Good morning!

Some updates worth looking at today:

- Gear4music (LON:G4M) - interim results

- Footasylum (LON:FOOT) - half year report

- dotDigital (LON:DOTD) - preliminary results

- B.P. Marsh & Partners (LON:BPM)

- Smartspace Software (LON:SMRT) - half year report

- IG Design (LON:IGR)

Gear4music (LON:G4M)

- Share price: 500p (+4%)

- No. of shares: 21 million

- Market cap: £105 million

Gear4music (Holdings) plc, ("Gear4music" or "the Group") (LSE: G4M), the largest UK based online retailer of musical instruments and music equipment, today announces its unaudited financial results for the six months ended 31 August 2018 ("the Period").

Paul has provided lots of coverage of this share - see his piece for the September trading update.

Key points:

- Revenues up 36% but competitive pressure reduced gross margins, so gross profit is up by just 23%.

- Own-brand sales grew at a slower pace than 3rd party sales (I value own brand sales higher than 3rd party sales, so I view this as a negative).

- The move to the new distribution centre in Sweden is going according to plan

- Trading is in line to meet full year expectations, due to very strong revenue growth so far in H2.

The company's confidence in the full-year result has evidently produced some firmness for the share price today.

Despite the loss suffered in H1, Equity Development has published a note suggesting that full-year net income could be £1.9 million, on the basis that gross margin will recover in H2.

Remember that there is a very heavy weighting of sales to H2, so it's the H2 result that really matters.

This bit is important:

Efforts are on-going to improve gross margins including negotiations with certain suppliers, potentially removing very low margin products, and taking advantage of any tactical buying opportunities as and when they arise. Early indications in FY19 H2 are that gross margins are improving.

I have a few concerns:

- The company is changing its accounting year end-date (probably for good reasons, but I hate dealing with accounts that aren't for 12 months!)

- Lower gross margins could be a recurring threat to profitability, if not in H2 then in H1 next year.

- Software development costs are being capitalised faster than amortisation (£1.1 million of spending versus £0.5 million of amortisation). Again, this is probably reasonable given that the company is in growth mode, but we need to remember that it makes EBITDA less useful.

The big picture view in terms of G4Ms's software development is that it now has £5 million of software expenses which have been capitalised on its balance sheet. The amortisation policy says that the company's software platform is being amortised over "3 - 8 years" (in general I prefer if these are amortised over 3 years only).

Valuation - the company is forecast to generate gross profits of £26.7 million this year, so the valuation is effectively 4x gross profits.

That sounds cheap but we need to see some operating leverage kick in to get some meaningful profits on the bottom line. Maybe in FY 2020?

My view - as you can probably tell, I'm lukewarm on this share. In principle, I think it's a good idea to exploit the move to online sales of musical instruments. But I'd much rather invest in the brands themselves which people treasure, rather than the middleman/website which delivers it to them.

That's why I focus more on G4M's own-brand sales, but the company itself has been prioritising 3rd-party sales.

Its financial performance has been better much better than AO World (LON:AO.), but conceptually I see this company as its musical equivalent.

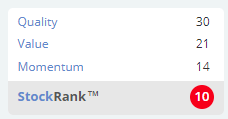

It gets a very poor rating from Stockopedia (classified as a "Sucker Stock") and qualifies for a short-selling screen, so the raw numbers would tend to back up my scepticism.

Footasylum (LON:FOOT)

- Share price: 32p (-1.5%)

- No. of shares: 104.5 million

- Market cap: £33 million

These shares are now at 20% of the level where they floated - less than a year ago!

It's another instance of gross margins being under pressure for a middleman of 3rd party brands. Additionally, Footasylum is suffering from the everyday problems on the High Street.

Revenues are up 19% while gross profits are up by 13%. Expenses increase significantly ("investments for growth") so there is a loss even at the Underlying EBITDA level. In the end, the net loss is £2.7 million.

