30% in the last year. This makes me very uncomfortable, seeing such a huge drop in asset values.

Actuarial deficit is only £35m, and this is the figure which drives the deficit recovery payments, currently £20m p.a. This seems to imply that only 2 years’ worth of payments will be necessary. Although on such large gross assets & liabilities, small movements in assumptions could open up a deficit again. So it’s not without risk, but do we have here the ingredients for the pension scheme being fully funded by late 2024? That looks possible. In which case, the PER of 9 could re-rate to something like say 13-14 (not an aggressive valuation), which implies c.50% upside on this share if you’re patient.

Going concern statement - no issues here. Forecast to stay within bank facilities, and covenants, even in a severe but plausible stress test.

Balance sheet - this is complicated! NAV is quite modest for the size of business, at £70.4m. However, WIN has 2 attractive features - it gets paid in advance by customers, and it holds negligible inventories. Hence it doesn’t need much in the way of NAV.

I make a lot of adjustments, being writing off all these items, to get to a NTAV figure which makes sense to me -

Write off £109.8m intangible assets, and the associated £(19.1)m deferred tax provision.

Write off the £126.1m pension surplus asset, because it’s not real - the pension scheme is in a real world deficit, so a £35m creditor should be added.

IFRS 16 lease entries are £178.7m RoUA, less £37.8m + £155.9m liabilities, so a £(15)m liability that needs eliminating.

Totting all this up, arrives at adj NTAV for my purposes of negative £(166.4)m.

So this is absolutely not a strong balance sheet, contrary to what management always claim each time they report. It’s a weak balance sheet, but it works OK due to the features mentioned (customers paying up front, and little capital needed - no inventories, and modest PPE).

Overall then I’ve probably tied everyone in knots with this section, but it’s actually an adequate balance sheet. The main thing is, there’s hardly any bank debt, although I reckon there might be quite big intra-month swings, so it would be good to disclose the average daily cash/debt figure, which I would like to see from all companies. That’s a key gap in current accounting rules.

Forecasts - many thanks to Liberum for an update note. Unusually, Liberum publishes H1 forecasts, and the actual 18.8p is slightly below 19.7p EPS broker forecast. However it’s slightly raised full year forecast to 41.8p - for a PER of 9.0 - which I think is still cheap, given that the pension scheme’s cash hunger looks to be nearing its end.

My opinion - I’ve had a good rummage through the figures, and WIN shares pass with a thumbs up. It still looks good value to me, even after the strong recent rebound.

Stockopedia really likes it too - note the high StockRank.

Graham’s Section:

Redcentric (LON:RCN)

Share price: 119p (pre-market)

Market cap: £185m

This is a medium-sized managed IT services company, whose share price history goes back about ten years. The last five years have been solid, after an accounting mishap that nuked the share price in 2016.

Let’s check today’s trading update for the six months ended September 2022.

- Outlook is in line with expectations for the current year FY March 2023, but ahead of expectations for FY March 2024.

- H1 revenues £61.5m, after acquisitions. (H1 last year: £44.3m)

- H1 Adjusted EBITDA £11.7m (H1 last year: £11.9m)

- Adjusted net debt £39.3m (excludes supplier loans and leases), after £23m was spent on various acquisitions.

The net debt figure obviously stands out but there are some mitigating factors:

It includes £6.3m owed from customers of an acquired business that will reverse in H2.

It includes bloated inventories, half of which are also expected to reverse in H2.

Finally, it includes additional exceptional costs (appears to include some workforce reduction). Half of these costs will result in “like for like additional annual savings” in FY 2024.

Running the numbers, it sounds like around £9m of the net debt should reverse by FY 2024, if we include one year of the expected cost savings.

And if the company’s underlying profitability was also being applied to reduce leverage, then the debt figure would get paid down quite quickly (if that’s what the company chose to do).

The deal-making has resulted in major change.

As a result of the five acquisitions completed between September 2021 and July 2022, the Company has significantly strengthened its cyber security, hyper-cloud and consulting capabilities, and materially increased the annualised revenue base by c.70%. With these acquisitions, we feel that we now have one of the broadest product offerings in the market.

And more change is coming: rather than pay down the debt, the company has signed a new £100m bank facility, “to support and accelerate our acquisition strategy”.

Everything is going well on the sales front:

A significant increase in new sales orders during the second quarter of FY23 with order levels now substantially ahead of pre-covid levels. The increase in sales volumes reflects the enlarged customer base, additional capability and a restructuring and strengthening of the sales team.

