Good morning! It's Paul here. I'll be writing today's report.

Loads of results today, so I'll probably be doing shorter sections, so I can get through more companies.

Please note that I added several new sections to yesterday's report last night, on;

Finsbury Food (LON:FIF) - underwhelming results & prospects

Michelmersh Brick Holdings (LON:MBH) - very strong balance sheet & big increase in divis

Maintel Holdings (LON:MAI) - very brief comment, doesn't interest me, but market liked its results

Please click here to revisit yesterday's full report.

IQE (LON:IQE)

Share price: 47.0p (down 14.4% at 08:28)

No. shares: 675.7m

Market cap: £317.6m

Final results - for the year ended 31 Dec 2016.

The share price has been volatile so far this morning, on heavy volume, hence why I've added the time in the price snapshot above. It's a popular private investor stock, so perhaps some stop losses were triggered this morning, with a larger fall earlier?

The share price of this company has been roaring upwards, tripling in price since Jul 2016, so perhaps good news is now already priced in?

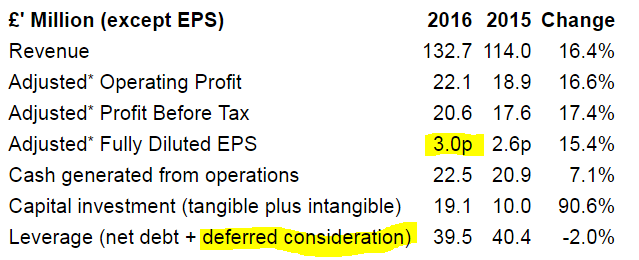

Results today look good to me;

Adjusted EPS of 3.0p puts this share on a PER of 15.7. This seems to be ahead of the broker consensus figure on Stockopedia, which is 2.91p.

It's interesting to note that the company includes deferred consideration within its leverage figure, which seems prudent. I think many investors focus too much on just bank debt, and hence give enterprise value calculations too much emphasis. At many companies, other creditors (especially trade creditors) are often greater than bank debt. Yet many investors ignore those creditors (which are easy to manipulate, to reduce reported net debt on balance sheet dates).

Outlook comments sound upbeat to me;

The Group's technology and market leadership, and its strong pipeline of high growth opportunities positions it well to continue its growth profile over the coming years.

The current financial year has started well and trading is in line with expectations.

The outlook for the full year remains very positive, with good upside potential.

The Board remains confident that the Group is on track to achieve expectations for the full year, and anticipates that the Group will continue to benefit from strong cash flows.

I don't know much about this company, but so far, given strong results & very upbeat outlook comments, I'm wondering why the price spiked down c.16% at the open today? Seems rather odd. Perhaps some investors/punters were hoping for even stronger results?

Capex - note that this is a capital-intensive business. Whilst cashflow looks good, at £20.1m net cash generated from operating activities, almost all of this was invested in capex (£11.0m purchase of physical assets, and £8.1m in intangible assets). That's probably why it doesn't pay any...

Dividends - the StockReport shows a big slab of empty space in the dividends section - nothing appears to have been paid in the last 6 years. The word "dividend" is only used once in today's results statement, in this sentence;

"The Board will not be recommending the payment of a dividend."

My opinion - I fail to see the attraction of this business model. It reports big profits, but in cashflow terms that is almost all used up on capex. Leaving nothing in divis for shareholders. That doesn't sound much cop to me.

Shareholders who caught the big wave up from Jul 2016 to date have done very nicely, tripling their money. Not bad for a business that's generating virtually nothing in free cashflow, and paying nothing in dividends.

I see the share price has now (at 09:03) recovered to -7.5% on the day, at 50.6p. It's an interesting share, where you could argue that it's good value on the strong profit growth + positive outlook. However, the lack of cashflow generation and dividends rules out this one for me. I prefer businesses that require little capex, churn out cash, and give it to shareholders as divis.

Fevertree Drinks (LON:FEVR)

Share price: 1381p (down 5.5% at 09:21)

No. shares: 115.2m

Market cap: £1,590.9m

Preliminary results - for the year ended 31 Dec 2016.

