Good morning ladies & gentlemen! It's Paul here.

I added a few extra sections to Graham's report last night, in the comments section. So for my comments on Elecosoft (ELCO), Interquest (ITQ), and Conviviality (CVR), please see my comment (no.26) using this link.

I appreciate that me adding extra sections in the comments isn't ideal, but it's a quick & easy way to post stuff on my days off, that otherwise wouldn't be posted at all. Plus I will always add a link to such extra sections, the following day.

Safestyle UK (LON:SFE)

Share price: 230.8p (down 10.2% today)

No. shares: 82.8m

Market cap: £191.1m

Half year trading update - for the 6 months to 30 Jun 2017.

I hadn't realised how much this double glazing company's share price had fallen recently. As you can see from the 2-year chart below, it's now close to the post-Brexit vote low, and autumn 2015 low. So if you like the company, this could be a buying opportunity. Or something might be going badly wrong. That's always the big quandary with buying dips.

It sounds like market conditions are getting a fair bit tougher - which is consistent with other companies reporting more fragile consumer confidence;

Since our last trading statement at our AGM on 18 May 2017, the Company has continued to trade in line with earlier months, with order intake levels continuing up 2% year on year. Within this overall figure, however, the trend from week to week during Q2 has been more volatile than we have experienced for a long time.

Furthermore, FENSA statistics for the five month period to the end of May 2017 show a market decline in volume terms in excess of 10%. Against this backdrop of patchier consumer demand, it is clear that Safestyle continues to significantly outperform the market and to increase share.

It's good to see that the company is giving fairly specific guidance to investors on how 2017 is likely to pan out;

As outlined in our AGM statement, we expect to report marginal revenue growth in the first half of 2017, with reduced profits. Given the uncertain market conditions and weaker consumer confidence, we consider it prudent to expect only modest revenue growth again in the second half of the year.

This would result in profits for the year being lower than previously anticipated and broadly in line with 2016.

The normalised EPS for 2016 was 18.9p, so if the company does that same in 2017, then at 230.8p current share price, this equates to a PER of 12.2.

Balance sheet - is solid, and the accounts generally look clean to me (I've just had a quick recap on the last full year accounts, which I reported on here. In that brief report, I flagged that, due to its cyclicality, people probably shouldn't pay more than a PER of 8-10 in the buoyant times, for this type of business.

Cashflow - this sounds fine;

Cash flow has continued to be strong and we had net cash of £17.7 million at 30 June 2017 (30 June 2016: £23.6 million), the year on year reduction reflecting the investment in our new production facilities and the payment of a special dividend in July 2016.

Cost-cutting has already been done, to reflect a weaker trading environment;

In anticipation of a continuation of the recent weaker trading environment we have taken firm action to reduce our operating costs in the second half. Having successfully completed the investment in our enhanced production facility on time and on budget, we are well positioned to take advantage of the upturn in demand when it occurs."

My opinion - this announcement is not a disaster by any means. So if you think that consumer confidence, and hence willingness to spend on big ticket items like double glazing is likely to recover, then this might be a buying opportunity.

On reflection, I feel that the share price of this company probably ran well ahead of itself, and the recent fall looks more like an adjustment to bring it down to a more sensible valuation.

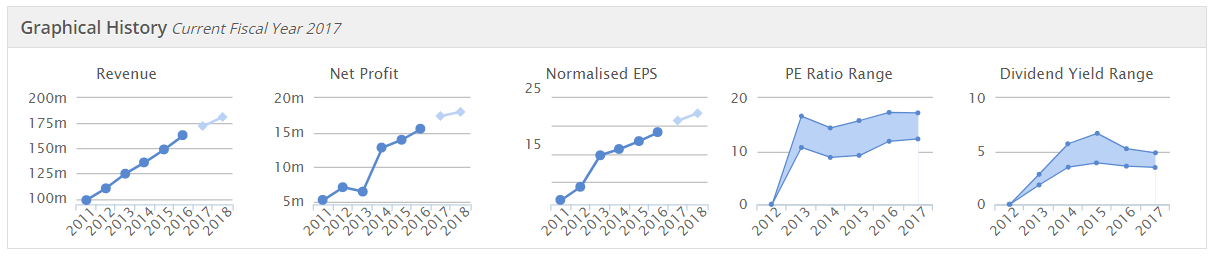

As you can see from the usual Stockopedia graphs below, SFE has had an excellent track record, and mentions today that it has been gaining market share, so there is some attraction to this company:

The big question is, where do things go from here? Is this just a temporary softening of demand, or the start of a more serious downturn? Will the company have to discount more, to maintain revenues? That would put its strong profit margin under pressure.

Overall, it doesn't look particularly cheap to me, even after the big recent falls. In a time of wobbly consumer confidence, I'm not sure that I'd want to buy shares in a double-glazing company. Historically they often go bust in recessions, although this one looks too financially solid for that to be likely.

It doesn't appeal to me, although dividend seekers might find it beguiling - if you think those generous divis are likely to be maintained? So a tricky one - quite a nice business, that's still trading OK, which can now be bought at almost a third more cheaply than 3 months ago. I can see why some people might find that quite interesting, but it's not for me.

Somero Enterprises Inc (LON:SOM)

Share price: 287.5p (up 3.2% today)

No. shares: 56.2m

Market cap: £161.6m

(at the time of writing, I hold a long position in this share)

Trading update - for the 6m to 30 Jun 2017.

This sounds encouraging;

Somero is pleased to report that trading in June was stronger than both the previous month and the prior year comparison. This strong performance, together with the continuation of the positive global trading environment, margin improvement and solid operating cash flow generation, has underpinned a positive outlook for H2 2017 and the Group's continued expectation that trading for the full year will be in line with market expectations, as highlighted in the update provided on 5 June 2017.