Updated forecasts: there is no change to revenue forecasts at the company’s broker, either for this year or next year.

However, the profit forecasts have changed. It looks like costs for the current year are coming in higher than expected (the “exceptional costs”), while costs for next year are coming in lower than expected. The adjusted PBT forecast for next year is increased by 12% to £18.7m.

My view

As I’ve said before, the managed IT services sector is one which I classify as a “people business”, and I do find it difficult to distinguish between companies in this space.

However, I think there is a lot to be said for increased scale: with scale, large customers can trust that they will be able to access a wide range of services from the same provider, and the services provided can be increasingly complex and difficult to source.

Think of Computacenter (LON:CCC) and its wonderful track record: it is a low-margin business, but it has done very well for itself and its shareholders.

Computacenter (LON:CCC) chart:

Redcentric is a long way off from CCC’s scale, but maybe the growth-by-acquisition strategy is exactly what it needs?

This comes with the usual proviso that debt-fuelled acquisitions often lead to many years of heavy adjustments in the accounts, and the financial risk can be significant. Fortunately, Redcentric does not look like it has over-extended itself financially at this point, and it appears to be executing its strategy well so far.

If I was an investor in this sector, I’d probably want to buy the blue-chip CCC shares first, as they don’t look too expensive, before buying any RCN.

DX (Group) (LON:DX.)

Share price: 27p (+8%)

Market cap: £155m

As discussed in July, this delivery company had a mysterious “corporate governance” problem, that resulted in it failing to file accounts and in its shares being suspended for an extended period of time.

Fortunately, the issue has been resolved and, as hoped, the company and its shareholders have emerged intact. As revealed in September, the issue related to an allegation of bribery by employees at a DX company:

The Investigation identified evidence that confidential competitor information was obtained over a period of time and that an isolated offer of payment (of de minimis financial amount) for such information had been made by employees.

It is extraordinary that the investigation took so long and had such a drawn-out effect on the company’s shareholders, but there we are.

Let’s move on to today’s news.

Firstly, the Executive Chairman Ron Series is retiring, to be replaced by Mark Hammond. This is a change that was lobbied for by Gatemore (an activist investor who is also the largest DX shareholder).

Now let’s take a look at results for the year ended July 2022. These are “significantly ahead of original management expectations”, thanks to very strong trading even while the company’s shares were suspended and investors worried if they would ever get to trade their shares again!

- Revenue +12% to £428m

- Profit from operating activities +46% to £22.1m

- Pre-tax profit +64% to £17.4m

Freight (large / heavy items): did very well, revenues up 15% to £257m and an improved operating margin of over 12%. Four new depots.

Express (fast delivery of high-value items): revenues up 8% to £171m, slight improvement in operating margin to 8.4%. Four new depots here, too.

Outlook

- Trading in Q1 (FY June 2023) was in line with expectations.

- Revenue and margin expansion from £20-£25m investment programme.

- Expects to pay its first dividend since 2016.

“The Group is well positioned to achieve its growth objectives despite current economic headwinds.”

Strategy

In the short-term, the growth strategy here is centred on organic investment in new depots and equipment for the existing depot network. Spending plans are £8-£10m p.a. It’s good to see an organic growth strategy for a change!

Over the medium-term, it will look at investments in property and in business acquisitions.

The dividend track record at this company is poor but it wants to pay a progressive dividend that is covered 2x or 3x by adjusted EPS. Special dividends and buybacks are also possible.

My view

This is a long results announcement so I’ve had to skip over parts of it. The main point and the bottom line is that the corporate governance problem did not affect the business itself. Shareholders have had almost the best possible outcome from the whole affair.

New management will now have to move forward with the growth plans. I like the emphasis on organic growth for now, with the possibility of other growth strategies in the future.

Net cash of £27m is reassuring. Cash increased by £10m over the course of the year, so the cash conversion looks ok (after-tax net income was £14m).

I’m impressed and I’m starting to get the impression that logistics and delivery companies are quite good at managing their costs in this environment, and passing on inflation to their companies.

These shares are superficially cheap so there’s a big opportunity for reward here if trading momentum continues on its current track:

I do think it’s correct that companies in this space should be cheap, since they do tend to get into trouble from time to time, and it’s very much low-margin work. But given the outlook, I must say that the prospects look decent here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.