Sorry, I can't resist commenting on this one! I know it's not a small cap, but it's such a fascinating situation. Results today are terrific;

Revenue growth (organic) of 73%, to £102.2m (so the PSR is a tad warm, at 15.6)

Operating profit up 99% to £34.4m (note the superb operating margin, of 33.6% - so a third of revenue is pure profit)

Outsourced business model, so capex is negligible (P,P & E is only £1.2m)

Strong balance sheet (although on a small scale relative to the market cap)

Diluted EPS up 106% to 23.7p - giving a PER of 58.3 - expensive, but if earnings continue soaring, then the company would rapidly grow into that valuation

Outlook - no specifics, but "an encouraging start to 2017"

Dividends - total for 2016 has more than doubled, to 6.25p - that's a small, but rapidly growing yield of just under 0.5%

Overseas - this isn't just a UK business (still the biggest market though, at 43.7% of sales), but there is also strong growth coming from USA, Europe, and (much smaller) RoW

My opinion - who cares what I think, as like most other commentators, I was completely wrong on this! People who better understood the opportunity, and bought at IPO have absolutely cleaned up.

As regards the future, it all depends on how sustainable the growth, and profits are?

Bull case goes something like this - there's only room & appetite in most bars for one premium brand. Fevertree spotted the opportunity, and is now unassailable as the market leader. The product tastes great, and people love the premium branding. Why buy premium spirits, and then put in a cheap mixer, which makes up the bulk of the drink? So more growth is likely to continue. Hence the share price likely to continue rising.

Bear case - it's a fad, and competition will fight back with their own premium products (Fevertree caught big brands like Schweppes napping). There's little to no difference in taste, people just think there is (for now), because the clever marketing has fooled them. Valuation is crazy, and the first signs of slowing growth are likely to see the share price crash.

Overall, I can see merit in both arguments. It all depends on consumer behaviour. Drinking out is now so much more expensive than buying from the supermarket, that I think that many people do want premium products & experience, and are prepared to pay extra for that. If people think that a drink tastes better with a Fever Tree mixer, and it makes them feel good & special, to be drinking something premium & fashionable, then everyone is happy.

Whether it's sustainable or not, Fever Tree are in my view, marketing geniuses, and they deserve their success, raking it in from this clever business model. Well done to shareholders who spotted the opportunity too. The trick is knowing when to sell, of course.

Also, I question the wisdom of selling the product in non-premium places, like Asda. If your huge margins depend on people perceiving that the product is special, then selling it in a downmarket environment is a well-established way to cheapen your own brand. So the dash for maximum growth could begin to sow seeds for erosion of the brand premium, and margins, longer term perhaps?

SCS (LON:SCS)

Share price: 163p (up 1.0% today at 10:20)

No. shares: 40.0m

Market cap: £65.2m

Interim results - for the 26 weeks ended 28 Jan 2017.

The first thing that strikes me from these results, is that the company seems to have a very lop-sided year - with H1 being loss-making, and H2 decently profitable last year. A similar pattern seems to be occurring this year.

A few snippets;

Operating loss of £2.6m is improved somewhat from a loss of £3.4m in H1 last year.

Interim divi raised by 4.9% to 4.9p. That seems consistent with forecasts of 14.9p total divis for the year, for a staggering yield of 9.1%. That's usually a red flag - a 9.1% yield is the market telling us that it doesn't believe the divis are sustainable at that level. Either that, or this share is a stonking bargain.

Strong prior year comparatives are mentioned several times - together with 0.9% LFL order intake growth (33 weeks to 18 Mar 2017), suggests that further organic growth may now be hard to come by.

"Challenging" recent trading in Feb 2017, but improvement since beginning of March.

Key Easter & May Bank Hol periods yet to come, and facing "very strong" comparatives during the remainder of the year. So it sounds like they're trying to lower expectations.

"Board currently expects" to be in line with full year expectations. In conjunction with other cautious comments, this doesn't fill me with confidence - I wouldn't be surprised to see forecasts edged down later this year.

Profit margin - has always been low at ScS. This is fine in the good times, as it gives scope for profit to rise strongly. However, it also means that when demand dries up, profits vanish very easily. Remember it went bust in the last big recession - although that was exceptional, and more due to withdrawal of credit for customers. The business is forecast to make a net profit margin of only 2.6% this year (a good year).