As usual, the company goes on to give a brief comment on performance in each region, which you can see in the RNS, if you're interested. The main thing for me is that they confirm trading is in line with market expectations.

Directorspeak/outlook comments are upbeat;

"With improved margins and positive cash flow generation, momentum in H1 2017 has continued and we are particularly pleased to see that our customers anticipate a high level of activity going into the second half of the year.

We look to the period ahead with confidence and this is reflected in the Board's decision to pay a special dividend as announced in our previous trading update."

My opinion - this sounds fine to me.

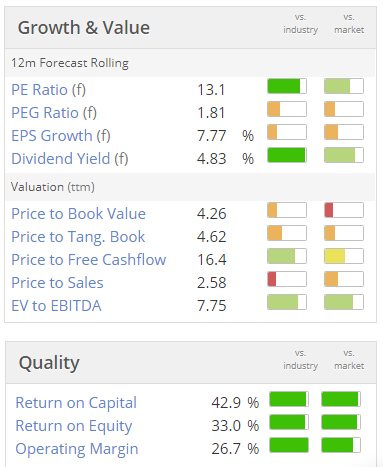

As you can see from the usual Stockopedia graphics below, this is a high quality company, on a modest rating;

Of course, Somero is a cyclical company. Investors still remember how profits collapsed back in 2008. That said, I think the company's overall markets are now a lot larger. This is because ultra-flat flooring is increasingly important for warehouses, given higher stacking, and automation. Plus, internet businesses mean that many new, high tech warehouses are springing up all over the world. That's a huge market for Somero's customers to address.

So for me, risk:reward still looks good. Therefore I remain a holder in the long-term section of my portfolio. Actually, I forgot I still had them until recently, as they're in an account where I only trade a handful of times per year. So for me, this has literally been a tuck away & forget share!

Hi, it's Graham here with some more updates!

Northern Bear (LON:NTBR)

- Share price: 83p (+8.5%)

- No. of shares: 18 million

- Market cap: £15 million

I mentioned this building services company last month in the SCVR when it released its trading update.

It said results to March 2017 were going to be ahead of expectations and furthermore that it had a particularly strong order book for the time of year, so that there was optimism for the year ending March 2018 too.

Those March 2017 results are announced today, and are excellent:

Turnover from continuing operations of £45.6m (2016: £34.7m)

Profit before tax from continuing operations of £2.4m (2016: £1.8m)

Basic earnings per share from continuing operations of 11.3p (2016: 7.9p)

Cash generated from operations grew to £4.5m (2016: £3.7m)

See how large the cash generated from operations is versus the market cap - a multiple of only 3.3x! But it's probably not worth getting carried away by that, as the company concedes that "favourable payment terms" are responsible for an element of this, and it may reverse.

With the swing from £10 million in net debt in 2009 all the way to net cash today, it is confident now to announce a special dividend of 1.5p. And the final dividend increases to 2.5p from 2p.

Acquisitions: I am pleased to see caution expressed in relation to acquisition policy. Acquisitions will only be executed where, among other things, they "predictably enhance earnings". Good! Adventurous acquisitions have a tendency to go badly wrong.

Indeed, included in today's results are the discontinued operations of an asbestos-related subsidiary which has been disposed of after it continued to drag on the Group's resources.

A willingness to retrench when appropriate is a mark of good management, in my view.

My opinion

As was the case last month, I'm impressed by this company's results and outlook, and I like the valuation.

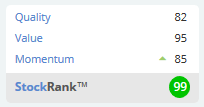

The StockRanks have also been flagging it up for a good while, so this is a perfect example of when they can work extremely well over a particular timeframe.

Looking forward, you again probably have to take a view on the outlook for service markets in roofing, solar panels, fire protection, forklift supply, health & safety, etc.

But if you're willing to take on that kind of macro risk, this looks like a great place to do it.

dotDigital (LON:DOTD)

- Share price: 71p (+1.4%)

- No. of shares: 296 million

- Market cap: £210 million

This richly-rated email marketing automation company announces an update for the year ended June 2017.

Growth and EBITDA are in line with market expectations (disclaimer: EBITDA excludes share option scheme expenses).

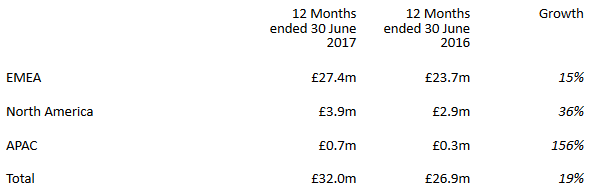

Overall revenues grew by 19% organically to approximately £32.0m (FY16: £26.9m);

Monthly recurring revenues from dotmailer's SaaS-based usage up approximately 23% to £26.0m (FY16: £21.1m);

Strong cash balances at 30 June 2017 of £20.4m (FY16: £17.2m)

Paul has spoken previously about how this company has been "sweating" its existing clients, even while by implied growth rates the total number of clients appears to be decreasting.

Again, according to these numbers, revenue per client is up by 24%, which outpaces organic revenue growth.

11.9 billion emails have been sent by the dotmailer platform in the period.

It's still a UK business, with some decent prospects abroad too:

The estimates are for net income of £6.6 million to June 2017, rising to £7.9 million to June 2018.

The dividend yield is only about 1%, but is not relevant since this stock is all about the big growth prospects.

Certainly, it's a strong proposition to marketers at the Dotmailer website (new tab), with one customer describing it as "MailChimp on steroids". I really like MailChimp, personally, so that's a strong statement indeed!

In terms of valuation, the market cap is not quite so expensive when you consider the net cash pile (already at £17 million a year ago).

Fairly impressive stuff overall, then, and I wouldn't be surprised if it had plenty further to go.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.