Balance sheet - it's fine in terms of a lack of debt, but I can't help noticing that the stock of inventory is up by 42% compared to a year ago, having grown much faster than revenue and COGS. It's now £43.5 million - much bigger than the market cap for the entire company! It might have been worth a comment by the company?

Outlook - in line with the rebased expectations from the September trading update. Only targeting two new stores and two upsizes annually for now.

My view - Clearly the market views this as unattractive - a loss-making High Street retailer of 3rd party brands

That having been said, I wonder if it could turn into a deep value situation at some point, if the shares get cheap enough? Balance sheet equity is £40 million and is almost entirely tangible.

Stockopedia algorithms think there is value, giving it a Value Rank of 97:

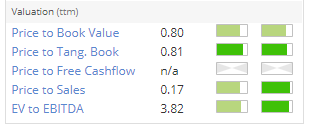

The counter-argument to this is that Footasylum is quite highly leveraged in reality, when you take its lease liabilities into account.

From the most recent annual report, we learn that £122 million of lease payments were due:

Suffering losses in the stores associated with all of these lease payments could take a big bite out of the company's book value, making it hard to argue that the shares are good value based on the discount to book.

dotDigital (LON:DOTD)

- Share price: 87.5p (+4%)

- No. of shares: 297 million

- Market cap: £260 million

Replacement: Preliminary Results

I've described this company's flagship product as "a deluxe version of Mailchimp" (email marketing software). See my coverage in July.

The shares enjoyed a big boost then, when fears over GDPR turned out to be overblown, but it sold off like many other shares did last week.

Highlights:

- revenues +35% to £43 million (note that gross margins are huge at 87% in the core business)

- 11% sales growth in EMEA despite GDPR. USA revenue +43% (from a low base).

- adjusted operating profit £10 million, net income £8.6 million (+20%)

Outlook - first few months of the new year have started "very well and in line with our plan".

My view - I have a positive impression of this, viewing it as a quality software business with a strong core product (though I haven't figured out the merits of the acquisition it made, yet).

References to "artificial intelligence" and "machine learning" are likely to excite some people, but we have to bear in mind that it's not the only email marketing solution which offers a lot of useful automation capabilities.

For example, ActiveCampaign claims to have very strong machine learning features, and the developers I have spoken to rate it as the best email marketing solution. On the other hand, I personally use MailChimp because it's quite cheap and user-friendly. This will remain a competitive space, and a lucrative one for the winners.

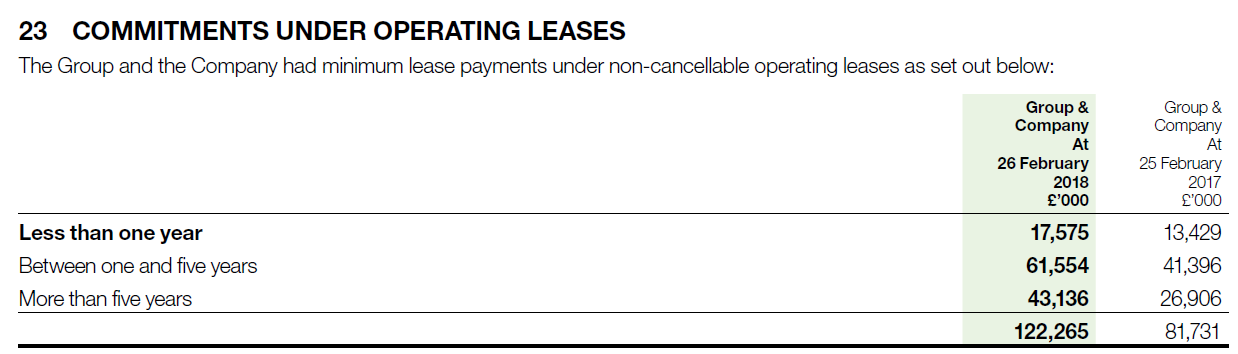

Dotdigital has done very well and signs are good for continued progress. On that basis, I expect that it deserves a premium rating and might offer good prospects for investors even at this earnings multiple:

B.P. Marsh & Partners (LON:BPM)

- Share price: 284p (+0.4%)

- No. of shares: 37.5 million

- Market cap: £106 million

B.P. Marsh & Partners Plc, the specialist investor in financial services intermediary businesses, announces its unaudited Group interim results for the six months to 31 July 2018 (the "Period").