Cash - looks great, at first glance, with £36.8m in the bank. However, it's vital to understand that this cash is mainly customer deposits. This can be seen from a corresponding entry in creditors of £22.8m called "Payments received on account". That's a favourable cashflow profile, but remember that when business slows down, then the business becomes cashflow negative, as the deposits unwind. Combine that with a lot of fixed costs, and trading losses in a downturn, and it's easy to see how this business would probably be one of the first casualties of the next big recession. So this is very much a share to enjoy in the good times, and run for cover when the next recession looks even vaguely possible.

My opinion - I feel management are being imprudent, paying out far too much in dividends, and leaving the business potentially unprepared for the next recession. You would have thought they'd have learned to fix the roof properly in the good times, after last time, but people have short memories.

Overall, it may look cheap on the usual value metrics, but you can't get away from the reality that this is a low margin business, operating in a very cyclical area, with a lot of fixed costs. That's why the forward PER is only 6.94, and the dividend yield 9.4%. The market is just factoring in the cyclicality.

The valuation figures look remarkably similar to Bonmarche Holdings (LON:BON) actually.

There may be money to be made on these shares, if you buy at the right price, and ditch them at the right time, but to my mind, both are fairly poor quality businesses that are not resilient in economic downturns. So the pattern tends to be that they get floated on the stock market when times are relatively good, then go on to disappoint when times become tougher. I can't see the attraction in either share. They're cheap for good reasons.

Pittards (LON:PTD)

Share price: 81.5p (down 2.4% today, end of day)

No. shares: 13.9m

Market cap: £11.3m

Final results - for the year ended 31 Dec 2016.

New management have recently been put in, and a profit warning which I covered here in Dec 2016 had already warmed us up to expect unimpressive results. I've been saying for years that the balance sheet contained unacceptably, indeed irrationally high inventories. Sure enough, new management has tackled this issue - with a horrible £4.3m exceptional stock provision, which dominates today's figures.

The trouble is that, even after making this provision against slow-moving or obsolete stock, the company still has a massive £17.4m of inventories on its balance sheet. That compares with P&L cost of sales for the year of £20.6m - so stock-turn is still appallingly slow, at nearly a year.

Overall, there's a £4.1m loss before tax for 2016. Or, an "underlying" profit before tax of £0.2m, if you ignore the stock write-down.

Is it likely to go bust? Net debt increased by £3.6m, to £10.1m, which seems far too high to me. The bank is therefore funding the excessive inventories. However, the balance sheet does contain £7.6m of freehold properties, in Yeovil, and Ethiopia. Banks like lending against the security of freeholds, so that's probably why the bank has remained supportive. So providing trading doesn't get any worse, then I would guess that the company should survive. Another equity fundraising wouldn't surprise me though.

Outlook - so are things getting any better? This sounds tentatively encouraging;

The restructuring and strengthening of the management team was completed in the final quarter of 2016 and strides have already been made to evolve and progress the strategic priorities and milestones for the next three years. Further updates on this will be given later this year.

Whilst it is still early days, we are beginning to experience a more positive demand environment for leather. Together with the actions being identified and taken, the Board believe we will start to see a benefit in the latter part of 2017 and that the prospects for the future are promising.

My opinion - It's a possible turnaround situation, but the level of bank debt worries me too much to want to get involved.

I do feel that this company has potential, if it can emulate the success of say Mulberry, with its handbags - where the profits can be huge, if the designs become a must-have fashion item. Looking at Pittards website, its products look very frumpy, so I don't see that being on the cards any time soon.

Another worry with Pittards is instability in Ethiopia, where it does a lot of manufacturing.

Goals Soccer Centres (LON:GOAL)

Share price: 109p (up 14.7% at end of day)

No. shares: 75.2m

Market cap: £82.0m

Final results - for the year ended 31 Dec 2016.

The price barely moved this morning, but then suddenly put on a big spurt this afternoon - so clearly someone decided they liked the results.

