Good morning!

Quite a few bits to look at today:

- On The Beach (LON:OTB)

- Pendragon (LON:PDG)

- Flowtech Fluidpower (LON:FLO)

- McBride (LON:MCB)

- Goco (LON:GOCO)

- Gear4Music (LON:G4M)

- Vianet (LON:VNET)

- DNEG - Intention to float

Uncertainty prevails

I wrote an article last night about how the fortunes of currency specialist Record (LON:REC) (in which I hold a long position) appear to have picked up in the last few quarters.

Indeed, in its most recent quarterly update, published last week, Record said:

Economic, political and market uncertainty continues to prevail. The client engagement opportunities which this creates, in conjunction with our ongoing focus on enhancement and innovation, have contributed to the inflows we have seen during the period.

If you are selling forex services to corporates, I imagine that it must be quite straightforward to get a conversation going about the challenges posed by the present situation.

This got me thinking about other possible winners of recent volatility and economic/political disruption.

Anecdotally, I've noticed an increase in the number of friends who ask me what I think about the prospects for the pound sterling, the euro, etc.

The CMC Markets (LON:CMCX) share price has rallied, and IG Group (LON:IGG) (in which I hold a long position) and Plus500 (LON:PLUS) are looking firm, too. Spread betting/CFD companies should thrive in this environment. Because if the general public are talking about exchange rates, that means they are probably tempted to bet on these rates, too.

Other winners from recent macro trends

I'd have a strong preference for importers over exporters, given the direction that Sterling is headed in.

The next wave of insolvencies (or "creative destruction" as I like to call it) will throw up plenty of opportunities for those who clean up after other firms go bust, e.g. Begbies Traynor (LON:BEG) and Volvere (LON:VLE) (in which I have a long position).

Legacy retailers with a heavy physical presence are the most vulnerable sector, as value shifts to online monopolists such as Amazon ($AMZN) and Google ($GOOGL) (in which I have a long position).

From an index point of view, the FTSE-250 and small-caps should do well from these levels, in my humble opinion. According to Stocko, the FTSE-250 is on a forward P/E ratio of 14.3x, and yields 3.7%. It's a high-quality index and looks great value to me in this interest rate environment.

The Brexit process will rumble on but as the outcome becomes more clear, I think that a lot of investors will want to come back to the markets. Boris Johnson's proposed deal has helped to show what the road map might be until 2021, with future details still to be ironed out.

These are exciting times in the markets. Trade carefully!

On The Beach (LON:OTB)

- Share price: 457p (+5%)

- No. of shares: 131 million

- Market cap: £599 million

Here's a potential winner from the creative destruction of Thomas Cook (LON:TCG):

The compulsory liquidation of Thomas Cook Group ("TCG") on 23 September 2019 has had a significant impact on the package travel industry. For On the Beach, this has created an unprecedented opportunity to take additional market share at an increased rate. As a result, the Group has started to strategically increase its marketing investment both online and offline to attract new customers to onthebeach.co.uk, sunshine.co.uk, Classic Collection and Classic Package Holidays, and is well positioned across all channels.

On The Beach has been one of the stand-out IPOs of recent years, going from 200p to the current level since listing in late 2015.

Investors might reasonably question whether it has any "moat", but I think that there is some value in the brand name and URL.

There's value in having a good reputation. Compare Trustpilot reviews of On The Beach versus reviews of Thomas Cook. People seem satisfied, on the whole, with their experiences at On The Beach. They trust it, they like it, and they want to use it again. The same could not be said for Thomas Cook.

The difference between the two companies is stark, although it must be said that Thomas Cook's reviews are skewed to the downside by the effects of its bankruptcy. And of course the two companies were running very different business models. It is probably more difficult to earn good reviews when you are doing lots of different activities, including running an airline (Thomas Cook!) versus just being an intermediary (On The Beach).

Anyway, this does sound like a great opportunity for On The Beach. I'm not clear on whether the increased "marketing investment" will cause an immediate bounce in profitability, but the medium and long-term effects of increased market share are likely to be very positive.