I last covered this insurance-focused investment vehicle at its full-year results announced in June.

The most recent six-months haven't seen any gains in NAV per share, which I understand is due to the fundraising it undertook over the summer at 252p. I remarked at the time that I thought it was a strangely large discount.

Taking a bigger-picture view, the company has a long track record of delivering growth in dividends and NAV per shares.

Stockopedia records book value per share at 189p five years ago. It's now 333p (July 2018).

Dividends have also made excellent progress over that time, and the company announces today that this year's dividend will at least match last year's.

Chairman comment:

The performance of our portfolio of eighteen investments has been pleasing during the Period with the majority of our investments delivering strong returns. We expect this to continue for the remainder of the year.

If you want further detail into the performance of the underlying investments, the announcement includes plenty of that! Suffice to say that they are powering ahead, on the whole.

Share Buybacks - buybacks by good companies always get me interested. In BPM's own words, the authority to buy back shares "is an important stabilising mechanism in times of market or share price volatility".

In my own words, buybacks (at a discount to NAV) are a great way to increase NAV, while also boosting investor confidence and putting a floor on the share price!

Last week (not coincidentally around the time that the market was crashing), BPM announced that it was revising its Share Buyback policy. The amendment allows the company to buy back shares whenever they trade at a >15% NAV discount. Previously, a >20% discount was required.

It's a modest change, yet a strong signal of intent and interest in buying back shares. As it said at the time:

The Company remains committed to its previously stated objective to reduce the share price discount to net asset value and reserves the right to exercise the Authority and effect share Buy-Backs if, in the opinion of the Company's directors, such action would further enhance shareholder value.

My view

I have a positive impression and I reckon that this ought to trade at or above NAV, like most insurance shares, instead of trading near to the 15% discount where buybacks are possible.

Smartspace Software (LON:SMRT)

- Share price: 90p (+1.7%)

- No. of shares: 21 million

- Market cap: £19 million

This was formerly known as Redstone Connect (REDS). It provides "'Workspace Management Software' for smart buildings, commercial spaces and the hospitality sector".

After a big disposal, it was left with £13 million of cash (July 2018) and continuing revenues of just £1.9 million in H1.

Today, it also announces the £5 million acquisition of a New Zealand-headquartered SaaS business that has a "visitor management solution", i.e. helping corporations to manage visitors to their offices.

This sounds like it should be a great fit with an existing workplace management product.

Rationale:

The SwipedOn product is highly complementary to SmartSpace's existing software offering as well as providing a launchpad for the company's ambition to offer entry level workplace optimisation solutions.

I'm not able to judge the investment merits of this share so I'll leave it at that, but good luck to all concerned.

IG Design (LON:IGR)

- Share price: 518p (+4%)

- No. of shares: 78 million

- Market cap: £404 million

A positive H1 update from this designer and manufacturer of "celebration" products (gift wrap and cards, etc).

The US-based acquisition it made has "delivered a strong post acquisition performance".

Diluted EPS is running in line with expectations.

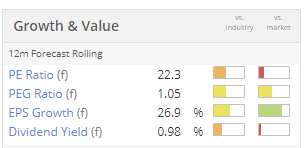

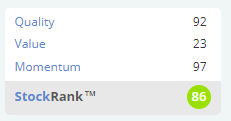

Well done to them. The high rating looks justified, in my view, and Stocko agrees:

Done for today. It was a nice change not to write about Patisserie Holdings (LON:CAKE) for once!

All the best

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.