This is a turnaround situation, which the Chairman is very open about, saying;

"2016 has been a huge period of transformational Change. Its a good start to report profit growth and positive trend in like-for-like sales.

These results are early but encouraging evidence of our new strategy starting well. The business is on its way to being fit for purpose."

The trouble is, this business has to spend heavily on capex & maintenance, to produce better figures. I think it was a reader here who commented a while back that his experience of this company's premises was that the pitches were run-down, and poor quality. Today's results say that 136 pitches have been re-laid. Yet despite heavy capex, LFL sales growth was only +0.5% for 2016 as a whole. Although H2 showed an improving trend, at +2.9%.

Note that the company seems to make use of heavy exceptional items, in order to show decent underlying profits.

Balance sheet - is quite strong now, following a fundraising at 100p per share. NAV is £91.7m, dominated by £115.2m of property, plant & equipment. I seem to recall the property is leasehold.

Only £5.1m is intangibles, so NTAV is £86.6m - a solid asset base, which only contains a relatively modest £24.0m in net debt.

Cashflow - this shows clearly that this business is basically a bottomless pit for capex. That's likely to be ongoing, in order to maintain & improve existing facilities, and open new sites in America.

Expansion - most sites are in the UK, but expansion was halted a while back, when it became clear that the roll-out wasn't really working. The focus instead turned to the USA, where the company has 2 sites, with a third one under construction in H1 of 2017. So the bull case rests on US expansion being profitable.

Dividends - the fairly modest divis stopped in 2016. Today the company says it intends recommencing divis "when appropriate".

My opinion - this strikes me as a roll out which went wrong, and is now bumping along in limbo - with new management trying to improve things. The trouble is, it all requires enormous capex. Historically, when cashflow did become positive, that seems to have been at the expense of running down the assets (i.e. inadequate maintenance capex).

Therefore, to my mind, this business is just a poor allocation of capital - building soccer centres that get heavily used by customers, then need a fortune spending on them to bring them back up to standard.

There have been various waves of shareholder optimism, and even a bid approach I seem to recall some time ago, but bottom line, the share price is now back to where it was at the start, in 2004. It really doesn't seem a sensible business model to me, unless management can do something transformative in terms of performance.

Probably the best hope is if someone comes along and bids for it, based on faulty EBITDA-based spreadsheets - mistakenly thinking that it's a cash cow, when it really isn't.

A few snippets now, to round off with;

Judges Scientific (LON:JDG) - results for 2016 - this collection of medical devices companies had a bumpy year in 2016, with a couple of profit warnings, and forecast reductions. The market seemed to be quite forgiving, perhaps because of the quality of management, and that previous profit warnings proved only temporary glitches.

- Adjusted EPS down 22.3% to 84.8p

- At 1587p per share, the 2016 PER is therefore 18.7 - looks a bit steep to me, given poor performance - maybe the market is anticipating an improvement?

- Divis - up 10% to 27.5p, yielding 1.7%

- Order books stronger than a year ago

- Net debt of £9.9m, looks fine

- 4 more small acquisitions have been made, totalling £9m

- Forex - as a UK exporter, this is providing a helpful tailwind

- Upbeat outlook comments, point to a better performance in 2017.

Overall I'd say the current price looks about right, as the company looks set to report a better performance in 2017 than last year.

Quality management here too, who've created decent shareholder value with a long series of good acquisitions. They've managed to follow an acquisitive path without wrecking the balance sheet too, which is impressive. So this is a rare case of a successful acquisition-driven strategy.

accesso Technology (LON:ACSO) - nice results here out today, and a confident outlook for 2017.

Although at the moment, the market cap is very big, at £353m (share price of 1583p per share). I wonder whether the growth reported today is enough to justify that? It seems to me that the market cap mainly rests on expectations for the future, and the unique nature of this business - dominating its niche globally. So undoubtedly a special business, but looking very expensive right now.

Revenue up 10% to $102.5m

Adjusted operating profit of $15.7m, up 24.6%

Capitalised development spending has shot up, heavily flattering the 2016 results - e.g. capitalised internal costs rose from $6.2m in 2015, to $11.6m in 2016. The amortisation charge in 2016 was only $1.9m, so profit was boosted by $9.7m through the arguably rather aggressive accounting - that's nearly 62% of profit which came from capitalising costs, versus what it would have been if all costs had been expensed as they go along.