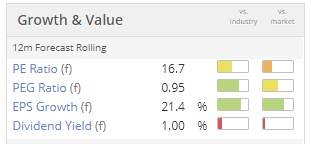

I reckon that this one is fairly valued and is worthy of consideration:

Pendragon (LON:PDG)

- Share price: 12.7p (+9.5%)

- No. of shares: 1.4 billion

- Market cap: £177 million

This is a Q3 update, for July to September.

Surprisingly (to me), it shows an 11% increase in like-for-like sales in new vehicles. But margins must be under pressure, as the corresponding gross profit generated by these sales is only up 2%.

Here's the explanation for lower margins:

The growth in sales was partially offset by lower margins from a combination of challenging economic conditions and our planned efforts to more naturally achieve manufacturer targets to minimise pre-registered vehicles.

The picture in used cars is very different: revenues are down 16.7% but Pendragon says that gross margin in this segment improved during the quarter, in line with its plans.

Skipping ahead to the outlook, the full-year underlying loss guidance remains in line with expectations.

Despite this update merely being "in-line", the share price is up 9.5%. So investors must have been pencilling in a further deterioration.

There are some reasons for cheer. For a start, like-for-like operating costs and interest are reduced by 8%.

From the commentary:

Good progress has been made with each of the planned operational improvements previously disclosed. A combination of better momentum during September, improved processes and good control of costs, resulted in Group underlying profit before tax of £3.0m, an increase of £1.9m against the same period in 2018.

My view

This is nice and cheap relative to historic profits but it does face a challenge to return to profitability. One for the contrarians among us.

Flowtech Fluidpower (LON:FLO)

- Share price: 110.7p (+2%)

- No. of shares: 61 million

- Market cap: £68 million

Trading update - nine month period to 30 Sept 2019

This is a decent Q3 update.

Total revenue is up 4.3%, within which the main "components" division is up 5.8%.

Organic growth is a modest 1.8% for the year to date.

Net debt: after-tax cash flow from operations was a solid £3.9 million, but the company paid out £2.5 million of this in dividends. After defcon payments, capex and interest, net debt increased during the quarter.

Shareholders are presumably happy with these large dividend payouts, even though the company has been raising fresh equity.

It's not exactly the most efficient way of doing things, considering how expensive the fundraising process is. But it must be what shareholders want, or they should be voting for something different!

Let's see if Q4 can finally see the company take a big bite out of the debt:

There is no further deferred consideration to pay and Q4 is expected to be cash generative.

Outlook

Our short-term focus is firmly on the delivery of sustained operational improvements, procurement benefits and wider Group synergies; detailed plans to achieve these savings are currently being finalised with the main phase of implementation beginning in early 2020. We are confident that these actions, combined with our continued focus on working capital management, will deliver improved profit and cash performance.

My view

Nothing has changed here. Still cheap, still indebted, still performing ok.

McBride (LON:MCB)

- Share price: 66.3p (-3%)

- No. of shares: 183 million

- Market cap: £121 million

This company makes private label household products.

It has two reporting segments: "Household" and "Aerosols". Household is responsible for the vast bulk of revenues.

Household revenues are up 1.8% in Q1. In this segment, expectations for revenues are unchanged (flat versus the prior year).

The company doesn't offer precisely the same reassurance for Aerosols, implying to me that there could be a question mark over revenue performance against expectations in this segment:

Reflecting the decision to exit UK Aerosol manufacture in the fourth quarter of the previous financial year, continuing revenues at constant currency were down 1.4% in the first quarter versus the prior year.

When it comes to earnings, these expectations are also unchanged, with earnings weighted to the second half of the year.

It's an uninspiring RNS from a company which is cheap but for valid reasons (e.g. the high debt load).

Out of time for today, but I'll catch up later in the week if I get a chance. Paul provided an excellent comment on Gear4music in the thread below, for those interested in that share.

Have a good evening!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.