It's up to each investor how you view this accounting treatment, I'm just flagging it up. In this particular case, I tend to agree with analysts who have said that the money is well spent. ACSO seems to have terrific market opportunities, so it makes sense for the company to deepen its dominance of this niche market, by developing the right new products.

The company is open about where it is, stressing in today's announcement that it's in an "investment period", to capitalise on the opportunities ahead of it. That's fine, and makes sense in my view. Far too many British companies try to maximise profit in the short term, and miss out of the bigger picture because they under-spent on R&D when they had a big opportunity. Shareholders here seem to understand that, so it's not a share to try and value on a PER basis - as with a lot of growth companies, that's missing the point.

Balance sheet - looks alright to me, in the circumstances. It's a tad on the weak side, but good to see net debt has reduced. Although personally I think a small placing, to make the balance sheet bulletproof, would be a good move - e.g. raising say £10-20m would cause very little dilution, but would protect the downside if anything were to go wrong in future.

My opinion - I like the company, and recognise it has a unique niche. However, a lot of highly rated growth stocks are seeing quite sharp corrections at the moment. So it's difficult to see what would propel this stock any higher in the short term at any rate, given that it's already very expensive.

Ubisense (LON:UBI) - 2016 results - show an improvement, under new management, but I'm still far from convinced that the company would make a good investment.

Despite an equity fundraising, the company is still strapped for cash. Also, the debtors figure looks much too high. The company says this is due to orders received towards the end of the year. I'd want to see confirmation that these funds have actually been received.

The outlook section doesn't sound particularly upbeat, and this bit in particular sounds worrying;

Looking forward on the Geospatial business, we see an excellent opportunity for the myWorld geomobility platform and its valuable attached services. However, we anticipate that the historic GIS services will show some decline in both revenues and potentially margin.

The highly specialist skills required to deliver myWorld services have been built on our long history of working with customers' GIS databases, and this transition will continue, leading to an expected improvement in margins and better penetration of our current and future customer base.

On this basis, we fully expect some older GIS consultancy services contracts not to renew and the associated revenue stream to begin to decline through 2017 and 2018, which we will look to offset with higher margin myWorld software sales and related services.

The company only just scraped into the black at the adjusted EBITDA level, to £324k in 2016. That of course ignores the £2.1m of costs which were capitalised, to it's really still loss-making. That's not good, when you have bank debt, as this does. Although the £324k EBITDA in 2016 was a big improvement on the £5.2m adj EBITDA loss in 2015.

My opinion - with a weak balance sheet, poor historic performance, and the prospect of some historic revenue streams needing to be replaced in 2017 & 2018, I see an unacceptable level of risk here. This strikes me as one of many weaker companies that has been lifted by a rising tide in this bull market, but where management have still got a lot to prove, before it can be considered a good investment.

Billington Holdings (LON:BILN) - 2016 results out today look pretty good to me. This is a structural steel manufacturer - so obviously a very cyclical business, but experiencing good times at the moment.

EPS up 20.4% to 25.4p

Share price 227.5p (down 3.2% today), so that's a PER of 9.0 - good value, but I wouldn't expect this type of business to command a high PER

Dividend - up 67% to 10p - yield of 4.4%

Good order book & upbeat outlook comments

Balance sheet looks reasonable. Includes £6.0m of cash, and £2.5m of borrowings, so £3.5m net cash.

Pension - is shown as an asset, but £123k of additional contributions were made in 2016. Not a big issue, but worth noting.

Overall - it looks OK, if you particularly want to own shares in a structural steel manufacturer. I tried to buy some shares in this a few years ago, around 100p, but found it fiendishly illiquid. So the risk with this type of stock is that people buy it on a half-hearted basis, but then find they can't get out when they want to. And/or have to suffer a horrible bid/offer spread cost.

It's not the sort of thing I'd be interested in buying, but looks reasonable value if you expect the good times to continue.

All done for today, what a marathon!

See you in the morning.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.